Mexico Structured Cabling Market Size, Share, Trends and Forecast by Product Type, Wire Category, Application, Vertical, and Region, 2025-2033

Mexico Structured Cabling Market Overview:

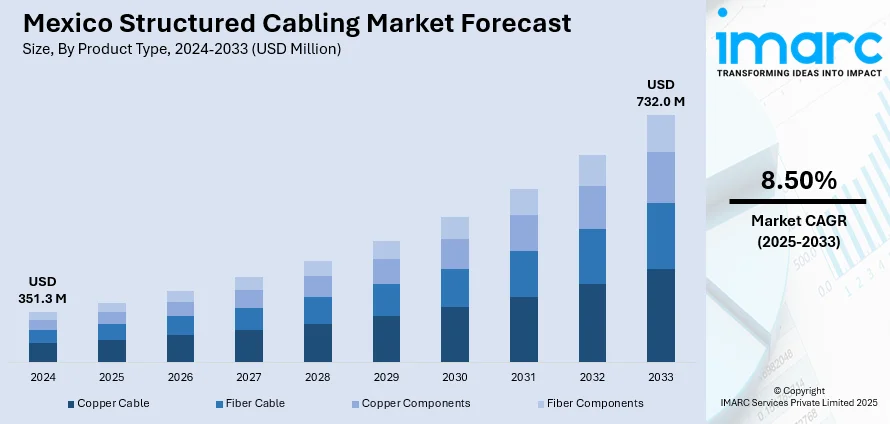

The Mexico structured cabling market size reached USD 351.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 732.0 Million by 2033, exhibiting a growth rate (CAGR) of 8.50% during 2025-2033. The market share is expanding, driven by the expansion of data centers, along with the growing reliance on telemedicine and remote monitoring systems, which is creating the need for stable information transmission.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 351.3 Million |

| Market Forecast in 2033 | USD 732.0 Million |

| Market Growth Rate 2025-2033 | 8.50% |

Mexico Structured Cabling Market Trends:

Rising applications in healthcare sector

The growing applications in the healthcare sector are offering a favorable Mexico structured cabling market outlook. Healthcare facilities rely on electronic health records (EHRs), telemedicine, medical imaging, and remote monitoring systems, which require fast, stable, and secure data transmission. Structured cabling systems support these applications by providing efficient network infrastructure that ensures smooth communication between departments and seamless access to patient data. As hospitals are expanding and modernizing, the need for integrated systems that connect medical equipment, administration platforms, and communication tools is growing. Structured cabling aids in reducing network complexity, improving data flow, and minimizing downtime, which is critical in healthcare settings. With real-time data exchange becoming essential for diagnostics and treatment, healthcare providers are investing in robust cabling solutions to maintain operational efficiency. The establishment of smart hospitals and the increasing use of the Internet of Things (IoT)-enabled medical devices are further driving the demand for structured cabling. Additionally, the development of specialized areas, such as healthcare cold chain logistics, which depends on real-time monitoring and effective communication systems, reinforces the importance of structured cabling in maintaining reliability and operational precision. According to the IMARC Group, the Mexico healthcare cold chain logistics market is set to attain USD 295.1 Million by 2033, exhibiting a growth rate (CAGR) of 6.1% during 2025-2033.

Expansion of data centers

The expansion of data centers is fueling the Mexico structured cabling market growth. In May 2024, Microsoft launched a data center in Querétaro, Mexico. It aimed to offer businesses and organizations local access to scalable and highly accessible cloud services. This facility was set to facilitate data residency and processing. Data centers require a robust and organized cabling infrastructure to manage large volumes of data efficiently. Structured cabling supports seamless communication between servers, storage systems, and network devices, which is critical in data-intensive environments. As the adoption of cloud computing, big data, and digital services continues to rise in Mexico, companies are wagering on expanding and building new data centers to meet high demand. This leads to increased deployment of structured cabling systems that provide flexibility and simplified maintenance. Structured cabling ensures efficient bandwidth management, reduces downtime, and supports higher data transfer speeds, making it an essential component in modern data centers. As industries, such as finance, e-commerce, and manufacturing, are digitizing their operations, the need for dependable data infrastructure is growing. This is further driving the demand for structured cabling solutions. Additionally, government efforts to boost digital infrastructure and attract tech investments are positively influencing the market. Structured cabling also helps future-proof data centers, allowing easy integration of new technologies without major system overhauls.

Mexico Structured Cabling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, wire category, application, and vertical.

Product Type Insights:

- Copper Cable

- Fiber Cable

- Copper Components

- Fiber Components

The report has provided a detailed breakup and analysis of the market based on the product type. This includes copper cable, fiber cable, copper components, and fiber components.

Wire Category Insights:

- Category 5e

- Category 6

- Category 6A

- Category 7

A detailed breakup and analysis of the market based on the wire category have also been provided in the report. This includes category 5e, category 6, category 6A, and category 7.

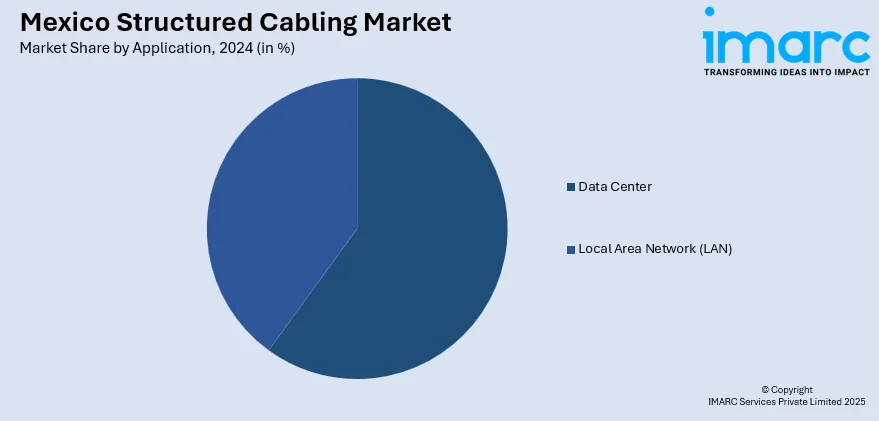

Application Insights:

- Data Center

- Local Area Network (LAN)

The report has provided a detailed breakup and analysis of the market based on the application. This includes data center and local area network (LAN).

Vertical Insights:

- Government

- Industrial

- IT and Telecommunications

- Residential and Commercial

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes government, industrial, IT and telecommunications, residential and commercial, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Structured Cabling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Copper Cable, Fiber Cable, Copper Components, Fiber Components |

| Wire Categories Covered | Category 5e, Category 6, Category 6A, Category 7 |

| Applications Covered | Data Center, Local Area Network (LAN) |

| Verticals Covered | Government, Industrial, IT and Telecommunications, Residential and Commercial, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico structured cabling market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico structured cabling market on the basis of product type?

- What is the breakup of the Mexico structured cabling market on the basis of wire category?

- What is the breakup of the Mexico structured cabling market on the basis of application?

- What is the breakup of the Mexico structured cabling market on the basis of vertical?

- What is the breakup of the Mexico structured cabling market on the basis of region?

- What are the various stages in the value chain of the Mexico structured cabling market?

- What are the key driving factors and challenges in the Mexico structured cabling market?

- What is the structure of the Mexico structured cabling market and who are the key players?

- What is the degree of competition in the Mexico structured cabling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico structured cabling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico structured cabling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico structured cabling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)