Mexico Ship Repairing Market Size, Share, Trends and Forecast by Vessel Type, Application, End User, and Region, 2025-2033

Mexico Ship Repairing Market Overview:

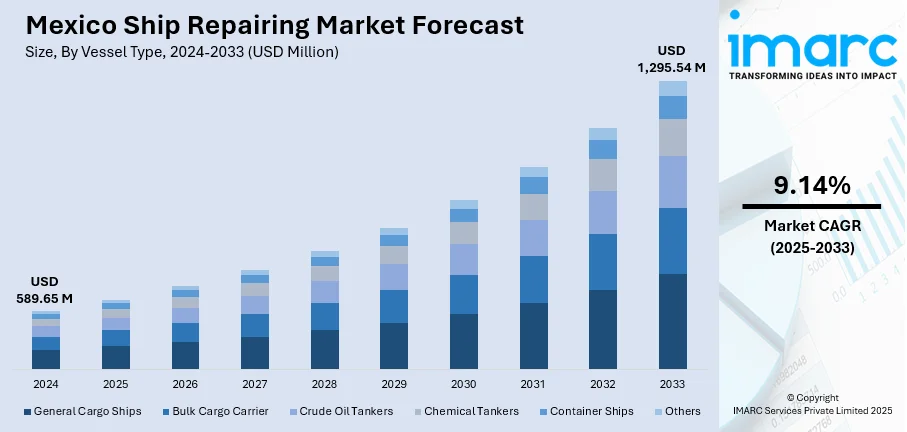

The Mexico ship repairing market size reached USD 589.65 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,295.54 Million by 2033, exhibiting a growth rate (CAGR) of 9.14% during 2025-2033. The market is growing, spurred by growing maritime trade and government policies favoring the maritime industry. Port infrastructure investments and cutting-edge repair technologies are fueling the growth of the market. Consequently, Mexico ship repairing market share is expected to increase, spurred by increased demand for effective ship maintenance services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 589.65 Million |

| Market Forecast in 2033 | USD 1,295.54 Million |

| Market Growth Rate 2025-2033 | 9.14% |

Mexico Ship Repairing Market Trends:

Rising Maritime Trade Driving Demand

The Mexican ship repair industry is growing with the growing amount of sea trade. Mexico's strategic location on main shipping routes such as the Pacific and the Gulf of Mexico has enhanced its significance within global trade. With maritime traffic increasing in volume, so is the demand for sound maintenance and repair services. This increased demand for ship repair is also propelled by an increasing emphasis on upholding environmental regulations within the shipping sector. The Mexican ship repair industry gains as ships need their regular maintenance, upgrades, and repairs to comply with tighter regulations. Mexico has invested heavily in its sea infrastructure as a direct response to this increased demand. The increase in dry docks and the fitting of new technologies enable Mexican shipyards to service a greater number of ships. These changes ensure the nation's capacity to accommodate the increasing international maritime commerce, offering reliable and extensive repair facilities for diverse types of ships. The consistent growth of sea commerce and the strict environmental policies are the main factors behind the growth of Mexico's ship repairing industry, fueling the demand for strong repair services.

To get more information on this market, Request Sample

Government Support Boosting the Ship Repairing Sector

Mexico's government policies to boost its maritime sector are the other major force that is fueling the growth of Mexico's ship-repair industry. Moreover, the government has implemented policies that include tax breaks, subsidies for the shipyards, and investments in port facilities with a focus on making the maritime sector competitive. These initiatives aim to get both regional and global shipping lines to Mexican ports for ship repair and maintenance services, stimulating the country's demand for ship repair services. In recent times, the government has financed improvements in different ports and shipyards, including investments in the modernization of facilities and the enlargement of dry docks. These efforts not only enhance the general capability of the ship repairing industry but also reinforce the level of safety and service quality, which renders Mexican shipyards competitive to international shipping companies that require top-quality repairs and maintenance. Besides, state-supported infrastructure upgrades and encouraging policies play a crucial role in driving the Mexico ship repairing market growth, making the nation a formidable force in international maritime repair services.

Mexico Ship Repairing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on vessel type, application, and end user.

Vessel Type Insights:

- General Cargo Ships

- Bulk Cargo Carrier

- Crude Oil Tankers

- Chemical Tankers

- Container Ships

- Others

The report has provided a detailed breakup and analysis of the market based on the vessel type. This includes general cargo ships, bulk cargo carrier, crude oil tankers, chemical tankers, container ships, and others.

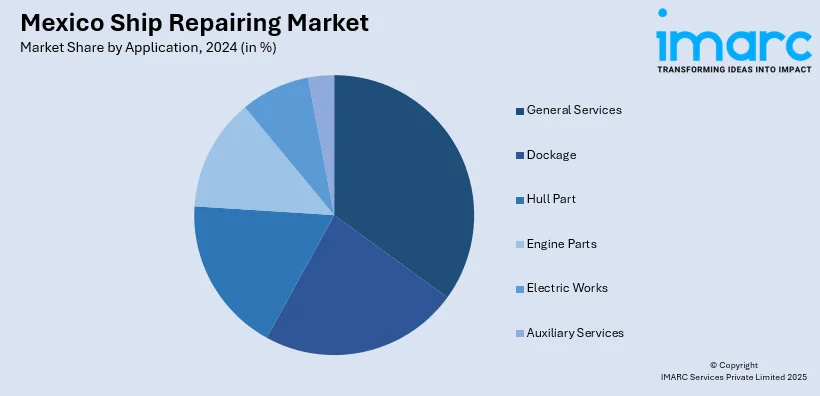

Application Insights:

- General Services

- Dockage

- Hull Part

- Engine Parts

- Electric Works

- Auxiliary Services

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes general services, dockage, hull part, engine parts, electric works, and auxiliary services.

End User Insights:

- Transport Companies

- Military

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes transport companies, military, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Ship Repairing Market News:

- August 2024: DeepOcean secured a five-year contract extension with Diavaz for the vessel Arbol Grande, focusing on Inspection, Maintenance, and Repair (IMR) services in Mexico. This extension enhanced ship repair demand in the region, bolstering long-term market stability and growth for offshore vessel maintenance.

Mexico Ship Repairing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vessel Types Covered | General Cargo Ships, Bulk Cargo Carrier, Crude Oil Tankers, Chemical Tankers, Container Ships, Others |

| Applications Covered | General Services, Dockage, Hull Part, Engine Parts, Electric Works, Auxiliary Services |

| End Users Covered | Transport Companies, Military, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico ship repairing market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico ship repairing market on the basis of vessel type?

- What is the breakup of the Mexico ship repairing market on the basis of application?

- What is the breakup of the Mexico ship repairing market on the basis of end user?

- What is the breakup of the Mexico ship repairing market on the basis of region?

- What are the various stages in the value chain of the Mexico ship repairing market?

- What are the key driving factors and challenges in the Mexico ship repairing market?

- What is the structure of the Mexico ship repairing market and who are the key players?

- What is the degree of competition in the Mexico ship repairing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico ship repairing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico ship repairing market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico ship repairing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)