Mexico School Market Size, Share, Trends and Forecast by Level of Education, Ownership, Board of Affiliation, Fee Structure, and Region, 2025-2033

Mexico School Market Overview:

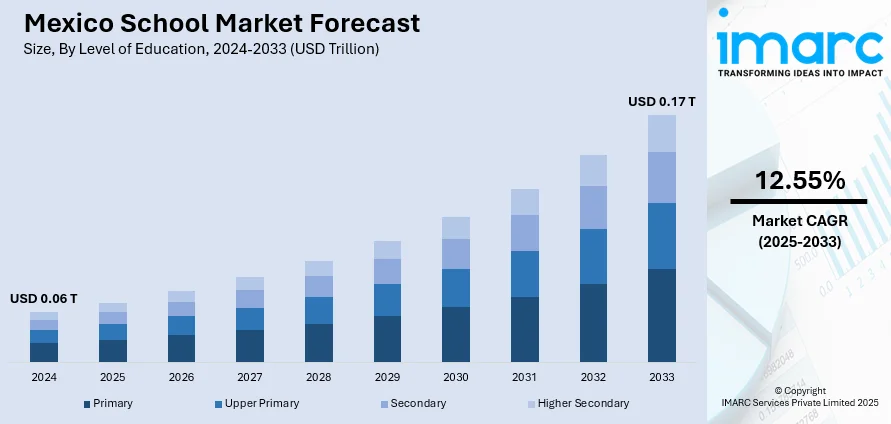

The Mexico school market size reached USD 0.06 Trillion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.17 Trillion by 2033, exhibiting a growth rate (CAGR) of 12.55% during 2025-2033. The market is evolving with rising private enrollment, government investment in public education, and growing demand for bilingual and international curricula. Moreover, digital adoption and regional infrastructure development are shaping access, quality, and competitiveness across education segments nationwide.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.06 Trillion |

| Market Forecast in 2033 | USD 0.17 Trillion |

| Market Growth Rate 2025-2033 | 12.55% |

Mexico School Market Trends:

Expansion of Bilingual and International Curriculum

Mexico is witnessing a steady rise in demand for bilingual and international education, particularly among urban, middle-, and high-income families seeking global academic standards for their children. This trend is contributing to Mexico school market growth as more institutions adopt English-medium instruction and align with global boards like IB, Cambridge, and other internationally recognized programs. Parents increasingly value fluency in English and global competencies as essential for future academic and career success. In response, private schools are expanding their bilingual offerings, while new international schools are entering the market in major cities such as Mexico City, Monterrey, and Guadalajara. For instance, in February 2025, Kipling School in Mexico City joined the Nord Anglia Education network, expanding its presence in Mexico to four schools. Known for its rigorous bilingual curriculum, Kipling School serves over 2,500 students. Joining Nord Anglia offers enhanced global learning opportunities and professional development for both students and staff. These programs are also gaining traction in the medium-income fee segment through hybrid models that combine local and global curricula. This strategic shift in curriculum offerings is expected to remain a defining factor shaping the Mexico school market outlook.

Government Push for Infrastructure

The Mexican government is actively investing in public education infrastructure to bridge the urban-rural divide and improve learning outcomes nationwide. This includes large-scale programs targeting the construction and renovation of school buildings, provision of digital devices and internet connectivity, and enhancement of sanitation and safety standards particularly in underserved rural and semi-urban areas. For instance, in March 2025, Mexico's government announced its plans to invest MX$ 2.5 Billion in educational infrastructure, led by SICT and SEP. The plan includes building 18 new high schools, converting 35 secondary schools, and expanding 33 existing campuses, benefiting over 38,700 students. Additional investments under the La Escuela Es Nuestra program will further enhance educational facilities. Additionally, efforts to upskill teachers through training programs and integrate technology into classrooms are improving the quality of instruction in public institutions. These initiatives are part of broader federal education reforms aimed at making public schools more competitive and inclusive. By addressing critical gaps in resources and accessibility, the government is strengthening confidence in public education and reducing overdependence on private institutions in certain regions. This expanded reach and improved capacity are playing a key role in sustaining and stabilizing Mexico school market share.

Mexico School Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on level of education, ownership, board of affiliation, and fee structure.

Level of Education Insights:

- Primary

- Upper Primary

- Secondary

- Higher Secondary

The report has provided a detailed breakup and analysis of the market based on the level of education. This includes primary, upper primary, secondary, and higher secondary.

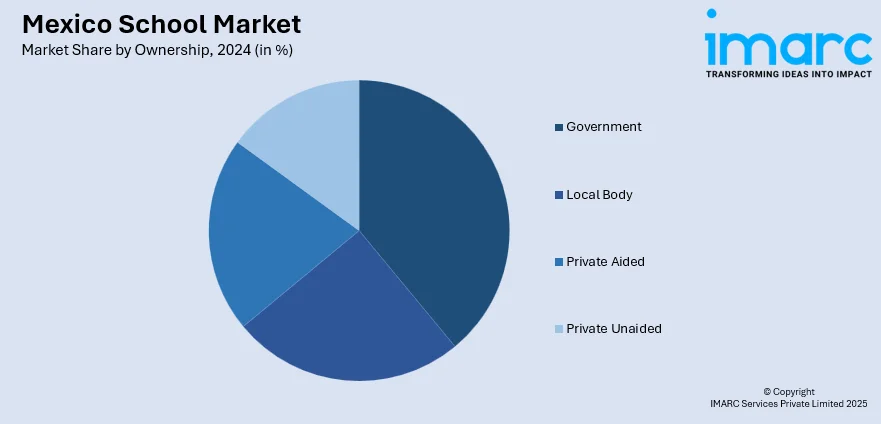

Ownership Insights:

- Government

- Local Body

- Private Aided

- Private Unaided

A detailed breakup and analysis of the market based on the ownership have also been provided in the report. This includes government, local body, private aided, and private unaided.

Board of Affiliation Insights:

- Central Board of Secondary Education (CBSE)

- Council for the Indian School Certificate Examinations (CISCE)

- State Government Boards

- Others

A detailed breakup and analysis of the market based on the board of affiliation have also been provided in the report. This includes Central Board of Secondary Education (CBSE), Council for the Indian School Certificate Examinations (CISCE), State Government Boards, and others.

Fee Structure Insights:

- Low-Income

- Medium-Income

- High-Income

A detailed breakup and analysis of the market based on the fee structure have also been provided in the report. This includes low-income, medium-income, and high-income.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico School Market News:

- In February 2025, the Mexican government announced its plans to eliminate admission exams for public high schools in Mexico City, promoting universal access to education. Under the "National High School for All" initiative, students can apply to up to 10 schools, with guaranteed placements by May, alongside infrastructure improvements and streamlined educational tracks.

- In September 2024, Inspired welcomed The Wingate School, a prestigious Cambridge international school located in Mexico City, into its global family. This partnership strengthens Inspired's presence in Mexico and provides Wingate students with access to best practices in education. Both institutions focus on individualized learning, with the goal of developing resilient, independent learners who are prepared for success in a global environment.

Mexico School Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Trillion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Levels of Education Covered | Primary, Upper Primary, Secondary, Higher Secondary |

| Ownerships Covered | Government, Local Body, Private Aided, Private Unaided |

| Boards of Affiliation Covered | Central Board of Secondary Education (CBSE), Council for the Indian School Certificate Examinations (CISCE), State Government Boards, Others |

| Fee Structures Covered | Low-Income, Medium-Income, High-Income |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico school market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico school market on the basis of level of education?

- What is the breakup of the Mexico school market on the basis of ownership?

- What is the breakup of the Mexico school market on the basis of board of affiliation?

- What is the breakup of the Mexico school market on the basis of fee structure?

- What is the breakup of the Mexico school market on the basis of region?

- What are the various stages in the value chain of the Mexico school market?

- What are the key driving factors and challenges in the Mexico school?

- What is the structure of the Mexico school market and who are the key players?

- What is the degree of competition in the Mexico school market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico school market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico school market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico school industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)