Mexico Smartwatch Market Size, Share, Trends and Forecast by Product, Operating System, Application, Distribution Channel, and Region, 2025-2033

Mexico Smartwatch Market Overview:

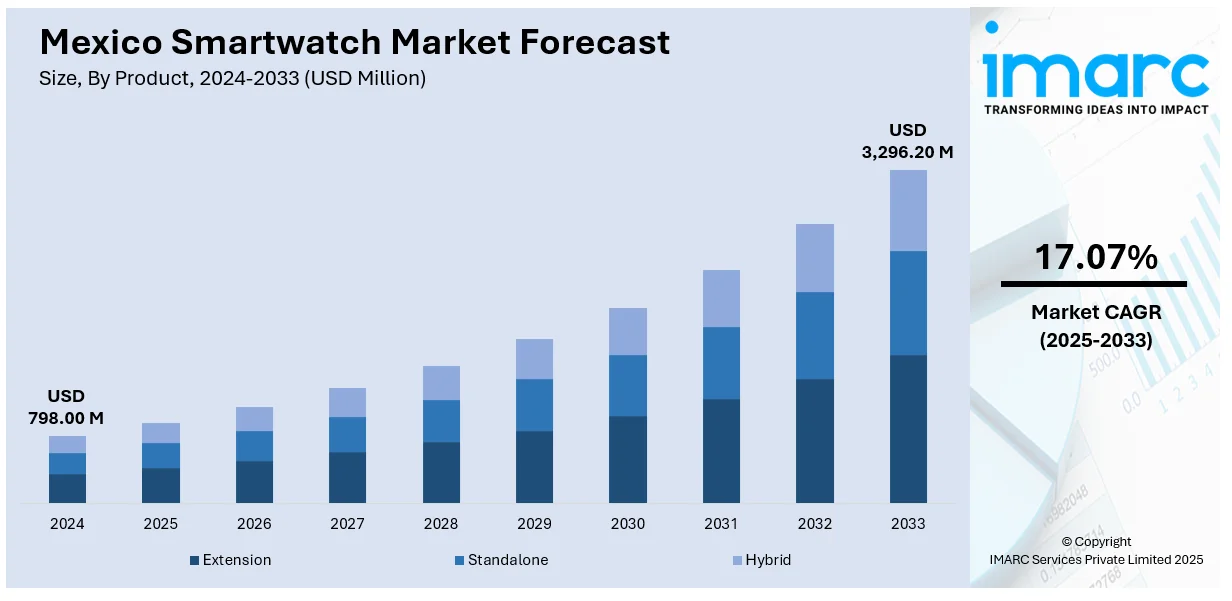

The Mexico smartwatch market size reached USD 798.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,296.20 Million by 2033, exhibiting a growth rate (CAGR) of 17.07% during 2025-2033. The growing health consciousness, expanding urban population, increasing demand for fitness tracking features, and improved internet connectivity, affordable product offerings, tech-savvy youth demographics, and integration with health monitoring apps are some of the factors propelling market expansion in Mexico.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 798.00 Million |

| Market Forecast in 2033 | USD 3,296.20 Million |

| Market Growth Rate 2025-2033 | 17.07% |

Mexico Smartwatch Market Trends:

Integration of Health and Wellness Features

The growing integration of health monitoring features is significantly enhancing Mexico smartwatch market outlook. According to an industry survey, approximately 77% of Mexican adults exhibit two or more lifestyle-related risk factors, prompting increased public concern around health maintenance. This is resulting in a noticeable rise in awareness regarding preventive healthcare. As a result, consumers are displaying a growing interest in wearable devices that provide real-time tracking of physiological metrics, including heart rate, sleep quality, and blood oxygen levels. Mexican users, particularly in urban regions, are becoming more invested in personal health data, seeking devices that provide actionable insights and encourage healthy behavior. In addition to this, fitness enthusiasts are adopting smartwatches to monitor activity levels, calorie burn, and workout efficiency. As a result, smartwatch brands are optimizing battery life and refining sensor accuracy to support constant data capture. Furthermore, integration with telemedicine platforms and local health apps is also rising, making smartwatches a valuable tool in the broader digital healthcare ecosystem in Mexico.

Rise of Affordable and Hybrid Smartwatches

The expansion of affordable and hybrid smartwatch offerings is propelling Mexico smartwatch market growth. The market expansion is driven by price sensitivity among a large segment of consumers. With many users seeking basic smart features without premium pricing, brands are launching entry-level models or hybrid devices that combine analog aesthetics with core digital functionalities like step counting, notification alerts, and sleep tracking. These hybrids appeal to consumers who prefer traditional watch designs but desire some degree of connectivity and health monitoring. Local and Asian manufacturers are playing a major role in this segment, providing lower-cost alternatives with acceptable performance and battery life. Moreover, offline retail channels and promotions through e-commerce platforms are helping increase reach. Additionally, the availability of installment-based payment options and bundled smartphone offers have made smartwatches more accessible to first-time buyers, further accelerating their adoption across broader income groups.

Localization and Voice Assistant Compatibility

The growing importance of localization, particularly in language compatibility and regional content integration, is strengthening the market. Voice assistant support in a regional language is increasingly becoming a standard requirement for smartwatch adoption, especially among older and mid-income demographics. Global brands are optimizing their devices for native language processing, enhancing functionality for tasks like setting reminders, dictating messages, and accessing local services through voice commands. This trend is also driven by the rising popularity of smart ecosystems, where smartwatches act as an interface to control home automation devices. Moreover, voice commands are particularly beneficial for users with limited literacy or mobility challenges, along with increasing accessibility. As smartwatches transition from niche gadgets to lifestyle tools, seamless interaction through localized voice control is expected to be a key differentiator for both international and domestic brands targeting the Mexican consumer base. These factors are collectively augmenting the Mexico smartwatch market share.

Mexico Smartwatch Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, operating system, application, and distribution channel.

Product Insights:

- Extension

- Standalone

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the product. This includes extension, standalone, and hybrid.

Operating System Insights:

- WatchOS

- Android

- Others

A detailed breakup and analysis of the market based on the operating system have also been provided in the report. This includes watchOS, android, and others.

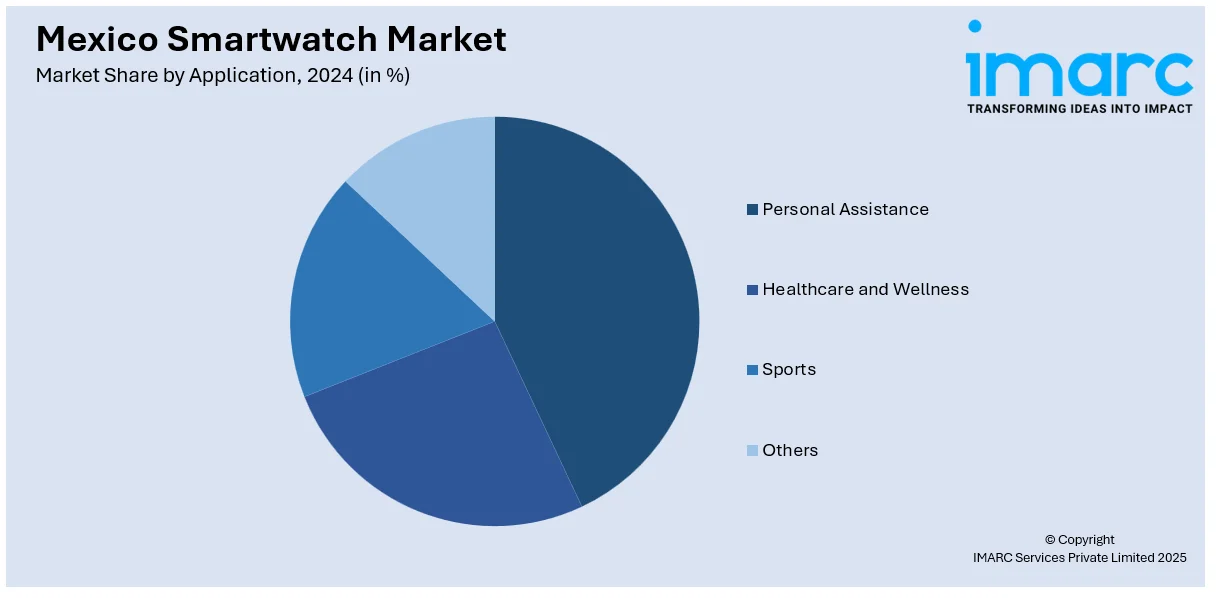

Application Insights:

- Personal Assistance

- Healthcare and Wellness

- Sports

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes personal assistance, healthcare and wellness, sports, and others.

Distribution Channel Insights:

- Online Stores

- Offline Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online stores and offline stores.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Smartwatch Market News:

- On February 9, 2023, Huawei commenced the global rollout of its Watch GT Cyber smartwatch, beginning with availability in Mexico. Distinguished by its modular design, the device allows users to interchange both the casing and strap, and features a 1.32-inch AMOLED display, GPS, Bluetooth calling, voice assistant, and SpO2 sensor. The Watch GT Cyber offers up to seven days of battery life and is available in black and grey, with additional watch case/strap options in black, grey, yellow, and gold.

Mexico Smartwatch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Extension, Standalone, Hybrid |

| Operating Systems Covered | WatchOS, Android, Others |

| Applications Covered | Personal Assistance, Healthcare and Wellness, Sports, Others |

| Distribution Channels Covered | Online Stores, Offline Stores |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico smartwatch market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico smartwatch market on the basis of product?

- What is the breakup of the Mexico smartwatch market on the basis of operating system?

- What is the breakup of the Mexico smartwatch market on the basis of application?

- What is the breakup of the Mexico smartwatch market on the basis of distribution channel?

- What is the breakup of the Mexico smartwatch market on the basis of region?

- What are the various stages in the value chain of the Mexico smartwatch market?

- What are the key driving factors and challenges in the Mexico smartwatch market?

- What is the structure of the Mexico smartwatch market and who are the key players?

- What is the degree of competition in the Mexico smartwatch market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico smartwatch market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico smartwatch market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico smartwatch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)