Mexico Spectrometry Market Size, Share, Trends and Forecast by Type, Product, Application, End User, and Region, 2025-2033

Mexico Spectrometry Market Overview:

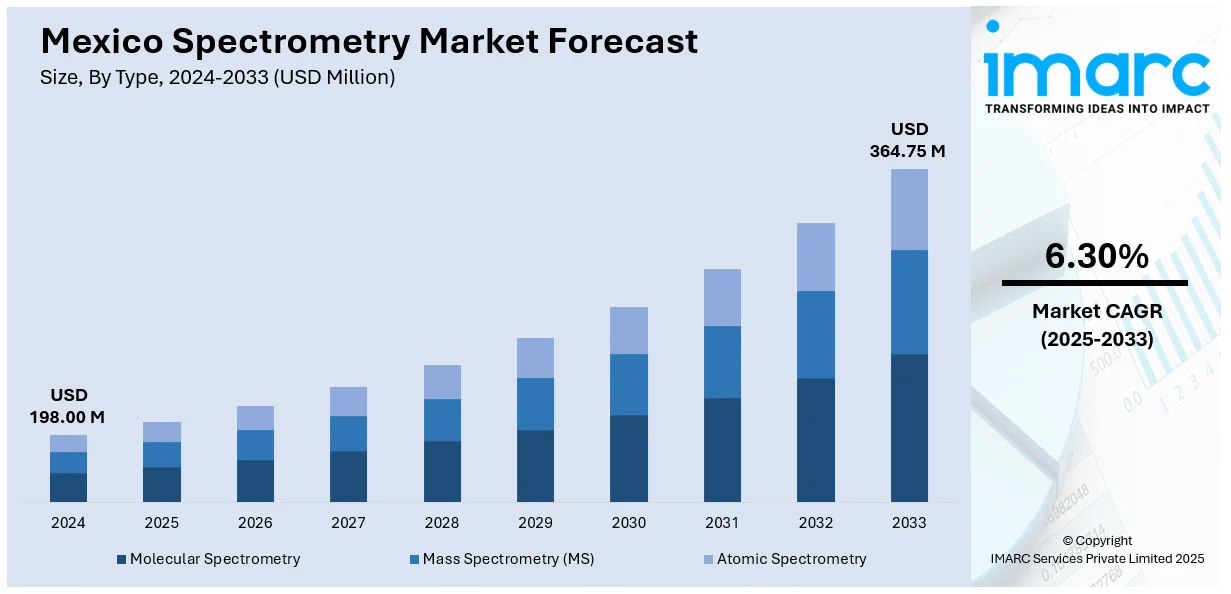

The Mexico spectrometry market size reached USD 198.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 364.75 Million by 2033, exhibiting a growth rate (CAGR) of 6.30% during 2025-2033. Tighter environmental regulations, increased industrial complexity, and growing emphasis on pollutant detection are driving analytical adoption. Rising pharmaceutical research activity, expanded clinical trials, and public-private investments are enhancing instrumentation demand. Strategic biotech partnerships, improved data accuracy requirements, and high-throughput research integration are some of the factors positively impacting the Mexico spectrometry market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 198.00 Million |

| Market Forecast in 2033 | USD 364.75 Million |

| Market Growth Rate 2025-2033 | 6.30% |

Mexico Spectrometry Market Trends:

Increasing Industrial and Environmental Applications

The demand for advanced analytical tools in Mexico has risen in response to stricter environmental regulations and increasing industrial complexity. Regulatory bodies have intensified monitoring requirements across sectors such as mining, petrochemicals, and wastewater treatment. This heightened scrutiny necessitates precise, real-time analytical technologies, with mass spectrometry and related techniques offering unmatched sensitivity and reliability. Industrial facilities, particularly in northern Mexico, are integrating these systems into quality control and emissions tracking processes, ensuring compliance with national and international standards. On November 2023, Balluff announced the opening of a new production facility in Aguascalientes, Mexico, with an investment of EUR 50 Million (USD 53 Million). This 7000-sq-m facility will enhance the company's capabilities in sensor and network technology, which are integral to spectrometry applications. The expansion is expected to improve the availability of advanced analytical instruments, positively impacting the Mexico spectrometry market share. Furthermore, the country’s growing emphasis on sustainable practices and trace-level pollutant detection has elevated the need for analytical precision. Concurrently, large-scale infrastructure and energy projects require advanced materials analysis to meet safety benchmarks, where spectrometry methods remain indispensable. These developments have directly contributed to Mexico spectrometry market growth, as companies prioritize robust, regulation-compliant solutions to optimize productivity and operational transparency.

Expanding Pharmaceutical and Clinical Research Sector

Mexico’s life sciences sector has witnessed a significant transformation in recent years, driven by increased clinical trial activity and pharmaceutical manufacturing. The country’s strategic position as a nearshore destination for U.S. biotech companies, combined with its competitive labor costs and growing medical infrastructure, has positioned it as a central hub for drug discovery and validation. Analytical technologies are at the core of this expansion, with mass spectrometry systems playing a critical role in pharmacokinetics, toxicology, proteomics, and biomarker research. As regulatory expectations surrounding drug efficacy and patient safety become more rigorous, demand has risen for analytical platforms capable of high-throughput, high-resolution performance. Universities and contract research organizations are increasingly adopting such technologies to improve data quality and accelerate development timelines. Public-private partnerships have also contributed to technology adoption, enhancing local capabilities in metabolomics and targeted compound analysis.

Growing Demand for Forensic and Security Applications

Mexico has seen an increased need for analytical tools in forensic science and security applications, particularly in drug enforcement and criminal investigations. Mass spectrometry, with its ability to detect trace amounts of substances with high sensitivity, is integral to forensic labs analyzing illegal drugs, explosives, and other illicit materials. This trend has been driven by heightened efforts to combat drug trafficking and organized crime. Law enforcement agencies are increasingly adopting mass spectrometry techniques to enhance the accuracy of evidence analysis, improve the speed of criminal investigations, and ensure compliance with international security standards. The growing integration of advanced spectrometry systems in forensic departments is expected to contribute to the expansion of the Mexico spectrometry market share, as they help bolster national security and support criminal justice processes.

Mexico Spectrometry Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, application, and end user.

Type Insights:

- Molecular Spectrometry

- Visible and Ultraviolet Spectroscopy

- Infrared Spectroscopy

- Nuclear Magnetic Resonance (NMR) Spectroscopy

- Others

- Mass Spectrometry (MS)

- MALDI-TOF

- Triple Quadrupole

- Quadrupole-Trap

- Hybrid Linear Ion Trap Orbitrap

- Quadrupole-Orbitrap

- Atomic Spectrometry

- Atomic Absorption Spectroscopy (AAS)

- Atomic Emission Spectroscopy (AES)

- Atomic Fluorescence Spectroscopy (AFS)

- X-ray Fluorescence (XRF)

- Inorganic Mass Spectroscopy

The report has provided a detailed breakup and analysis of the market based on the type. This includes molecular spectrometry (visible and ultraviolet spectroscopy, infrared spectroscopy, nuclear magnetic resonance (NMR) spectroscopy, and others), mass spectrometry (MS) (MALDI-TOF, triple quadrupole, quadrupole-trap, hybrid linear ion trap orbitrap, and quadrupole-orbitrap), and atomic spectrometry (atomic absorption spectroscopy (AAS), atomic emission spectroscopy (AES), atomic fluorescence spectroscopy (AFS), X-ray fluorescence (XRF), and inorganic mass spectroscopy).

Product Insights:

- Instrument

- Consumables

- Services

The report has provided a detailed breakup and analysis of the market based on the product. This includes instrument, consumables, and services.

Application Insights:

- Proteomics

- Metabolomics

- Pharmaceutical Analysis

- Forensic Analysis

- Others

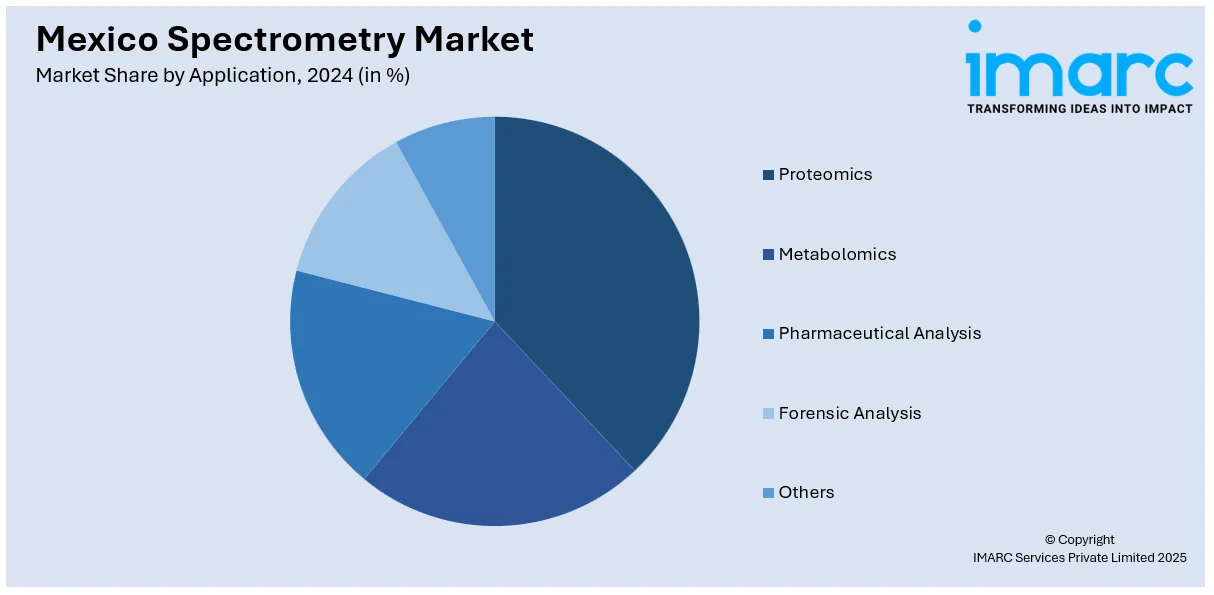

The report has provided a detailed breakup and analysis of the market based on the application. This includes proteomics, metabolomics, pharmaceutical analysis, forensic analysis, and others.

End User Insights:

- Government and Academic Institutions

- Pharmaceutical and Biotechnology Companies

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes government and academic institutions, pharmaceutical and biotechnology companies, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Spectrometry Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Products Covered | Instrument, Consumables, Services |

| Applications Covered | Proteomics, Metabolomics, Pharmaceutical Analysis, Forensic Analysis, Others |

| End Users Covered | Government and Academic Institutions, Pharmaceutical and Biotechnology Companies, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico spectrometry market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico spectrometry market on the basis of type?

- What is the breakup of the Mexico spectrometry market on the basis of product?

- What is the breakup of the Mexico spectrometry market on the basis of application?

- What is the breakup of the Mexico spectrometry market on the basis of end user?

- What is the breakup of the Mexico spectrometry market on the basis of region?

- What are the various stages in the value chain of the Mexico spectrometry market?

- What are the key driving factors and challenges in the Mexico spectrometry?

- What is the structure of the Mexico spectrometry market and who are the key players?

- What is the degree of competition in the Mexico spectrometry market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico spectrometry market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico spectrometry market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico spectrometry industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)