Mexico Sauces and Seasonings Market Size, Share, Trends and Forecast by Product Type, Packaging Type, Distribution Channel, End User, and Region, 2025-2033

Mexico Sauces and Seasonings Market Overview:

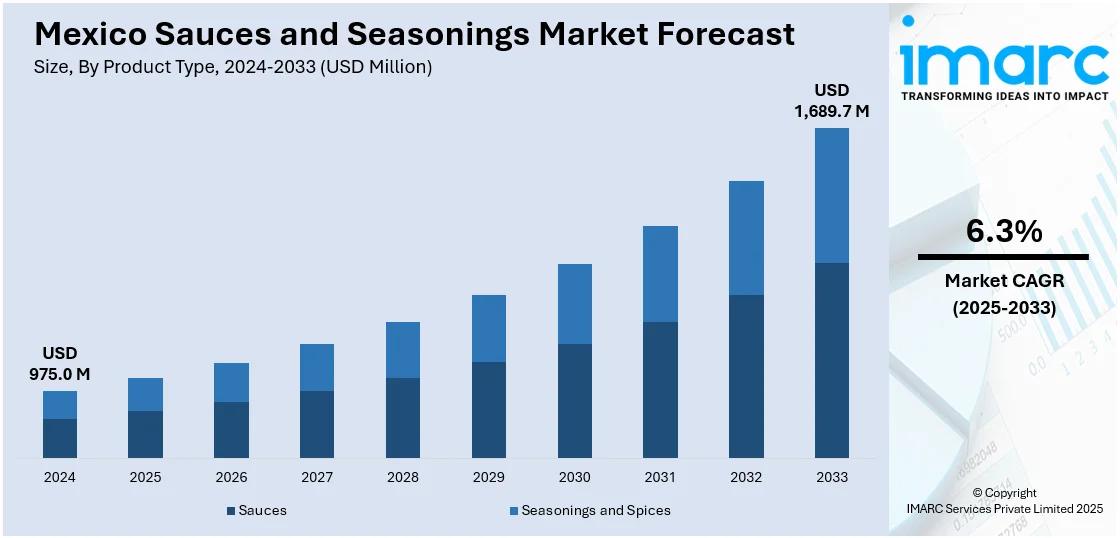

The Mexico sauces and seasonings market size reached USD 975.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,689.7 Million by 2033, exhibiting a growth rate (CAGR) of 6.3% during 2025-2033. The market is driven by rising demand for authentic regional flavors, fueled by food tourism and global interest in Mexican cuisine. Health-conscious consumers are shifting toward natural, organic, and clean-label products, while innovation in traditional ingredients and e-commerce expansion further accelerates growth. Government health initiatives also support market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 975.0 Million |

| Market Forecast in 2033 | USD 1,689.7 Million |

| Market Growth Rate 2025-2033 | 6.3% |

Mexico Sauces and Seasonings Market Trends:

Growing Demand for Authentic and Regional Mexican Flavors

The rise in demand for authentic and regional flavors, driven by consumers' increasing interest in traditional and artisanal food products, is favoring the Mexico sauces and seasonings market growth. As Mexican cuisine gains global popularity, both domestic and international consumers are seeking genuine taste experiences, such as Oaxacan mole, Yucatecan recados, and Sinaloan chili-based sauces. This trend is further fueled by the rise of food tourism and social media, where consumers discover and crave unique regional dishes. 94% of internet users in Mexico are connected to the web through smart devices at home. In 2023, 81.2% of the population used the Internet, up 9.7 percentage points since 2020, which points to progress in the digital inclusion of the population. The data highlights significant opportunities for sauces and seasonings producers as digital engagement grows across rural and urban centers. Local brands and small-scale producers are capitalizing on this trend by offering high-quality, heritage recipes with minimal preservatives. Additionally, supermarkets and e-commerce platforms are expanding their selections of regional sauces and seasonings to cater to this demand. As consumers become more adventurous with their palates, manufacturers are innovating with traditional ingredients such as huitlacoche, chapulines (grasshoppers), and rare chili varieties, further creating a positive Mexico sauces and seasonings market outlook.

Health-Conscious Shift Toward Natural and Organic Ingredients

Another key trend in the Mexico sauces and seasonings market is the growing preference for natural, organic, and clean-label products. In 2023, Mexico authorized 571,608 hectares for organic agriculture, of which 60% are for wild harvesting, and 40% are for crops produced on farms. The top crop was coffee, on 88,173 hectares, followed by oranges, mangoes, and lemons. 46,030 certified organic plant producers. This trend reflects a significant growth opportunity for the premium organic market in Mexico, especially for seasonings. Health-conscious consumers are increasingly avoiding artificial additives, opting instead for sauces and seasonings made with non-GMO, organic, and sustainably sourced ingredients. This shift aligns with global wellness trends, where transparency in food production is highly valued. Brands are responding by reducing sodium, eliminating MSG, and incorporating superfoods such as chia seeds, turmeric, and spirulina into their products. The demand for low-sugar, gluten-free, and vegan-friendly options is also rising, particularly among urban millennials and Gen Z shoppers. Furthermore, government initiatives promoting healthy eating and the proliferation of organic certification labels are enhancing consumer trust. As a result, both established companies and startups are reformulating their products to meet these health-driven expectations, making natural and organic sauces and seasonings a dominant segment in the market. Therefore, this is further expanding the Mexico sauces and seasonings market share.

Mexico Sauces and Seasonings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, packaging type, distribution channel, and end user.

Product Type Insights:

- Sauces

- Hot Sauces

- Table Sauces

- Cooking Sauces

- Dips and Dressings

- Seasonings and Spices

- Powdered Seasonings

- Liquid Seasonings

- Herb and Spice Blends

The report has provided a detailed breakup and analysis of the market based on the product type. This includes sauces (hot sauces, table sauces, cooking sauces, and dips and dressings), and seasonings and spices (powdered seasonings, liquid seasonings, and herb and spice blends).

Packaging Type Insights:

- Bottles and Jars

- Pouches and Sachets

- Cans and Tins

- Spray and Squeeze Packs

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes bottles and jars, pouches and sachets, cans and tins, and spray and squeeze packs.

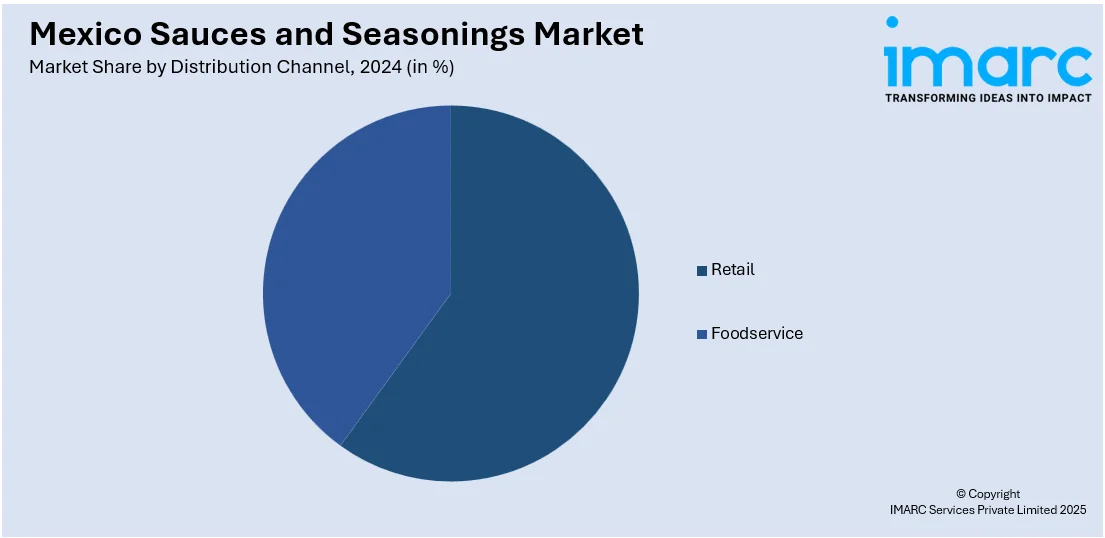

Distribution Channel Insights:

- Retail

- Foodservice

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes retail and foodservice.

End User Insights:

- Household/Consumer

- Food manufacturers

- HoReCa (Hotels, Restaurants, Cafés)

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes household/consumer, food manufacturers, and HoReCa (hotels, restaurants, cafés).

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Sauces and Seasonings Market News:

- October 04, 2024: Mexican food brand SOMOS launched a new range of simmer sauces in the United States in taco, fajita, and al pastor flavors made with authentic ingredients including tomatoes, chiles, and pineapple juice. The sauces will be sold in 12-ounce jars at USD 4.99 and 8-ounce pouches at USD 2.99. Whole Foods, Meijer, and Sprouts will carry the products, and Target will add them later. This debut represents growing consumer demand for Mexico-themed seasonings and sauces, responding to the need for convenient and flavorful home-cooking meals.

Mexico Sauces and Seasonings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Packaging Types Covered | Bottles and Jars, Pouches and Sachets, Cans and Tins, Spray and Squeeze Packs |

| Distribution Channels Covered | Retail, Foodservice |

| End Users Covered | Household/Consumer, Food manufacturers, HoReCa (Hotels, Restaurants, Cafés) |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico sauces and seasonings market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico sauces and seasonings market on the basis of product type?

- What is the breakup of the Mexico sauces and seasonings market on the basis of packaging type?

- What is the breakup of the Mexico sauces and seasonings market on the basis of distribution channel?

- What is the breakup of the Mexico sauces and seasonings market on the basis of end user?

- What is the breakup of the Mexico sauces and seasonings market on the basis of region?

- What are the various stages in the value chain of the Mexico sauces and seasonings market?

- What are the key driving factors and challenges in the Mexico sauces and seasonings market?

- What is the structure of the Mexico sauces and seasonings market and who are the key players?

- What is the degree of competition in the Mexico sauces and seasonings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico sauces and seasonings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico sauces and seasonings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico sauces and seasonings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)