Mexico Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2026-2034

Mexico Steel Tubes Market Summary:

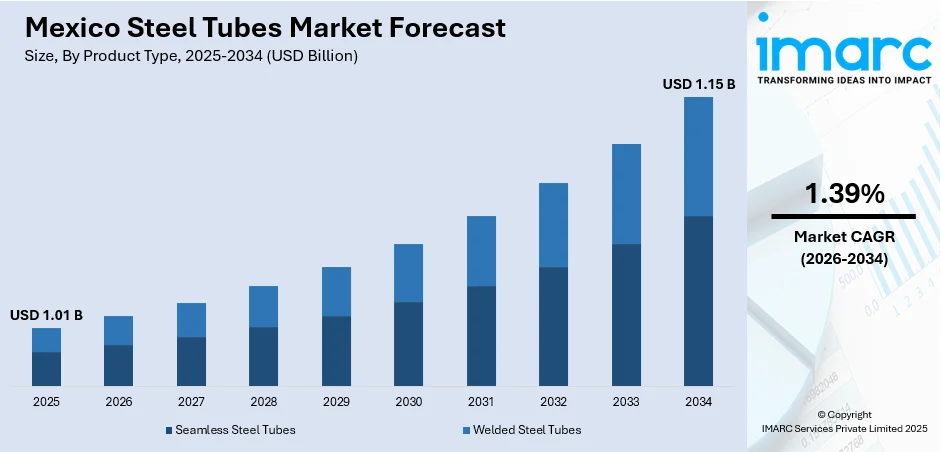

The Mexico steel tubes market size was valued at USD 1.01 Billion in 2025 and is projected to reach USD 1.15 Billion by 2034, growing at a compound annual growth rate of 1.39% from 2026-2034.

The Mexico steel tubes market is experiencing progressive expansion, driven by rising infrastructure development, sustained demand from automotive fabrication, and growing activity in the energy and construction sectors. The government's emphasis on large-scale projects, including railway expansions and urban development initiatives, has amplified the need for structural steel components. Additionally, advancements in manufacturing processes, including seamless and welded production methods, are enhancing efficiency and product quality across the supply chain, shaping the Mexico steel tubes market share.

Key Takeaways and Insights:

-

By Product Type: Welded steel tubes dominate the market with a share of 70.53% in 2025, owing to their cost-effectiveness, versatility in fabrication, and widespread applicability across construction, infrastructure, and industrial manufacturing sectors.

-

By Material Type: Carbon steel represents the largest segment with a market share of 39.32% in 2025, attributed to its excellent mechanical properties, affordability, and broad suitability for structural applications in construction and heavy industries.

-

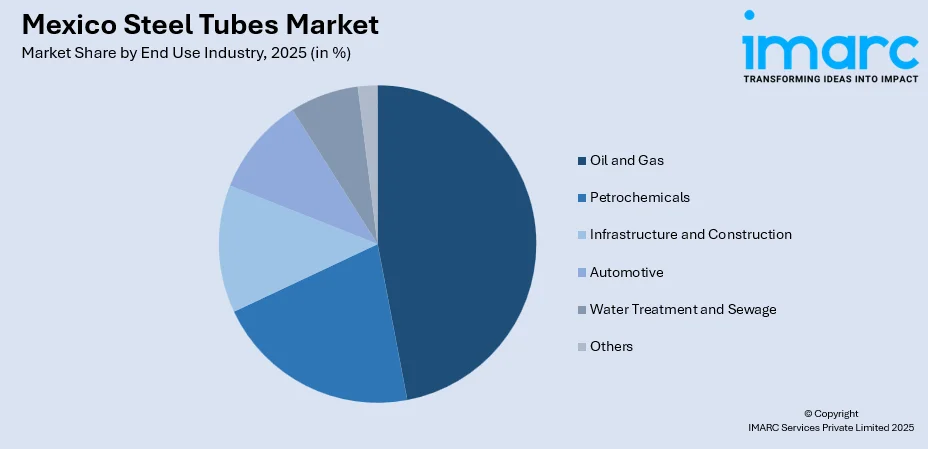

By End Use Industry: Oil and gas leads the market with a share of 46.56% in 2025, driven by extensive pipeline infrastructure requirements, offshore exploration activities, and the ongoing modernization of petroleum transportation and distribution networks.

-

Key Players: The Mexico steel tubes market exhibits moderate competitive intensity, with domestic manufacturers competing alongside multinational corporations across various price segments. Regional producers are strengthening their market positions through strategic capacity expansions and technological upgrades.

To get more information on this market Request Sample

The Mexico steel tubes market benefits from the country's strategic geographic position and well-established manufacturing base, which supports both domestic consumption and export activities. Infrastructure modernization efforts, including the completion of the Maya Train railway project spanning over 1,500 kilometers across southeastern Mexico, exemplify the scale of construction activities driving steel tube demand. The automotive sector, producing nearly four million light vehicles in 2024, continues to require substantial quantities of steel tubes for exhaust systems, chassis components, and structural applications. Furthermore, the energy sector's ongoing pipeline expansion projects and refinery maintenance activities maintain consistent demand for specialized steel tubing products. Regional trade agreements and logistical improvements further bolster industry momentum, positioning Mexican manufacturers competitively in North American supply chains.

Mexico Steel Tubes Market Trends:

Infrastructure Projects Drive Steady Demand

Large-scale infrastructure initiatives are generating sustained demand for steel tubes across Mexico. Government investment in transportation networks, including highways, bridges, and railways, requires substantial quantities of steel tubes for structural frameworks and piping systems. The completion of the Maya Train project, connecting major cities and tourist destinations across the Yucatan Peninsula, demonstrates the government's commitment to infrastructure development that will continue to support market expansion. For instance, Manzanillo–Cuyutlán port, which is already operating near capacity, is set to undergo a major expansion aimed at transforming it into Latin America’s largest container port. The development plan includes the construction of five new container terminals, backed by more than MX$88 billion in private investment, significantly boosting the port’s cargo-handling capacity and regional trade importance.

Domestic Production Capacity Expansion

Mexican steel tube producers are increasingly enhancing domestic manufacturing capacity by investing in new production facilities and upgrading existing equipment. These efforts aim to reduce dependence on imported products, improve supply chain reliability, and shorten delivery timelines for customers. Strengthening local production also allows manufacturers to exercise greater control over quality, dimensions, and technical specifications. Such improvements are particularly important for meeting the specialized requirements of infrastructure projects and industrial manufacturing applications across the country.

Technological Advancement in Manufacturing Processes

Steel tube producers are increasingly adopting automation and digitalization to improve production efficiency and reduce costs. The integration of Electric Arc Furnace technology and advancements in welding processes are central to these efforts. For instance, in June 2024, Mexican steelmaker Talleres y Aceros S.A. de C.V. (TYASA), in collaboration with Primetals Technologies, marked a significant milestone at the world’s first EAF Quantum plant in Ixtaczoquitlán, Mexico. As of May 7, 2024, the 100-ton electric arc furnace completed a decade of continuous operation, achieving approximately 77,000 heats and producing nearly eight million tons of steel over its operational lifespan. These innovations not only improve operational efficiency but also align with global sustainability standards, positioning Mexican steel tube manufacturers competitively in both domestic and international markets.

Market Outlook 2026-2034:

The Mexico steel tubes market outlook remains positive, supported by ongoing infrastructure initiatives, expanding automotive production, and sustained energy sector activities. Government programs focusing on transportation modernization and industrial development are expected to generate consistent demand for steel tube products. The nearshoring trend, which encourages manufacturing relocation to Mexico from Asia, presents additional growth opportunities for steel tube suppliers serving automotive and industrial sectors. The market generated a revenue of USD 1.01 Billion in 2025 and is projected to reach a revenue of USD 1.15 Billion by 2034, growing at a compound annual growth rate of 1.39% from 2026-2034.

Mexico Steel Tubes Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Welded Steel Tubes |

70.53% |

|

Material Type |

Carbon Steel |

39.32% |

|

End Use Industry |

Oil and Gas |

46.56% |

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

Welded steel tubes lead the market with a share of 70.53% of the total Mexico steel tubes market in 2025.

Welded steel tubes maintain their dominant position due to their cost-effectiveness and manufacturing versatility. The production process, which involves rolling steel plates or strips and welding along the edges, enables efficient large-scale manufacturing at competitive price points. These tubes find extensive applications in construction, furniture manufacturing, fluid transport services, and general structural uses where satisfactory strength and corrosion resistance are required.

The construction and infrastructure sectors drive significant demand for welded steel tubes, utilizing them in building frameworks, fencing, scaffolding, and piping systems. The automotive industry also contributes to consumption, employing welded tubes in exhaust systems and structural components. Manufacturing advancements, including improved welding technologies and quality control processes, continue to enhance product reliability and expand application possibilities across diverse industrial segments.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

Carbon steel dominates the market with a share of 39.32% of the total Mexico steel tubes market in 2025.

Carbon steel tubes maintain market leadership due to their exceptional balance of mechanical properties, affordability, and broad applicability across industrial sectors. The material offers excellent weldability, machinability, and strength characteristics that make it suitable for structural applications in construction, manufacturing, and infrastructure development. Cost advantages compared to specialty steels contribute to sustained demand across price-sensitive applications.

The construction industry represents a major consumer of carbon steel tubes, utilizing them in building frames, structural supports, and piping systems. Industrial applications include machinery components, conveyor systems, and manufacturing equipment. The automotive sector employs carbon steel tubes in various structural applications where weight considerations are less critical than durability and cost-effectiveness.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

Oil and gas holds the largest share with 46.56% of the total Mexico steel tubes market in 2025.

The oil and gas sector maintains its position as the leading end use industry for steel tubes, driven by extensive pipeline infrastructure requirements and ongoing exploration activities. Mexico's state petroleum company has outlined strategic plans to expand natural gas production and pipeline networks, creating sustained demand for specialized steel tubing products. Offshore drilling operations in the Gulf of Mexico require corrosion-resistant and high-pressure seamless tubes for extraction and transportation applications.

Pipeline expansion and maintenance activities form the backbone of steel tube demand in this sector. The development of gas transportation infrastructure, including projects connecting processing centers to power plants and industrial facilities, requires substantial quantities of large-diameter steel pipes. Refinery operations and petrochemical facilities also consume significant volumes of steel tubes for process piping and structural applications.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico’s steel tubes market is driven by industrial expansion and nearshoring-led manufacturing growth. Automotive, electronics, and heavy industries require steel tubes for structural frameworks, machinery, and piping systems. Large-scale logistics hubs, border infrastructure, and energy-related projects further support demand. Proximity to the US market encourages continuous investment in industrial facilities, increasing consumption of high-quality steel tubes across construction and manufacturing applications.

Central Mexico leads demand due to dense urbanization, infrastructure development, and a strong manufacturing base. Steel tubes are widely used in commercial buildings, residential construction, transportation networks, and industrial facilities. Ongoing modernization of roads, railways, and public infrastructure, combined with the presence of automotive and consumer goods manufacturing clusters, sustains steady demand. The region’s central location also supports efficient distribution and supply chain integration.

In Southern Mexico, steel tube demand is primarily driven by infrastructure expansion, energy projects, and tourism-related construction. Development of ports, transportation links, and public utilities increases the need for steel tubes in structural and piping applications. Growth in residential and hospitality construction also contributes to market expansion. Additionally, government initiatives aimed at improving regional connectivity and economic development are supporting long-term demand for steel tubes.

Market Dynamics:

Growth Drivers:

Why is the Mexico Steel Tubes Market Growing?

Expanding Infrastructure Development Programs

Government-driven infrastructure development across Mexico is creating sustained demand for steel tubes in multiple construction applications. Large transportation initiatives, including railways, highways, and urban transit systems, rely heavily on steel tubes for structural frameworks, drainage networks, and utility installations. At the same time, expanding urban development projects such as residential housing, commercial complexes, and public facilities are increasing the use of structural steel tubing. Together, public works and urban construction activities continue to support long-term growth in steel tube consumption nationwide.

Automotive Industry Expansion and Nearshoring Trends

Mexico’s growing automotive industry remains a major driver of steel tube demand, supported by strong manufacturing activity and nearshoring trends. As global manufacturers relocate production closer to North American markets, investments in automotive and industrial facilities are increasing. Steel tubes are widely used in vehicle chassis, exhaust systems, and structural components. Furthermore, the gradual transition toward electric vehicle production is generating additional demand for specialized steel tubing, as manufacturers upgrade facilities and adapt supply chains to support advanced automotive technologies.

Energy Sector Modernization and Pipeline Expansion

The energy sector represents a significant driver of steel tube demand, with ongoing investments in pipeline infrastructure and refinery operations. Mexico's strategic plan for energy development includes expanding natural gas pipeline networks to reduce import dependency and support industrial growth. For instance, in June 2024, Mexico’s state-owned utility CFE and Energía Mayakán, a subsidiary of ENGIE Mexico, began construction of the “Ampliación Energía Mayakán” natural gas pipeline. The project is designed to strengthen long-term gas supply reliability for power generation across the Yucatán Peninsula, supporting rising electricity demand and enhancing regional energy security in the coming years.

The Energia Mayakan pipeline expansion project, involving the construction of additional pipeline capacity between processing centers and power generation facilities, exemplifies the scale of infrastructure investments requiring steel tube products. Offshore exploration activities in the Gulf of Mexico and maintenance programs for existing petroleum infrastructure maintain consistent demand for specialized corrosion-resistant and high-pressure steel tubing products.

Market Restraints:

What Challenges the Mexico Steel Tubes Market is Facing?

Raw Material Price Volatility

Fluctuations in iron ore, scrap metal, and coking coal prices impact production costs and profit margins for steel tube manufacturers. Price volatility creates uncertainty in supply contracts and can lead to delayed projects as buyers and suppliers negotiate terms. The reliance on imported raw materials exposes the market to exchange rate fluctuations and global supply chain disruptions.

Trade Policy Uncertainties

Evolving trade policies and tariff structures create challenges for market participants engaged in cross-border commerce. Concerns regarding potential tariff increases and trade restrictions with major trading partners introduce uncertainty into strategic planning and investment decisions. Anti-dumping investigations and trade disputes add complexity to import-export activities and pricing strategies.

Competition from Import Channels

Domestic producers face competitive pressure from imported steel products, particularly from regions with lower production costs or excess manufacturing capacity. The influx of competitively priced imports can compress margins for local manufacturers and challenge market share retention efforts. Maintaining quality differentiation and service advantages becomes essential for domestic producers competing against import alternatives.

Competitive Landscape:

The Mexico steel tubes market exhibits a moderately concentrated competitive structure, characterized by the presence of established domestic manufacturers alongside international steel producers operating in the region. Competition centers on product quality, pricing strategies, delivery reliability, and technical service capabilities. Domestic producers are strengthening their market positions through capacity expansion investments, technological upgrades, and strategic partnerships with end-use industries. The automotive and construction sectors represent key battlegrounds for market share, with suppliers competing to establish long-term supply agreements with major manufacturers and construction contractors. Innovation in product specifications, including development of high-strength and corrosion-resistant tube products, enables differentiation among competitors. Regional manufacturers are also emphasizing supply chain integration and logistics optimization to enhance service levels and responsiveness to customer requirements.

Recent Developments:

-

April 2025: TYASA, Mexico's leading steel producer, announced a major expansion investment of USD 450 million to consolidate its operations. The investment includes the construction of a new rolling mill for special steel bars with 350,000 metric tons annual capacity and expansion of galvanizing and finishing capacity at its Veracruz plant. This development serves to propel domestic demand in sectors including automotive, aerospace, and mining while reducing dependence on imports.

-

January 2024: Conduit Rymco, a Mexican steel tubing specialist, commenced construction of a new USD 45 million facility in Frontera, Coahuila, to produce pipes tailored for aeronautical and automotive applications. The expansion, expected to be operational by 2025, will add 230 direct jobs and underscores the company's commitment to serving key industrial sectors and enhancing its operational footprint in Mexico's steel tubing industry.

Mexico Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Types Covered | Carbon Steel, Stainless Steel, Alloy Steel, Other |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico steel tubes market size was valued at USD 1.01 Billion in 2025.

The Mexico steel tubes market is expected to grow at a compound annual growth rate of 1.39% from 2026-2034 to reach USD 1.15 Billion by 2034.

Welded steel tubes dominated the market with a 70.53% share in 2025, driven by their cost-effectiveness, manufacturing versatility, and widespread applications across construction, infrastructure, and industrial sectors.

Key factors driving the Mexico steel tubes market include expanding infrastructure development programs, automotive industry growth supported by nearshoring trends, and energy sector modernization with ongoing pipeline expansion projects.

Major challenges include raw material price volatility affecting production costs, trade policy uncertainties impacting cross-border commerce, and competitive pressure from imported steel products entering the domestic market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)