Mexico Residential Battery Storage Market Size, Share, Trends and Forecast by Battery Type, Capacity, Ownership Model, Sales Channel, Application, and Region, 2025-2033

Mexico Residential Battery Storage Market Overview:

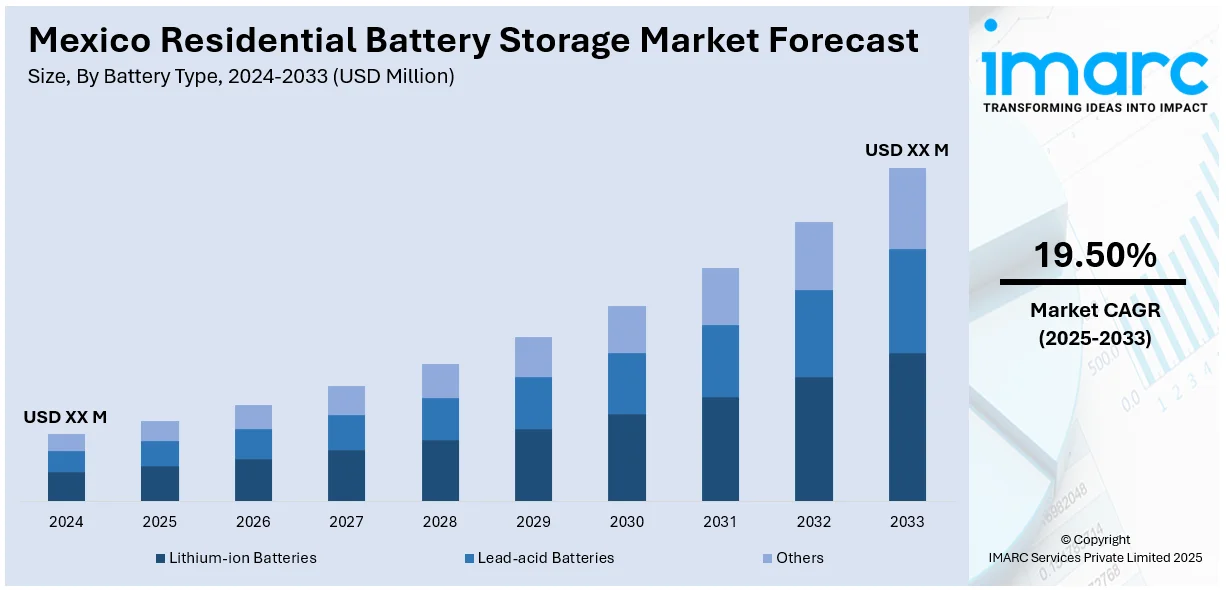

The Mexico residential battery storage market size is projected to exhibit a growth rate (CAGR) of 19.50% during 2025-2033. The market is majorly driven by rising electricity prices and household demand for energy cost reduction. Also, regulatory incentives and regional tax relief are fueling the product adoption. Additionally, frequent grid outages and unstable supply are increasing residential reliance on battery storage. Financial motivations, regional policy shifts, and unreliable infrastructure are some of the other factors positively impacting the Mexico residential battery storage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 19.50% |

Mexico Residential Battery Storage Market Trends:

Rising Energy Costs and Household Demand for Cost Savings

Escalating residential electricity prices in Mexico have made energy storage systems a financially attractive solution for homeowners. With Comisión Federal de Electricidad (CFE) tariff increases affecting thousands of residential customers, many are looking for long-term solutions to reduce monthly utility expenses. In Baja California Sur and other regions of the Mexico, the fixed charge is 130.77 pesos, with an additional charge per kWh ranging from 5.334 to 5.844 pesos. Energy storage enables users to store power during off-peak hours and use it when rates peak, effectively lowering their bills without sacrificing consumption. Households in urban areas such as Mexico City, Guadalajara, and Monterrey are more aggressively pursuing such options due to their higher average consumption and greater exposure to tiered tariff structures. As solar adoption increases, residents pairing solar PV with batteries are further motivated by the promise of energy independence and protection from grid fluctuations. The capability to manage energy flows, backed by smart inverters and software, helps optimize usage and reduce waste, making battery systems effective financial tools. This is one of the core factors driving Mexico residential battery storage market growth, particularly in regions with unstable grid infrastructure and high solar penetration. The shift from reactive to proactive energy management at the household level aligns with consumer priorities that favor autonomy, cost control, and reliability.

Policy Incentives and Regulatory Support

Governmental backing has played a significant role in shaping the residential battery storage landscape. Although national policy has historically focused more on utility-scale renewable projects, several regional and municipal initiatives are now encouraging residential-scale systems. Tax benefits, such as value-added tax (VAT) exemptions for renewable components, along with streamlined permitting processes in progressive states like Jalisco and Nuevo León, are reducing the friction for residential deployment. The broader energy reform framework, underpinned by Mexico’s Energy Transition Law, sets ambitious targets for clean energy generation, indirectly supporting distributed energy storage by encouraging self-consumption and grid decongestion. Regulatory agencies are also beginning to define clearer technical standards and interconnection requirements for residential storage units, offering certainty to manufacturers and installers. On March 14, 2025, Mexico’s Energy Regulatory Commission formalized rules for integrating battery energy storage systems (BESS) into the national grid, targeting 8,412 MW of storage deployment between 2024 and 2038. The new regulation treats BESS as power plants eligible to participate in wholesale electricity markets, mandates a minimum of three hours of storage for firm capacity, and introduces five operational categories, including co-located, isolated, and standalone systems. These policy moves have catalyzed investor interest, particularly from international companies seeking to establish supply chains and service operations in urban residential markets. As the policy environment matures and grid modernization efforts continue, Mexico’s residential sector is positioned to play a more active role in achieving national energy resilience goals.

Mexico Residential Battery Storage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on battery type, capacity, ownership model, sales channel, and application.

Battery Type Insights:

- Lithium-ion Batteries

- Lead-acid Batteries

- Others

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lithium-ion batteries, lead-acid batteries, and others.

Capacity Insights:

- Below 5 kWh

- 5–10 kWh

- 10–20 kWh

- Above 20 kWh

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes below 5 kWh, 5–10 kWh, 10–20 kWh, and above 20 kWh.

Ownership Model Insights:

- Customer-owned Systems

- Third-party Owned/Leasing Models

The report has provided a detailed breakup and analysis of the market based on the ownership model. This includes customer-owned systems and third-party owned/leasing models.

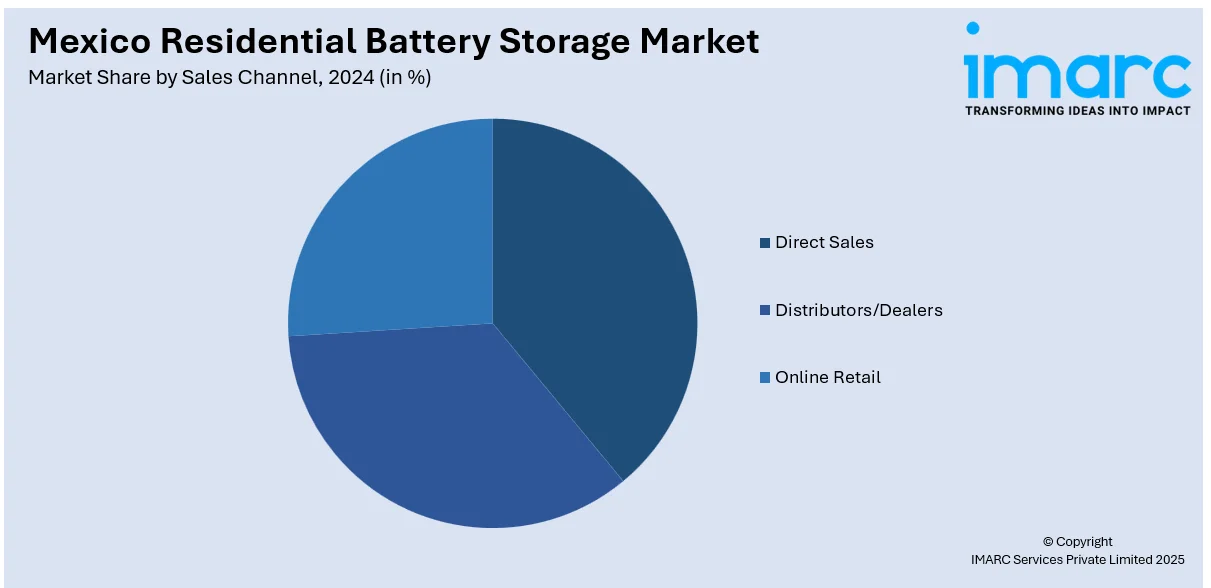

Sales Channel Insights:

- Direct Sales

- Distributors/Dealers

- Online Retail

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes direct sales, distributors/dealers, and online retail.

Application Insights:

- Backup Power Supply

- Solar Energy Storage

- Off-grid Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes backup power supply, solar energy storage, off-grid systems, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Residential Battery Storage Market News:

- On March 26, 2025, BYD and Pireos Capital announced a partnership to deploy 100 MWh of battery energy storage systems (ESS) in Mexico as part of a broader two-year plan targeting 240 MW of PV+ESS capacity. The systems will utilize BYD’s lithium iron phosphate (LFP) technology across residential, commercial, industrial, and utility-scale applications, with over 50% of the capacity expected to be deployed within the first year. The collaboration introduces a fully integrated solar-plus-storage solution to the Mexican market, offering a model relevant to Australian firms pursuing bundled offerings and cross-sector deployment strategies.

Mexico Residential Battery Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lithium-ion Batteries, Lead-acid Batteries, Others |

| Capacities Covered | Below 5 kWh, 5–10 kWh, 10–20 kWh, Above 20 kWh |

| Ownership Models Covered | Customer-owned Systems, Third-party Owned/Leasing Models |

| Sales Channels Covered | Direct Sales, Distributors/Dealers, Online Retail |

| Applications Covered | Backup Power Supply, Solar Energy Storage, Off-grid Systems, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico residential battery storage market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico residential battery storage market on the basis of battery type?

- What is the breakup of the Mexico residential battery storage market on the basis of capacity?

- What is the breakup of the Mexico residential battery storage market on the basis of ownership model?

- What is the breakup of the Mexico residential battery storage market on the basis of sales channel?

- What is the breakup of the Mexico residential battery storage market on the basis of application?

- What is the breakup of the Mexico residential battery storage market on the basis of region?

- What are the various stages in the value chain of the Mexico residential battery storage market?

- What are the key driving factors and challenges in the Mexico residential battery storage market?

- What is the structure of the Mexico residential battery storage market and who are the key players?

- What is the degree of competition in the Mexico residential battery storage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico residential battery storage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico residential battery storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico residential battery storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)