Mexico Rubber Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Mexico Rubber Market Overview:

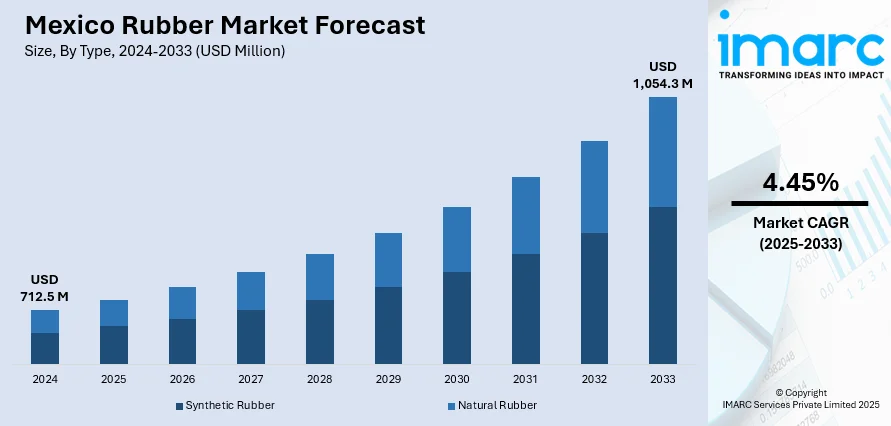

The Mexico rubber market size reached USD 712.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,054.3 Million by 2033, exhibiting a growth rate (CAGR) of 4.45% during 2025-2033. The market is supported by escalating demand from automotive, construction, and industrial applications, and ongoing innovations enhancing product performance. As industrial output grows, the demand for rubber imports and local production also increased to meet the stringent performance and safety standards, thus contributing to the increasing Mexico rubber market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 712.5 Million |

| Market Forecast in 2033 | USD 1,054.3 Million |

| Market Growth Rate 2025-2033 | 4.45% |

Mexico Rubber Market Trends:

Growth in the Automotive Industry

The expansion of Mexico’s automotive sector is a primary driver of the rubber market. As a global manufacturing hub, Mexico attracts major automotive companies due to its strategic location, trade agreements, and skilled labor force. Rubber is a key component in tires, seals, belts, and various automotive parts, making its demand directly tied to vehicle production. The push for electric vehicles (EVs) and increased domestic car ownership also contributes to steady growth. Automakers rely on both synthetic and natural rubber to meet quality and performance standards. As automotive production scales up to meet local and export demands, the need for high-quality rubber products continues to rise, boosting overall market development. For instance, in August 2024, prominent global tire producer ZC Rubber commemorated the groundbreaking event for its third international manufacturing site, situated in Saltillo, Coahuila. The facility signified an investment exceeding US$500 million and is a vital element of ZC Rubber’s global growth strategy, highlighting its dedication to addressing the increasing tire demand in North and Latin America.

To get more information of this market, Request Sample

Expansion of Construction and Infrastructure Projects

Mexico’s construction sector is witnessing consistent growth driven by government infrastructure initiatives, urban development, and industrial expansion. Rubber is essential in construction for its durability, flexibility, and resistance to weathering, making it ideal for seals, insulation, roofing membranes, and flooring. The demand for modern infrastructure, including roads, bridges, and commercial buildings, is pushing the adoption of rubber-based materials. Public-private partnerships and foreign investments in infrastructure also contribute to this trend. Additionally, building codes and safety regulations increasingly favor materials that offer long-term performance, where rubber plays a critical role. This sustained demand from construction activities directly fuels the growth of the rubber industry across various product segments.

Rise in Industrial Manufacturing and Exports

Mexico’s manufacturing sector, including electronics, aerospace, and machinery, heavily relies on rubber for gaskets, hoses, belts, and vibration-dampening components, which is driving the Mexico rubber market growth. As industrial output grows, so does the demand for rubber products that meet stringent performance and safety standards. Mexico’s role as a key exporter of manufactured goods to North America and beyond boosts the need for reliable raw materials like rubber. The country’s integration into global supply chains has led to increased rubber imports and local production to meet quality and delivery requirements. The emphasis on efficiency and durability in industrial applications strengthens the market for specialized rubber compounds tailored to diverse operational needs across various manufacturing sectors.

Mexico Rubber Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Synthetic Rubber

- Natural Rubber

The report has provided a detailed breakup and analysis of the market based on the type. This includes synthetic rubber and natural rubber.

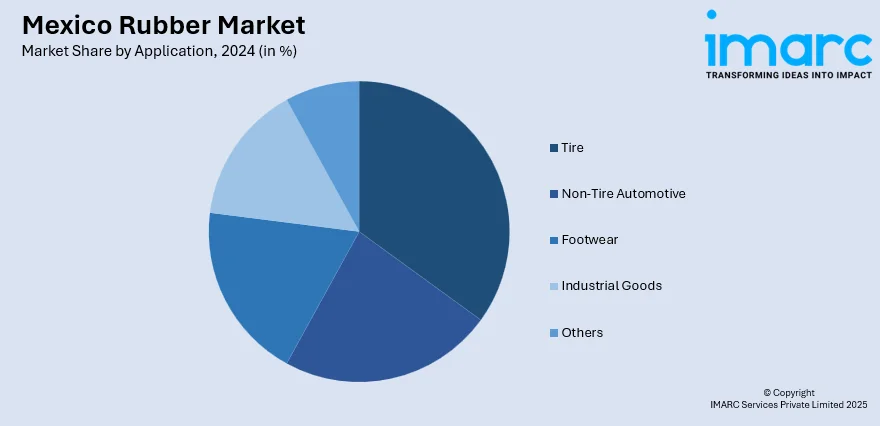

Application Insights:

- Tire

- Non-Tire Automotive

- Footwear

- Industrial Goods

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes tire, non-tire automotive, footwear, industrial goods, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Rubber Market News:

- In March 2024, The Yokohama Rubber Company claimed that to increase its ability to supply tires to the North American market, it would construct a passenger car tire plant in Mexico. With a proposed capital investment of $380 million (Rs 3,165 crore), the new facility will have the capacity to produce 5 million tires annually.

- In February 2024, the tire producer Zhongce Rubber Group, often known as ZC Rubber, is based in Hangzhou and plans to expand its global footprint by building a new plant in Saltillo, Mexico, to satisfy the growing demand for tires in the area.

Mexico Rubber Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Synthetic Rubber, Natural Rubber |

| Applications Covered | Tire, Non-Tire Automotive, Footwear, Industrial Goods, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico rubber market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico rubber market on the basis of type?

- What is the breakup of the Mexico rubber market on the basis of application?

- What is the breakup of the Mexico rubber market on the basis of region?

- What are the various stages in the value chain of the Mexico rubber market?

- What are the key driving factors and challenges in the Mexico rubber market?

- What is the structure of the Mexico rubber market and who are the key players?

- What is the degree of competition in the Mexico rubber market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico rubber market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico rubber market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico rubber industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)