Mexico Sugar Substitutes Market Size, Share, Trends and Forecast by Product Type, Application, Origin, and Region, 2025-2033

Mexico Sugar Substitutes Market Overview:

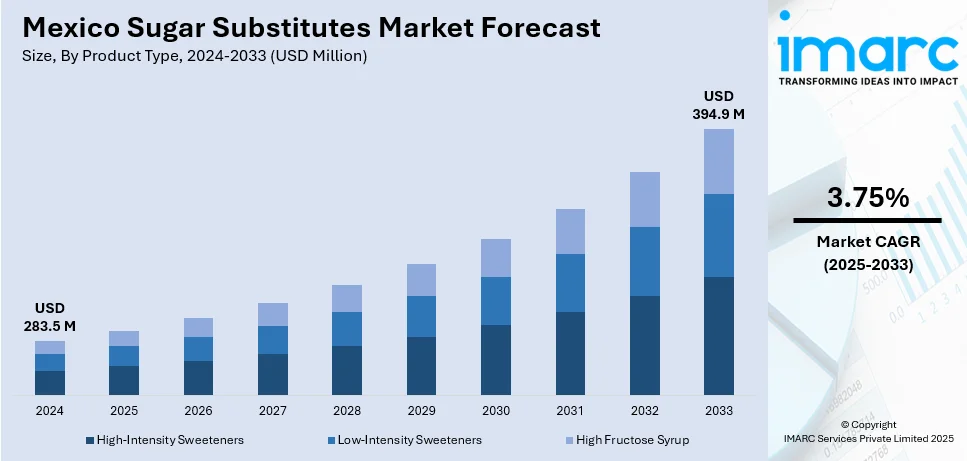

The Mexico sugar substitutes market size reached USD 283.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 394.9 Million by 2033, exhibiting a growth rate (CAGR) of 3.75% during 2025-2033. The market is experiencing stable growth as a result of heightening health awareness, rising diabetic population, and heightened demand for natural and low-calorie sweeteners. Developments in technology and novel product formulations also facilitate market growth, providing a vast array of sugar-free products in food, beverages, and personal care applications, contributing to the expanding Mexico sugar substitutes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 283.5 Million |

| Market Forecast in 2033 | USD 394.9 Million |

| Market Growth Rate 2025-2033 | 3.75% |

Mexico Sugar Substitutes Market Trends:

Increasing Consumer Demand for Natural Sweeteners

Heightened health consciousness among Mexican consumers has prompted an amplified demand for natural sweeteners. This shift is being fueled by growing concern about the negative health impacts of refined sugar, including diabetes and obesity. Naturally sourced sweeteners like stevia, monk fruit, and sugar alcohols are gaining popularity among households and foodservice outlets, especially in urban markets. As per the sources, in March 2024, Tagatose became the first sweetener to be awarded the NutraStrong™ Prebiotic Verified mark, further establishing itself as a functional, low-calorie food, beverage, and nutraceutical ingredient prebiotic sweetener. Furthermore, the shift from man-made ingredients corresponds to a broader consumer trend away from dirty labels and plant-centric formulations. Besides, shifting consumer eating habits such as the move towards low-carb and keto diets have sustained demand for sugar substitutes with less calorie content. Consequently, Mexico sugar substitutes market outlook is also promising with broadening prospects for products marketed on the lines of being healthy, organic, and naturally derived. This trend will strengthen as regulatory authorities and public health programs continue to encourage lower sugar intake through reformulated offerings and clear nutritional labeling.

Growth of Sugar-Free Product Lines

The rising prevalence of lifestyle diseases has spurred the creation of a broad range of sugar-free or lower-sugar food and beverage products in Mexico. From soft drinks and milk substitutes to bakery products and personal care products, manufacturers are introducing increasing amounts of sugar substitutes into products to satisfy the needs of health-aware consumers. For instance, in October 2023, Grupo Bimbo collaborated with Oobli to incorporate sweet proteins into its baked products, with the goal of substituting up to 90% of sugar with this eco-friendly protein-based alternative. Moreover, the presence of such varied products facilitates the switch to low-sugar diets among demographic groups, ranging from children, adults, and the elderly. This boosting range of products is not only accommodating dietary needs but also mounting accessibility and normalizing sugar substitutes for everyday consumption. Retailers in supermarkets and internet sites are observing a significant upswing in products without sugar, indicative of change on both demand and supply fronts. With expanding market penetration into mainstream and niche segments, Mexico sugar substitutes market share is also expected to expand, solidifying the position of sugar substitutes in establishing a healthier national eating environment.

Technological Development of Sweetener Formulation

Constant advances in food science and processing technologies have allowed for the creation of more acceptable, functional, and stable sugar substitutes. In Mexico, it has resulted in the introduction of advanced formulations which not only capture the sweetness pattern of sugar but also are tolerant in most kitchen applications. The improved thermal stability, shelf-life compatibility, and synergistic formulation with other constituents have enabled such substitutes to become acceptable in food processing, drinking beverages, and pharmaceutical applications. The outcome has been a second generation of sugar substitutes which allow taste integrity with no compromise towards health objectives. These innovations are further supported by academic research and public-private partnerships that explore innovative sources and methods of extraction. As consumer expectations evolve, producers are driven to enhance the sensory and functional properties of sugar substitutes. Spurred by these advances, sugar substitutes market growth in Mexico illustrates a dynamic market environment embracing high-performance solutions for long-term dietary sustainability.

Mexico Sugar Substitutes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, application, and origin.

Product Type Insights:

- High-Intensity Sweeteners

- Stevia

- Aspartame

- Cyclamate

- Sucralose

- Saccharin

- Others

- Low-Intensity Sweeteners

- D-Tagatose

- Sorbitol

- Maltitol

- Xylitol

- Mannitol

- Others

- High Fructose Syrup

The report has provided a detailed breakup and analysis of the market based on the product type. This includes high-intensity sweeteners (stevia, aspartame, cyclamate, sucralose, saccharin, and others), low-intensity sweeteners (d-tagatose, sorbitol, maltitol, xylitol, mannitol, and others), and high fructose syrup.

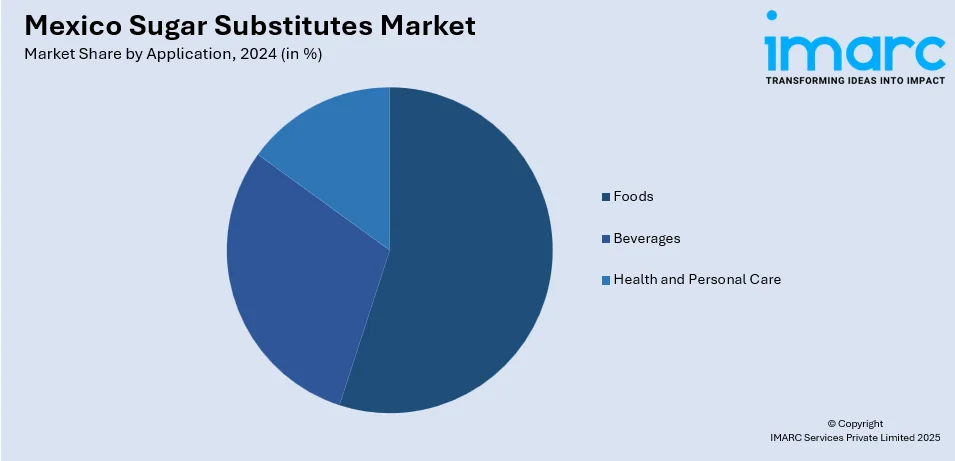

Application Insights:

- Foods

- Beverages

- Health and Personal Care

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes foods, beverages, and health and personal care.

Origin Insights:

- Artificial

- Natural

The report has provided a detailed breakup and analysis of the market based on the origin. this includes artificial and natural.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Sugar Substitutes Market News:

- In January 2024, Ingredion introduced PureCircle Clean Taste Solubility Solution, a clean-label, plant-based stevia solution for food manufacturers. This groundbreaking solution replicates sugar's sensory character without additives and has better solubility than artificial sweeteners, perfect for beverages, syrups, sauces, and more.

Mexico Sugar Substitutes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Foods, Beverages, Health and Personal Care |

| Origins Covered | Artificial, Natural |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico sugar substitutes market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico sugar substitutes market on the basis of product type?

- What is the breakup of the Mexico sugar substitutes market on the basis of application?

- What is the breakup of the Mexico sugar substitutes market on the basis of origin?

- What is the breakup of the Mexico sugar substitutes market on the basis of region?

- What are the various stages in the value chain of the Mexico sugar substitutes market?

- What are the key driving factors and challenges in the Mexico sugar substitutes?

- What is the structure of the Mexico sugar substitutes market and who are the key players?

- What is the degree of competition in the Mexico sugar substitutes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico sugar substitutes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico sugar substitutes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico sugar substitutes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)