Mexico Statin Market Size, Share, Trends and Forecast by Type, Therapeutic Area, Drug Class, Application, Distribution, and Region, 2025-2033

Mexico Statin Market Overview:

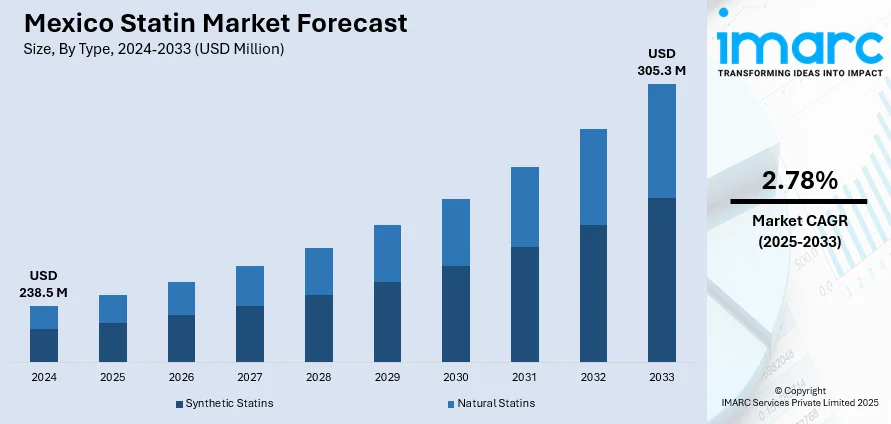

The Mexico statin market size reached USD 238.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 305.3 Million by 2033, exhibiting a growth rate (CAGR) of 2.78% during 2025-2033. The market is primarily driven by rising prevalence of cardiovascular risk factors, increasing incidence of dyslipidemia, early intervention through clinical guidelines, government-subsidized healthcare programs, inclusion of statins in essential medicine lists, and institutional support for preventive care and chronic disease management.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 238.5 Million |

| Market Forecast in 2033 | USD 305.3 Million |

| Market Growth Rate 2025-2033 | 2.78% |

Mexico Statin Market Trends:

Rising Prevalence of Cardiovascular Risk Factors and Dyslipidemia

Mexico faces an increasing burden of cardiovascular risk factors, particularly high cholesterol, obesity, diabetes, and hypertension. These conditions, common in both urban and semi-urban populations, have heightened the need for pharmacological interventions targeting lipid levels. Statins are widely prescribed due to their proven efficacy in reducing LDL cholesterol and preventing cardiac events. Physicians are adopting earlier intervention strategies, driven by national health campaigns and clinical guidelines emphasizing preventive care. Electronic medical records and risk assessment tools are also aiding in timely diagnosis and prescription. As a result, statins are becoming central to long-term cardiovascular disease management across public and private health systems. This trend supports the broader expansion of the Mexico statin market share. In Mexico, statins are the primary treatment for lowering LDL-C, but many high-risk patients fail to achieve target levels. A study in Mexico City reported that 63% of patients were not on any lipid-lowering therapy, and only 12.4% were receiving high-intensity statins. Affordability further supports access. Generic statins are available at lower prices, and fixed-dose combinations offer convenient options for patients managing multiple conditions. Pharmaceutical distribution has expanded beyond major cities, increasing availability in remote regions. Government-subsidized healthcare programs, such as IMSS and Seguro Popular, provide coverage for statin therapy under essential medicine lists. These developments enable consistent access and adherence, supporting therapy continuity. With a growing patient base and institutional focus on chronic disease control, treatment rates continue to increase, contributing to the overall Mexico statin market growth across diverse therapeutic settings.

Government Programs and Strengthening of Public Health Infrastructure

Public healthcare policies and institutional frameworks play a critical role in expanding access to statin therapy in Mexico. The government has introduced screening initiatives for cholesterol management through the Secretaría de Salud and national insurance bodies, which focus on early detection of cardiovascular risk in underserved populations. Statins are incorporated into these preventive care models and are prescribed as first-line agents per national therapeutic protocols. Hospitals and primary care clinics follow structured guidelines, ensuring widespread prescription and consistent therapeutic outcomes. Atorvastatin is the most prescribed statin (71%), with simvastatin at 17%. Adherence after 12 months is just 56.6%, reflecting cost barriers, inconsistent guidelines, and low physician awareness. Procurement of statins through government contracts ensures low-cost availability, enabling inventory stability and reliable supply chains throughout the public health system. Further, electronic health systems and standardized care protocols contribute to better patient monitoring, adherence tracking, and long-term treatment planning. Insurance schemes such as ISSSTE and community health programs increase accessibility for economically vulnerable groups. These systems reinforce preventive care and ensure continued use of prescribed statins. Pharmacists and primary care providers maintain steady demand by integrating statin therapy into chronic disease programs. Combined, these healthcare strategies form a foundation for the stable expansion of the Mexico statin market outlook, supported by institutional commitment, public health investment, and efficient medicine distribution networks.

Mexico Statin Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, therapeutic area, drug class, application, and distribution.

Type Insights:

- Synthetic Statins

- Natural Statins

The report has provided a detailed breakup and analysis of the market based on the type. This includes synthetic statins and natural statins.

Therapeutic Area Insights:

- Cardiovascular Disorders

- Obesity

- Inflammatory Disorders

- Others

The report has provided a detailed breakup and analysis of the market based on the therapeutic area. This includes cardiovascular disorders, obesity, inflammatory disorders, and others.

Drug Class Insights:

- Atorvastatin

- Fluvastatin

- Lovastatin

- Pravastatin

- Simvastatin

- Others

The report has provided a detailed breakup and analysis of the market based on the drug class. This includes atorvastatin, fluvastatin, lovastatin, pravastatin, simvastatin, and others.

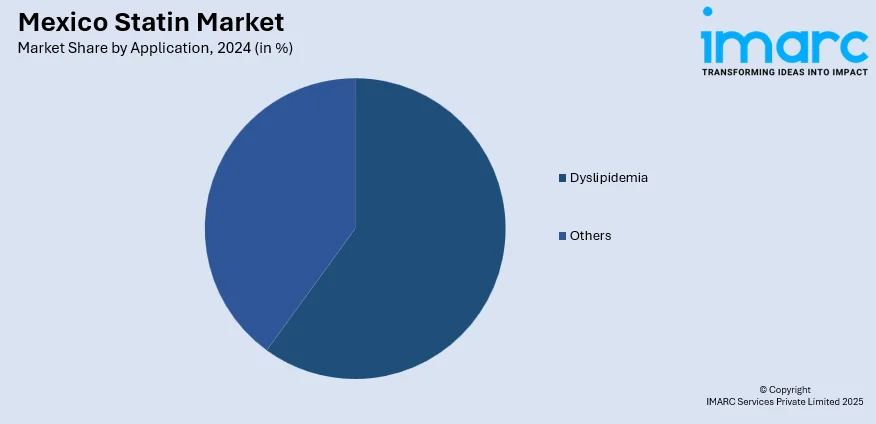

Application Insights:

- Dyslipidemia

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes dyslipidemia and others.

Distribution Insights:

- Hospitals

- Clinics

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution. This includes hospitals, clinics, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has provided a detailed breakup and analysis of the market based on the region. This includes Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Statin Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Synthetic Statins, Natural Statins |

| Therapeutic Areas Covered | Cardiovascular Disorders, Obesity, Inflammatory Disorders, Others |

| Drug Classes Covered | Atorvastatin, Fluvastatin, Lovastatin, Pravastatin, Simvastatin, Others |

| Applications Covered | Dyslipidemia, Others |

| Distributions Covered | Hospitals, Clinics, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico statin market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico statin market on the basis of type?

- What is the breakup of the Mexico statin market on the basis of therapeutic area?

- What is the breakup of the Mexico statin market on the basis of drug class?

- What is the breakup of the Mexico statin market on the basis of application?

- What is the breakup of the Mexico statin market on the basis of distribution?

- What is the breakup of the Mexico statin market on the basis of region?

- What are the various stages in the value chain of the Mexico statin market?

- What are the key driving factors and challenges in the Mexico statin market?

- What is the structure of the Mexico statin market and who are the key players?

- What is the degree of competition in the Mexico statin market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico statin market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico statin market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico statin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)