Mexico Subscription E-Commerce Market Size, Share, Trends and Forecast by Subscription Type, Application, Payment Mode, End User, and Region, 2025-2033

Mexico Subscription E-Commerce Market Overview:

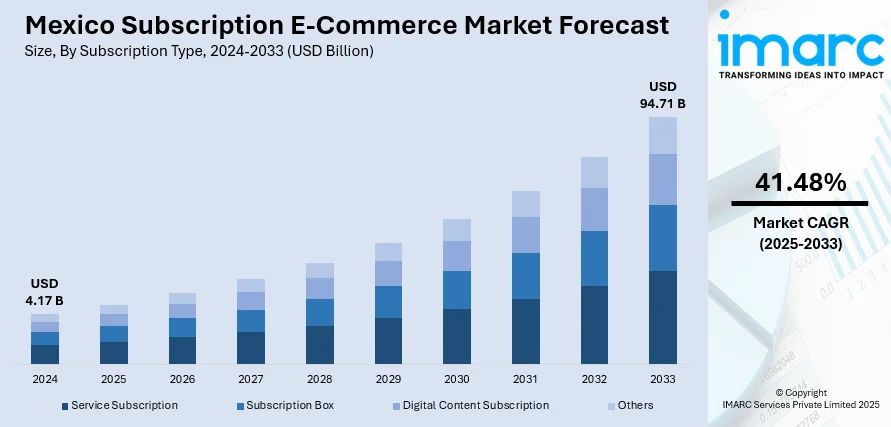

The Mexico subscription e-commerce market size reached USD 4.17 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 94.71 Billion by 2033, exhibiting a growth rate (CAGR) of 41.48% during 2025-2033. The market is propelled by increasing internet and smartphone usage, growing middle class with higher disposable income, and a shift toward convenience-driven shopping habits. Enhanced logistics and payment systems further support the adoption of subscription-based models across various sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.17 Billion |

| Market Forecast in 2033 | USD 94.71 Billion |

| Market Growth Rate 2025-2033 | 41.48% |

Mexico Subscription E-Commerce Market Trends:

Rising Middle-Class Income and Consumer Spending

Mexico's growing middle class is characterized by increased disposable income and a shift toward convenience-oriented lifestyles. The target audience selects subscription services that combine time efficiency and customized service to invest their money. Middle-income consumers prefer curated product offerings, which include meal kits and beauty boxes together with streaming services because they provide quality choices with decreased shopping hassles. As this segment continues to expand, their spending power fuels the demand for diverse subscription offerings, making it a significant driver of the Mexico subscription e-commerce market growth.

Advancements in Logistics and Delivery Infrastructure

The efficiency of logistics and delivery systems is crucial for the success of subscription e-commerce. Mexico has seen notable improvements in this area, with companies investing in advanced logistics solutions to ensure timely and reliable deliveries. For instance, instance, in February 2025, UPS Healthcare introduced three new cross-dock centers in Mexico City, Milan, and Frankfurt, aimed at facilitating pharmaceutical deliveries with different temperature and time specifications. This initiative is part of the firm's strategy to satisfy the increasing need for cold chain logistics, especially in North America, where the demand for temperature-regulated services is projected to grow by 76% by 2024, as per industry reports. The development of last-mile delivery services and the integration of technologies like AI and big data analytics have enhanced inventory management and demand forecasting, which is further fueling the Mexico subscription e-commerce market share. These advancements reduce delivery times and improve customer satisfaction, making subscription services more attractive to consumers who value consistency and reliability in receiving their products.

Growth of Fintech Solutions and Digital Payment Adoption

The expansion of fintech services in Mexico has played a pivotal role in facilitating subscription e-commerce. With a significant portion of the population previously unbanked, fintech innovations have introduced accessible digital payment solutions, enabling more consumers to participate in online transactions. Mobile wallets, digital banking, and alternative payment platforms have bridged the gap, allowing for seamless recurring payments essential for subscription models. As trust in digital payments grows and more consumers adopt these technologies, the barrier to entry for subscription services diminishes, creating a positive impact on the Mexico subscription e-commerce market outlook.

Mexico Subscription E-Commerce Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on subscription type, application, payment mode, and end user.

Subscription Type Insights:

- Service Subscription

- Subscription Box

- Digital Content Subscription

- Others

The report has provided a detailed breakup and analysis of the market based on the subscription type. This includes service subscription, subscription box, digital content subscription, and others.

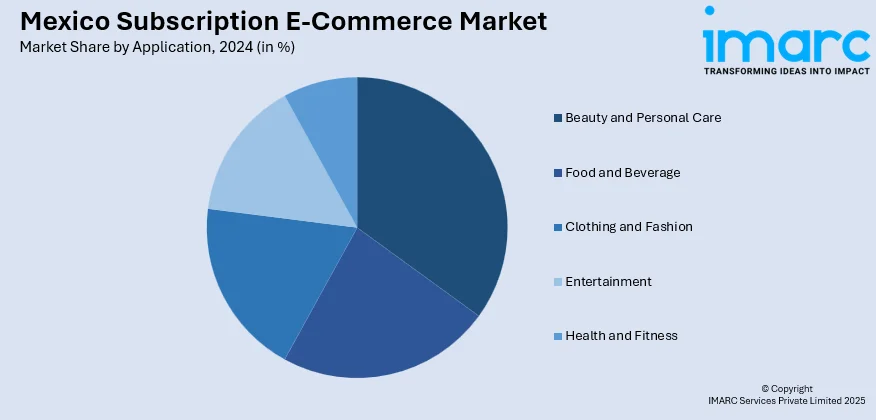

Application Insights:

- Beauty and Personal Care

- Food and Beverage

- Clothing and Fashion

- Entertainment

- Health and Fitness

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes beauty and personal care, food and beverage, clothing and fashion, entertainment, and health and fitness

Payment Mode Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the payment mode have also been provided in the report. This includes online, and offline.

End User Insights:

- Women

- Men

- Kids

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes women, men, and kids.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Subscription E-Commerce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Subscription Types Covered | Service Subscription, Subscription Box, Digital Content Subscription, Others |

| Applications Covered | Beauty and Personal Care, Food and Beverage, Clothing and Fashion, Entertainment, Health and Fitness |

| Payment Modes Covered | Online, Offline |

| End-Users Covered | Women, Men, Kids |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico subscription e-commerce market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico subscription e-commerce market on the basis of subscription type?

- What is the breakup of the Mexico subscription e-commerce market on the basis of application?

- What is the breakup of the Mexico subscription e-commerce market on the basis of payment mode?

- What is the breakup of the Mexico subscription e-commerce market on the basis of end user?

- What is the breakup of the Mexico subscription e-commerce market on the basis of region?

- What are the various stages in the value chain of the Mexico subscription e-commerce market?

- What are the key driving factors and challenges in the Mexico subscription e-commerce market?

- What is the structure of the Mexico subscription e-commerce market and who are the key players?

- What is the degree of competition in the Mexico subscription e-commerce market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico subscription e-commerce market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico subscription e-commerce market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico subscription e-commerce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)