Mexico Superfoods Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033

Mexico Superfoods Market Overview:

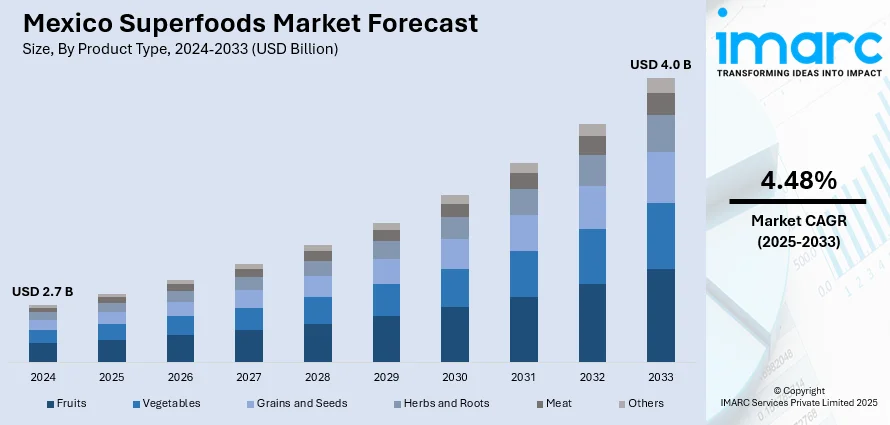

The Mexico superfoods market size reached USD 2.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.0 Billion by 2033, exhibiting a growth rate (CAGR) of 4.48% during 2025-2033. The market share is expanding, driven by increasing number of health-conscious consumers, which is propelling brands to respond with more variety and clearer labeling, along with the expansion of e-commerce portals, aiding in enhancing the accessibility of food products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.7 Billion |

| Market Forecast in 2033 | USD 4.0 Billion |

| Market Growth Rate 2025-2033 | 4.48% |

Mexico Superfoods Market Trends:

Increasing health awareness

The growing health awareness among the masses is offering a favorable Mexico superfoods market outlook. More people are starting to care about what they eat and how it affects their bodies, so they are looking for food products that offer real health benefits. Superfoods like chia seeds, amaranth, quinoa, berries, and turmeric are gaining popularity among people because they are packed with nutrients and aid with things, such as digestion, energy, weight control, and immunity. As people get more interested in fitness, mental well-being, and clean eating, they are turning to options that are natural, organic, and free from additives. This shift is especially noticeable among younger adults and working professionals who are trying to balance busy lives with healthy choices. Many individuals are replacing processed snacks with nutrient-rich alternatives and experimenting with smoothies, bowls, and plant-based meals at home. Superfoods fit right into this lifestyle. Moreover, the rising number of health-conscious consumers is making brands respond with more variety, better packaging, and clearer labeling. Furthermore, social media plays a huge part in positively influencing the market. With more people being active on social media platforms, they are gaining exposure to healthy recipes, influencer tips, and success stories online. According to the statcounter, as of March 2025, 76.17% of the population in Mexico was using Facebook and 10.72% of people were on Instagram. These channels are flooded with superfood content, which motivates individuals to try new ingredients and share their own health journeys.

Expansion of e-commerce sites

The expansion of e-commerce portals is fueling the Mexico superfoods market growth. According to industry reports, in Mexico, the e-commerce revenue accounted for 15% of overall retail sales in 2024. E-commerce sales in the country are expected to hit USD 176.8 Billion by 2026. Online shopping makes it super easy for people to access a wide variety of superfoods that might not be available in local stores. E-commerce platforms also offer more information, such as product details, nutrition facts, reviews, and recipe ideas, which helps consumers make better choices. Many people prefer the convenience of ordering from their phones or laptops, especially those with busy schedules or limited access to health stores. Moreover, online platforms often have better deals, discounts, and subscription options, making it affordable to maintain healthy habits. Small and local brands also get a chance to reach a bigger audience through digital marketplaces. As more people shop online and focus on healthy living, the demand for superfoods through e-commerce channels keeps increasing steadily.

Mexico Superfoods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, application, and distribution channel.

Product Type Insights:

- Fruits

- Vegetables

- Grains and Seeds

- Herbs and Roots

- Meat

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fruits, vegetables, grains and seeds, herbs and roots, meat, and others.

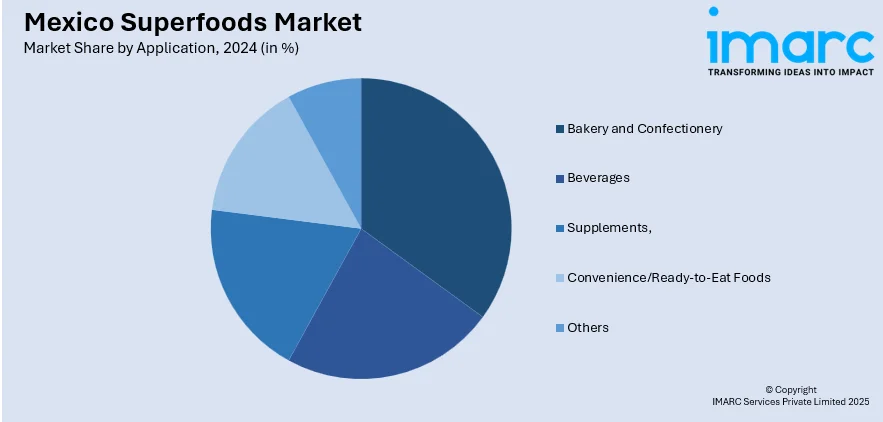

Application Insights:

- Bakery and Confectionery

- Beverages

- Supplements,

- Convenience/Ready-to-Eat Foods

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bakery and confectionery, beverages, supplements, convenience/ready-to-eat foods, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Independent Small Grocery Stores

- Online Sales

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, specialty stores, independent small grocery stores, online sales, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Superfoods Market News:

- In March 2024, KWS, the renowned seed expert, launched its breeding facility in Sinaloa, Mexico. The firm was set to conduct breeding for peppers and tomatoes, along with screening activities for cucumber, melon, and watermelon. The station in Navolato allowed the company to create competitive varieties that could provide answers to the key challenges encountered by local farmers and aimed to enhance its market presence.

- In February 2025, Tozi Azteca Superfoods, the food product brand based in Mexico, revealed a major brand makeover. The firm created its products with powerful native superfoods, such as amaranth, agave, and nopal, appealing to health-oriented consumers seeking culturally vibrant nutritious choices. If Only Creative's rebranding strategy was based on four core principles, respecting Mexico’s culinary traditions and indigenous superfoods, advocating for organic items, acknowledging Latina entrepreneurs and their impact on the culinary scene, and informing people about the advantages of indigenous superfoods while endorsing sustainable practices.

Mexico Superfoods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fruits, Vegetables, Grains and Seeds, Herbs and Roots, Meat, Others |

| Applications Covered | Bakery and Confectionery, Beverages, Supplements, Convenience/Ready-to-Eat Foods, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Independent Small Grocery Stores, Online Sales, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico superfoods market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico superfoods market on the basis of product type?

- What is the breakup of the Mexico superfoods market on the basis of application?

- What is the breakup of the Mexico superfoods market on the basis of distribution channel?

- What is the breakup of the Mexico superfoods market on the basis of region?

- What are the various stages in the value chain of the Mexico superfoods market?

- What are the key driving factors and challenges in the Mexico superfoods market?

- What is the structure of the Mexico superfoods market and who are the key players?

- What is the degree of competition in the Mexico superfoods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico superfoods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico superfoods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico superfoods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)