Mexico Solar Panel Recycling Market Size, Share, Trends and Forecast by Process, Type, Material, Shelf Life, and Region, 2025-2033

Mexico Solar Panel Recycling Market Overview:

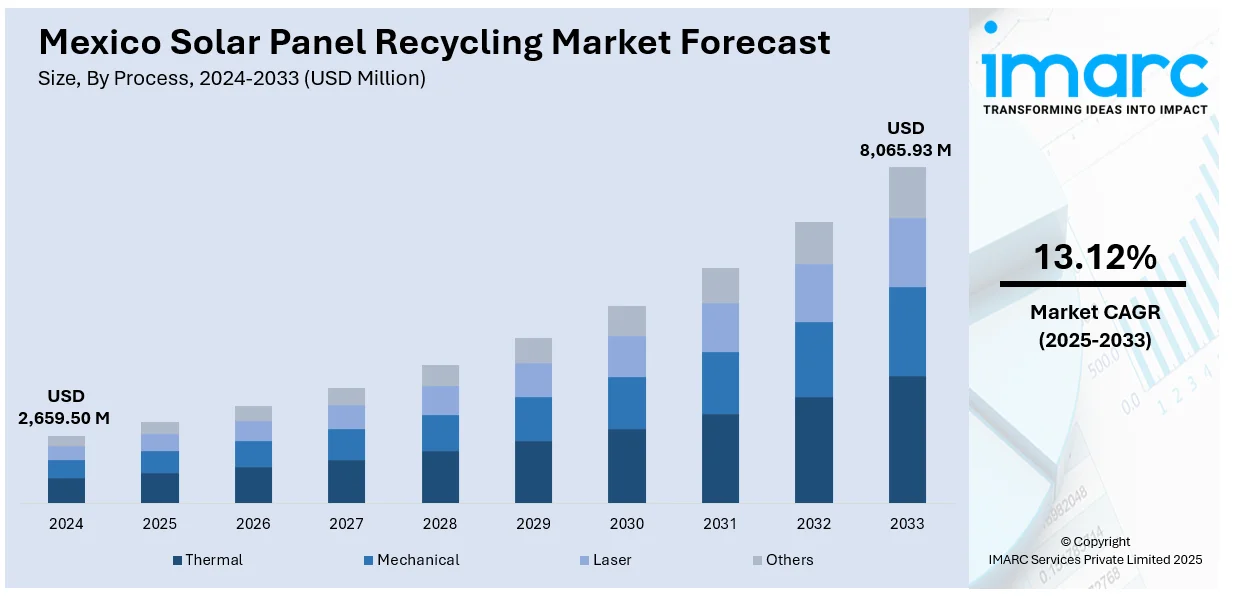

The Mexico solar panel recycling market size reached USD 2,659.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 8,065.93 Million by 2033, exhibiting a growth rate (CAGR) of 13.12% during 2025-2033. The market is driven by Mexico’s accelerating solar installations, spurred by declining panel costs and renewable energy targets, which will generate a rise in end-of-life PV waste, necessitating recycling solutions. Growing investments in green finance, including green bonds targeted by 2025, are channeling capital toward sustainable infrastructure, with solar recycling gaining prominence as a key circular economy practice. Additionally, technological advancements and cross-border collaborations are enhancing recycling efficiency, further augmenting the Mexico solar panel recycling market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,659.50 Million |

| Market Forecast in 2033 | USD 8,065.93 Million |

| Market Growth Rate 2025-2033 | 13.12% |

Mexico Solar Panel Recycling Market Trends:

Rising Demand for Solar Panel Recycling Due to Increasing Solar Installations

Mexico’s solar energy sector has experienced rapid growth, driven by declining solar panel costs and government incentives for renewable energy. In 2024, Mexico generated 25% of its electricity from low-carbon sources, lower than the global average of 41%, of which solar contributed 8%. As Mexico targets 33% renewable power by 2030, recycling solar panels will have an important role to play in enabling the local long-term growth of clean power. With the advent of more solar projects, the volume of end-of-life solar panels is expected to rise significantly over the next decade. This rise in decommissioned panels is creating a pressing need for efficient recycling solutions to manage photovoltaic (PV) waste. Currently, Mexico lacks comprehensive regulations for solar panel recycling, but industry stakeholders are pushing for standardized processes to recover precious materials such as silicon, aluminum, and silver. Companies specializing in solar panel recycling are emerging to address this demand, offering services to dismantle and repurpose components sustainably. The trend highlights a shift toward circular economy practices in Mexico’s renewable energy sector, further propelling the Mexico solar panel recycling market growth.

Growing Investments in Solar Recycling Infrastructure and Technology

The market is attracting investments as businesses and policymakers recognize the economic and environmental benefits of recycling PV waste. Mexico is witnessing a rapid development of green finance by issuing over USD 2.2 Billion of sustainable bonds at the start of 2024, which indicates a 75% rise in euro-denominated bonds. It plans to achieve a USD 10 billion market for green bonds by 2025, of which the finances will be directed towards the increase in renewable resources, especially solar power, currently accounting for 8% of Mexico's power generation. With investments in sustainability increasing by 50% in the non-public sector, recycling of solar panels will be crucial to maintaining long-term efficiency and effective resource management within Mexico's clean energy sector. As a result, international recycling firms and local startups are collaborating to establish specialized facilities capable of processing solar panels efficiently. Advanced recycling technologies, such as mechanical separation and chemical treatment, are being introduced to improve material recovery rates. Additionally, Mexico’s proximity to the U.S. positions it as a potential hub for solar recycling in North America, fostering cross-border partnerships. Government initiatives and private-sector incentives are expected to accelerate infrastructure development, making solar panel recycling more accessible and cost-effective. This trend reflects a broader movement toward sustainable waste management in the renewable energy industry, ensuring that Mexico’s solar boom does not lead to long-term environmental challenges.

Mexico Solar Panel Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on process, type, material, and shelf life.

Process Insights:

- Thermal

- Mechanical

- Laser

- Others

The report has provided a detailed breakup and analysis of the market based on the process. This includes thermal, mechanical, laser, and others.

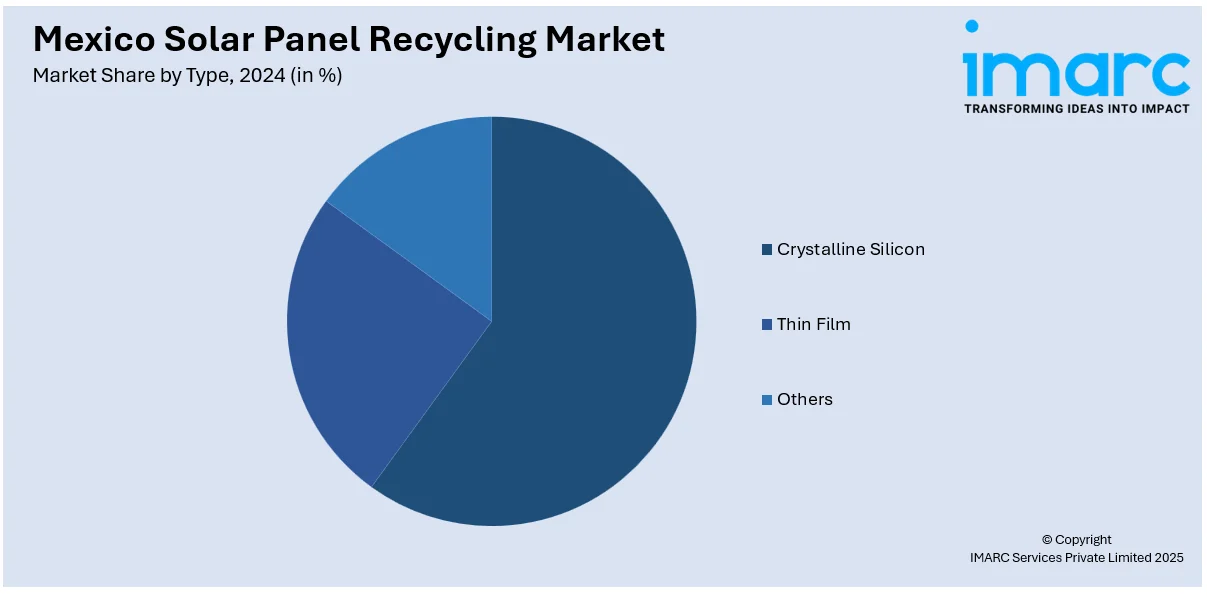

Type Insights:

- Crystalline Silicon

- Thin Film

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes crystalline silicon, thin film, and others.

Material Insights:

- Metal

- Glass

- Aluminum

- Silicon

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes metal, glass, aluminum, silicon, and others.

Shelf Life Insights:

- Normal Loss

- Early Loss

A detailed breakup and analysis of the market based on the shelf life have also been provided in the report. This includes normal loss and early loss.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Solar Panel Recycling Market News:

- March 07, 2025: Rafiqui and Jalisco launched the nation's first solar panel recycling plant, requiring MX$12-15 million (approximately USD 680,000 to USD 850,000) in investment to recover 85-90% of materials such as aluminum and glass from the state, which holds a leadership in solar installations (90,876 contracts, projected 658.04MW capacity in 2024). Located in Guadalajara, the plant will start operations this year, applying circular economy principles as the number of end-of-life panels increases, with the possibility for future lithium battery recycling.

Mexico Solar Panel Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Processes Covered | Thermal, Mechanical, Laser, Others |

| Types Covered | Crystalline Silicon, Thin Film, Others |

| Materials Covered | Metal, Glass, Aluminum, Silicon, Others |

| Shelf Lives Covered | Normal Loss, Early Loss |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico solar panel recycling market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico solar panel recycling market on the basis of process?

- What is the breakup of the Mexico solar panel recycling market on the basis of type?

- What is the breakup of the Mexico solar panel recycling market on the basis of material?

- What is the breakup of the Mexico solar panel recycling market on the basis of shelf life?

- What is the breakup of the Mexico solar panel recycling market on the basis of region?

- What are the various stages in the value chain of the Mexico solar panel recycling market?

- What are the key driving factors and challenges in the Mexico solar panel recycling market?

- What is the structure of the Mexico solar panel recycling market and who are the key players?

- What is the degree of competition in the Mexico solar panel recycling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico solar panel recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico solar panel recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico solar panel recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)