Mexico Security as a Service Market Size, Share, Trends and Forecast by Component, Organization Size, Application, Vertical, and Region, 2025-2033

Mexico Security as a Service Market Overview:

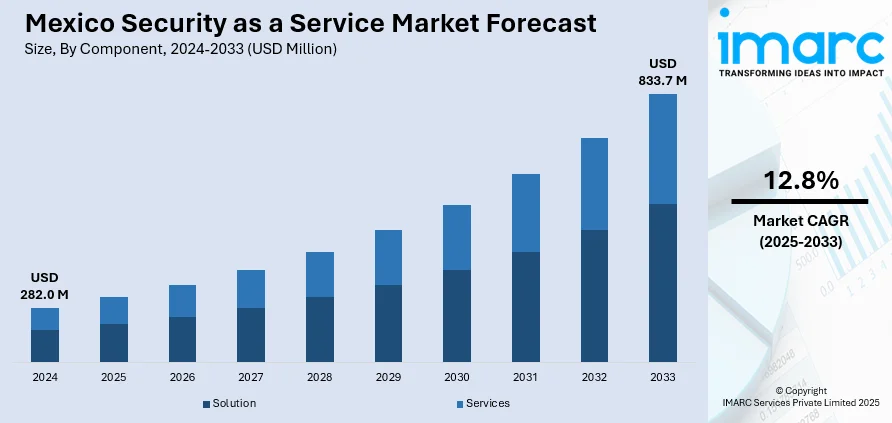

The Mexico security as a service market size reached USD 282.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 833.7 Million by 2033, exhibiting a growth rate (CAGR) of 12.8% during 2025-2033. The rising cyber threats across government and enterprise networks and increasing regulatory compliance requirements are propelling market demand. Moreover, growing digital transformation, heightened demand for real-time threat detection and response, the surge in ransomware attacks, rising awareness of data privacy, growing use of BYOD policies, increasing investments in managed security services, and technological advancements in AI-driven threat analytics are some of the major factors augmenting Mexico security as a service market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 282.0 Million |

| Market Forecast in 2033 | USD 833.7 Million |

| Market Growth Rate 2025-2033 | 12.8% |

Mexico Security as a Service Market Trends:

Expanding Remote Workforce and Hybrid Work Models

The rapid expansion of remote and hybrid work arrangements across Mexico is significantly reshaping cybersecurity priorities and accelerating the adoption of security solutions. According to industry reports, about 42.1% of Mexican tech workers prefer working remotely, about 24.7% favor flexible work arrangements, and 26.6% prefer hybrid approaches. With the growing number of employees accessing corporate networks from unsecured home or public internet connections, traditional perimeter-based security architectures have proven inadequate. Organizations are increasingly migrating toward cloud-based, scalable security models that can provide consistent protection across dispersed endpoints. This includes the use of cloud access security brokers (CASBs), secure web gateways (SWGs), endpoint detection and response (EDR), and identity and access management (IAM) systems delivered as services. In addition to this, the push for zero-trust architecture, where access is granted based on verification rather than assumed trust, is gaining momentum due to the decentralization of workforces. Businesses in sectors like financial services, professional services, and education are particularly focused on ensuring data confidentiality and preventing unauthorized access in a distributed work environment, which is contributing to Mexico security as a service market growth. Furthermore, vendors offering robust remote access security, real-time threat analytics, and centralized monitoring are experiencing increased demand, especially among firms managing hybrid IT infrastructure and mobile workforces.

To get more information of this market, Request Sample

Growing Adoption Among Small and Medium-Sized Enterprises (SMEs)

The small and medium-sized enterprises (SMEs) form a critical segment of the country's economic landscape. As per industry reports, small and medium-sized enterprises (SMEs) account for 99.8% of all businesses in the nation. These businesses face the dual challenge of escalating cyber threats and limited in-house cybersecurity resources, prompting a shift toward subscription-based, outsourced security services. With cyberattacks like phishing, ransomware, and business email compromise targeting SMEs with increasing frequency, many firms are turning to managed security providers for cost-effective protection that doesn't require building extensive internal teams. Moreover, regulatory expectations tied to data protection laws are compelling SMEs to strengthen their cybersecurity posture. SECaaS solutions, offering modularity, affordability, and automatic updates, are well-aligned with SME needs. In addition to this, major market players are tailoring offerings for SMEs by bundling key features and offering multilingual support, streamlined onboarding, and flexible payment models that suit firms with constrained capital and evolving security needs.

Mexico Security as a Service Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, organization size, application, and vertical.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

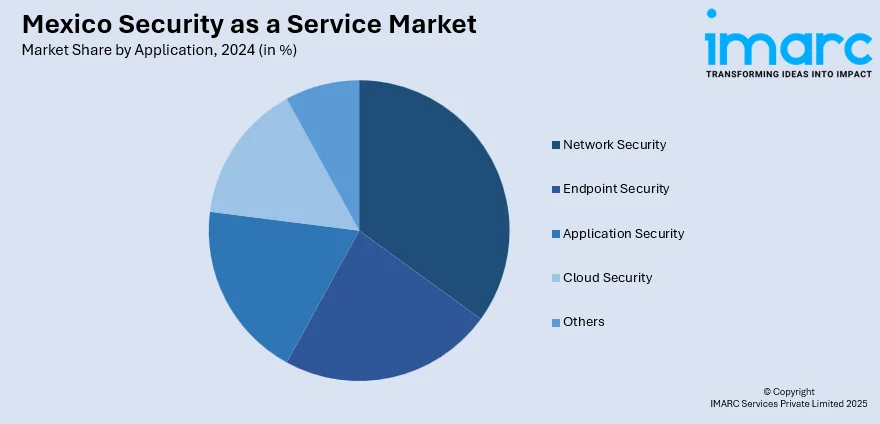

Application Insights:

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes network security, endpoint security, application security, cloud security, and others.

Vertical Insights:

- BFSI

- Government and Defense

- Retail and E-Commerce

- Healthcare and Life Sciences

- IT and Telecom

- Energy and Utilities

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes BFSI, government and defense, retail and e-commerce, healthcare and life sciences, IT and telecom, energy and utilities, manufacturing, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Security as a Service Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Applications Covered | Network Security, Endpoint Security, Application Security, Cloud Security, Others |

| Verticals Covered | BFSI, Government and Defense, Retail and E-Commerce, Healthcare and Life Sciences, IT and Telecom, Energy and Utilities, Manufacturing, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico security as a service market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico security as a service market on the basis of component?

- What is the breakup of the Mexico security as a service market on the basis of organization size?

- What is the breakup of the Mexico security as a service market on the basis of application?

- What is the breakup of the Mexico security as a service market on the basis of vertical?

- What is the breakup of the Mexico security as a service market on the basis of region?

- What are the various stages in the value chain of the Mexico security as a service market?

- What are the key driving factors and challenges in the Mexico security as a service market?

- What is the structure of the Mexico security as a service market and who are the key players?

- What is the degree of competition in the Mexico security as a service market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico security as a service market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico security as a service market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico security as a service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)