Mexico Smart Display Market Size, Share, Trends and Forecast by Type, Display Size, Resolution, End User, and Region, 2025-2033

Mexico Smart Display Market Overview:

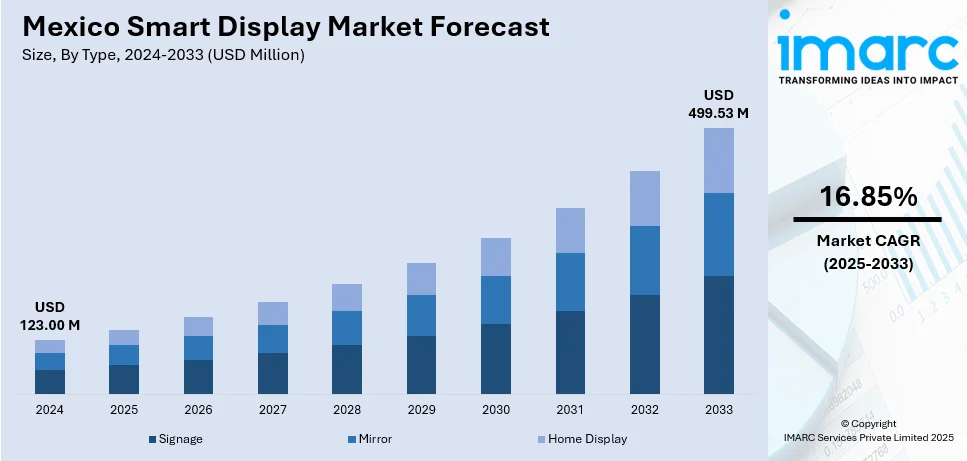

The Mexico smart display market size reached USD 123.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 499.53 Million by 2033, exhibiting a growth rate (CAGR) of 16.85% during 2025-2033. The market is undergoing strong growth with the developments in display technologies like OLED and QLED, improving the visual enhancement and functionality of smart displays to make them popular among consumers. Also, a growing need for connected devices and smart home systems has created growth in the uptake of smart displays, which can act as core hubs for smart device control. Government efforts, such as Mexico 2030 plan, have been intended to enhance digitalization and technological innovation, further contributing to the Mexico smart display market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 123.00 Million |

| Market Forecast in 2033 | USD 499.53 Million |

| Market Growth Rate 2025-2033 | 16.85% |

Mexico Smart Display Market Trends:

Integration with Smart Homes and IoT Ecosystems

In Mexico, the adoption of smart displays is becoming essentially linked with smart home and Internet of Things (IoT) systems. Smart display users are looking for frictionless integration with all of their devices to provide connected living spaces. Smart displays hence act as control centers where users can remotely manage lighting, climate, security systems, and entertainment systems using voice or touch control. This integration increases user convenience and helps save energy, which is in line with the sustainability objectives of the country. The various government programs also encourage the use of smart technologies, such as smart displays, in homes and businesses. Consequently, there is an increased demand for intelligent displays that support compatibility with a range of IoT devices and platforms, which is further fueling the Mexico smart display market growth.

Developments in Display Technologies

The Mexican market for smart displays is also experiencing rapid developments in display technologies, with increased demand for ultra-high-definition (UHD) and organic light-emitting diode (OLED) displays. These technologies provide better image quality, richer colors, and power efficiency and are extremely consumer-friendly, appealing to consumers who demand high-quality viewing experiences. Featuring high dynamic range (HDR) capabilities and AI-driven image processing, these displays deliver an overall enhanced user experience. Moreover, the growth in 4K and 8K content availability, combined with the rise in streaming services, further contributes to the heightened demand for high-resolution displays. Hence, smart displays with sophisticated features are being brought in by manufacturers to address changing consumer preferences among Mexicans.

Government Initiatives and Infrastructure Development

Government initiatives such as the Mexico 2030 plan is key to influencing the smart display market through the propagation of digital transformation and infrastructure expansion. Investments across industries like retail, hospitality, and entertainment are fueling demand for sophisticated display solutions. Smart displays are finding greater applications across diverse segments, such as digital signage in shopping malls, interactive kiosks at museums, and giant screens in entertainment centers and sports events. Smart displays improve consumer interaction and also aid in the modernization of public spaces. Moreover, the government's focus on energy efficiency fuels the uptake of eco-friendly display technologies, further stimulating the market for smart displays in Mexico.

Mexico Smart Display Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, display size, resolution, and end user.

Type Insights:

- Signage

- Mirror

- Home Display

The report has provided a detailed breakup and analysis of the market based on the type. This includes signage, mirror, and home display.

Display Size Insights:

- Below 32 Inch

- Between 32 and 52 Inch

- Above 52 Inch

The report has provided a detailed breakup and analysis of the market based on the display size. This includes below 32 inch, between 32 and 52 inch, and above 52 inch.

Resolution Insights:

- UHD

- FHD

- HD

The report has provided a detailed breakup and analysis of the market based on the resolution. This includes UHD, FHD, and HD.

End User Insights:

- Residential

- Retail

- Automotive

- Healthcare

- Sports and Entertainment

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, retail, automotive, healthcare, and sports and entertainment.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Smart Display Market News:

- In December 2024, Samsung Electronics revealed its plans to introduce its cutting-edge screen technology to a wider array of home appliances, marking a significant advancement in achieving its “Screens Everywhere” vision. This year, Samsung is enhancing the kitchen experience by introducing a refrigerator with a new 9” AI Home1 display and incorporating the 7” AI Home1 into the Wall Oven. The Bespoke AI Laundry Combo featuring a 4.3” LCD display will be introduced in India, Chile, Peru, Argentina, Panama, Honduras, Mexico, Colombia, El Salvador, Costa Rica, the Dominican Republic, and Paraguay.

Mexico Smart Display Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Signage, Mirror, Home Display |

| Display Sizes Covered | Below 32 Inch, Between 32 and 52 Inch, Above 52 Inch |

| Resolutions Covered | UHD, FHD, HD |

| End Users Covered | Residential, Retail, Automotive, Healthcare, Sports and Entertainment |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico smart display market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico smart display market on the basis of type?

- What is the breakup of the Mexico smart display market on the basis of display size?

- What is the breakup of the Mexico smart display market on the basis of resolution?

- What is the breakup of the Mexico smart display market on the basis of end user?

- What is the breakup of the Mexico smart display market on the basis of region?

- What are the various stages in the value chain of the Mexico smart display market?

- What are the key driving factors and challenges in the Mexico smart display market?

- What is the structure of the Mexico smart display market and who are the key players?

- What is the degree of competition in the Mexico smart display market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico smart display market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico smart display market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico smart display industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)