Mexico Snack Bar Market Size, Share, Trends and Forecast by Product Type, Ingredient, Distribution Channel and Region, 2025-2033

Mexico Snack Bar Market Overview:

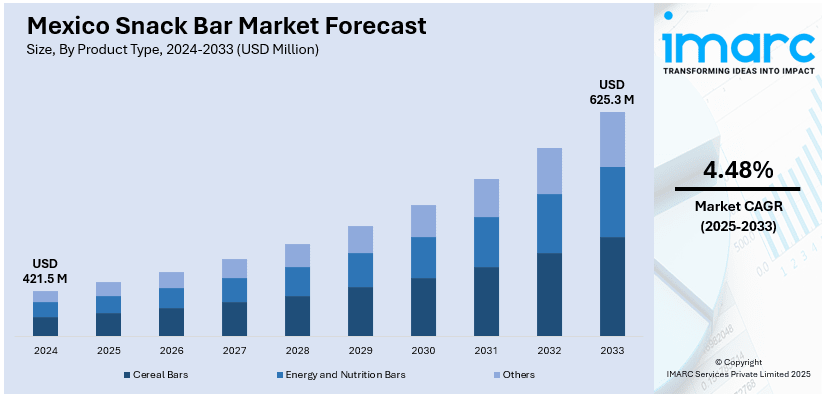

The Mexico snack bar market size reached USD 421.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 625.3 Million by 2033, exhibiting a growth rate (CAGR) of 4.48% during 2025-2033. The market is driven by growing health awareness, surging demand for convenient on-the-go foods, and the increasing popularity of protein-rich and plant-based diets. Urban lifestyles, hectic schedules, and a move toward clean-label, healthy snacking choices are driving innovation and growth in the consumption of snack bars throughout the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 421.5 Million |

| Market Forecast in 2033 | USD 625.3 Million |

| Market Growth Rate 2025-2033 | 4.48% |

Mexico Snack Bar Market Trends:

Health-Conscious Snacking

Growing concern about individual health and wellness in Mexico is fueling demand for healthy and functional snack bar products. Consumers are increasingly aware of the role that food plays in maintaining long-term health, and as a result, brands are being forced to provide snack bars that are rich in protein, fiber, and necessary nutrients, but low in sugar and without artificial ingredients. Functional ingredients like chia seeds, nuts, probiotics, and superfoods are becoming increasingly popular in snack bar formulations. Government initiatives to fight obesity and diabetes through front-of-pack labeling and awareness campaigns have also impacted buying behavior. Consequently, clean-label and minimally processed snack bars have emerged as a choice of preference, particularly among millennials and young professionals looking for better-for-you snacks. Healthy snacking is a long-term shift, with consumers demanding transparency and wellness benefits in every product. This shift is strongly influencing innovation and product development in the Mexico snack bar market outlook.

Convenience and On-the-Go Consumption

With increasingly hectic lifestyles, especially in cities such as Mexico City, Monterrey, and Guadalajara, consumers are valuing convenience and portability in foods. Snack bars are the ideal solution—light, portable, and ready to eat anytime. This trend is particularly apparent among working adults, students, and commuters who need quick bursts of energy throughout the day. The small format of the snack bar, single-serve package, and low mess make it well-suited for on-the-go eating. Also, the increase in gig economy workers and flexible working hours has transformed snacking habits, with fewer formal meals and more snacking occasions. This changing eating habit prefers portable, healthy snacks such as snack bars over conventional snacks. The increasing availability of these products in convenience stores, supermarkets, and vending machines also aids impulse purchases. As busy consumers look for products that offer convenience and nutrition, snack bars continue to gain popularity among various demographics, further fueling the Mexico snack bar market growth.

Plant-Based and Specialized Diet Preferences

The increasing popularity of plant-based and alternative diets in Mexico is having a major impact on the snack bar market. Consumers are increasingly opting for vegan, vegetarian, gluten-free, and keto-friendly snack bars to suit personal health objectives and moral principles. This transformation is fueled by a combination of health issues, sustainability consciousness, and social media promotion of healthy eating. Plant-based snack bars typically contain ingredients such as pea protein, almonds, oats, and dates that provide clean nutrition without sacrificing taste. Most brands are also including superfoods like spirulina, quinoa, and cacao to resonate with health-conscious consumers. In addition, consumers are increasingly demanding allergen-free products, compelling manufacturers to create snack bars free from popular allergens such as dairy, soy, and gluten. With younger consumers particularly adopting flexitarian diets, brands that provide creative, plant-based products are acquiring a competitive advantage. As specialty diets become mainstream, the Mexico snack bar market share is rapidly diversifying to accommodate these changing consumer demands.

Mexico Snack Bar Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, ingredient, and distribution channel.

Product Type Insights:

- Cereal Bars

- Granola/Muesli Bars

- Others

- Energy and Nutrition Bars

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cereal bars (granola/muesli bars, others), energy and nutrition bars, and others.

Ingredient Insights:

- Nuts

- Whole Grains

- Dry Fruits

- Others

The report has provided a detailed breakup and analysis of the market based on the ingredient. This includes nuts, whole grains, dry fruits, and others.

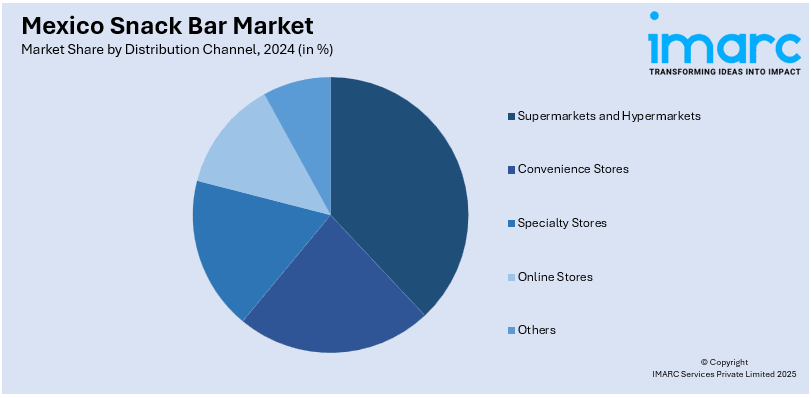

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Snack Bar Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Ingredients Covered | Nuts, Whole Grains, Dry Fruits, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico and Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico snack bar market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico snack bar market on the basis of product type?

- What is the breakup of the Mexico snack bar market on the basis of ingredient?

- What is the breakup of the Mexico snack bar market on the basis of distribution channel?

- What is the breakup of the Mexico snack bar market on the basis of region?

- What are the various stages in the value chain of the Mexico snack bar market?

- What are the key driving factors and challenges in the Mexico snack bar market?

- What is the structure of the Mexico snack bar market and who are the key players?

- What is the degree of competition in the Mexico snack bar market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico snack bar market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico snack bar market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico snack bar industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)