Mexico Running Gear Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2025-2033

Mexico Running Gear Market Overview:

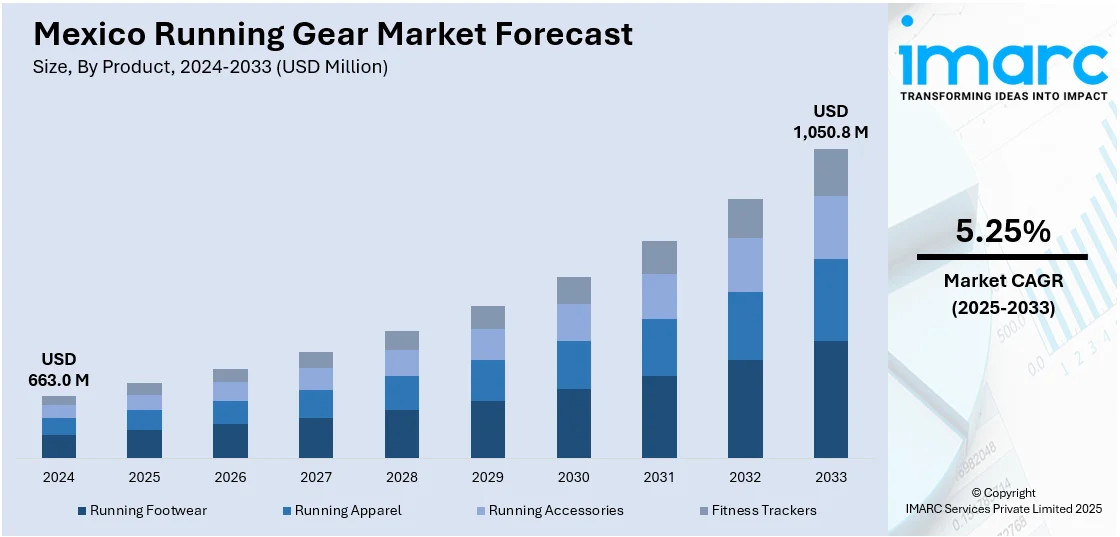

The Mexico running gear market size reached USD 663.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,050.8 Million by 2033, exhibiting a growth rate (CAGR) of 5.25% during 2025-2033. Increasing health and fitness culture, inflating disposable incomes, and greater participation in marathons are fueling market demand. Sports initiatives from the government and marketing through influencers and the augmenting demand for sustainable products are further broadening the Mexico running equipment market share, which makes Mexico an important expansion prospect for global as well as domestic brands.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 663.0 Million |

| Market Forecast in 2033 | USD 1,050.8 Million |

| Market Growth Rate 2025-2033 | 5.25% |

Mexico Running Gear Market Trends:

Rising Demand for Sustainable yet Affordable Running Gear

The significant shift toward sustainability, driven by environmentally conscious consumers is contributing to the Mexico running gear market growth. Brands are increasingly adopting eco-friendly materials such as recycled polyester, organic cotton, and biodegradable fabrics in their running apparel and footwear. This trend aligns with global movements toward reducing carbon footprints and waste, appealing to Mexican runners who prioritize ethical consumption. Additionally, local and international brands are launching initiatives such as take-back programs for old shoes and apparel recycling to promote circular fashion. They are also shifting to nearshoring, the relocation of production and manufacturing operations closer to end consumers, which is driving significant economic growth in Mexico and is expected to continue in the near future. A notable example of this is Tesla's $5 billion automotive factory in Monterrey, Mexico. The shift towards nearshoring has resulted in Mexico replacing China as the top U.S. trading partner in 2023. Social media and influencer marketing have also amplified awareness, encouraging more runners to choose sustainable options. As government regulations on environmental impact tighten, companies investing in green innovations are gaining a competitive edge. The demand for sustainable running gear is expected to grow further, especially among urban millennials and Gen Z consumers who value both performance and planet-friendly products.

Growth of Online Retail and Direct-to-Consumer Sales for Running Gear

The rise in online sales, fueled by increased internet penetration and smartphone usage is creating a positive Mexico running gear market outlook. E-commerce platforms and specialized sports retailers are expanding their running gear offerings, providing consumers with convenience and competitive pricing. A research report from the IMARC Group indicates that the e-commerce market in Mexico achieved a size of USD 47.5 Billion in 2024. It is projected to grow to USD 176.6 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 14.5% from 2025 to 2033. Direct-to-consumer (DTC) brands are also gaining traction, leveraging social media advertising and influencer partnerships to reach fitness enthusiasts. This shift has reduced reliance on traditional brick-and-mortar stores, especially post-pandemic, as runners prefer home delivery and virtual try-on features. Additionally, subscription-based models for running apparel and personalized shopping experiences are enhancing customer loyalty. With digital payment solutions becoming more accessible, online sales are projected to dominate the market, pushing brands to optimize their digital presence and logistics for faster, more efficient delivery across Mexico.

Mexico Running Gear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, gender, and distribution channel.

Product Insights:

- Running Footwear

- Running Apparel

- Running Accessories

- Fitness Trackers

The report has provided a detailed breakup and analysis of the market based on the product. This includes running footwear, running apparel, running accessories, and fitness trackers.

Gender Insights:

- Male

- Female

- Unisex

A detailed breakup and analysis of the market based on the gender have also been provided in the report. This includes male, female, and unisex.

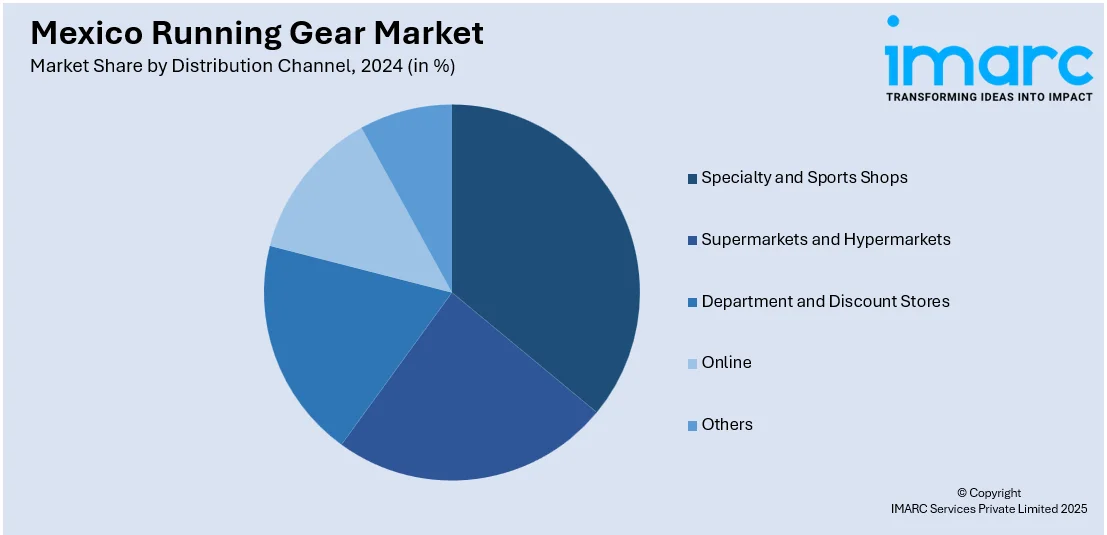

Distribution Channel Insights:

- Specialty and Sports Shops

- Supermarkets and Hypermarkets

- Department and Discount Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes specialty and sports shops, supermarkets and hypermarkets, department and discount stores, online, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Running Gear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Running Footwear, Running Apparel, Running Accessories, Fitness Trackers |

| Genders Covered | Male, Female, Unisex |

| Distribution Channels Covered | Specialty and Sports Shops, Supermarkets and Hypermarkets, Department and Discount Stores, Online, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico running gear market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico running gear market on the basis of product?

- What is the breakup of the Mexico running gear market on the basis of gender?

- What is the breakup of the Mexico running gear market on the basis of distribution channel?

- What is the breakup of the Mexico running gear market on the basis of region?

- What are the various stages in the value chain of the Mexico running gear market?

- What are the key driving factors and challenges in the Mexico running gear market?

- What is the structure of the Mexico running gear market and who are the key players?

- What is the degree of competition in the Mexico running gear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico running gear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico running gear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico running gear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)