Mexico Rubber Hose Market Size, Share, Trends and Forecast by Product Type, Media, Pressure Rating, Application, and Region, 2025-2033

Mexico Rubber Hose Market Overview:

The Mexico rubber hose market size reached USD 2,34,318.18 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,15,210.24 Million by 2033, exhibiting a growth rate (CAGR) of 3.35% during 2025-2033. Expanding automotive production, rising construction activities, industrial manufacturing growth, burgeoning oil and gas sector investment, infrastructure modernization, surging demand from agriculture, advancements in hose technology, and stricter regulatory standards are factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,34,318.18 Million |

| Market Forecast in 2033 | USD 3,15,210.24 Million |

| Market Growth Rate 2025-2033 | 3.35% |

Mexico Rubber Hose Market Trends:

The Growing Automotive Industry

The robust expansion of Mexico’s automotive sector significantly supports the rubber hose market. As one of the world’s leading vehicle manufacturing hubs, Mexico hosts major global automakers and component suppliers, driving consistent demand for automotive hoses. These hoses are integral to several vehicle systems, including fuel delivery, air conditioning, hydraulic brakes, and engine cooling. The growth in domestic vehicle production, coupled with rising exports to the United States and other regions, has led to steady procurement of high-performance rubber hoses. Additionally, the shift towards more fuel-efficient and lightweight vehicle designs necessitates hoses that can withstand higher temperatures and pressures, which is providing a positive Mexico rubber hose market outlook. With rising consumer demand for passenger and commercial vehicles, especially in the electric vehicle (EV) segments, the need for reliable fluid transfer components is growing. This trend is expected to continue as automotive manufacturers expand their operations and new players enter the market, creating sustained demand for rubber hose products.

.webp)

Construction and Infrastructure Development

Mexico’s focus on strengthening its construction and infrastructure framework is a key driver for the rubber hose market. Large-scale projects in residential housing, commercial buildings, roads, and utilities demand a range of industrial hoses for fluid and air transfer applications. Rubber hoses are widely used in concrete pumping, water delivery, dewatering, and fuel supply on construction sites. The government’s emphasis on infrastructure modernization, through public-private partnerships and investment initiatives, further boosts hose demand. Moreover, the increase in tourism infrastructure and logistics hubs enhances the need for robust mechanical and plumbing systems, where rubber hoses offer durability and cost efficiency, which is propelling the Mexico rubber hose market growth. Growth in the cement and construction materials sector also drives usage of abrasion-resistant hoses. As construction activities become more mechanized and safety standards tighten, contractors and developers are opting for certified, high-quality hoses that comply with environmental and operational regulations. In support of this trend, Continental's ContiTech division announced plans to construct an €82 million hydraulic hose manufacturing facility in Mexico. Scheduled to commence operations in late 2025, this 85,000 square meter plant will be Continental's largest in the country, aimed at bolstering its industrial business in the Americas region.

Manufacturing Sector Expansion

The changing manufacturing landscape is one of the key factors boosting the Mexico rubber hose market share. Burgeoning foreign direct investment (FDI) due to the country’s strategic location and trade agreements, along with competitive labor costs is another factors stimulating the market growth. Rubber hoses play an essential role in these operations, enabling air, gas, steam, and liquid transfers in various manufacturing systems. As industries transition toward precision manufacturing and adopt Industry 4.0 technologies, the need for durable and efficient hose assemblies rises. Additionally, manufacturing facilities are placing greater emphasis on safety and maintenance, leading to regular replacement and upgrading of hose infrastructure. The increase in machinery imports and domestic production activities strengthens distribution channels for industrial hoses.

Mexico Rubber Hose Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, media, pressure rating, and application.

Product Type Insights:

- Natural Latex (Rubber)

- Synthetic

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes natural latex (rubber), synthetic, and others.

Media Insights:

- Water

- Oil

- Hot Water and Steam

- Air/Gas

- Food and Beverage

- Chemical

A detailed breakup and analysis of the market based on the media have also been provided in the report. This includes water, oil, hot water and steam, air/gas, food and beverage, and chemical.

Pressure Rating Insights:

- Low

- Medium

- High

The report has provided a detailed breakup and analysis of the market based on the pressure rating. This includes low, medium, and high.

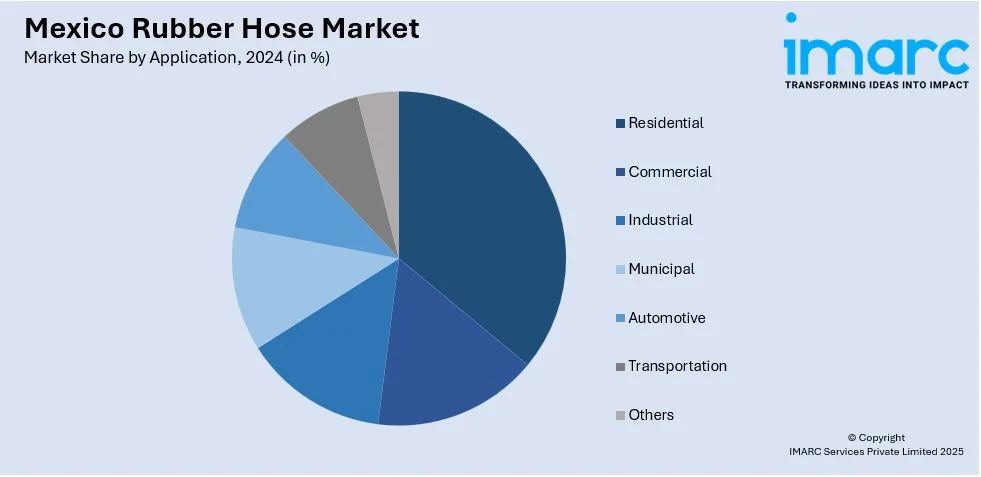

Application Insights:

- Residential

- Commercial

- Industrial

- Municipal

- Automotive

- Transportation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, industrial, municipal, automotive, transportation, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Rubber Hose Market News:

- In 2024, Continental announced a USD 90 million investment in Aguascalientes, Mexico, to build a new hydraulic hose production plant. This facility will increase production capacity to meet rising demand in the automotive sector, reinforcing Continental's presence in North America and expanding its manufacturing capabilities in Mexico.

Mexico Rubber Hose Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Natural Latex (Rubber), Synthetic, Others |

| Medias Covered | Water, Oil, Hot Water and Steam, Air/Gas, Food and Beverage, Chemical |

| Pressure Ratings Covered | Low, Medium, High |

| Applications Covered | Residential, Commercial, Industrial, Municipal, Automotive, Transportation, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico rubber hose market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico rubber hose market on the basis of product type?

- What is the breakup of the Mexico rubber hose market on the basis of media?

- What is the breakup of the Mexico rubber hose market on the basis of pressure rating?

- What is the breakup of the Mexico rubber hose market on the basis of application?

- What is the breakup of the Mexico rubber hose market on the basis of region?

- What are the various stages in the value chain of the Mexico rubber hose market?

- What are the key driving factors and challenges in the Mexico rubber hose market?

- What is the structure of the Mexico rubber hose market and who are the key players?

- What is the degree of competition in the Mexico rubber hose market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico rubber hose market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico rubber hose market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico rubber hose industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)