Mexico Small-Scale Hydropower Market Size, Share, Trends and Forecast by Capacity, Component, and Region, 2025-2033

Mexico Small-Scale Hydropower Market Overview:

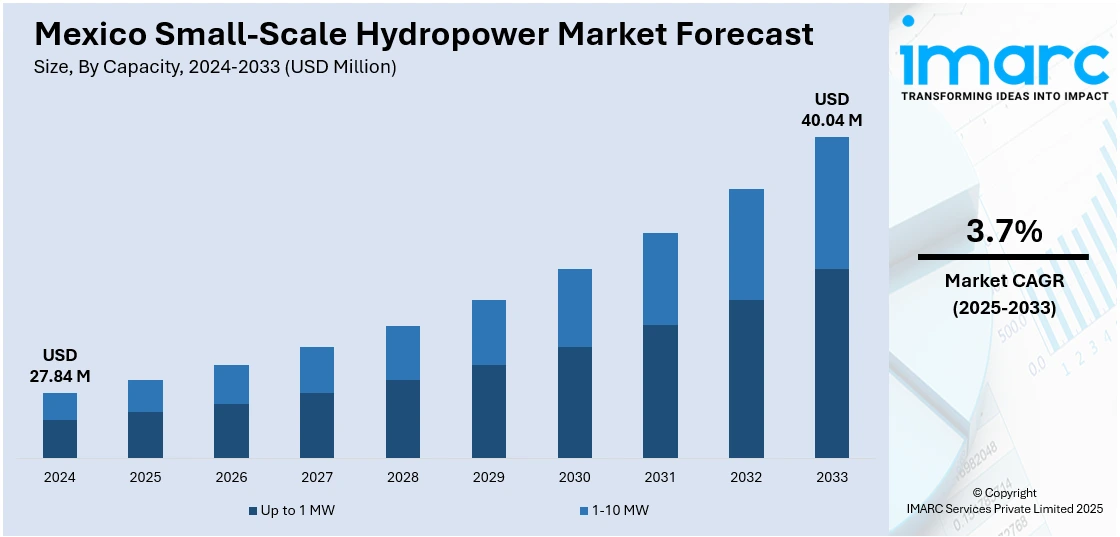

The Mexico small-scale hydropower market size reached USD 27.84 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 40.04 Million by 2033, exhibiting a growth rate (CAGR) of 3.7% during 2025-2033. Rural electrification needs, government incentives, renewable energy targets, and abundant untapped water resources are some of the factors contributing to Mexico small-scale hydropower market share. Supportive regulatory frameworks and rising energy demand in remote areas also contribute to market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 27.84 Million |

| Market Forecast in 2033 | USD 40.04 Million |

| Market Growth Rate 2025-2033 | 3.7% |

Mexico Small-Scale Hydropower Market Trends:

Focus on Modernization of Existing Hydropower Assets

Efforts to revamp older hydroelectric facilities are gaining momentum in Mexico, particularly within the small-scale segment. Recent developments indicate a push toward upgrading existing plants rather than constructing new infrastructure, highlighting a cost-effective and environmentally responsible approach. By enhancing generation capacity and efficiency without altering dam structures, such initiatives support national clean energy objectives. This modernization wave is expected to reduce dependence on fossil fuels and optimize underperforming assets, strengthening decentralized power generation in rural and semi-urban areas. It also reflects broader government and institutional support for low-carbon technologies that can operate within existing ecological and social boundaries. The focus is clearly shifting toward scalable, efficient solutions that maximize current hydropower potential without triggering large-scale environmental disruptions. These factors are intensifying the Mexico small-scale hydropower market growth. For example, in September 2023, MIGA issued a USD 536 Million guarantee to support the upgrade of seven hydroelectric plants operated by Mexico’s CFE. These enhancements would boost power generation by 113 MW without expanding existing dam infrastructure. The project aligns with Mexico’s clean energy goals and supports the small-scale hydropower segment by modernizing aging assets, enhancing efficiency, and contributing to a more sustainable energy mix.

Shift toward Sustainable Infrastructure Financing

There is growing institutional backing for projects that revitalize Mexico’s existing hydroelectric capacity, particularly within the small-scale category. Financial support mechanisms are now being used not just to build new installations but to upgrade older plants, enhancing their output and reliability. These interventions prioritize operational efficiency while maintaining the original environmental footprint, making them more acceptable from both regulatory and community perspectives. Importantly, they signal a maturing energy sector where cleaner alternatives are integrated through strategic capital deployment rather than greenfield development alone. The focus on refurbishing infrastructure allows for faster implementation and lower environmental risk, which is especially relevant in regions where water availability and land use are sensitive issues. This development model also promotes long-term stability by reinforcing grid resilience and enabling cleaner power sources to feed local networks. As a result, small-scale hydropower is being positioned as a practical and scalable pillar within Mexico’s renewable energy portfolio.

Mexico Small-Scale Hydropower Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on capacity and component.

Capacity Insights:

- Up to 1 MW

- 1-10 MW

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes up to 1 MW and 1-10 MW.

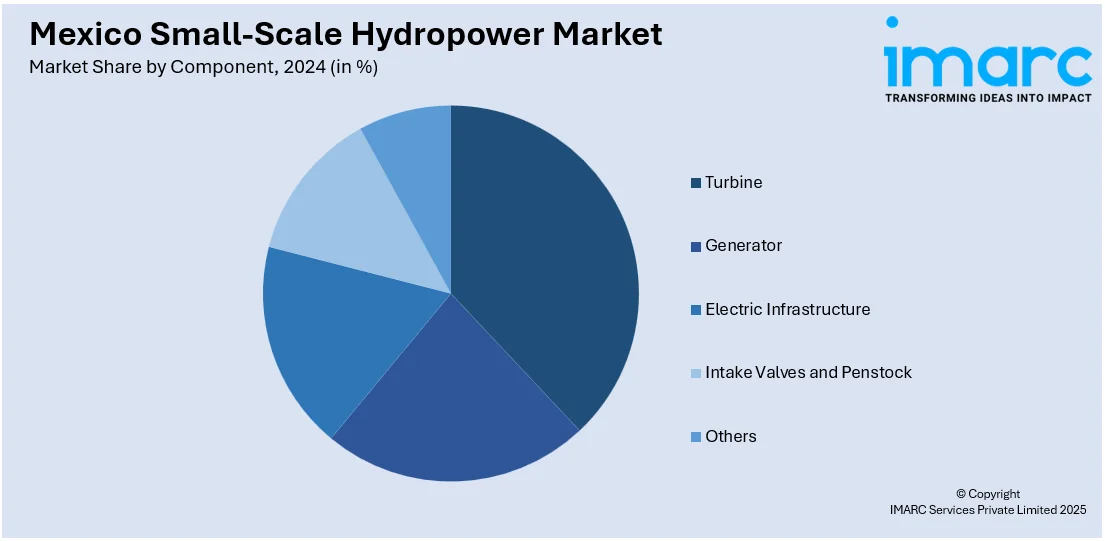

Component Insights:

- Turbine

- Generator

- Electric Infrastructure

- Intake Valves and Penstock

- Others

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes turbine, generator, electric infrastructure, intake valves and penstock, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Small-Scale Hydropower Market News:

- In November 2024, at COP29 in Baku, the International Hydropower Association launched the Global Alliance for Pumped Storage (GAPS), with support from over 30 governments, including Mexico. This initiative aims to accelerate the deployment of pumped storage hydropower, enhancing energy security and supporting renewable energy integration.

Mexico Small-Scale Hydropower Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Capacities Covered | Up to 1 MW, 1-10 MW |

| Components Covered | Turbine, Generator, Electric Infrastructure, Intake Valves and Penstock, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, and Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico small-scale hydropower market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico small-scale hydropower market on the basis of capacity?

- What is the breakup of the Mexico small-scale hydropower market on the basis of component?

- What is the breakup of the Mexico small-scale hydropower market on the basis of region?

- What are the various stages in the value chain of the Mexico small-scale hydropower market?

- What are the key driving factors and challenges in the Mexico small-scale hydropower market?

- What is the structure of the Mexico small-scale hydropower market and who are the key players?

- What is the degree of competition in the Mexico small-scale hydropower market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico small-scale hydropower market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico small-scale hydropower market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico small-scale hydropower industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)