Mexico Smart Welding Equipment Market Size, Share, Trends and Forecast by Component, Material Type, Welding Technology, Automation Level, End Use Industry, and Region, 2025-2033

Mexico Smart Welding Equipment Market Outlook 2033:

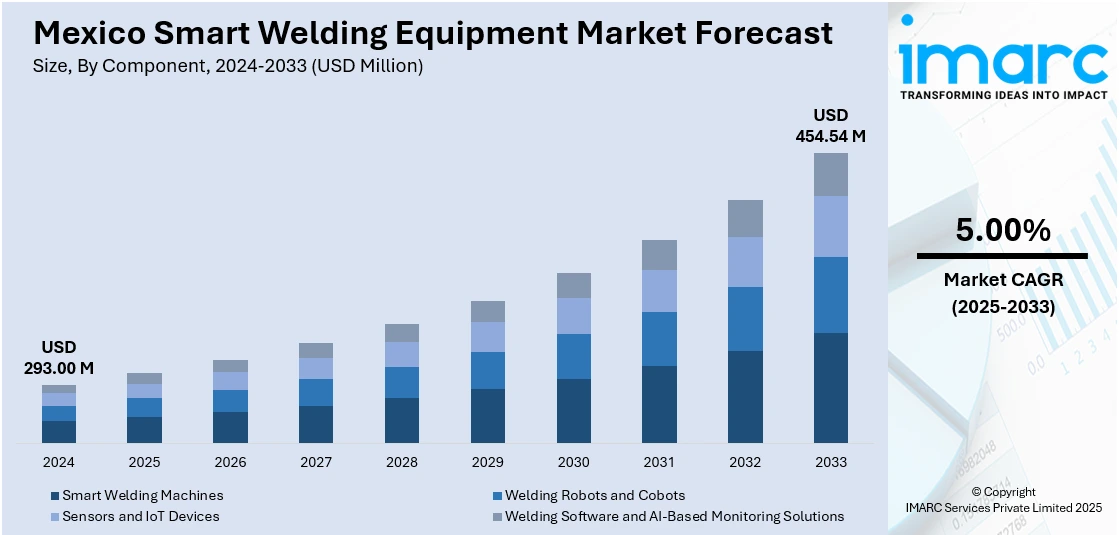

The Mexico smart welding equipment market size reached USD 293.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 454.54 Million by 2033, exhibiting a growth rate (CAGR) of 5.00% during 2025-2033. The market is driven by the adoption of advanced technologies like robotics and automation in sectors such as automotive, construction, and energy. Government initiatives promoting industrial modernization and infrastructure development also support this trend. The increasing demand for precision and efficiency in manufacturing processes is further influencing the Mexico smart welding equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 293.00 Million |

| Market Forecast in 2033 | USD 454.54 Million |

| Market Growth Rate 2025-2033 | 5.00% |

Mexico Smart Welding Equipment Market Analysis:

- Key Market Trend: Manufacturers are embracing automated and digitally connected welding systems to boost precision and productivity, reflecting a shift toward smart factories, predictive maintenance, and real-time data use in industrial welding.

- Key Market Driver: Industrial automation growth, skilled labor shortages, and rising production demands are fueling adoption of smart welding equipment, supported by modernization efforts across automotive, aerospace, and construction sectors in Mexico.

- Key Opportunity: The market is boosted by the rising companies offering customizable, AI-powered welding solutions, training support, and energy-efficient systems tailored to evolving industry needs—especially in sectors upgrading to meet global quality and safety standards.

- Key Challenge: High initial investment costs and limited technical expertise pose barriers for widespread adoption, particularly among small and mid-sized firms hesitant to shift from traditional methods to advanced welding technologies in the Mexico smart welding equipment market forecast.

Mexico Smart Welding Equipment Market Trends:

Expansion of Key End-Use Industries

Mexico’s thriving automotive, aerospace, and energy industries are major contributors to the growth of smart welding equipment. The country serves as a global manufacturing hub, particularly for automobiles and auto components, requiring advanced welding technologies for chassis, engine, and structural assembly. Additionally, the aerospace sector's strict precision and quality demands make automated, sensor-enabled welding solutions indispensable. As production volumes and quality standards rise, manufacturers increasingly rely on intelligent welding systems to ensure consistency, reduce rework, and enhance throughput. The combination of rising industrial activity and foreign direct investment is fueling Mexico smart welding equipment market demand for efficient and reliable welding technologies, making the growth of end-use sectors a pivotal factor in the expansion of Mexico’s smart welding equipment market. For instance, in July 2024, Heron Intelligent Equipment Ltd. Co. and QUAT Industrial of Mexico formed a strategic relationship to provide Heron and QUAT clients in the region with increased value. Customers will get access to a wider range of products, better installation and maintenance services, and engineering guidance catered to the various requirements of Mexican manufacturers due to the combined capabilities of both businesses.

Technological Advancements and Industry 4.0 Adoption

The adoption of Industry 4.0 technologies is reshaping Mexico smart welding equipment market analysis, with smart welding equipment playing a key role in this transformation. These systems incorporate automation, IoT sensors, and real-time analytics to enable predictive maintenance, fault detection, and precision control, which is driving the Mexico smart welding equipment market growth. Manufacturers benefit from improved weld quality, lower downtime, and better data traceability, which are crucial for compliance and operational efficiency. As digital transformation accelerates across industries, companies are investing in smart welding tools that support integrated, data-driven production environments. This alignment with Industry 4.0 standards is not just a trend but a necessity for companies aiming to stay competitive. As a result, technological advancement is a critical growth driver for Mexico’s smart welding equipment market. For instance, in March 2025, Herrmann Ultrasonics, a German maker of auto parts, opened its newest lab and technology center in Monterrey, Mexico. The 1,600-square-foot facility will facilitate teamwork in creating solutions that are specifically suited to production requirements. Additionally, it will give access to ultrasonic welding equipment, including the HiQ series, which combines the efficiency of series manufacturing with the versatility of custom machines. Features include digital integration for improved use, customisable components, and guided tool adjustments.

Skilled Labor Shortage and Emphasis on Automation

A shortage of highly skilled welders in Mexico is prompting industries to adopt smart welding equipment that can compensate for labor gaps. These systems automate critical tasks, reduce errors, and allow less experienced operators to achieve high-quality results using pre-programmed settings and real-time feedback. As manufacturers strive to meet increasing production demands, automation provides a cost-effective and scalable solution. Smart welding technology minimizes the need for constant manual oversight and increases operational consistency across shifts. In addition, rising labor costs and global competition further underscore the importance of automation. This labor challenge is a major reason why many Mexican companies are transitioning to smart welding solutions that improve efficiency without compromising quality.

Mexico Smart Welding Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, material type, welding technology, automation level, and end use industry.

Component Insights:

- Smart Welding Machines

- Welding Robots and Cobots

- Sensors and IoT Devices

- Welding Software and AI-Based Monitoring Solutions

The report has provided a detailed breakup and analysis of the market based on the component. This includes smart welding machines, welding robots and cobots, sensors and IoT devices, and welding software and AI-based monitoring solutions.

Material Type Insights:

- Steel and Stainless Steel Welding

- Aluminum and Non-Ferrous Metal Welding

- Composite and Advanced Material Welding

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes steel and stainless steel welding, aluminum and non-ferrous metal welding, and composite and advanced material welding.

Welding Technology Insights:

- Arc Welding

- Resistance Welding

- Laser Welding

- Electron Beam Welding

- Ultrasonic Welding

- Friction Stir Welding

- Plasma Welding

A detailed breakup and analysis of the market based on the welding technology have also been provided in the report. This includes arc welding, resistance welding, laser welding, electron beam welding, ultrasonic welding, friction stir welding, and plasma welding.

Automation Level Insights:

- Manual Welding Equipment

- Semi-Automated Welding Systems

- Fully Automated and AI-Integrated Welding Systems

A detailed breakup and analysis of the market based on the automation level have also been provided in the report. This includes manual welding equipment, semi-automated welding systems, and fully automated and AI-integrated welding systems.

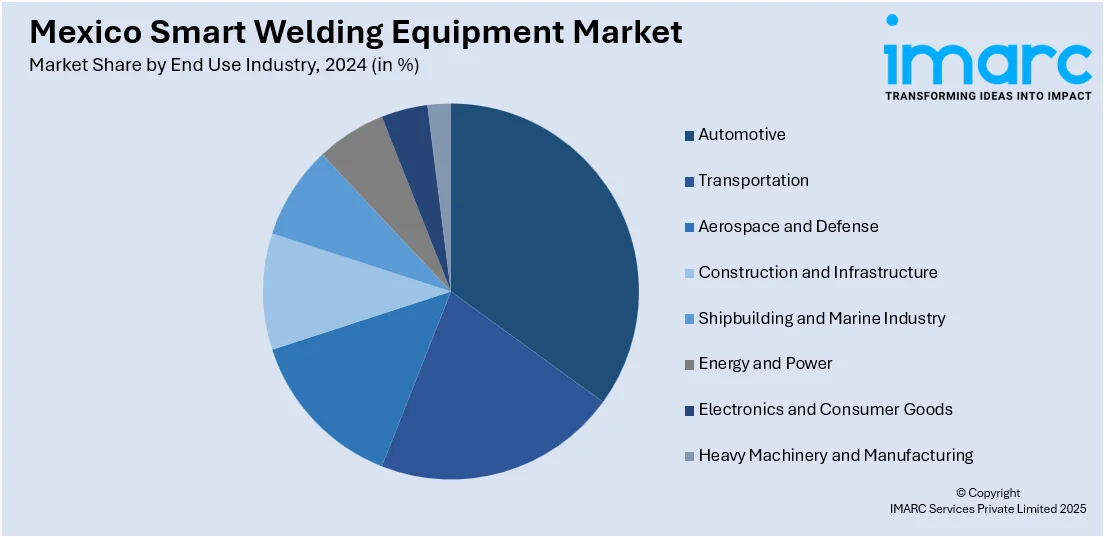

End Use Industry Insights:

- Automotive

- Transportation

- Aerospace and Defense

- Construction and Infrastructure

- Shipbuilding and Marine Industry

- Energy and Power

- Electronics and Consumer Goods

- Heavy Machinery and Manufacturing

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, transportation, aerospace and defense, construction and infrastructure, shipbuilding and marine industry, energy and power, electronics and consumer goods, and heavy machinery and manufacturing.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In July 2024, Heron Intelligent Equipment Ltd. and QUAT Industrial formed a strategic partnership to expand their reach in Mexico. This collaboration will enhance product offerings, localized service, and engineering support for industrial clients. With Heron’s global expertise in welding and fastening and QUAT’s regional installation capabilities, the alliance aims to deliver cost-effective, innovative solutions and drive growth across automotive, HVAC, and general manufacturing sectors.

Mexico Smart Welding Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Smart Welding Machines, Welding Robots and Cobots, Sensors and IoT Devices, Welding Software and AI-Based Monitoring Solutions |

| Material Types Covered | Steel and Stainless Steel Welding, Aluminum and Non-Ferrous Metal Welding, Composite and Advanced Material Welding |

| Welding Technologies Covered | Arc Welding, Resistance Welding, Laser Welding, Electron Beam Welding, Ultrasonic Welding, Friction Stir Welding, Plasma Welding |

| Automation Levels Covered | Manual Welding Equipment, Semi-Automated Welding Systems, Fully Automated and AI-Integrated Welding Systems |

| End Use Industries Covered | Automotive, Transportation, Aerospace and Defense, Construction and Infrastructure, Shipbuilding and Marine Industry, Energy and Power, Electronics and Consumer Goods, Heavy Machinery and Manufacturing |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico smart welding equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico smart welding equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico smart welding equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Mexico smart welding equipment market was valued at USD 293.00 Million in 2024.

The Mexico smart welding equipment market is projected to exhibit a CAGR of 5.00% during 2025-2033, reaching a value of USD 454.54 Million by 2033.

The Mexico smart welding equipment market is driven by growing demand from the automotive, aerospace, and construction industries, along with rising adoption of automation and Industry 4.0 technologies. Manufacturers seek efficient, precise, and energy-saving solutions, while infrastructure development and the push for modern, connected factories further fuel equipment upgrades and innovation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)