Mexico Soup Market Size, Share, Trends and Forecast by Type, Category, Packaging, Distribution Channel, and Region, 2025-2033

Mexico Soup Market Overview:

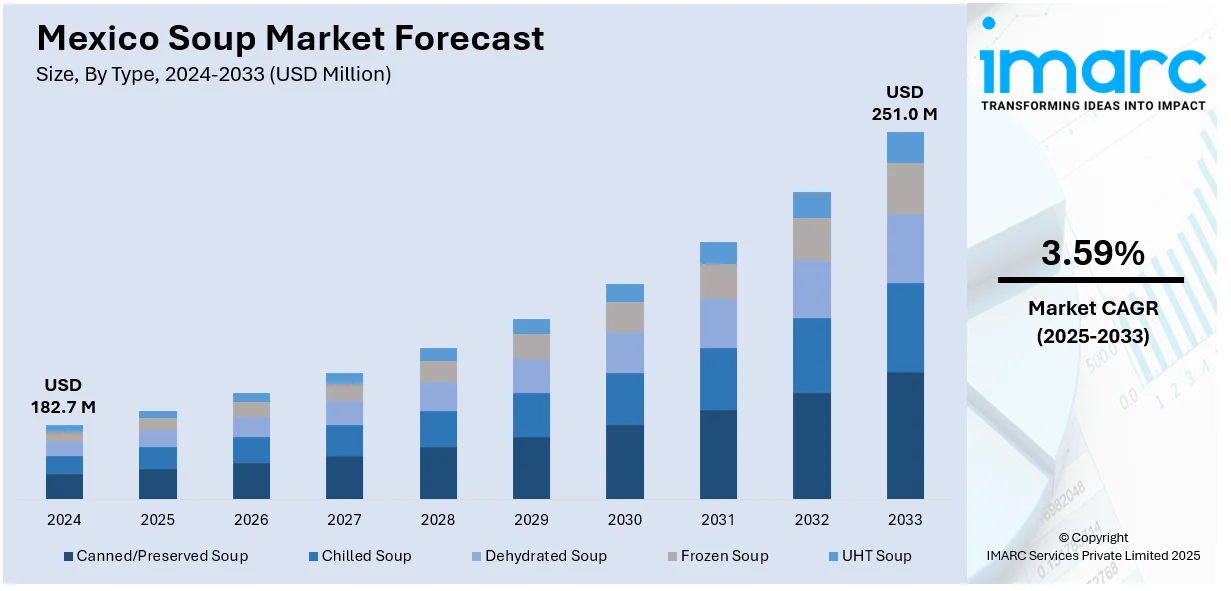

The Mexico soup market size reached USD 182.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 251.0 Million by 2033, exhibiting a growth rate (CAGR) of 3.59% during 2025-2033. The market is driven by rising urbanization, increasing disposable income, growing demand for convenient meals, expanding retail channels, widespread adoption of health-conscious consumer trends, continuous innovations in traditional flavors, and surging ready-to-eat (RTE) product offerings.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 182.7 Million |

| Market Forecast in 2033 | USD 251.0 Million |

| Market Growth Rate 2025-2033 | 3.59% |

Mexico Soup Market Trends:

Rising Demand for Healthier and Plant-Based Soup Options

The rising demand for healthier and plant-based soup options is boosting the Mexico soup market share, as consumers are developing an interest toward soups made with healthy plant-based components. In addition, the market demands soups based on natural organic ingredients without artificial preservatives or additives because people recognize the connection between diet and chronic diseases. Moreover, the Mexican market demonstrates growing interest in plant-based soups because consumers are prioritizing wellness and vegetarian and vegan dietary requirements. For example, SOMOS Foods offers a range of Mexican dishes made with authentic recipes and plant-based, non-genetically modified organisms (GMOs) ingredients. Their offerings include a Chicken Enchilada Soup, providing a plant-based twist on traditional Mexican flavors. Additionally, the manufacturing industry reacts through recipe innovation, which combines nutritious vegetables with legumes along with whole grains to deliver both taste experience and health advantages. As a result. the food industry is experiencing a general transformation towards nutritious, sustainable eating patterns throughout the region, which is driving the Mexico soup market growth.

Embracing Traditional Flavors with Modern Convenience

A growing number of Mexican consumers seek traditional soup flavors that combine traditional tastes along with contemporary convenience features. In line with this, the traditional Mexican soups, such as pozole and menudo, are culturally important, and so companies are developing pre-packaged and convenient versions of these traditional dishes. For instance, in 2023, Juanita's Foods, recognized as the nation's largest manufacturer of canned menudo, broadened its product line to include hominy, sauces, stews, and other high-quality Mexican foods, enhancing the convenience of traditional dishes. Concurrently, the combination of quick urban living with a preference for legitimate food tastes drives this consumer pattern further. Besides this, the demand for traditional Mexican flavors through convenient packaged soup products enables food companies to target this market segment effectively. Furthermore, traditional soup preservation through these approaches maintains cultural food heritage while satisfying modern consumer needs for convenience by making these dishes more accessible to a wide range of people, thereby enhancing the Mexico soup market outlook.

Mexico Soup Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, category, packaging, and distribution channel.

Type Insights:

- Canned/Preserved Soup

- Chilled Soup

- Dehydrated Soup

- Frozen Soup

- UHT Soup

The report has provided a detailed breakup and analysis of the market based on the type. This includes canned/preserved soup, chilled soup, dehydrated soup, frozen soup, and UHT soup.

Category Insights:

- Vegetarian Soup

- Non-Vegetarian Soup

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes vegetarian soup and non-vegetarian soup.

Packaging Insights:

- Canned

- Pouched

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging. This includes canned, pouches, and others.

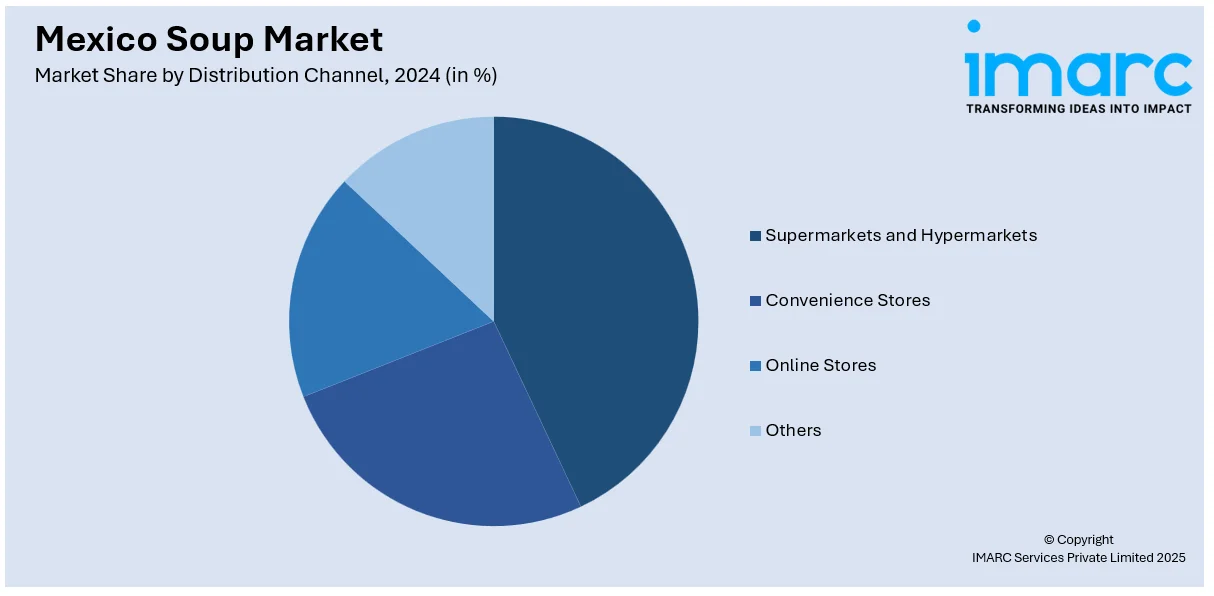

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis, such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Soup Market News:

- In November 2024, Lakeview Farms acquired the Noosa Yoghurt brand from Campbell Soup Company. While this acquisition primarily impacts the dairy sector, it indicates Campbell's strategic focus on its core product lines, including soups, which may lead to increased investments and innovations in the Mexican soup market.

- In September 2024, Campbell Soup Company announced its intention to change its name to The Campbell’s Company, reflecting its diversified portfolio beyond soups. This rebranding aligns with the company's strategy to broaden its market appeal and product offerings, potentially influencing its operations in Mexico.

Mexico Soup Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Canned/Preserved Soup, Chilled Soup, Dehydrated Soup, Frozen Soup, UHT Soup |

| Categories Covered | Vegetarian Soup, Non-Vegetarian Soup |

| Packagings Covered | Canned, Pouches, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico soup market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico soup market on the basis of type?

- What is the breakup of the Mexico soup market on the basis of category?

- What is the breakup of the Mexico soup market on the basis of packaging?

- What is the breakup of the Mexico soup market on the basis of distribution channel?

- What is the breakup of the Mexico soup market on the basis of region?

- What are the various stages in the value chain of the Mexico soup market?

- What are the key driving factors and challenges in the Mexico soup?

- What is the structure of the Mexico soup market and who are the key players?

- What is the degree of competition in the Mexico soup market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico soup market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico soup market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico soup industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)