Mexico Simulation Software Market Size, Share, Trends and Forecast by Component, Deployment, End Use, and Region, 2025-2033

Mexico Simulation Software Market Overview:

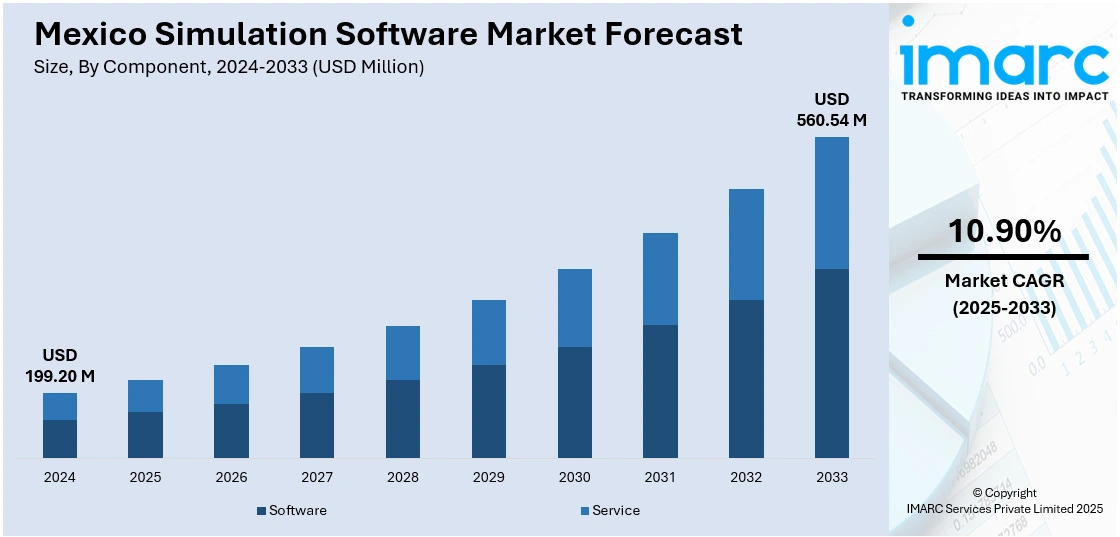

The Mexico simulation software market size reached USD 199.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 560.54 Million by 2033, exhibiting a growth rate (CAGR) of 10.90% during 2025-2033. The growth is driven by increasing demand for advanced technologies, such as artificial intelligence (AI), cloud computing, and immersive simulations. Industries like automotive, aerospace, and manufacturing seek improved product development, cost efficiency, and better training solutions. Additionally, government investments and digital transformation initiatives further aiding the Mexico simulation software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 199.20 Million |

| Market Forecast in 2033 | USD 560.54 Million |

| Market Growth Rate 2025-2033 | 10.90% |

Mexico Simulation Software Market Trends:

Shift Towards Cloud-Based Simulation Solutions

Mexico's simulation software market is seeing a robust trend toward cloud-based platforms due to the demand for more efficiency, flexibility, and cost savings. Cloud-based simulation enables businesses to avoid the expense of having to keep costly on-premises infrastructure while achieving access to scalable computing capabilities. Cloud-based platforms enable real-time collaboration among teams to speed up product development and enhance innovation cycles. Manufacturing, aerospace, and automotive industries are all using cloud-based solutions more and more to streamline processes, minimize operating expenses, and enhance the accuracy of simulation. The ability to execute intricate models from anywhere further increases responsiveness and decision-making. With digital transformation efforts on the rise across the nation, cloud-based simulation is emerging as an essential solution for companies wanting to stay competitive and responsive in an ever-changing technology environment.

Integration of AI and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are quickly becoming the backbone of simulation software in Mexico, allowing for sophisticated data analysis, predictive modeling, and automation. These technologies allow simulations to recognize patterns, optimize designs, and refine models with real-time feedback, assisting companies in making better, data-driven decisions. Their combination is revolutionizing major sectors like the automotive, aerospace, and manufacturing industries by improving design precision and speeding up innovation cycles. Most significantly, 50% of Mexican industry leaders indicate prevalent AI use in their companies, higher than the percentage reported by other countries surveyed. This identifies Mexico as a leader in AI adoption for operational efficiency and technical progress. With simulation software increasingly becoming AI-based, firms are not only using these products to test and model but also for strategic planning and ongoing improvement throughout product lifecycles.

Advancements in Immersive Simulation Technologies

Immersive technologies like virtual reality (VR) and augmented reality (AR) are revolutionizing the world of simulation software in Mexico by developing very interactive and realistic simulation environments. These technologies are gaining mass use in industries such as healthcare, education, and defense to increase training, decision-making, and performance. VR and AR enable the user to experience real-life scenarios, thus making learning more effective and impactful. In medicine, they allow medical personnel to rehearse interventions in secure, virtual settings. In education, they provide interactive, hands-on teaching devices, while in military, they aid tactical training and mission preparation. As Mexican businesses adopt digitalization, the use of immersive simulations is fueling the Mexico simulation software market growth as well as enabling companies to lower the risk, enhance the efficiency of training, and develop more pragmatic solutions to real-world issues.

Mexico Simulation Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional for 2025-2033. Our report has categorized the market based on component, deployment, and end use.

Component Insights:

- Software

- Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and service.

Deployment Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes on-premises and cloud-based.

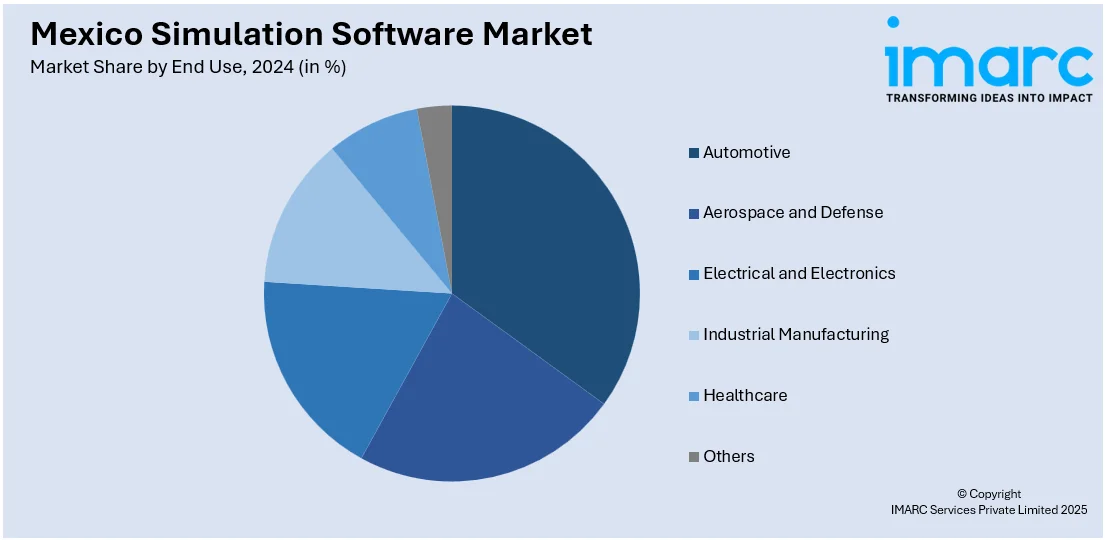

End Use Insights:

- Automotive

- Aerospace and Defense

- Electrical and Electronics

- Industrial Manufacturing

- Healthcare

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes automotive, aerospace and defense, electrical and electronics, industrial manufacturing, healthcare, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Central, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Simulation Software Market News:

- In February 2025, SandboxAQ expanded its alliance with Deloitte to deliver AI-powered simulation solutions using Large Quantitative Models (LQMs) across sectors like biopharma and energy. The partnership integrates SandboxAQ’s AQBioSim and AQChemSim with Deloitte’s data, life sciences expertise, and Atlas AI™ capabilities. This collaboration aims to accelerate drug discovery and materials science by enhancing data analysis, model testing, and hypothesis generation, offering transformative value beyond traditional AI applications.

- In September 2024, AVL partnered with InSilicoTrials to integrate its advanced CFD tool, FIRE™ M, into InSilicoTrials' AI-driven simulation platform, expanding capabilities in the healthcare and pharmaceutical sectors. This collaboration combines FIRE M’s strengths in fluid and heat simulations with InSilicoTrials’ XPS software for granular flow modeling. The integration enables precise, high-speed simulations for complex processes like Wurster coating, enhancing product development and operational efficiency across life sciences industries.

Mexico Simulation Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Service |

| Deployments Covered | On-premises, Cloud-based |

| End Uses Covered | Automotive, Aerospace and Defense, Electrical and Electronics, Industrial Manufacturing, Healthcare, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico simulation software market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico simulation software market on the basis of component?

- What is the breakup of the Mexico simulation software market on the basis of deployment?

- What is the breakup of the Mexico simulation software market on the basis of end use?

- What is the breakup of the Mexico simulation software market on the basis of region?

- What are the various stages in the value chain of the Mexico simulation software market?

- What are the key driving factors and challenges in the Mexico simulation software?

- What is the structure of the Mexico simulation software market and who are the key players?

- What is the degree of competition in the Mexico simulation software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico simulation software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico simulation software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico simulation software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)