Mexico Shipping Container Market Size, Share, Trends and Forecast by Product, Container Size, Application, and Region, 2025-2033

Mexico Shipping Container Market Overview:

The Mexico shipping container market size reached USD 178.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 322.4 Million by 2033, exhibiting a growth rate (CAGR) of 6.79% during 2025-2033. The market is witnessing significant growth, driven by the growth in market by nearshoring and trade expansion and increasing adoption of sustainable and smart shipping containers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 178.5 Million |

| Market Forecast in 2033 | USD 322.4 Million |

| Market Growth Rate 2025-2033 | 6.79% |

Mexico Shipping Container Market Trends:

Growth by Nearshoring and Trade Expansion

Mexico's shipping container market is poised for substantial growth driven by the nearshoring trend as foreign companies relocate manufacturing closer to North American markets. With ever-increasing labor costs in Asia and a slew of disruptive factors disrupting supply chains, companies are moving production to Mexico to take advantage of its proximity to the United States and several strong trade agreements such as the United States-Mexico-Canada Agreement (USMCA). This shift has consequently driven container demand higher for transporting raw materials, components, and finished goods across borders. For instance, in June 2024, eight vessels of 4,000–6,000 TEU will serve key ports, boosting the Asia- Mexico trade. Mexican ports saw 18.2% growth, with Cosco Shipping operating 12 services, totaling over 220,000 TEU capacity. Additionally, Mexico’s expanding role as a key logistics hub has driven investment in port infrastructure, inland container depots, and intermodal transportation networks, further enhancing the efficiency of containerized trade. The growth of e-commerce and increased consumer demand have also contributed to the rising use of shipping containers for both international and domestic freight movement. As companies continue to prioritize supply chain resilience and cost efficiency, the demand for shipping containers in Mexico is expected to rise steadily, positioning the country as a critical player in global trade logistics. These factors collectively support sustained growth in the shipping container market, fostering economic expansion and trade competitiveness.

.webp)

Increasing Adoption of Sustainable and Smart Shipping Containers

The Mexican shipping container market is witnessing a growing shift toward sustainability and technological advancements, driven by regulatory requirements and industry demand for eco-friendly solutions. Companies are increasingly investing in sustainable container solutions, including those made from recycled materials, modular container designs for repurposing, and energy-efficient refrigerated containers to reduce carbon footprints. For instance, in November 2024, Mexico's Manzanillo port is undergoing a USD 3 Billion expansion to double capacity to 10 million TEU by 2030, making it Latin America's largest container port, with sustainable development and mitigation measures in place. Additionally, shipping lines and logistics providers are adopting smart container technology, which integrates IoT-enabled tracking systems, temperature monitoring, and real-time analytics to improve supply chain visibility and operational efficiency. These innovations enhance security, reduce cargo loss, and optimize container utilization, ultimately lowering costs and environmental impact. Government policies promoting green logistics, along with industry efforts to achieve carbon neutrality, are further propelling the adoption of sustainable shipping solutions. As trade volumes continue to grow, Mexico’s ports and transportation networks are adapting to accommodate eco-friendly and technology-driven container solutions. With ongoing advancements in container technology and increasing environmental awareness, businesses are expected to continue prioritizing sustainable and intelligent shipping practices, positioning Mexico as a leader in modern logistics solutions within the global supply chain.

Mexico Shipping Container Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product, container size, and application.

Product Insights:

- Dry Storage Containers

- Flat Rack Containers

- Refrigerated Containers

- Special Purpose Containers

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes dry storage containers, flat rack containers, refrigerated containers, special purpose containers, and others.

Container Size Insights:

- Small Containers (20 feet)

- Large Containers (40 feet)

- High Cube Containers

- Others

A detailed breakup and analysis of the market based on the container size have also been provided in the report. This includes small containers (20 feet), large containers (40 feet), high cube containers, and others.

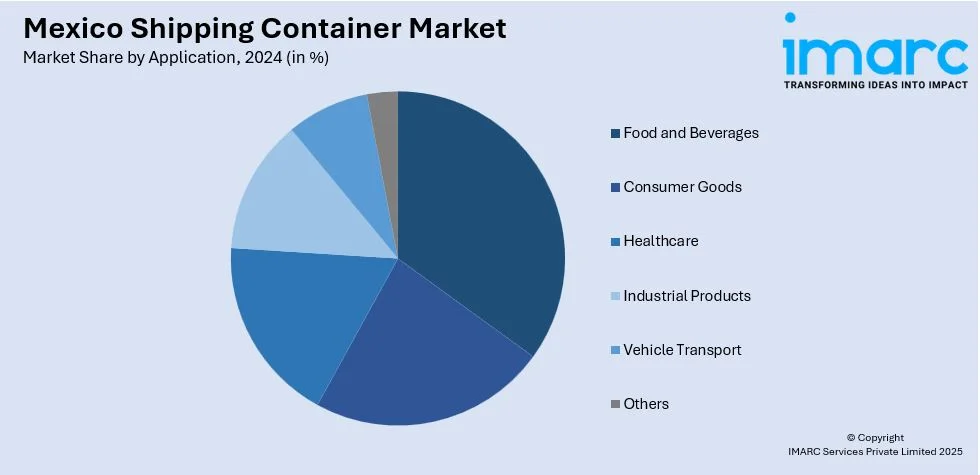

Application Insights:

- Food and Beverages

- Consumer Goods

- Healthcare

- Industrial Products

- Vehicle Transport

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and beverages, consumer goods, healthcare, industrial products, vehicle transport, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Shipping Container Market News:

- In July 2024, HMM and Ocean Network Express announced that they will launch the Far East-Latin America Express (FLX) on August 16, linking Asia to Mexico with a 42-day route via Shanghai, Busan, and Lázaro Cárdenas. Zim and CMA CGM introduced a Georgia-Mexico short-sea service, while Maersk expanded with a Tijuana warehouse for growing cross-border demand. These developments reinforce the increasing role of shipping containers in global and regional supply chains.

- In September 2023, Mexico, UNODC, and the U.S. Embassy launched the Container Control Programme to enhance port security and combat organized crime. Part of the Mexico-U.S. Bicentennial Framework, the initiative is supported by Mexican and U.S. funding, including the Bureau of International Narcotics and Law Enforcement Affairs.

Mexico Shipping Container Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Dry Storage Containers, Flat Rack Containers, Refrigerated Containers, Special Purpose Containers, Others |

| Container Sizes Covered | Small Containers (20 feet), Large Containers (40 feet), High Cube Containers, Others |

| Applications Covered | Food and Beverages, Consumer Goods, Healthcare, Industrial Products, Vehicle Transport, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico shipping container market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico shipping container market on the basis of product?

- What is the breakup of the Mexico shipping container market on the basis of container size?

- What is the breakup of the Mexico shipping container market on the basis of application?

- What is the breakup of the Mexico shipping container market on the basis of region?

- What are the various stages in the value chain of the Mexico shipping container market?

- What are the key driving factors and challenges in the Mexico shipping container?

- What is the structure of the Mexico shipping container market and who are the key players?

- What is the degree of competition in the Mexico shipping container market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico shipping container market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico shipping container market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico shipping container industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)