Mexico Smart Microgrids Market Size, Share, Trends and Forecast by Type, Component, Power Technology, Consumer Pattern, Application, and Region, 2025-2033

Mexico Smart Microgrids Market Overview:

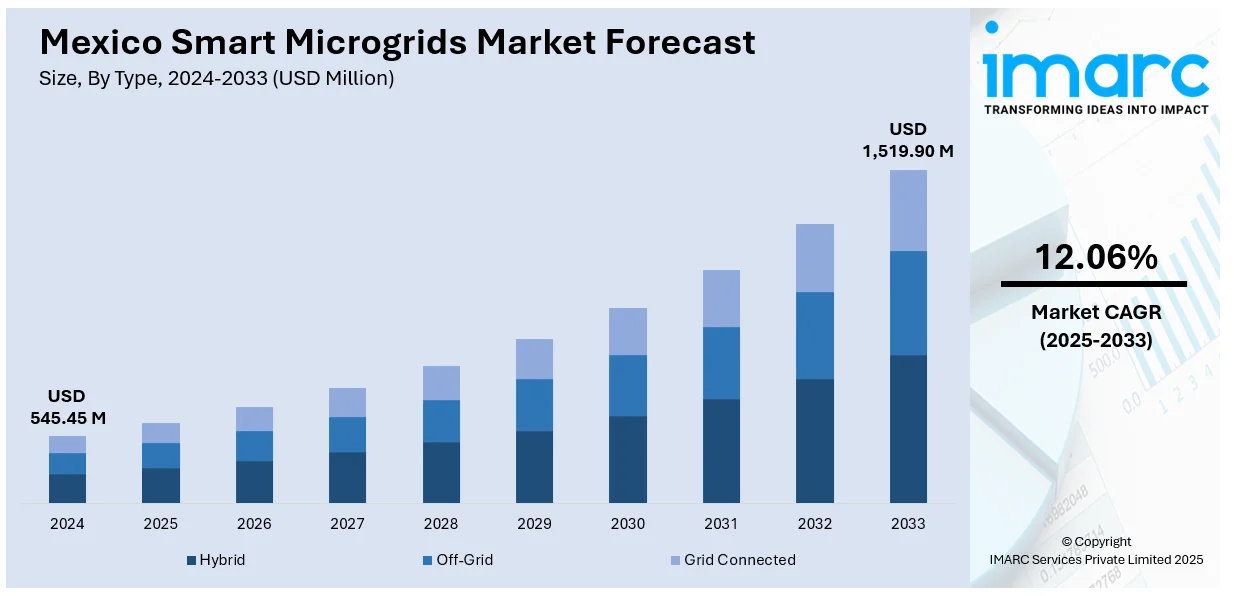

The Mexico smart microgrids market size reached USD 545.45 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,519.90 Million by 2033, exhibiting a growth rate (CAGR) of 12.06% during 2025-2033. Rising rural electrification, increasing integration of renewable energy sources (RES), and supportive government policies and programs are fueling the market growth. Apart from this, corporate environmental, social, and governance (ESG) initiatives, deployment in educational and commercial smart campuses, innovations in software and Internet of Things (IoT) platforms, the need for resilience after natural disasters, and strong collaboration through public-private partnerships (PPP) in the energy sector are factors accelerating the Mexico smart microgrids market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 545.45 Million |

| Market Forecast in 2033 | USD 1,519.90 Million |

| Market Growth Rate 2025-2033 | 12.06% |

Mexico Smart Microgrids Market Trends:

Growing Rural Electrification Initiatives

Mexico has made significant progress in rural electrification, achieving 99.1% access to electricity for its rural population in 2023. This advancement is part of the government's broader efforts to ensure universal electricity access, as outlined in the National Power System Development Program (PRODESEN). The program emphasizes the importance of expanding electricity infrastructure to underserved areas, recognizing that reliable energy access is crucial for social and economic development. In regions like Chiapas, local governments and universities have collaborated to prioritize electrification projects based on various criteria, including community needs and resource availability. These initiatives often involve the deployment of decentralized renewable energy systems, such as solar home systems, which are particularly effective in remote areas where extending the traditional grid is challenging. For instance, in Juntas de Neji, Baja California, organizations like generating renewable ideas for development alternatives (GRID) have installed solar home systems, bringing clean and reliable electricity to communities for the first time.

Integration of Renewable Energy in Distributed Networks

Mexico's distributed generation capacity has seen substantial growth, reaching 3,361 MW by the end of 2023, with 700 MW added that year alone. This expansion is largely driven by solar photovoltaic installations, which account for the majority of distributed generation projects. The country's favorable solar irradiance and declining costs of solar technology have made it an attractive option for both residential and commercial users. Distributed generation allows for electricity to be produced close to the point of consumption, reducing transmission losses and enhancing grid reliability. Moreover, it empowers consumers to become prosumers, generating their own electricity and potentially selling excess back to the grid. This shift not only contributes to energy diversification but also supports Mexico's clean energy goals. According to the National Power System Development Program, clean energy sources accounted for 31.2% of the country's power generation in 2022, indicating a positive trend towards renewable integration. As distributed generation continues to grow, it plays a crucial role in decentralizing the energy system, enhancing energy security, and promoting sustainable development.

Supportive Government Regulations and Funding Programs

The Mexican government has implemented various policies and programs to promote renewable energy adoption and improve energy efficiency. For instance, the National Project for Energy Efficiency in Municipal Public Lighting, operated by the National Commission for the Efficient Use of Energy, focuses on enhancing energy efficiency in municipal lighting systems. Additionally, Mexico City offers incentives for buildings that adopt sustainable and energy-efficient designs, encouraging the integration of green technologies in urban development. These initiatives are part of a broader strategy to reduce greenhouse gas emissions and transition towards a more sustainable energy system. Furthermore, the federal government has established programs to support green energy ventures, providing subsidies and incentives to entrepreneurs and companies investing in renewable energy projects. These measures not only facilitate the deployment of renewable energy technologies but also stimulate economic growth by attracting investment and creating jobs in the green energy sector.

Mexico Smart Microgrids Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, power technology, consumer pattern, and application.

Type Insights:

- Hybrid

- Off-Grid

- Grid Connected

The report has provided a detailed breakup and analysis of the market based on the type. This includes hybrid, off-grid, and grid connected.

Component Insights:

- Storage

- Inverter

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes storage and inverter.

Power Technology Insights:

- Fuel Cell

- CHP

The report has provided a detailed breakup and analysis of the market based on the power technology. This includes fuel cell and CHP.

Consumer Pattern Insights:

- Urban

- Rural

A detailed breakup and analysis of the market based on the consumer pattern have also been provided in the report. This includes urban and rural.

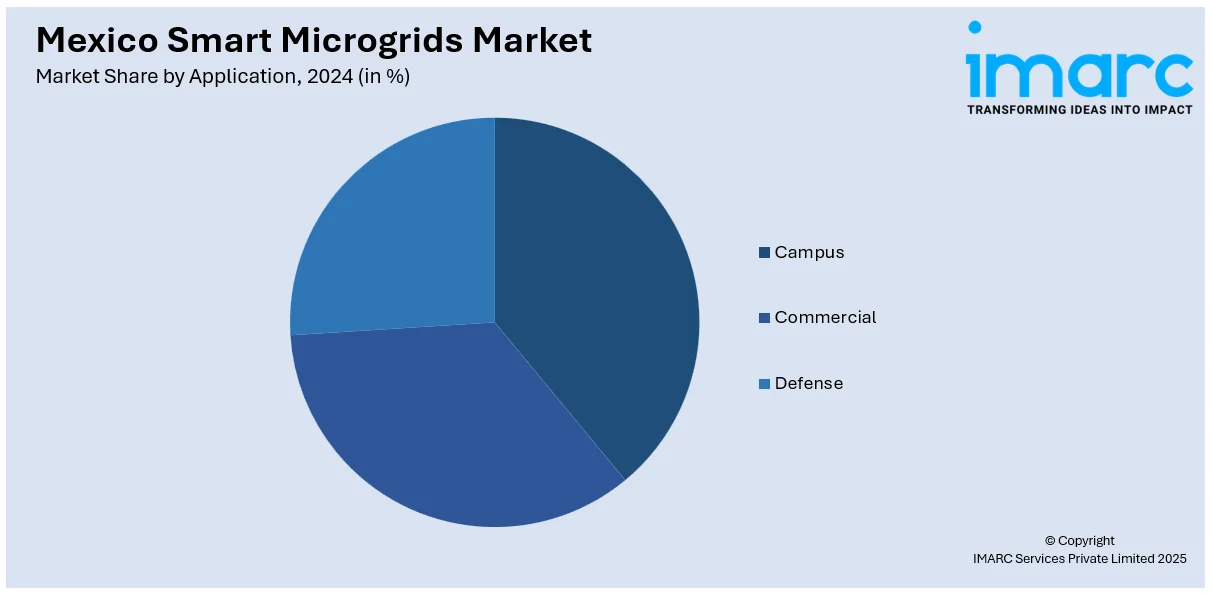

Application Insights:

- Campus

- Commercial

- Defense

The report has provided a detailed breakup and analysis of the market based on the application. This includes campus, commercial, and defense.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Smart Microgrids Market News:

- In 2024, Mexico announced a USD 23 billion investment plan for its electricity infrastructure, aiming to enhance grid reliability and promote private sector participation.

- In June 2023, Iberdrola sold 55% of its Mexican power generation assets to Mexico Infrastructure Partners for USD 6 billion. This move allows Iberdrola to focus on expanding its wind and solar portfolio in Mexico.

Mexico Smart Microgrids Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hybrid, Off-Grid, Grid Connected |

| Components Covered | Storage, Inverter |

| Power Technologies Covered | Fuel Cell, CHP |

| Consumer Patterns Covered | Urban, Rural |

| Applications Covered | Campus, Commercial, Defense |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico smart microgrids market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico smart microgrids market on the basis of type?

- What is the breakup of the Mexico smart microgrids market on the basis of component?

- What is the breakup of the Mexico smart microgrids market on the basis of power technology?

- What is the breakup of the Mexico smart microgrids market on the basis of consumer pattern?

- What is the breakup of the Mexico smart microgrids market on the basis of application?

- What is the breakup of the Mexico smart microgrids market on the basis of region?

- What are the various stages in the value chain of the Mexico smart microgrids market?

- What are the key driving factors and challenges in the Mexico smart microgrids?

- What is the structure of the Mexico smart microgrids market and who are the key players?

- What is the degree of competition in the Mexico smart microgrids market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico smart microgrids market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico smart microgrids market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico smart microgrids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)