Mexico Smart Power Transmission Market Size, Share, Trends and Forecast by Component, Technology, Voltage Level, End User, and Region, 2025-2033

Mexico Smart Power Transmission Market Overview:

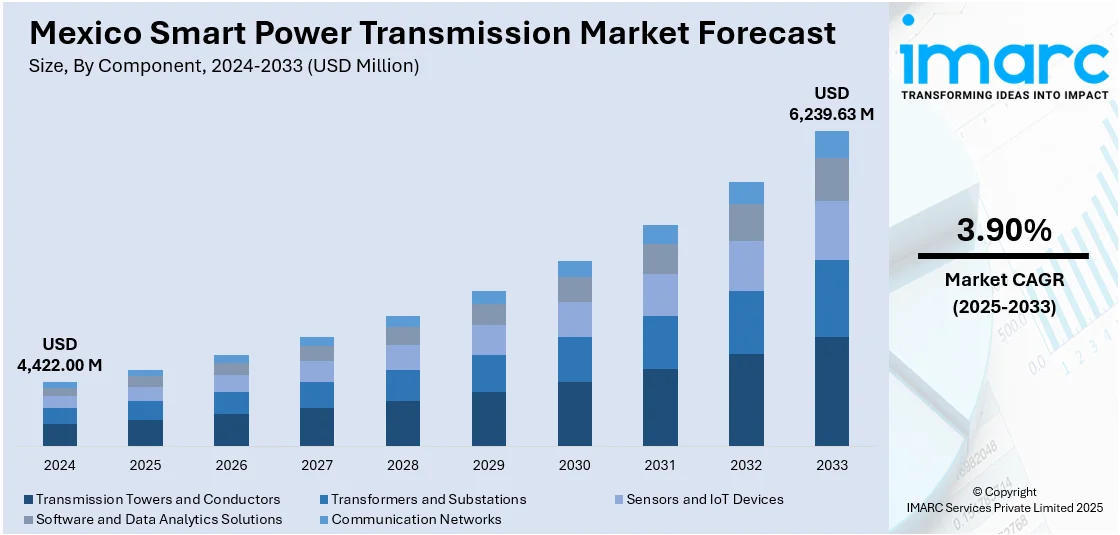

The Mexico smart power transmission market size reached USD 4,422.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 6,239.63 Million by 2033, exhibiting a growth rate (CAGR) of 3.90% during 2025-2033. Mexico is fast modernizing its power network with the help of advanced grid monitoring systems, digital substations integrated with Internet of Things (IoT), and High Voltage Direct Current (HVDC) technology. These technologies advance real-time tracking of performance, increase grid stability, and facilitate integration of renewable sources of energy. The trend toward a wiser and stronger infrastructure is led by increasing energy demands and urbanization. Such improvements are playing an important role in the growth of Mexico smart power transmission market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,422.00 Million |

| Market Forecast in 2033 | USD 6,239.63 Million |

| Market Growth Rate 2025-2033 | 3.90% |

Mexico Smart Power Transmission Market Trends:

Integration of Advanced Grid Monitoring Technologies

Mexico is experiencing a dramatic shift in its power transmission infrastructure with the greater use of cutting-edge grid monitoring technologies. Infrastructure like Phasor Measurement Units (PMUs) and Wide-Area Monitoring Systems (WAMS) is facilitating real-time monitoring of grid performance, allowing operators to quickly identify and correct anomalies. These technologies enhance system performance and minimize transmission losses through high-resolution reporting of voltage, current, and frequency parameters. As Mexico tries to improve the stability and resilience of its electricity grid, the installation of such smart monitoring infrastructure is increasingly becoming a priority. According to the reports, in September 2023, Mexico's CFE has announced a US$750 million investment to expand its National Transmission Network, including 766 km of 400kV lines and STATCOM devices over three states. Moreover, the strategic aggregation of data analytics and grid smarts is also facilitating preventive care and emergency planning. Mexico smart power transmission development is thus being propelled by this technological shift, situating the nation towards a more responsive and digitally controlled transmission space that complies with international standards for power quality and operational transparency.

Development of Digital Substations and IoT Integration

Digital substations are becoming a benchmark in Mexico's power transmission system modernization. By substituting analog components with intelligent electronic devices (IEDs), these substations offer higher control, automation, and protection functions. Coupled with Internet of Things (IoT) sensors, integration enables continuous monitoring of equipment and predictive maintenance to minimize downtime and maximize asset longevity. For instance, in May of 2023, Infineon released the OPTIGA™ Authenticate NBT NFC I2C bridge tag, which might boost Mexico's Smart Power Transmission Market through the protection of IoT devices within smart grid applications, enhancing efficiency and reliability. Furthermore, this digitization provides remote access and real-time visibility across the power network, supporting faster decision-making and better resource utilization. In addition, the merging of operational technology (OT) with information technology (IT) supports data sharing and system integration. With rising energy demand and urbanization, digital substations are making sure that Mexico's grid infrastructure is scalable and future-proof. These developments not only enhance operating efficiency but also facilitate the national shift towards smarter, cleaner energy systems that can accommodate changing consumption trends and regulatory requirements.

Implementation of High Voltage Direct Current (HVDC) Systems

The implementation of High Voltage Direct Current (HVDC) transmission systems is a forward step in Mexico's strategy for the transfer of power over long distances and high capacity. HVDC technology is more efficient than the conventional alternating current systems, especially in reducing losses during transmission over long distances. This is particularly relevant in a geographically separated energy generation and consumption hub like Mexico. Implementation of HVDC makes interconnection to the grid easier, aids integration of renewable sources, and stabilizes regional grid power flow. It is also an effective answer to improved voltage control and enhanced load balancing. As Mexico goes on modernizing its transmission facilities, HVDC systems are proving to be vital facilitators for energy security and grid stability. The cost-effectiveness and scalability of these systems position them to effectively address future energy needs and underpin wider sustainability objectives, while supporting the core capabilities of a smart, responsive national grid.

Mexico Smart Power Transmission Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, technology, voltage level, and end user.

Components Insights:

- Transmission Towers and Conductors

- Transformers and Substations

- Sensors and IoT Devices

- Software and Data Analytics Solutions

- Communication Networks

The report has provided a detailed breakup and analysis of the market based on the components. This includes transmission towers and conductors, transformers and substations, sensors and iot devices, software and data analytics solutions, and communication networks.

Technology Insights:

- Supervisory Control and Data Acquisition (SCADA) Systems

- Phasor Measurement Units (PMUs)

- Flexible AC Transmission Systems (FACTS)

- Advanced Metering Infrastructure (AMI)

- Smart Transformers

- High Voltage Direct Current (HVDC) Transmission

- Wide-Area Monitoring Systems (WAMS)

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes supervisory control and data acquisition (SCADA) systems, phasor measurement units (PMUs), flexible AC transmission systems (FACTS), advanced metering infrastructure (AMI), smart transformers, high voltage direct current (HVDC) transmission, and wide-area monitoring systems (WAMS).

Voltage Level Insights:

- Extra High Voltage (EHV) Transmission (≥ 220 kV)

- High Voltage (HV) Transmission (66 kV - 220 kV)

- Medium Voltage (MV) Transmission (11 kV - 66 kV)

The report has provided a detailed breakup and analysis of the market based on the voltage level. This includes extra high voltage (EHV) transmission (≥ 220 kV), high voltage (HV) transmission (66 kV - 220 kV), and medium voltage (MV) transmission (11 kV - 66 kV).

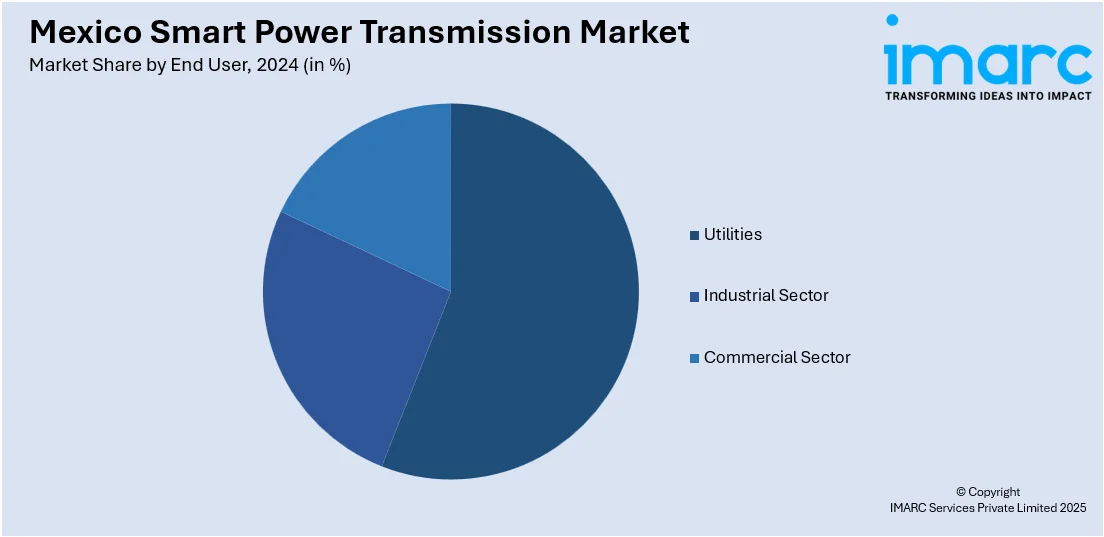

End User Insights:

- Utilities

- Industrial Sector

- Commercial Sector

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes utilities, industrial sector, and commercial sector.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Smart Power Transmission Market News:

- In November 2024, as part of its US$23bn investment in the power sector, Mexico's National Strategy for the Electricity Sector 2024-2030 features an emphasis on the upgrade of smart power transmission systems. The project is designed to improve grid reliability, incorporate renewable energy sources, and enhance efficiency in electricity distribution across the country.

Mexico Smart Power Transmission Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Transmission Towers and Conductors, Transformers and Substations, Sensors and IoT Devices, Software and Data Analytics Solutions, Communication Networks |

| Technologies Covered | Supervisory Control and Data Acquisition (SCADA) Systems, Phasor Measurement Units (PMUs), Flexible AC Transmission Systems (FACTS), Advanced Metering Infrastructure (AMI), Smart Transformers, High Voltage Direct Current (HVDC) Transmission, Wide-Area Monitoring Systems (WAMS) |

| Voltage Levels Covered | Extra High Voltage (EHV) Transmission (≥ 220 kV), High Voltage (HV) Transmission (66 kV - 220 kV), Medium Voltage (MV) Transmission (11 kV - 66 kV) |

| End Users Covered | Utilities, Industrial Sector, Commercial Sector |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico smart power transmission market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico smart power transmission market on the basis of component?

- What is the breakup of the Mexico smart power transmission market on the basis of technology?

- What is the breakup of the Mexico smart power transmission market on the basis of voltage level?

- What is the breakup of the Mexico smart power transmission market on the basis of end user?

- What is the breakup of the Mexico smart power transmission market on the basis of region?

- What are the various stages in the value chain of the Mexico smart power transmission market?

- What are the key driving factors and challenges in the Mexico smart power transmission?

- What is the structure of the Mexico smart power transmission market and who are the key players?

- What is the degree of competition in the Mexico smart power transmission market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico smart power transmission market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico smart power transmission market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico smart power transmission industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)