Mexico Solar Power Equipment Market Size, Share, Trends and Forecast by Equipment, Application, and Region, 2025-2033

Mexico Solar Power Equipment Market Overview:

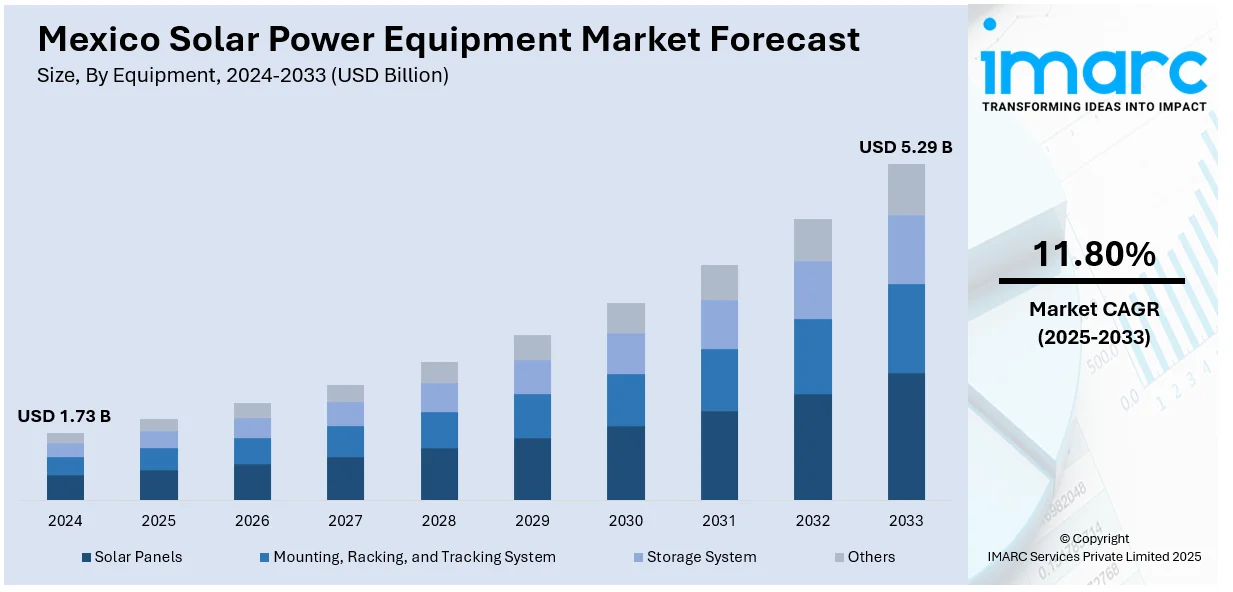

The Mexico solar power equipment market size reached USD 1.73 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.29 Billion by 2033, exhibiting a growth rate (CAGR) of 11.80% during 2025-2033. The market is driven by increasing government policies supporting renewable energy, technological innovation, and increasing demand for clean energy solutions. The country's ambitious energy transition goals, combined with favorable natural resources and foreign investment, provide lucrative opportunities for Mexico solar power equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.73 Billion |

| Market Forecast in 2033 | USD 5.29 Billion |

| Market Growth Rate 2025-2033 | 11.80% |

Mexico Solar Power Equipment Market Trends:

Government Support and Renewable Energy Policies

Mexico's government has made considerable efforts to encourage solar energy by way of positive policies, tax benefits, and regulatory measures. Mexico's Energy Reform, with its ambitious renewable energy goals, requires 35% of its energy to be generated from clean technologies by 2024. Moreover, the establishment of initiatives like the "Energy Transition Law" has further entrenched Mexico's resolve to develop solar power. For instance, in March 2025, Mexico introduced a mandate requiring future renewable energy projects, including solar and wind, to incorporate battery energy storage systems equal to 30% of their capacity. The batteries must be able to store energy for at least three hours of discharge. This policy aims to address the intermittency of renewable energy and enhance grid stability. It follows similar actions by other countries, with Mexico planning to add 574 MW of batteries by 2028, reinforcing its commitment to clean energy. Consequently, the market has seen a constant development of solar power projects, particularly large installations that support diversification of energy in the grid. The initiative by the government has attracted local and foreign capital investments, making possible the development of solar equipment markets.

Technological Advancements and Cost Reductions

The Mexico solar power equipment market growth has seen rapid acceleration due to advancements in solar technology, particularly the reduction in the costs of solar panels and related infrastructure. With the increasing efficiency and reducing cost of solar photovoltaic (PV) technology, solar equipment demand has grown substantially. Advances like bifacial solar panels, energy storage, and smart grid technologies are leading to higher system efficiency and reliability. Not only do these technologies optimize the energy generation, but they also decrease long-term operational expenses for solar installations. The trend will be sustained as Mexico embraces the new technologies, pushing the growth of the market as well as enhancing energy access, particularly in rural regions. For instance, in September 2024, Bernalillo County, New Mexico, approved up to $942 million in revenue bonds for Ebon Solar’s planned 834,000-square-foot solar cell manufacturing facility near Mesa del Sol. The project will create over 900 jobs and position New Mexico as a hub for advanced energy manufacturing. The facility will use advanced chip technology to produce solar cells, contributing to the U.S. domestic supply chain, while the state continues to attract leading renewable energy companies amidst global manufacturing competition.

Mexico Solar Power Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on equipment and application.

Equipment Insights:

- Solar Panels

- Mounting, Racking, and Tracking System

- Storage System

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment This includes solar panels, mounting, racking, and tracking system, storage system, and others.

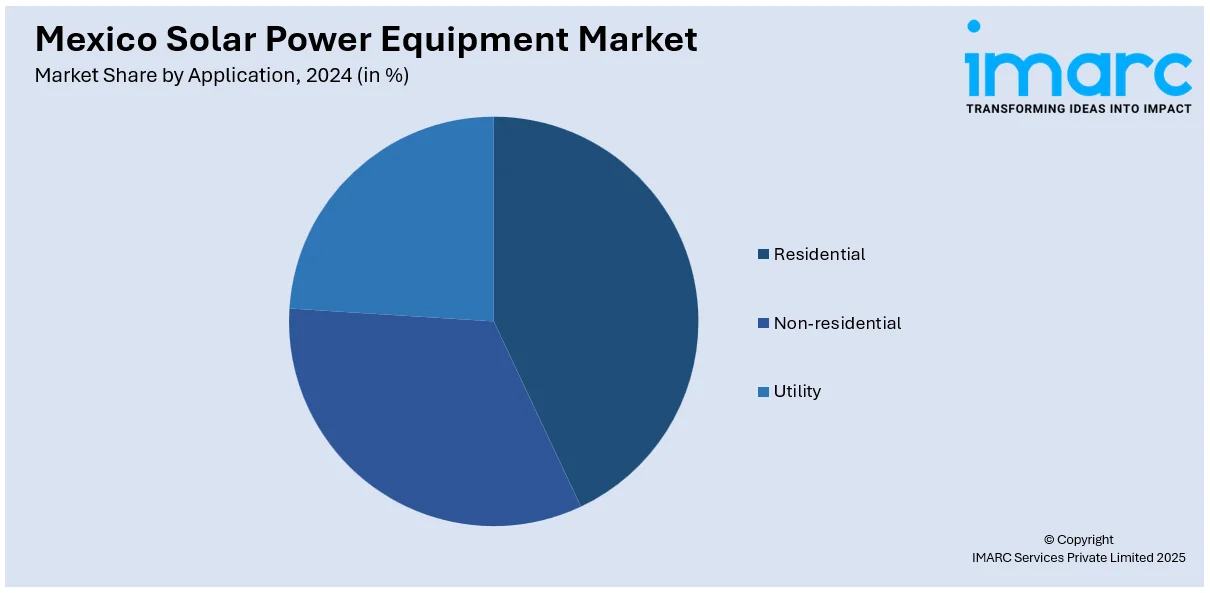

Application Insights:

- Residential

- Non-residential

- Utility

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, non-residential, and utility.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Solar Power Equipment Market News:

- In March 2025, JA Solar signed a 260 MW distribution agreement with Exel Solar to strengthen its position in Mexico’s solar market. The deal, announced at RE+ Mexico 2025, will see JA Solar supply its DeepBlue 4.0 Pro modules, known for their efficiency in high temperatures and low light conditions. This partnership supports Mexico’s clean energy transition by enhancing the availability of high-performance photovoltaic solutions across residential, commercial, and industrial applications, contributing to sustainable energy growth in the region.

- In March 2025, Odyssey Energy Solutions expanded into Mexico to support the country’s growing solar market by offering its finance platform. With rising energy costs, sustainability goals, and regulatory changes driving solar adoption, Odyssey’s supply chain credit will help businesses secure financing for solar projects. This initiative aims to streamline transactions for solar developers, EPCs, and suppliers, addressing capital deployment challenges and promoting sustainable energy solutions in Mexico.

- In January 2025, Revolve Renewable Power Corp. successfully completed the construction and commissioning of its 451-kilowatt Colima Solar Project in Mexico, which is now operational. The project is expected to generate over 650,000 kWh annually, offsetting around 325 tonnes of CO2 emissions. Revolve aims to expand its renewable energy portfolio, currently including 12.78 MW of solar, wind, and hydro projects across Canada and Mexico. The company also plans further growth in distributed generation projects, emphasizing recurring revenue through long-term power purchase agreements.

Mexico Solar Power Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipments Covered | Solar Panels, Mounting, Racking, And Tracking System, Storage System, Others |

| Applications Covered | Residential, Non-Residential, Utility |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico solar power equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico solar power equipment market on the basis of equipment?

- What is the breakup of the Mexico solar power equipment market on the basis of application?

- What is the breakup of the Mexico solar power equipment market on the basis of region?

- What are the various stages in the value chain of the Mexico solar power equipment market?

- What are the key driving factors and challenges in the Mexico solar power equipment market?

- What is the structure of the Mexico solar power equipment market and who are the key players?

- What is the degree of competition in the Mexico solar power equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico solar power equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico solar power equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico solar power equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)