Mexico Robotics in Manufacturing Market Size, Share, Trends and Forecast by Component, Type, End User, and Region, 2025-2033

Mexico Robotics in Manufacturing Market Overview:

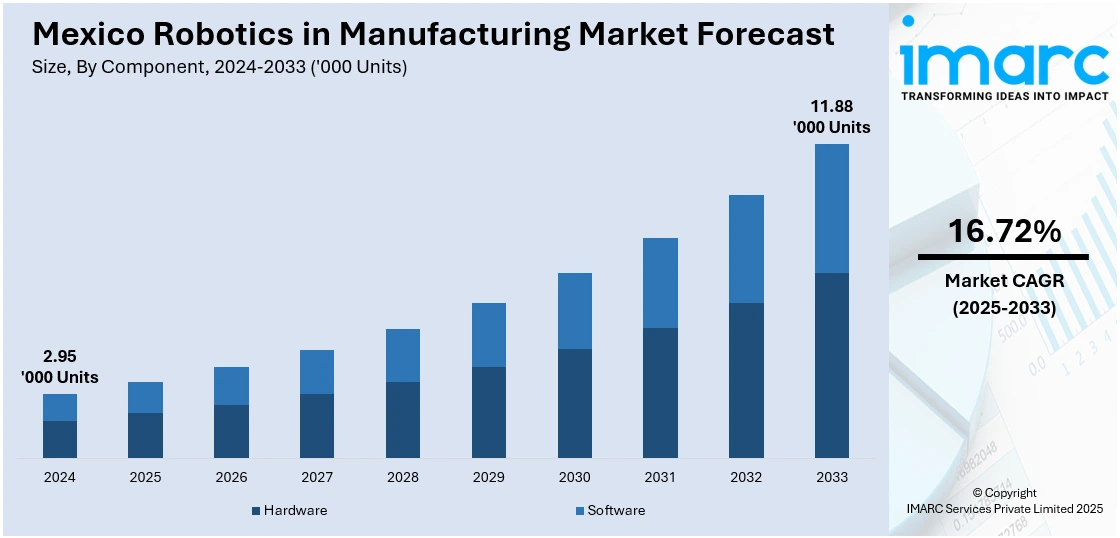

The Mexico robotics in manufacturing market size reached 2.95 Thousand Units in 2024. Looking forward, IMARC Group expects the market to reach 11.88 Thousand Units by 2033, exhibiting a growth rate (CAGR) of 16.72% during 2025-2033. The market is driven by increasing labor costs, rising demand for precision and productivity, and the country’s expanding role as a global manufacturing hub. Also, government incentives for automation, growing automotive and electronics sectors, and nearshoring trends are accelerating robot adoption in assembly lines, welding, and material handling. In addition to this, continuous technological advancements, cost reductions in robotic systems, and integration of AI and IoT are some of the important factors augmenting Mexico robotics in manufacturing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 2.95 Thousand Units |

| Market Forecast in 2033 | 11.88 Thousand Units |

| Market Growth Rate 2025-2033 | 16.72% |

Mexico Robotics in Manufacturing Market Trends:

Expansion of Mexico’s Manufacturing Sector Driving Robotics Demand

The steady expansion of Mexico’s manufacturing sector has significantly contributed to the rising demand for industrial robotics. According to industry reports, Mexico hosted over 600,000 establishments linked to the manufacturing sector by the end of 2023, underscoring the scale of opportunity for advanced automation solutions such as robotics. The key manufacturing hubs across states such as Nuevo León, Guanajuato, Querétaro, and Coahuila are attracting sustained investments from both domestic and international players, particularly in automotive, aerospace, appliances, and general metal fabrication. In addition to this, large automotive assemblers and tier-1 suppliers are leading this transformation by installing robotic welding arms, painting units, and automated inspection systems. Moreover, the proliferation of advanced manufacturing parks and nearshoring-driven supply chain expansion is prompting small and mid-sized enterprises (SMEs) to adopt scalable robotic solutions to meet international standards. This, in turn, is contributing to Mexico robotics in manufacturing market growth. In addition to this, government-backed industrial modernization programs, tax incentives, and technology transfer partnerships are supporting the robotics ecosystem. As output levels grow, manufacturers are increasingly relying on robotics to maintain consistency, reduce error margins, and enhance productivity across production cycles.

Rising Demand from the Electronics Sector

The rapid expansion of Mexico’s electronics industry is playing a pivotal role in accelerating the adoption of robotics across the country’s manufacturing landscape. Precision assembly lines and high-speed component handling requirements in this sector have made automation not just beneficial, but essential for maintaining competitive output levels. Leading global manufacturers in consumer electronics, semiconductors, printed circuit boards (PCBs), and communication devices are either establishing new facilities or scaling existing operations in states such as Jalisco, Chihuahua, and Baja California. These regions are emerging as key clusters for electronics manufacturing, drawing investment due to their skilled workforce, logistical advantages, and favorable trade access. In particular, the Monterrey manufacturing industry has established a strong foothold in the domestic electronics space. The region is known for producing household appliances, and Monterrey alone accounts for approximately 30% of Mexico’s total national exports in this category. To meet the volume and quality demands of such output, manufacturers are increasingly integrating robotics into assembly, soldering, material handling, and inspection processes. The use of articulated robotic arms, vision-guided systems, and surface-mount placement machines is growing steadily, enabling firms to improve precision, reduce defects, and operate in cleaner environments required for electronics production. This shift toward automation is reinforcing Mexico’s position as a reliable electronics manufacturing hub.

Mexico Robotics in Manufacturing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, type, and end user.

Component Insights:

- Hardware

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware and software.

Type Insights:

- Industrial Robots

- Collaborative Robots (Cobots)

- SCARA Robots

- Cartesian Robots

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes industrial robots, collaborative robots (Cobots), SCARA robots, and cartesian robots.

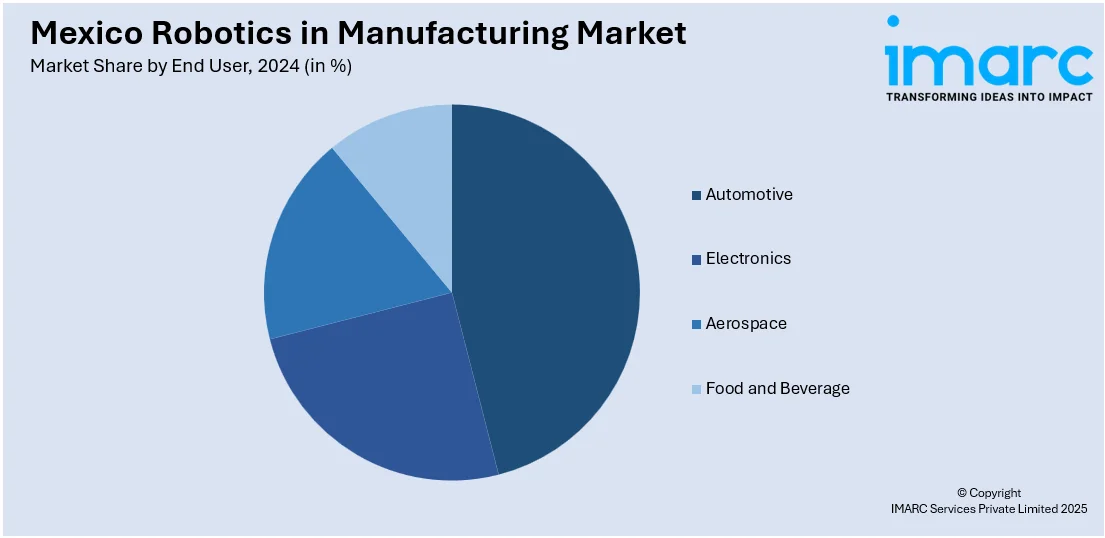

End User Insights:

- Automotive

- Electronics

- Aerospace

- Food and Beverage

The report has provided a detailed breakup and analysis of the market based on the end user. This includes automotive, electronics, aerospace, and food and beverage.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Robotics in Manufacturing Market News:

- Huayan Robotics, also known as Han's Robot, announced that it will make its official debut at FABTECH Mexico 2025, which will take place in Monterrey, Mexico, from May 6 to 8. The company will demonstrate its sophisticated automation solutions, such as the E12-Pro Collaborative Robot and the S35 Heavy Payload Robot, which are designed to improve efficiency and performance in industrial environments. This is Huayan Robotics' first significant appearance since its rebranding, indicating a deliberate shift to strengthen its position in the global robotics market.

Mexico Robotics in Manufacturing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Units |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software |

| Types Covered | Industrial Robots, Collaborative Robots (Cobots), SCARA Robots, Cartesian Robots |

| End Users Covered | Automotive, Electronics, Aerospace, Food and Beverage |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico robotics in manufacturing market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico robotics in manufacturing market on the basis of component?

- What is the breakup of the Mexico robotics in manufacturing market on the basis of type?

- What is the breakup of the Mexico robotics in manufacturing market on the basis of end user?

- What is the breakup of the Mexico robotics in manufacturing market on the basis of region?

- What are the various stages in the value chain of the Mexico robotics in manufacturing market?

- What are the key driving factors and challenges in the Mexico robotics in manufacturing market?

- What is the structure of the Mexico robotics in manufacturing market and who are the key players?

- What is the degree of competition in the Mexico robotics in manufacturing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico robotics in manufacturing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico robotics in manufacturing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico robotics in manufacturing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)