Mexico Solar Thermal Systems Market Size, Share, Trends and Forecast by Technology, Application, End User, and Region, 2025-2033

Mexico Solar Thermal Systems Market Overview:

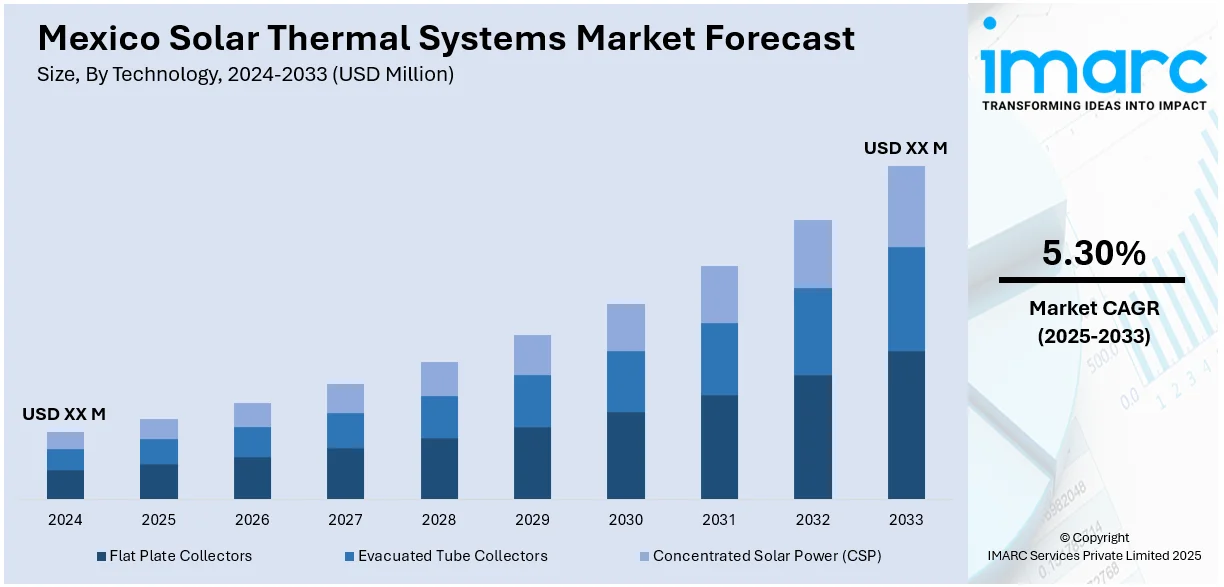

The Mexico solar thermal systems market size is projected to exhibit a growth rate (CAGR) of 5.30% during 2025-2033. Mexico’s high solar radiation, rising urban water heating needs, and increasing LPG and electricity costs are fueling solar thermal adoption. Government subsidies, integration in public housing, and industrial uses in food and textiles further support growth. National energy efficiency mandates, active NGO campaigns, and expanded financing access are driving installations. Additionally, domestic and international players offering affordable solutions and growing concerns over fossil fuel dependence and energy security continue to foster the Mexico solar thermal market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 5.30% |

Mexico Solar Thermal Systems Market Trends:

Abundant Solar Radiation Across Mexico

Mexico benefits from one of the highest solar irradiance levels in the world, with average daily solar radiation ranging between 5 and 6.5 kWh/m². This high exposure makes the country an ideal location for solar thermal energy deployment. Regions such as Sonora, Chihuahua, Baja California, and parts of central Mexico receive consistent and strong sunlight throughout the year, reducing the dependency on backup systems and improving system efficiency. This natural advantage lowers the payback period for solar thermal installations and enhances long-term operational performance. For households and businesses, it translates to predictable heating outputs, making solar thermal systems a reliable alternative to conventional gas or electric heaters. As solar collectors perform optimally under clear skies and stable sunlight, the country's geography significantly supports scalable implementation. This environmental factor continues to attract both domestic and international investment in solar thermal infrastructure across residential, commercial, and industrial sectors.

Growing Residential and Commercial Need for Water Heating

Water heating represents a substantial portion of energy consumption in Mexican households and commercial buildings, especially in urban areas. As living standards rise and population density increases in cities, the demand for consistent and cost-effective hot water solutions has become more pronounced, which is further stimulating the Mexico solar thermal systems market growth. In the commercial sector, particularly in hotels, hospitals, and restaurants, hot water usage is continuous and significant, prompting a shift toward more sustainable and lower-cost heating methods. Solar thermal systems offer a compelling solution, especially in multi-unit dwellings and service-oriented establishments where energy savings can be scaled. Additionally, the rising cost of conventional fuels, including liquefied petroleum gas (LPG) and electricity, has made solar water heating systems more attractive in terms of long-term cost efficiency. In line with this, the Mexican Energy Efficiency Commission (CONUEE) launched a nationwide initiative in July 2024 to promote solar thermal adoption in low-income urban neighborhoods by offering subsidies and technical training for local installers. With installation becoming more accessible through financing schemes and local suppliers, both homeowners and business owners are increasingly viewing solar thermal systems as practical, environmentally responsible investments that reduce operating costs over time.

High Energy Prices Encouraging Cost-Effective Alternatives

The volatility and long-term upward trend of energy prices in Mexico have become a major driver for solar thermal adoption. LPG and electricity tariffs, particularly in regions not covered by subsidized rates, have increased steadily, making conventional heating methods financially burdensome for many consumers. In this context, solar thermal systems present an appealing alternative due to their low operating costs after installation. Once deployed, these systems require minimal maintenance and operate using free solar energy, helping households and businesses shield themselves from fluctuating fuel prices. This is particularly relevant in low- to middle-income neighborhoods where utility expenses form a considerable part of monthly household budgets. For commercial users, the operational cost savings can significantly impact profitability, especially in energy-intensive sectors like hospitality and healthcare. As financial awareness about energy expenses grows, solar thermal technologies are increasingly being adopted not just for sustainability goals but as a cost-management strategy across market segments.

Mexico Solar Thermal Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, application, and end user.

Technology Insights:

- Flat Plate Collectors

- Evacuated Tube Collectors

- Concentrated Solar Power (CSP)

- Parabolic Trough

- Solar Tower

- Fresnel Reflectors

- Dish Stirling

The report has provided a detailed breakup and analysis of the market based on the technology. This includes flat plate collectors, evacuated tube collectors, and concentrated solar power (CSP) (parabolic trough, solar tower, Fresnel reflectors, and dish Stirling).

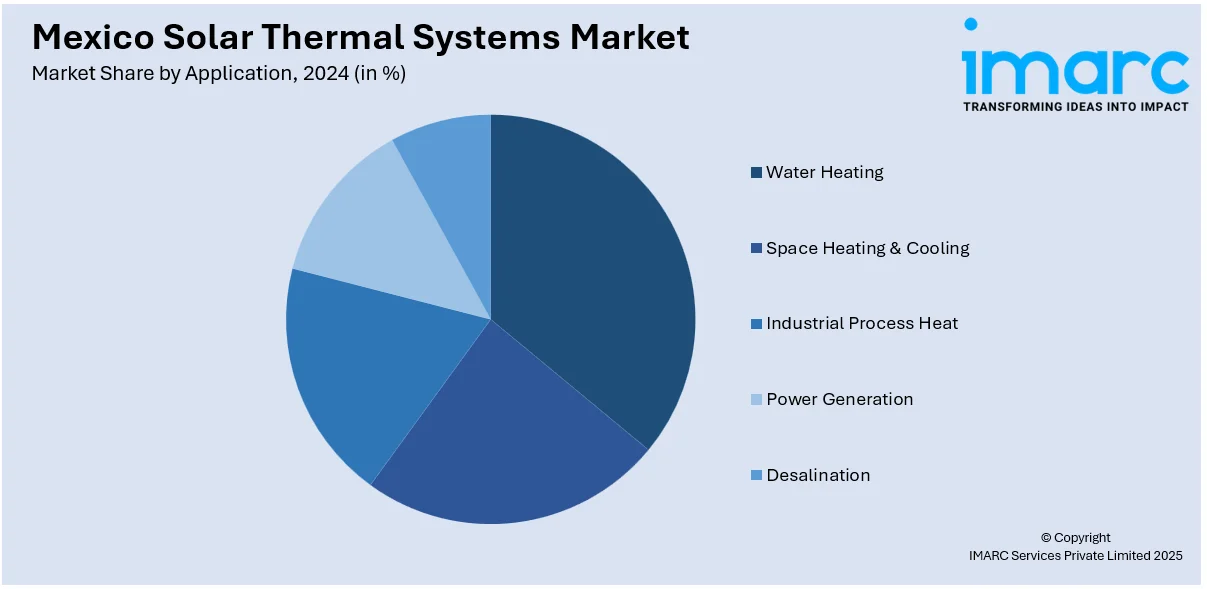

Application Insights:

- Water Heating

- Space Heating & Cooling

- Industrial Process Heat

- Power Generation

- Desalination

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes water heating, space heating & cooling, industrial process heat, power generation, and desalination.

End User Insights:

- Residential

- Commercial

- Industrial

- Agricultural

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, industrial, and agricultural.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Solar Thermal Systems Market News:

- In 2025, Inventive Power completed a zero-CAPEX solar heat installation for Famo Alimentos, featuring a 720 m² parabolic trough collector field. The system operates under a 15-year steam purchase agreement, offering a fixed price 10% lower than previous LPG costs.

Mexico Solar Thermal Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered |

|

| Applications Covered | Water Heating, Space Heating & Cooling, Industrial Process Heat, Power Generation, Desalination |

| End Users Covered | Residential, Commercial, Industrial, Agricultural |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico solar thermal systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico solar thermal systems market on the basis of technology?

- What is the breakup of the Mexico solar thermal systems market on the basis of application?

- What is the breakup of the Mexico solar thermal systems market on the basis of end user?

- What is the breakup of the Mexico solar thermal systems market on the basis of region?

- What are the various stages in the value chain of the Mexico solar thermal systems market?

- What are the key driving factors and challenges in the Mexico solar thermal systems market?

- What is the structure of the Mexico solar thermal systems market and who are the key players?

- What is the degree of competition in the Mexico solar thermal systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico solar thermal systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico solar thermal systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico solar thermal systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)