Mexico Spreads Market Size, Share, Trends and Forecast by Product Type, Nature, Distribution Channel, End Use, and Region, 2025-2033

Mexico Spreads Market Overview:

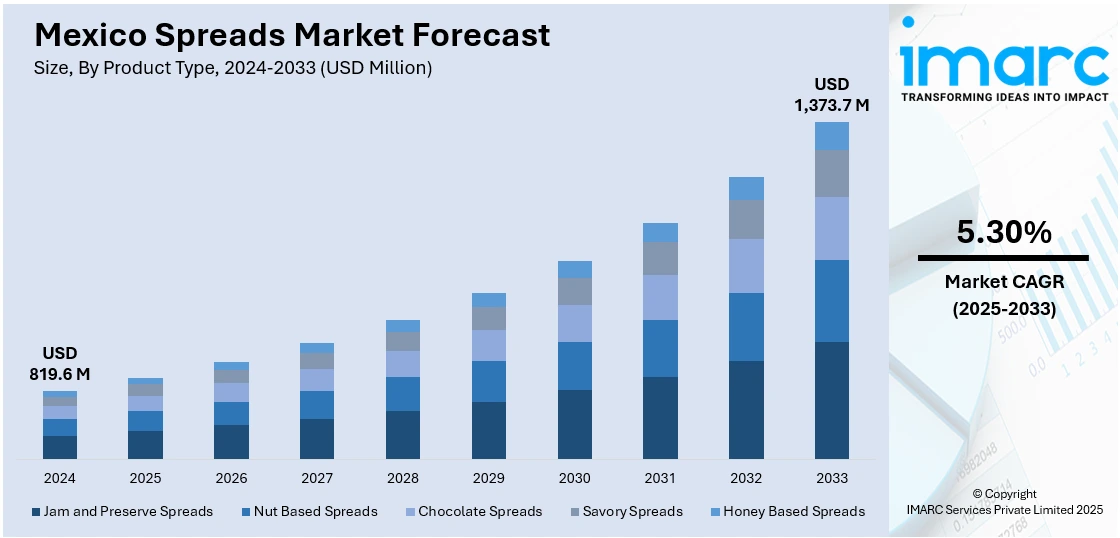

The Mexico spreads market size reached USD 819.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,373.7 Million by 2033, exhibiting a growth rate (CAGR) of 5.30% during 2025-2033. The market is fueled by the increasing demand for natural and organic ingredients, and growing interest in traditional and global flavors. Increased snacking habits also boosts demand for versatile, flavorful spreads, while innovation in product variety and packaging further fuels market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 819.6 Million |

| Market Forecast in 2033 | USD 1,373.7 Million |

| Market Growth Rate 2025-2033 | 5.30% |

Mexico Spreads Market Trends:

Rising Demand for Natural and Organic Spreads

The gradual shift toward healthy food choices, is one of the factors driving the Mexico spreads market growth. Statistics indicate that 75% of adults in Mexico are either overweight or obese, while 49% suffer from hypertension. Moreover, chronic malnutrition impacts 1 in 3 children of preschool age and 1 in 4 children of primary school age, resulting in developmental and cognitive setbacks. Hence, consumers today are increasingly demanding products that support their well-being objectives, which in turn drives the demand for natural and organic spreads. This is part of a wider global shift toward clean labels and a desire for spreads produced from natural sources like fruits, nuts, and other sweeteners such as stevia and agave. Manufacturers are meeting this by reformulating products with lower added sugars and artificial ingredients, seeking to satisfy the consumer demand for healthier products. This change is influenced by health-consciousness while it also reflects a desire for transparency in food labeling, which is leading several brands to use simpler ingredients that are sourced sustainably. Consequently, the Mexican spreads market is experiencing a shift toward healthier and ethically produced products.

Product Offering Innovation

Constant innovation is a significant factor driving the Mexico spreads market share, with companies regularly launching new flavors and packaging to meet the varying tastes of consumers. The use of local ingredients and flavors in spreads is becoming increasingly popular, which is an indication of Mexico's diverse culinary culture. For example, chili, cacao, or tropical fruit-infused spreads are gaining traction, providing consumers with distinctive and locally inspired choices. There is also growing demand for functional spreads that offer enhanced health benefits, such as vitamin, mineral, or probiotic-fortified spreads. This trend also influences packaging, where brands are looking at sustainable materials and convenient formats to improve user experience and appeal to environmentally aware consumers. With these innovations, Mexico's spreads market is becoming more diversified, and providing consumers with more options that cater to their changing tastes.

E-Commerce and Digital Engagement

E-commerce growth is having a huge influence on the Mexico spreads market outlook, providing brands with new channels to engage with consumers and respond to shifting shopping habits. Online channels offer ease and convenience, enabling consumers to browse through a greater range of spreads than can be physically offered at local outlets. According to the Mexican Association of Online Sales (AMVO), Mexico’s e-commerce industry grew by 24.6% in 2023, exceeding $44 billion in revenue. There is hence a corresponding digital interaction with higher digital interest, where brands use social media and digital marketing efforts to tap into a digitally connected audience. Influencer partnerships and sponsored ad campaigns are now standard techniques used to drive brand awareness and consumer confidence. In addition, the presence of product descriptions and online customer reviews gives consumers the confidence to make informed purchases. As the growth of e-commerce gains further momentum, it will play a more critical role in determining the expansion of the Mexican spreads market, from product range to marketing channels.

Mexico Spreads Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, nature, distribution channel, and end use.

Product Type Insights:

- Jam and Preserve Spreads

- Nut Based Spreads

- Peanut Butter

- Almond Spreads

- Cashew Spreads

- Walnut Spreads

- Macadamia Spreads

- Chocolate Spreads

- Savory Spreads

- Honey Based Spreads

The report has provided a detailed breakup and analysis of the market based on the product type. This includes jam and preserve spreads, nut based spreads (peanut butter, almond spreads, cashew spreads, walnut spreads, and macadamia spreads), chocolate spreads, savory spreads, and honey based spreads.

Nature Insights:

- Organic

- Conventional

The report has provided a detailed breakup and analysis of the market based on the nature. This includes organic and conventional.

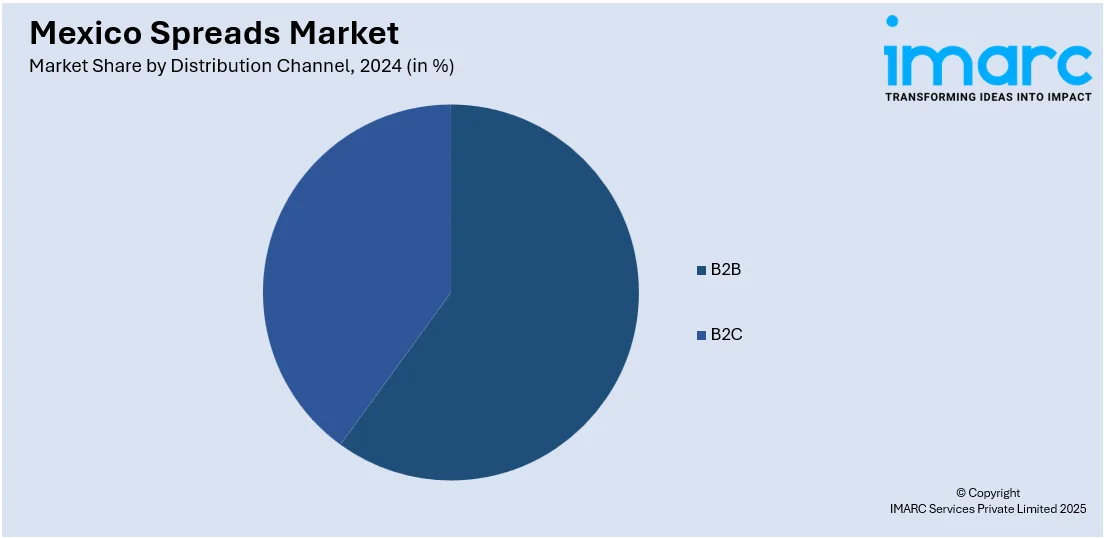

Distribution Channel Insights:

- B2B

- B2C

- Store-Based Retailing

- Online Retailing

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes B2B and B2C (store-based retailing and online retailing).

End Use Insights:

- Household/Retail

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end use. This includes household/retail and commercial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Spreads Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Natures Covered | Organic, Conventional |

| Distribution Channels Covered |

|

| End Uses Covered | Household/Retail, Commercial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexic, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico spreads market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico spreads market on the basis of product type?

- What is the breakup of the Mexico spreads market on the basis of nature?

- What is the breakup of the Mexico spreads market on the basis of distribution channel?

- What is the breakup of the Mexico spreads market on the basis of end use?

- What is the breakup of the Mexico spreads market on the basis of region?

- What are the various stages in the value chain of the Mexico spreads market?

- What are the key driving factors and challenges in the Mexico spreads market?

- What is the structure of the Mexico spreads market and who are the key players?

- What is the degree of competition in the Mexico spreads market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico spreads market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico spreads market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico spreads industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)