Mexico Smart Ticketing Market Size, Share, Trends and Forecast by Product, Component, System, Application, and Region, 2026-2034

Mexico Smart Ticketing Market Summary:

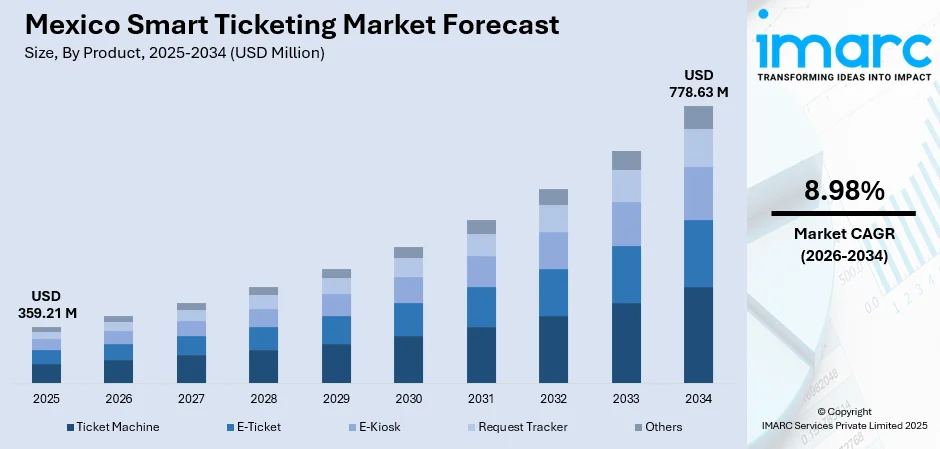

The Mexico smart ticketing market size was valued at USD 359.21 Million in 2025 and is projected to reach USD 778.63 Million by 2034, growing at a compound annual growth rate of 8.98% from 2026-2034.

The Mexico smart ticketing market is experiencing significant expansion driven by government-led digitalization initiatives and modernization of public transportation infrastructure. Growing smartphone penetration and rising demand for contactless payment solutions are accelerating adoption of electronic ticketing systems across urban transit networks. The market benefits from strategic investments in integrated mobility platforms that enable seamless fare collection across multiple transportation modes.

Key Takeaways and Insights:

-

By Product: E-Ticket dominates the market with a share of 40% in 2025, driven by increasing smartphone adoption and consumer preference for convenient mobile-based ticketing solutions.

-

By Component: Software leads the market with a share of 62% in 2025, owing to growing demand for integrated fare management platforms and backend processing systems.

-

By System: Smart card represents the largest segment with a market share of 48% in 2025, reflecting widespread adoption of reloadable transit cards across metro and bus networks.

-

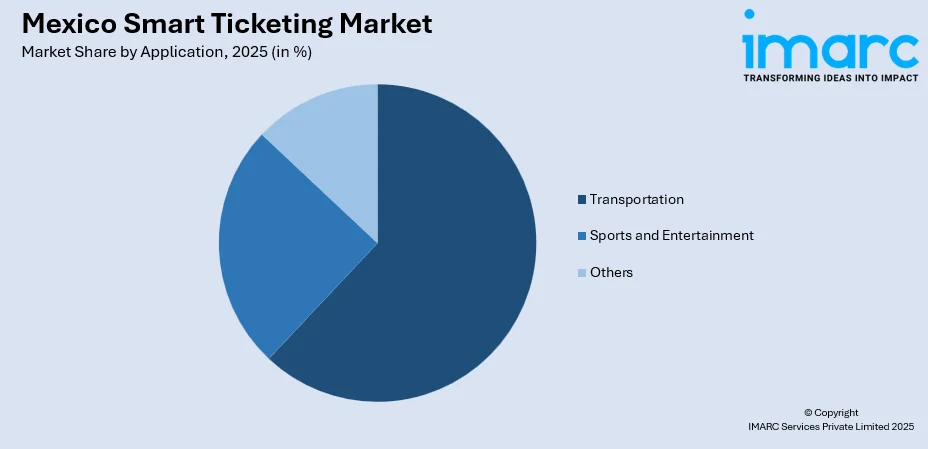

By Application: Transportation dominates with a share of 62% in 2025, fueled by government investments in modernizing public transit fare collection infrastructure.

-

Key Players: The Mexico smart ticketing market features a competitive landscape comprising global technology providers, payment processing companies, and regional system integrators collaborating with transit authorities to deploy advanced fare collection solutions.

To get more information on this market Request Sample

The Mexico smart ticketing market is undergoing transformative growth as urban transportation networks transition from legacy paper-based systems to digital fare collection platforms. Major cities including Mexico City, Monterrey, and Guadalajara are leading this modernization effort through deployment of integrated mobility cards, contactless payment validators, and mobile ticketing applications. For example, in 2025 the State of Yucatán launched Mexico’s first open‑loop contactless payments project for transit in Mérida with Littlepay powering tap‑to‑ride services across buses and BRT vehicles, enabling riders to pay with bank cards or mobile wallets. The market demonstrates strong alignment with broader smart city initiatives prioritizing operational efficiency, enhanced passenger experience, and data-driven transit management capabilities that support sustainable urban mobility development.

Mexico Smart Ticketing Market Trends:

Transition from Magnetic Tickets to Integrated Mobility Cards

Mexican transit authorities are systematically phasing out traditional magnetic stripe tickets in favor of rechargeable smart cards enabling seamless multimodal travel. In Mexico City, for example, authorities confirmed that as of November several Metro lines (including Lines 9 and B) now allow entry exclusively with the Tarjeta de Movilidad Integrada (MI), effectively ending the use of magnetic tickets across much of the network. This transition enhances operational efficiency by reducing cash handling requirements while providing passengers with convenient stored-value payment options that function across metro, bus, and light rail networks through unified fare integration platforms.

Adoption of Open-Loop Payment Systems and Contactless Technology

Transit operators are increasingly implementing open payment systems accepting contactless credit cards, debit cards, and mobile wallet payments directly at fare validators. In January 2025, the Mexicable aerial cable car system in the State of Mexico began accepting contactless bank cards and NFC‑enabled mobile wallets at its fare gates, allowing millions of passengers to tap and pay without needing a dedicated transit card as part of a broader modernization push led by the State Mobility Secretariat. This trend eliminates the need for dedicated transit cards, enhancing accessibility for occasional riders and tourists while aligning Mexican public transportation with global standards for seamless tap-and-ride payment experiences.

Integration of QR Code and Mobile Application Ticketing

Mobile ticketing applications featuring QR code functionality are gaining prominence across entertainment venues and transportation networks. In 2025, transport authorities in Jalisco partnered with the Hoozie mobile platform to launch QR‑based ticketing across the Mi Macro Periférico, Mi Tren lines, and feeder routes, allowing passengers to generate and validate QR tickets directly on their phones instead of using printed fares. These platforms enable ticket purchases, storage, and validation through smartphones, addressing security concerns associated with counterfeit physical tickets while providing operators with valuable ridership data analytics and enhanced customer engagement capabilities.

Market Outlook 2026-2034:

The Mexico smart ticketing market is positioned for sustained expansion throughout the forecast period, supported by continued government investment in public transportation modernization and smart city infrastructure development. Rising urbanization and growing transit ridership will drive demand for scalable fare collection solutions capable of handling increasing passenger volumes efficiently. The integration of advanced technologies including near-field communication, biometric authentication, and artificial intelligence-powered analytics will further enhance market sophistication. The market generated a revenue of USD 359.21 Million in 2025 and is projected to reach a revenue of USD 778.63 Million by 2034, growing at a compound annual growth rate of 8.98% from 2026-2034.

Mexico Smart Ticketing Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | E-Ticket | 40% |

| Component | Software | 62% |

| System | Smart Card | 48% |

| Application | Transportation | 62% |

Product Insights:

- Ticket Machine

- E-Ticket

- E-Kiosk

- Request Tracker

- Others

The e-ticket dominates with a market share of 40% of the total Mexico smart ticketing market in 2025.

Electronic ticketing has emerged as the leading product category in Mexico's smart ticketing market. This dominance reflects the accelerating shift toward mobile-first solutions as smartphone penetration expands across Mexican urban populations. For example, Ticketmaster México reported that by late 2024 about 90 % of the tickets it sells are digital e‑tickets, using its SafeTix platform which generates dynamic barcodes that refresh frequently to prevent fraud and eliminate paper tickets at major venues nationwide.

E-tickets offer consumers convenience through digital purchase, storage, and validation capabilities that eliminate physical ticket requirements while enabling dynamic pricing and promotional offerings for transit operators and event organizers. The e-ticket segment continues strengthening through enhanced security features including dynamic barcodes and encrypted QR codes that address counterfeiting concerns previously associated with paper tickets. Integration with popular mobile payment platforms and ride-hailing applications further expands accessibility, positioning electronic ticketing as the preferred solution for digitally-connected consumers seeking seamless, contactless transaction experiences across transportation and entertainment sectors.

Component Insights:

- Software

- Hardware

The software leads with a share of 62% of the total Mexico smart ticketing market in 2025.

Software components dominate Mexico's smart ticketing market, reflecting the critical importance of backend fare management systems, transaction processing platforms, and data analytics capabilities in modern ticketing infrastructure. These software solutions enable real-time fare calculation, account management, revenue distribution among transport operators, and comprehensive reporting functionalities essential for efficient system operation and strategic planning. In a notable development, global fare‑payments‑as‑a‑service provider Masabi formed a strategic partnership with Mexican integrator Ibergex to introduce its cloud‑native Justride ticketing and fare‑management platform to the Mexican public transport market, helping authorities deploy scalable account‑based ticketing and open payment solutions with reduced IT overhead.

The software segment demonstrates robust growth trajectory driven by increasing demand for cloud-based fare collection platforms offering scalability and reduced infrastructure maintenance requirements. Advanced software capabilities including artificial intelligence-powered fraud detection, predictive ridership analytics, and dynamic fare optimization are becoming essential features as transit authorities seek to maximize operational efficiency while enhancing passenger service quality through data-driven decision-making frameworks.

System Insights:

- Open Payment System

- Smart Card

- Near-Field Communication

The smart card dominates with a market share of 48% of the total Mexico smart ticketing market in 2025.

Smart card systems maintain market leadership, reflecting established infrastructure investments across Mexico's major transit networks. Reloadable stored-value cards including Mexico City's Integrated Mobility Card and Monterrey's MIA card provide reliable, proven technology for high-volume fare collection applications. In December 2025, the Mexico City government launched the Virtual Integrated Mobility Card through the updated App CDMX, allowing users to carry and recharge their transit smart card digitally on their smartphones via CoDi or bank cards, reducing dependence on physical cards and supporting the city’s broader digital transformation of public services.

The smart card segment benefits from extensive distribution networks and consumer familiarity developed over years of deployment across metro, bus, and light rail systems. Transit authorities continue investing in smart card infrastructure enhancements including expanded reload channel availability through mobile applications and retail partnerships while maintaining backward compatibility that protects existing cardholder investments and ensures smooth transitions to next-generation fare collection technologies.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Sports and Entertainment

- Transportation

- Others

The transportation leads with a share of 62% of the total Mexico smart ticketing market in 2025.

Transportation applications command the highest share of Mexico's smart ticketing market, driven by substantial government investments in public transit modernization programs across major metropolitan areas. Growing urban populations, increasing commuter demand for seamless travel, and government initiatives promoting digital payment adoption further fuel market growth. Integration with multi-modal transport networks and enhanced passenger convenience through contactless and mobile ticketing solutions also contribute to widespread adoption.

The transportation segment continues expanding as transit authorities extend smart ticketing coverage to suburban rail services, regional bus routes, and shared mobility options including bike-sharing programs. Integration with navigation applications and mobility-as-a-service platforms positions smart ticketing infrastructure as foundational technology supporting comprehensive urban mobility ecosystems that address congestion, environmental sustainability, and equitable transportation access objectives. The sector benefits from coordinated efforts to implement integrated fare collection systems enabling seamless travel across multiple transport modes including metro networks, bus rapid transit corridors, light rail lines, and cable car systems serving urban populations exceeding millions of daily passengers.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico demonstrates significant smart ticketing adoption led by Monterrey's Metrorrey system implementing MIA smart cards and integrated fare platforms. Industrial development and cross-border commercial activity drive investment in advanced transit infrastructure. Higher disposable incomes support premium digital payment adoption while technology-oriented consumer demographics accelerate mobile ticketing penetration across transportation and entertainment sectors.

Central Mexico dominates the national smart ticketing landscape anchored by Mexico City's comprehensive Integrated Mobility Card system serving metro, Metrobús, and light rail networks. The region benefits from concentrated population density requiring high-capacity fare collection solutions and government prioritization of digital transformation initiatives. Guadalajara's expanding transit network further strengthens regional market leadership through coordinated smart ticketing deployments.

Southern Mexico presents emerging opportunities driven by tourism infrastructure development in destinations like Cancun and expanding urban transit requirements in growing cities. Smart ticketing adoption focuses on entertainment venues, tourist transportation services, and intercity bus networks. Regional growth potential exists as government investment extends modern fare collection systems beyond established metropolitan centers to address evolving mobility demands.

Other regions including Pacific coastal areas and emerging economic corridors demonstrate growing smart ticketing adoption as transportation infrastructure development expands accessibility. These markets present opportunities for scalable ticketing solutions addressing diverse application requirements from regional bus services to entertainment venues serving tourist destinations and developing urban centers throughout Mexico.

Market Dynamics:

Growth Drivers:

Why is the Mexico Smart Ticketing Market Growing?

Government-Led Public Transportation Modernization Initiatives

Federal and municipal governments across Mexico are prioritizing substantial investments in public transportation infrastructure modernization, including comprehensive fare collection system upgrades. At the national level, the Mexican government is participating in the MOVERSE Sustainable Urban Mobility project, a government‑supported urban mobility program implemented with the German development agency GIZ and SEDATU that promotes integrated, inclusive, and sustainable transport solutions across cities, including fare system digitalization and infrastructure coordination to improve multimodal connectivity. Strategic initiatives such as Mexico City Metro's transition from magnetic tickets to integrated smart cards exemplify this commitment to digital transformation. These government-backed programs provide stable funding frameworks that enable transit authorities to deploy advanced ticketing technologies while ensuring affordable public transportation accessibility.

Rising Smartphone Penetration and Digital Payment Adoption

Mexico's rapidly expanding smartphone user base creates favorable conditions for mobile ticketing application deployment and digital payment acceptance. The Mexico smartphones market size reached 22.76 million units in 2024, and is expected to grow to 29.95 million units by 2033, reflecting rising device penetration that underpins broader adoption of mobile solutions. Growing consumer familiarity with mobile banking, e-commerce platforms, and contactless payment technologies translates directly into willingness to adopt smart ticketing solutions for transportation and entertainment purchases. Financial inclusion initiatives expanding banking access to previously unbanked populations further accelerate digital payment infrastructure development that supports cashless ticketing ecosystems. This technological readiness enables transit operators to implement advanced mobile ticketing features confident in consumer adoption capabilities.

Increasing Urbanization and Public Transit Ridership Growth

Rapid urbanization in Mexican metropolitan areas is fueling the need for efficient public transportation systems that can manage increasing passenger volumes. Smart ticketing solutions play a crucial role by enabling fast fare collection, minimizing boarding times, and improving passenger flow, which is essential for high-capacity transit operations. Growing concerns over traffic congestion, environmental sustainability, and economic efficiency are driving higher transit usage, making smart ticketing a strategic investment. These systems not only enhance operational efficiency but also improve service quality and passenger satisfaction, offering transit authorities a comprehensive solution to meet the demands of expanding urban mobility.

Market Restraints:

What Challenges the Mexico Smart Ticketing Market is Facing?

Infrastructure Limitations and Integration Complexity

In some regions, existing transportation infrastructure cannot fully support advanced smart ticketing systems, necessitating substantial capital investment for upgrades. Moreover, connecting diverse ticketing platforms across multiple transit operators presents significant challenges, requiring meticulous technical coordination, standardization, and interoperability efforts to ensure smooth integration, reliable operations, and a seamless experience for passengers across all transit services.

Cybersecurity and Data Privacy Concerns

Protecting personal and financial data in smart ticketing systems remains a key challenge, demanding strong cybersecurity measures and adherence to regulatory frameworks. Privacy and transaction security concerns can hinder adoption, especially among users less familiar with digital payments, making trust-building and transparent data practices essential for widespread acceptance and effective system implementation.

High Implementation Costs and Budget Constraints

Implementing comprehensive smart ticketing systems often requires substantial upfront capital, which may exceed the budgets of smaller transit operators and municipalities. Economic pressures and competing infrastructure priorities can further delay modernization efforts, especially in regions with limited public funding. These financial constraints pose significant challenges to timely adoption and scaling of advanced ticketing solutions across all transit networks.

Competitive Landscape:

The Mexico smart ticketing market exhibits a moderately consolidated competitive structure featuring global fare collection technology providers, regional system integrators, and specialized software developers serving diverse stakeholder requirements. Market participants compete across multiple dimensions including technological innovation, implementation expertise, after-sales support capabilities, and pricing strategies tailored to varying budget constraints. Strategic partnerships between international technology companies and local integration partners have proven effective for navigating regulatory requirements and addressing unique market characteristics while delivering proven solutions adapted to Mexican operational environments.

Recent Developments:

-

In December 2025, Mexico launches an official digital ticket resale platform and tourism app ahead of the 2026 FIFA World Cup to tackle scalping, enhance security and improve fan experience for millions of visitors. The Spanish‑language system complies with consumer protection laws and aims to make ticketing more transparent and fair.

Mexico Smart Ticketing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Ticket Machine, E-Ticket, E-Kiosk, Request Tracker, Others |

| Components Covered | Software, Hardware |

| Systems Covered | Open Payment System, Smart Card, Near-Field Communication |

| Applications Covered | Sports and Entertainment, Transportation, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico smart ticketing market size was valued at USD 359.21 Million in 2025.

The Mexico smart ticketing market is expected to grow at a compound annual growth rate of 8.98% from 2026-2034 to reach USD 778.63 Million by 2034.

E-Ticket held the largest market share with 40%, driven by rising smartphone adoption and growing consumer preference for convenient mobile-based ticketing solutions across transportation and entertainment applications.

Key factors driving the Mexico smart ticketing market include government-led public transportation modernization initiatives, rising smartphone penetration, increasing urbanization, growing demand for contactless payment solutions, and enhanced focus on operational efficiency in transit systems.

Major challenges include infrastructure limitations in certain regions, integration complexity across multiple transit operators, cybersecurity and data privacy concerns, high implementation costs, and interoperability issues between different ticketing system platforms.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)