Mexico Smart Industrial Motors Market Size, Share, Trends and Forecast by Motor Type, Connectivity & Intelligence, Power Rating, End-Use Industry, and Region, 2025-2033

Mexico Smart Industrial Motors Market Overview:

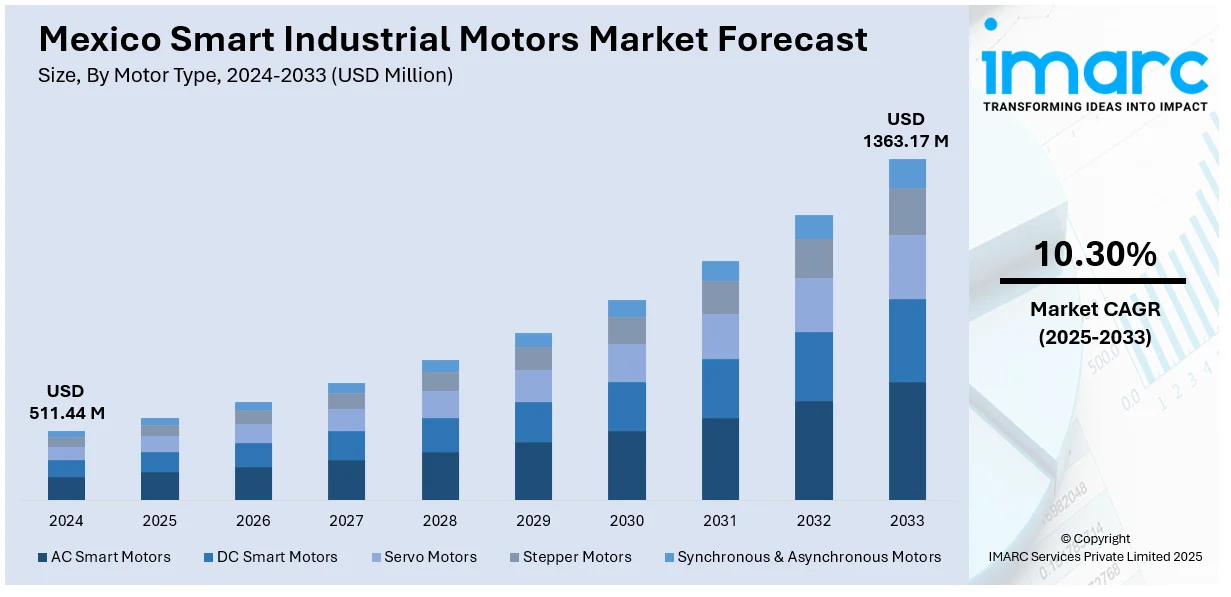

The Mexico smart industrial motors market size reached USD 511.44 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1363.17 Million by 2033, exhibiting a growth rate (CAGR) of 10.30% during 2025-2033. Increasing adoption of industrial automation, a stronger focus on energy efficiency, and expansion of automotive manufacturing are supporting the market growth. Moreover, the rising use of predictive maintenance systems, government initiatives supporting the Fourth Industrial Revolution (Industry 4.0), growth in the mining and metals sector, and demand for reduced equipment downtime are other growth-inducing factors. Apart from this, integration with Industrial Internet of Things (IIoT) platforms, expansion of food and beverage (F&B) processing facilities, ongoing infrastructure development, a need for more reliable and flexible motor systems, and technological advancements in motor control solutions are boosting the Mexico smart industrial motors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 511.44 Million |

| Market Forecast in 2033 | USD 1363.17 Million |

| Market Growth Rate 2025-2033 | 10.30% |

Mexico Smart Industrial Motors Market Trends:

Rising Industrial Automation

Mexico’s manufacturing and processing sectors are undergoing a gradual but clear transition toward automation, driven by the need to improve productivity, reduce labor dependency, and enhance operational control. This shift is being observed across industries like automotive, electronics, and consumer goods, where production cycles are increasingly being optimized using programmable systems. Smart industrial motors, which offer precise control, real-time monitoring, and connectivity features, are gaining popularity in these settings. These motors support flexible production systems, allowing manufacturers to adjust operations quickly based on demand or input variability. With automation becoming more accessible due to falling sensor and control system costs, small and medium enterprises are also showing interest. Additionally, labor cost fluctuations and the need for higher quality standards are prompting businesses to explore automated solutions. As these automation trends deepen, the demand for intelligent motors that can integrate seamlessly into broader industrial control systems is expected to increase steadily in the coming years.

Emphasis on Energy Efficiency

Energy efficiency is a key priority for industrial operations in Mexico, particularly as energy prices continue to fluctuate and sustainability regulations gain momentum. Smart industrial motors contribute to energy savings by continuously adjusting their performance based on load requirements, unlike traditional motors that often run at fixed speeds regardless of demand. This optimization leads to noticeable reductions in electricity usage, making them attractive to industries operating on tight margins. Additionally, companies pursuing energy certification programs or seeking to reduce their carbon footprint view smart motors as a reliable solution. The built-in monitoring and diagnostics also help identify inefficiencies early, preventing energy wastage and unplanned maintenance. In regions with high industrial activity, such as the Bajío and northern states, these motors are being adopted not only for compliance reasons but also for cost-saving opportunities, which is further providing a positive Mexico smart industrial motors market growth. Moreover, the Mexican government has been actively promoting energy efficiency through various initiatives. The National Programme of Sustainable Energy Use (PRONASE) aims to reduce energy consumption and promote energy efficiency, with a goal to decrease Mexico's energy consumption and increase energy efficiency by 15% by 2024 .

Expansion of Automotive Manufacturing

Mexico as a world-leader automotive production hub is one of the most influential drivers for demand for intelligent industrial motors. Leading automobile brands and tier-1 firms have continued to extend their footprint within states like Guanajuato, Puebla, and Coahuila, setting up advanced production lines that rely mainly on automation and high-control systems. Such production environments need motors capable of supporting continuous operation, high torque loads, and dynamic performance calibration, all features delivered by smart motor systems. The rising trend for electric vehicles (EVs) also is revolutionizing plant configuration and equipment specifications, with smart motors facilitating novel assembly processes and robotics. Furthermore, Mexican automobile firms are spending money on remote monitoring and predictive maintenance to decrease downtime, enhancing the significance of intelligent motor solutions.

Mexico Smart Industrial Motors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on motor type, connectivity & intelligence, power rating, and end-use industry.

Motor Type Insights:

- AC Smart Motors

- DC Smart Motors

- Servo Motors

- Stepper Motors

- Synchronous & Asynchronous Motors

The report has provided a detailed breakup and analysis of the market based on the motor type. This includes AC smart motors, DC smart motors, servo motors, stepper motors, and synchronous & asynchronous motors.

Connectivity & Intelligence Insights:

- IoT-Enabled Smart Motors

- AI & ML-Integrated Motors

- Wireless & Cloud-Connected Motors

- Edge Computing & Embedded Systems in Motors

A detailed breakup and analysis of the market based on connectivity and intelligence have also been provided in the report. This includes IoT-enabled smart motors, AI and ML-integrated motors, wireless and cloud-connected motors, and edge computing and embedded systems in motors.

Power Rating Insights:

- Low Power (0.1 kW – 10 kW)

- Medium Power (10 kW – 100 kW)

- High Power (Above 100 kW)

The report has provided a detailed breakup and analysis of the market based on the power rating. This includes low power (0.1 kW – 10 kW), medium power (10 kW – 100 kW), and high power (above 100 kW).

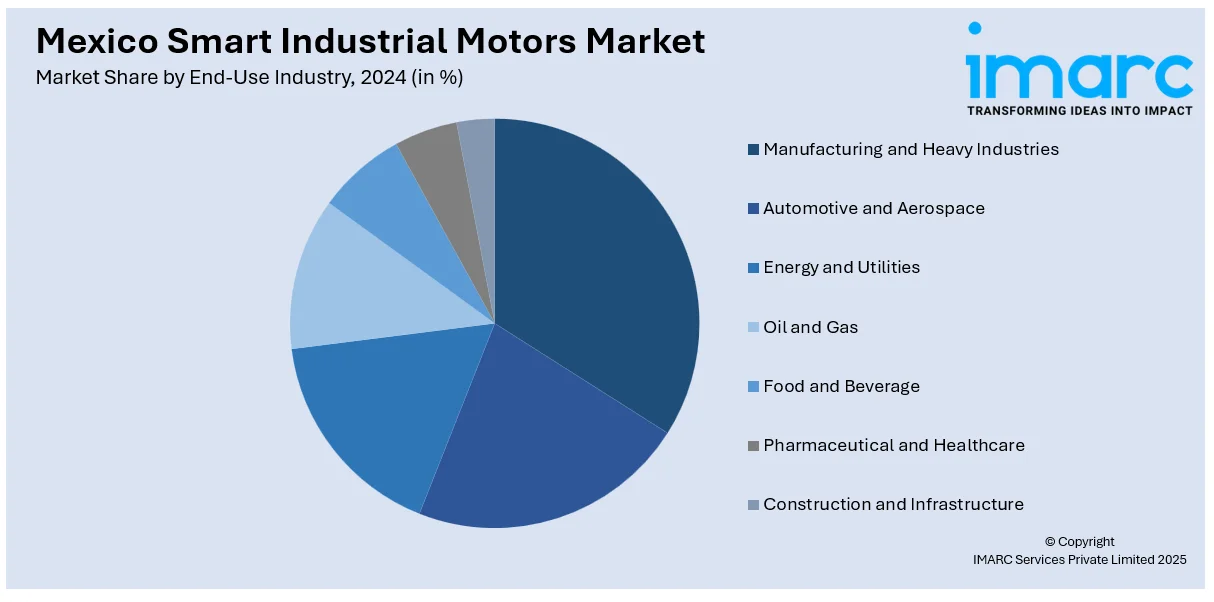

End-Use Industry Insights:

- Manufacturing and Heavy Industries

- Automotive and Aerospace

- Energy and Utilities

- Oil and Gas

- Food and Beverage

- Pharmaceutical and Healthcare

- Construction and Infrastructure

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes manufacturing and heavy industries, automotive and aerospace, energy and utilities, oil and gas, food and beverage, pharmaceutical and healthcare, and construction and infrastructure.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Smart Industrial Motors Market News:

- In March 2025, Brazilian company WEG acquired Regal Rexnord's industrial electric motors and generators business, including the Marathon, Cemp, and Rotor brands, expanding its footprint in Mexico and enhancing its capabilities in smart motor solutions.

- In October 2024, Intretech inaugurated a $60 million manufacturing facility in Monterrey, Mexico, aiming to bolster its global supply chain and support the growing demand for smart manufacturing solutions .

Mexico Smart Industrial Motors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Motor Types Covered | AC Smart Motors, DC Smart Motors, Servo Motors, Stepper Motors, Synchronous and Asynchronous Motors |

| Connectivity & Intelligence Covered | IoT-Enabled Smart Motors, AI and ML-Integrated Motors, Wireless and Cloud-Connected Motors, Edge Computing and Embedded Systems in Motors |

| Power Ratings Covered | Low Power (0.1 kW – 10 kW), Medium Power (10 kW – 100 kW), High Power (Above 100 kW) |

| End-Use Industries Covered | Manufacturing and Heavy Industries, Automotive and Aerospace, Energy and Utilities, Oil and Gas, Food and Beverage, Pharmaceutical and Healthcare, Construction and Infrastructure |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico smart industrial motors market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico smart industrial motors market on the basis of motor type?

- What is the breakup of the Mexico smart industrial motors market on the basis of connectivity & intelligence?

- What is the breakup of the Mexico smart industrial motors market on the basis of power rating?

- What is the breakup of the Mexico smart industrial motors market on the basis of end-use industry?

- What is the breakup of the Mexico smart industrial motors market on the basis of region?

- What are the various stages in the value chain of the Mexico smart industrial motors market?

- What are the key driving factors and challenges in the Mexico smart industrial motors market?

- What is the structure of the Mexico smart industrial motors market and who are the key players?

- What is the degree of competition in the Mexico smart industrial motors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico smart industrial motors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico smart industrial motors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico smart industrial motors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)