Mexico Soda Ash Market Size, Share, Trends and Forecast by Application, and Region, 2025-2033

Mexico Soda Ash Market Overview:

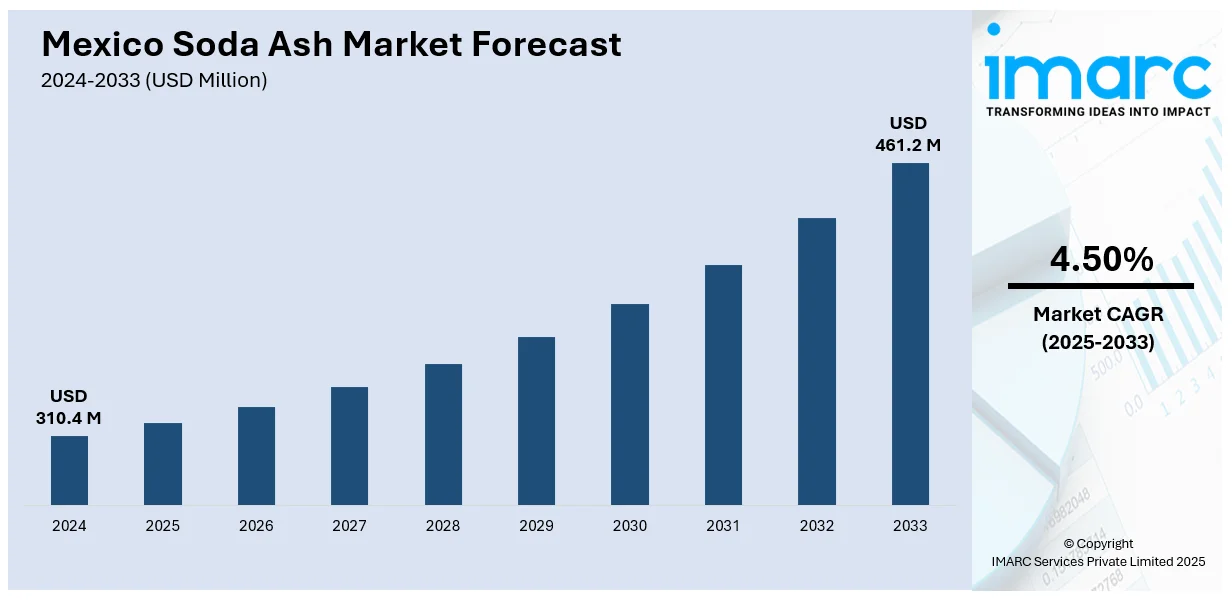

The Mexico soda ash market size reached USD 310.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 461.2 Million by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. The market is driven as a result of boosting industrial demand, enhanced production capacities, and stable consumption across industries, setting the industry up for long-term growth and solidifying its position in the nation's manufacturing and chemical processes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 310.4 Million |

| Market Forecast in 2033 | USD 461.2 Million |

| Market Growth Rate 2025-2033 | 4.50% |

Mexico Soda Ash Market Trends:

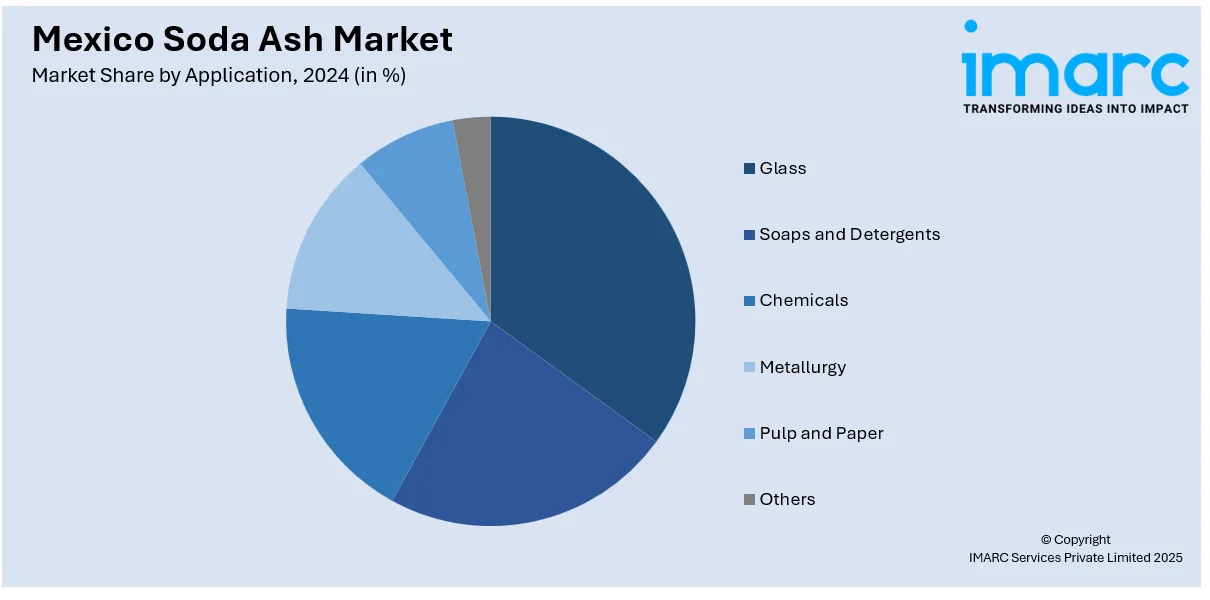

Increasing Demand from the Glass Manufacturing Sector

The Mexico soda ash market outlook is increasingly driven by the glass producing industry, which is the biggest user of soda ash. With Mexico finding greater footing as a regional center for glass production, the demand for soda ash is steadily rising. The building industry plays a significant role in driving the growth of the Mexico soda ash market, with increasing demand for flat glass used in residential and commercial buildings, automotive applications, solar panel manufacturing. The food and beverage (F&B) businesses are also pushing up glass container consumption, triggered by sustainability programs calling for reusable and recyclable packaging. Manufacturing specialty glass for high-performance applications like energy-saving windows and electronics also contributes to Mexico soda ash market growth. With ongoing investments in glass production and export-based manufacturing, soda ash continues to be an essential raw material, guaranteeing consistent demand in various sectors of Mexico's industrial economy. According to the reports, in March 2025, the Mexican soda ash market is dependent on imports for 90% of its demand, mainly from the U.S., making it vulnerable to global price fluctuations and supply chain risks.

Expanding Applications in the Chemical and Detergent Industries

Aside from its classical application in glass production, soda ash is becoming intensely important in the chemical and detergent industries, driving Mexico's soda ash development. The chemical industry depends on soda ash to produce sodium silicates, sodium bicarbonate, and other basic compounds utilized in different industrial processes. The detergent market, especially, has experienced an increase in the use of soda ash due to the changeover by manufacturers to phosphate-free products, in which soda ash is used as a good cleaning agent and pH adjuster. The pulp and paper industry also uses soda ash for bleaching and processing, further amplifying its industrial uses. Growing concern for water treatment solutions has contributed to higher demand for soda ash, which finds extensive use for pH adjustment as well as de-ashing for municipal and industrial water systems. With Mexico's industrial base constantly diversifying, soda ash shall continue to have its importance cutting across various industries with high-growth potential.

Rising Focus on Domestic Production and Supply Chain Resilience

Initiatives to promote domestic production and supply chain efficiency optimization are bolstering the Mexico soda ash market share. The nation is concentrating on decreasing dependence on imports through local production capacity enhancement, guaranteeing a cost-competitive and stable supply of soda ash for industry use. Investment in modern manufacturing plants, upgraded logistics infrastructure, and environmentally friendly production practices is further building stability in the market. In addition, supply chain shutdowns over the past few years have encouraged manufacturers to employ resilient approaches, such as diversifying raw material sources and improving storage capacity to offset potential shortages. The use of cleaner production methods, such as carbon capture and energy-efficient processing, is also becoming increasingly prominent, keeping with Mexico's overall sustainability agendas. As per the sources, in October 2024, Intertek awarded its first Low Carbon Intensity Certification for soda ash to WE Soda Ltd.'s two Turkish plants under its CarbonClear programme, confirming cradle-to-gate emissions performance. Moreover, with accelerating industrial demand and an aggressive strategy to secure domestic supply, Mexico is poised to enhance its position in the international soda ash market while guaranteeing long-term growth and economic dividends for its industrial sectors.

Mexico Soda Ash Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on application.

Application Insights:

- Glass

- Soaps and detergents

- Chemicals

- Metallurgy

- Pulp and paper

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes glass, soaps and detergents, chemicals, metallurgy, pulp and paper, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Soda Ash Market News:

- In March 2025, Solvay collaborated with ENOWA, NEOM's energy and water utility, to create the world's first carbon-neutral soda ash plant. With a 2030 operating target, the facility will operate on renewable energy and the revolutionary e.Solvay process, establishing a worldwide standard in sustainability, circularity, and competitiveness.

Mexico Soda Ash Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Application Covered | Glass, Soaps and Detergents, Chemicals, Metallurgy, Pulp and Paper, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico soda ash market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico soda ash market on the basis of application?

- What is the breakup of the Mexico soda ash market on the basis of region?

- What are the various stages in the value chain of the Mexico soda ash market?

- What are the key driving factors and challenges in the Mexico soda ash?

- What is the structure of the Mexico soda ash market and who are the key players?

- What is the degree of competition in the Mexico soda ash market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico soda ash market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico soda ash market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico soda ash industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)