Mexico Self Storage Market Size, Share, Trends and Forecast by Storage Unit Size, End Use, and Region, 2025-2033

Mexico Self Storage Market Overview:

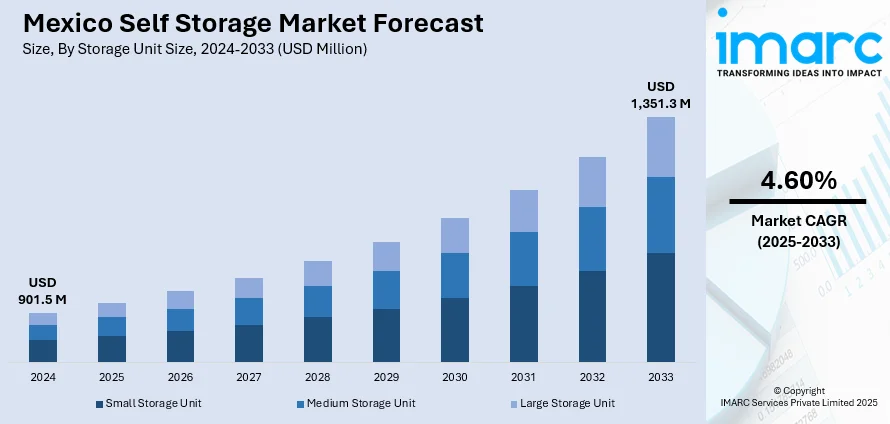

The Mexico self storage market size reached USD 901.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,351.3 Million by 2033, exhibiting a growth rate (CAGR) of 4.60% during 2025-2033. The market is driven by rapid urbanization, shrinking living spaces, and a growing middle class, increasing demand for storage solutions. The rise of e-commerce and small businesses fuels need for inventory storage, while technological advancements enhance operational efficiency. Additionally, flexible leasing options and modern amenities attract both individual and commercial customers, enhancing market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 901.5 Million |

| Market Forecast in 2033 | USD 1,351.3 Million |

| Market Growth Rate 2025-2033 | 4.60% |

Mexico Self Storage Market Trends:

Increasing Demand for Urban Self Storage Solutions

The rise in demand, particularly in urban areas such as Mexico City, Monterrey, and Guadalajara is majorly driving the Mexico self storage market growth. Rapid urbanization, shrinking residential spaces, and a growing middle class are key drivers behind this trend. As more individuals move into cities, living spaces become smaller, prompting individuals and businesses to seek external storage solutions for excess belongings, inventory, and documents. Additionally, the rise of e-commerce has led small businesses and entrepreneurs to rely on self storage units for storing products and supplies, further fueling market growth. A research report from the IMARC Group indicates that the e-commerce market in Mexico achieved a size of USD 47.5 Billion in 2024. It is projected to grow to USD 176.6 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 14.5% from 2025 to 2033. Developers are responding by expanding facilities with modern amenities, including climate control, 24/7 security, and flexible leasing options. This trend is expected to continue as urban populations grow and consumer behavior shifts toward convenience and space optimization.

Adoption of Technology and Automation in Self Storage Facilities

The increasing integration of technology to enhance customer experience and operational efficiency is augmenting the Mexico self storage market share. Many operators also are embracing digital solutions for online reservations, contactless entry and automated payment solutions to attract tech savvy consumers. Cutting-edge security solutions like biometric access and AI-driven surveillance are not just becoming standard; they are redefining safety and security, leading to an increased influx of clientele. Moreover, cloud-based management software is helping operators streamline inventory management and optimize space productivity. This tech advancement enhances operational efficiency and reduces staff overhead, which allows providers to price competitively. To distinguish themselves and increase market share, self-storage companies in Mexico are leveraging digital transformation, which is promulgating different sectors. Mexico faces a dual challenge of workforce transformation, with 18.9% of jobs at high risk of automation. This is 6.9 percentage points above the OECD average. Additionally, 19% of jobs are prone to Generative AI, highlighting the tech gap between urban and rural areas. Labor productivity is falling at a rate of 0.6% per year, and NEET rates in Chiapas amount to 30% of the population. Organizations are demanding more automation, including in sectors such as self storage, where AI and robotics can alleviate labor shortages and streamline operational processes. The trend toward automation is growing, creating a positive Mexico self storage market outlook.

Mexico Self Storage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on storage unit size and end use.

Storage Unit Size Insights:

- Small Storage Unit

- Medium Storage Unit

- Large Storage Unit

The report has provided a detailed breakup and analysis of the market based on the storage unit size. This includes small storage unit, medium storage unit, and large storage unit.

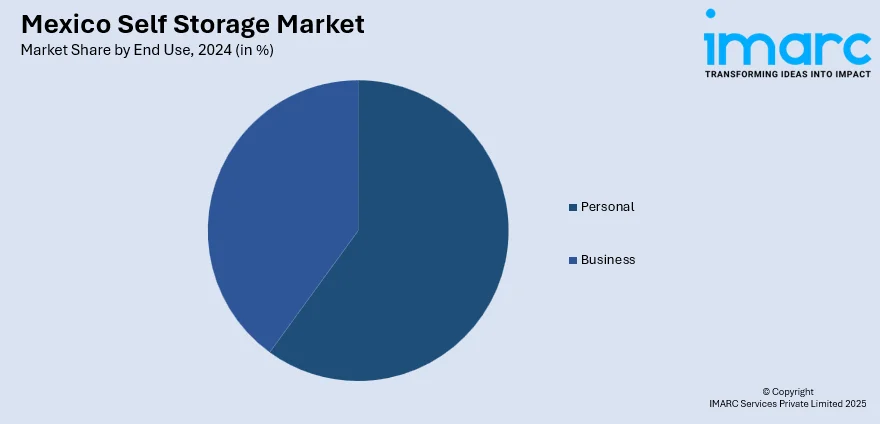

End Use Insights:

- Personal

- Business

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes personal and business.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Self Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Storage Unit Sizes Covered | Small Storage Unit, Medium Storage Unit, Large Storage Unit |

| End Uses Covered | Personal, Business |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico self storage market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico self storage market on the basis of storage unit size?

- What is the breakup of the Mexico self storage market on the basis of end use?

- What is the breakup of the Mexico self storage market on the basis of region?

- What are the various stages in the value chain of the Mexico self storage market?

- What are the key driving factors and challenges in the Mexico self storage market?

- What is the structure of the Mexico self storage market and who are the key players?

- What is the degree of competition in the Mexico self storage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico self storage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico self storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico self storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)