Mexico Solar Street Lighting Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Mexico Solar Street Lighting Market Overview:

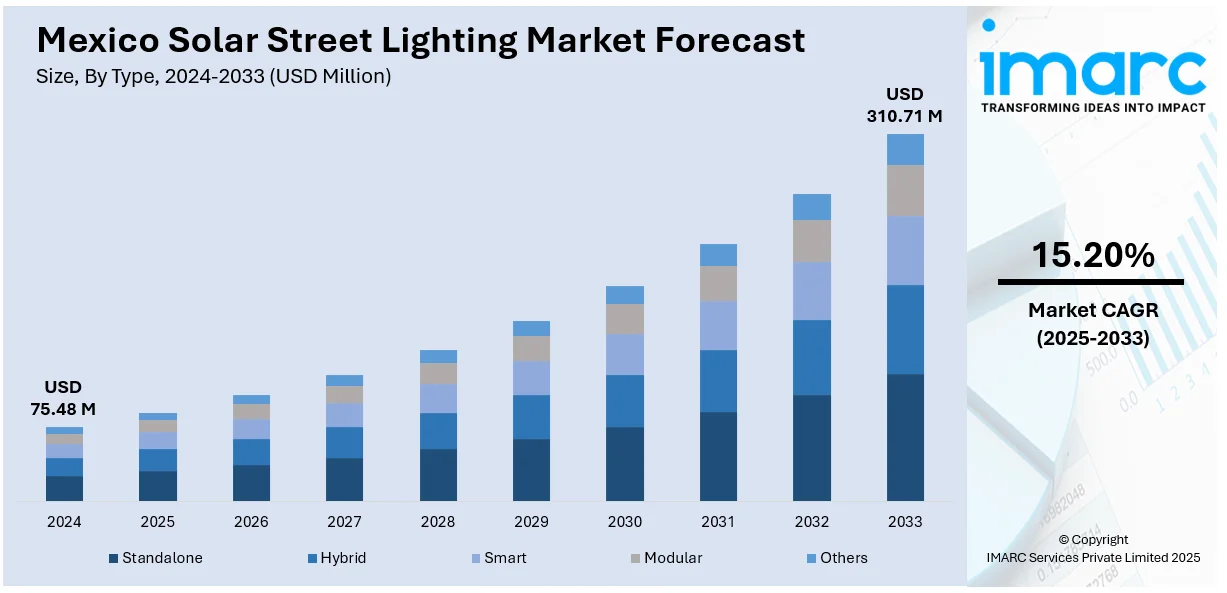

The Mexico solar street lighting market size reached USD 75.48 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 310.71 Million by 2033, exhibiting a growth rate (CAGR) of 15.20% during 2025-2033. The market in Mexico is driven with rising sustainability efforts, positive government policies, and growing demand for off-grid energy solutions. Technological innovations like smart and hybrid systems are enhancing efficiency and reliability, driving demand for solar lighting in residential, commercial, and industrial spaces. Urbanization and public infrastructure investments further fuel adoption. These trends are likely to have a positive impact on the Mexico solar street lighting market share during the forecast period.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 75.48 Million |

| Market Forecast in 2033 | USD 310.71 Million |

| Market Growth Rate 2025-2033 | 15.20% |

Mexico Solar Street Lighting Market Trends:

Incorporation of Smart Technology in Solar Street Lighting

Solar street lighting systems in Mexico are increasingly becoming smarter with technologies like motion sensors, remote monitoring, and adaptive control of lights. Such integration aids energy efficiency through optimized light output in terms of pedestrian and vehicle movement to ensure power usage only when needed. The use of IoT-based systems is also enabling predictive maintenance and operational efficiency, lowering long-term expenses for municipalities. For instance, in September 2024, Intersolar Mexico will exhibit solar energy solutions, such as solar street lighting, featuring technologies to enhance Mexico's infrastructure, energy efficiency, and sustainable urban development. Moreover, these intelligent features are part of Mexico's overall drive towards urban modernization and sustainable infrastructure. Moreover, government-sponsored digital transformation initiatives in urban management are offering a supportive framework for cities to implement smart lighting systems. The integration of intelligent technology not only enhances security and visibility within public spaces but also promotes environmental sustainability by lowering carbon emissions. Such innovations mark a forward-looking development in how public lighting infrastructure is controlled and serviced nationwide.

Government Support for Clean Energy Transition

Mexico has put forth different national and local regulations to minimize fossil fuel dependence and increase the utilization of renewable energy, where solar street lighting is a strategic priority. Initiatives supporting solar infrastructure in rural and underserved areas are actively playing a role in the installation of off-grid solar street lighting, which is critical for areas without access to reliable electricity. Financial incentives in terms of subsidies and tax reliefs have additionally helped the growth of sustainable light arrangements in both city and town areas. All this is the effect of long-term government determination of environmental viability coupled with infrastructure balance. Mexico solar street lighting market growth is thereby developing momentum both for environmentalism but also simply through formalized support policy coupled with renewable power requirement. This policy-induced momentum remains instrumental in revolutionizing street lighting infrastructure nationwide while saving public energy outlays.

Resilient and Off-Grid Lighting Demand

Increasing demand for climate-resilient infrastructure is driving demand for off-grid solar street lighting solutions in Mexico. These solutions are particularly useful in locations prone to grid instability due to natural phenomena like storms, earthquakes, or power shortages. Solar lights, being autonomous and independent of traditional grids of electricity, provide a secure source of light in case of emergencies and in remote areas. Utilization of tough battery storage and long-lasting materials provides long-term performance despite extreme weather conditions, and hence the systems are best suited for disaster hit areas. In addition, municipalities and local governments are seeing the cost savings and low maintenance of such systems, which is driving their use in rural development and infrastructure enhancement projects. This trend will continue as energy security and climate adaptation gain high importance in public infrastructure planning, further solidifying the place of solar street lighting in future-proof urban and rural development plans.

Mexico Solar Street Lighting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Standalone

- Hybrid

- Smart

- Modular

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes standalone, hybrid, smart, modular, and others.

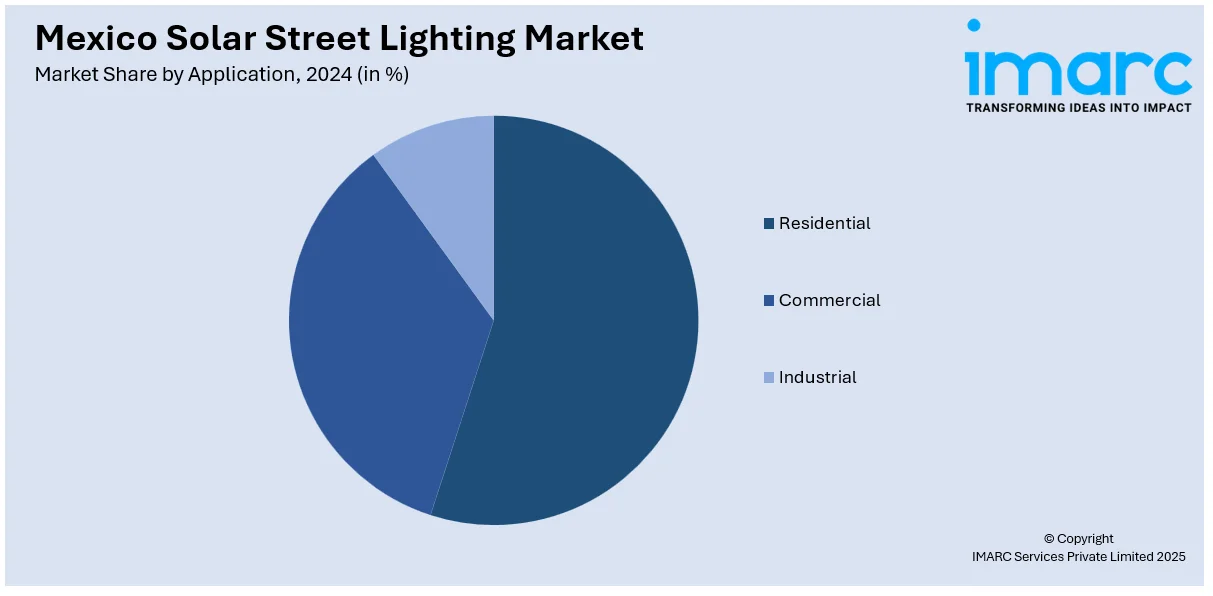

Application Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Solar Street Lighting Market News:

- In November 2024, Para Light Electronic released an all-in-one small solar LED streetlight that incorporates PV panels and battery within it, providing 15 hours of street lighting and pathway illumination. Increasing demand for urban efficient infrastructure prompts similar innovations that ride increasing interest in Mexico's solar street lighting sector towards sustainable and off-grid technologies.

- In September 2024, Lighting Science Group Corporation and BHP Energy Mexico will introduce the FreeLED™ solar roadway system in Mexico City. Installation of 500 units will offer energy-efficient LED lighting, enhance safety, lower costs, and enable sustainable infrastructure in areas of limited grid access.

Mexico Solar Street Lighting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Standalone, Hybrid, Smart, Modular, Others |

| Applications Covered | Residential, Commercial, Industrial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico solar street lighting market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico solar street lighting market on the basis of type?

- What is the breakup of the Mexico solar street lighting market on the basis of application?

- What is the breakup of the Mexico solar street lighting market on the basis of region?

- What are the various stages in the value chain of the Mexico solar street lighting market?

- What are the key driving factors and challenges in the Mexico solar street lighting?

- What is the structure of the Mexico solar street lighting market and who are the key players?

- What is the degree of competition in the Mexico solar street lighting market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico solar street lighting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico solar street lighting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico solar street lighting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)