Mexico Supply Chain Management Software Market Size, Share, Trends and Forecast by Solution Type, Deployment Mode, Organization Size, Industry Vertical, and Region, 2026-2034

Mexico Supply Chain Management Software Market Summary:

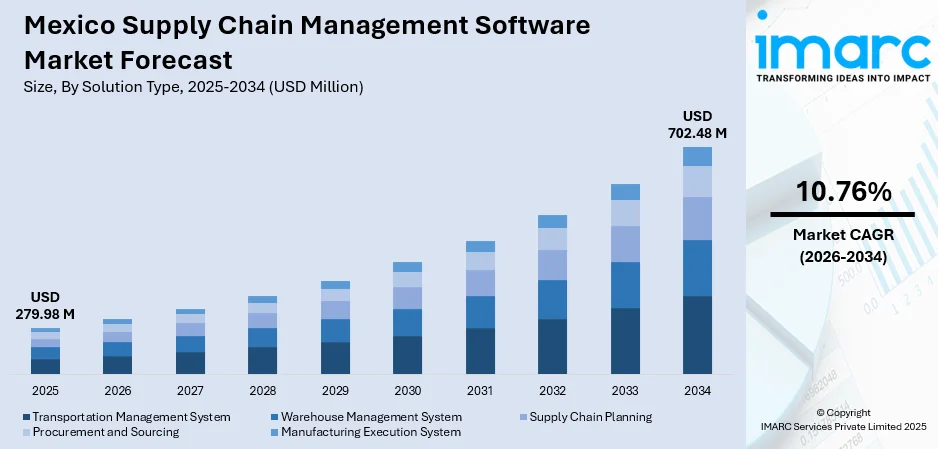

The Mexico supply chain management software market size was valued at USD 279.98 Million in 2025 and is projected to reach USD 702.48 Million by 2034, growing at a compound annual growth rate of 10.76% from 2026-2034.

The Mexico supply chain management software market growth is primarily driven by the country’s strategic positioning as a nearshoring hub for North American manufacturers seeking to optimize supply chain operations and reduce logistical complexities. The convergence of digital transformation initiatives across manufacturing, retail, and logistics sectors is fundamentally reshaping how enterprises manage procurement, inventory, and distribution networks. The growing e-commerce penetration and omnichannel fulfillment requirements are encouraging organizations to adopt sophisticated supply chain solutions that enhance visibility, agility, and operational efficiency.

Key Takeaways and Insights:

- By Solution Type: Transportation management system dominates the market with a share of 30% in 2025, driven by the critical need for optimizing cross-border freight movements, route planning efficiency, and real-time shipment visibility as nearshoring intensifies manufacturing activities throughout Mexico.

- By Deployment Mode: Cloud-based leads the market with a share of 62% in 2025, owing to its scalability advantages, reduced infrastructure requirements, lower upfront capital expenditure, and seamless integration capabilities that enable rapid deployment across distributed operations.

- By Organization Size: Large enterprises represent the largest segment with a market share of 54% in 2025. This dominance is driven by complex multi-site operations requiring sophisticated supply chain orchestration, substantial technology budgets enabling enterprise-wide implementations, and strategic imperatives for end-to-end visibility.

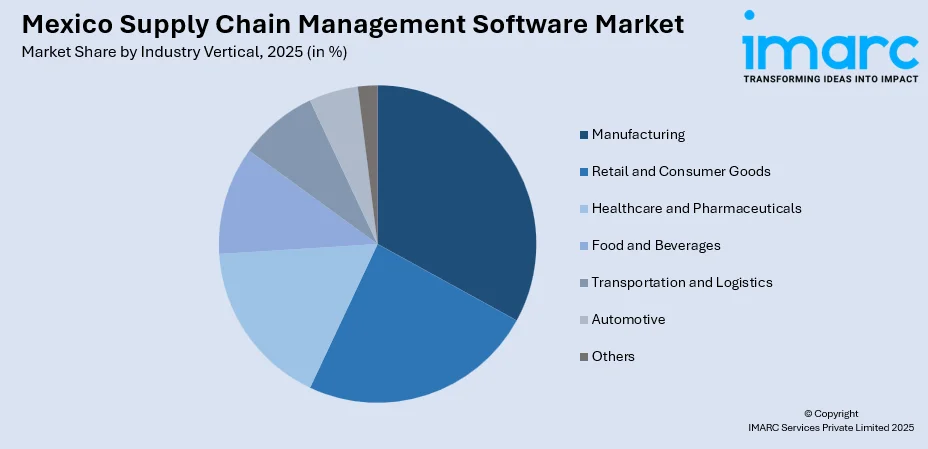

- By Industry Vertical: Manufacturing dominates the market with a share of 24% in 2025, reflecting Mexico's position as a global manufacturing powerhouse with extensive automotive, electronics, aerospace, and consumer goods production requiring advanced supply chain coordination.

- Key Players: The Mexico supply chain management software market exhibits moderate competitive intensity, with multinational enterprise software providers competing alongside specialized logistics technology vendors across deployment models and industry verticals.

To get more information on this market Request Sample

Mexico supply chain management software market is advancing as companies seek stronger oversight of logistics costs, quicker order processing, and clearer visibility across procurement and distribution activities. Firms are updating internal systems to meet the rising expectations for timely delivery and transparent tracking, moving away from manual coordination to reduce mistakes and improve communication between suppliers, warehouses, and transport providers. The growing interest in real-time information and the need to meet updated compliance rules are further encouraging adoption of supply chain management software. Apart from this, the rise in warehousing, last-mile activity, and cross-border movement of goods is catalyzing the demand for integrated platforms that support routing, capacity planning, and regulatory management. This direction became visible in 2025 when Huawei introduced its SMART Logistics & Warehousing Solution in Mexico, a digital system aimed at improving efficiency, lowering costs, and strengthening real-time coordination.

Mexico Supply Chain Management Software Market Trends:

Expansion of Strategic Technology Partnerships

Collaborations between technology providers are expanding the availability of modern supply chain software in Mexico and making adoption more practical for enterprises seeking better coordination and data visibility. These alliances combine established infrastructure capabilities with advanced cloud-based platforms, supporting automation, real-time monitoring, and streamlined decision-making. The partnership formed in June 2024 between Compucenter de México and Aratum further strengthened this trend by offering ISO-certified, real-time syncing solutions suited to sectors including e-commerce, telecom, and energy. Their combined expertise enabled flexible, efficient tools that advance digital transformation and support cost reduction across a growing number of local businesses.

Growing Role in Automotive Sector

Supply chain management software plays a critical role in the automotive industry by coordinating multi-tier supplier networks, regulating component sourcing, and ensuring alignment between production schedules and assembly requirements. The importance of these capabilities is underscored by INEGI data showing that Mexico exported 331,517 light vehicles in a single month in 2025, representing a 14.04 percent annual increase, while production reached 361,047 units, reflecting a 4.89 percent rise. Such output levels necessitate precise tracking, accurate forecasting, and consistent workflow synchronization. The software supports just-in-time practices, reduces operational disruptions, and reinforces production stability across the sector.

Increasing Utilization in Pharmaceuticals and Healthcare

Supply chain management software is vital in the pharmaceutical and healthcare sector, where it supports the tracking of sensitive medical products, regulatory compliance, and strict storage requirements throughout distribution. Its importance is reflected in national health conditions, as INEGI reported diabetes as the second leading cause of death in Mexico in 2024, underscoring the need for reliable access to essential medicines. These systems monitor batch data, expiration dates, documentation, and temperature-controlled logistics to ensure products reach hospitals, pharmacies, and distributors safely. By maintaining real-time visibility and precise process control, organizations safeguard product integrity and uphold consistent availability across healthcare networks.

Market Outlook 2026-2034:

The Mexico supply chain management software market exhibits growth potential throughout the forecast period, propelled by structural economic shifts that prioritize regional supply chain localization and relentless digital transformation mandates across diverse industries. These dynamics enhance operational resilience, streamline logistics, and optimize inventory control through advanced technological integrations. Enterprises increasingly adopt sophisticated platforms to navigate complexities in global trade, regulatory compliance, and real-time visibility. The market generated a revenue of USD 279.98 Million in 2025 and is projected to reach a revenue of USD 702.48 Million by 2034, growing at a compound annual growth rate of 10.76% from 2026-2034.

Mexico Supply Chain Management Software Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Solution Type | Transportation Management System | 30% |

| Deployment Mode | Cloud-based | 62% |

| Organization Size | Large Enterprises | 54% |

| Industry Vertical | Manufacturing | 24% |

Solution Type Insights:

- Transportation Management System

- Warehouse Management System

- Supply Chain Planning

- Procurement and Sourcing

- Manufacturing Execution System

Transportation management system dominates with a market share of 30% of the total Mexico supply chain management software market in 2025.

Transportation management system leads the market owing to its pivotal role in optimizing route planning, load consolidation, and carrier selection amid complex logistics networks. This system enables seamless freight coordination, reducing transit delays and enhancing delivery precision across diverse terrains and regulatory landscapes.

The dominance of the transportation management system is also influenced by its advanced capabilities in real-time tracking, dynamic scheduling, and cost analytics, which streamline multimodal operations and bolster supply chain visibility. By integrating carrier performance metrics and predictive modeling, it empowers enterprises to mitigate disruptions and achieve superior operational agility in a competitive environment.

Deployment Mode Insights:

- On-premises

- Cloud-based

Cloud-based leads the market with a share of 62% of the total Mexico supply chain management software market in 2025.

Cloud-based represents the largest segment owing to its inherent scalability, allowing seamless adaptation to fluctuating operational demands without substantial infrastructure investments. This platform facilitates rapid access to advanced features, fostering agility and cost efficiency across diverse enterprise sizes.

The leadership of cloud-based arises from its superior accessibility and real-time collaboration capabilities, enabling distributed teams to synchronize data effortlessly while minimizing maintenance burdens. Enhanced security protocols and automatic updates further solidify its position, promoting uninterrupted performance and innovation in dynamic logistics environments

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises exhibit a clear dominance with a 54% share of the total Mexico supply chain management software market in 2025.

Large enterprises dominate the market by organization size due to their extensive operational complexity, demanding integrated platforms for end-to-end visibility and coordination across global networks. These organizations require robust systems to synchronize procurement, production, and distribution seamlessly.

Their dominance arises from substantial resources enabling comprehensive implementations that deliver predictive analytics, risk mitigation, and customized automation at scale. The ability of large enterprises to leverage substantial resources for comprehensive, large-scale implementations is directly reflected in their economic impact, as shown by the INEGI 2024 Economic Census, where large establishments, representing only 0.2% of the total, contribute 43.5% of total revenues.

Industry Vertical Insights:

Access the Comprehensive Market Breakdown Request Sample

- Retail and Consumer Goods

- Healthcare and Pharmaceuticals

- Manufacturing

- Food and Beverages

- Transportation and Logistics

- Automotive

- Others

Manufacturing represents the leading segment with a 24% share of the total Mexico supply chain management software market in in 2025.

Manufacturing holds the biggest market share because of its intricate production processes requiring precise inventory synchronization, demand forecasting, and just-in-time delivery coordination. These operations demand robust platforms to manage raw material flows, assembly line efficiencies, and output distribution seamlessly.

Its leadership stems from the sector's vulnerability to supply disruptions, necessitating advanced traceability, quality control integration, and supplier collaboration tools. This enables manufacturers to optimize throughput, minimize waste, and respond agilely to market volatility across expansive production networks.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico is witnessing supply chain management software market growth through its strategic manufacturing corridors and cross-border logistics hubs, enabling sophisticated platforms for real-time freight optimization and client compliance. Advanced infrastructure facilitates seamless integration of transportation and inventory systems, supporting high-volume exports and nearshoring initiatives effectively.

Central Mexico commands the market with its dense concentration of enterprises, urban distribution centers, and industrial parks, driving adoption of comprehensive procurement and warehousing solutions. Proximity to major ports and airports enhances multimodal coordination and demand forecasting capabilities across interconnected supply networks.

Southern Mexico advances through the robust agro-exports, port modernizations, and tourism logistics, requiring resilient software for temperature-controlled shipments and regional traceability. Expanding trade agreements bolster platforms that manage perishable goods and infrastructure connectivity in developing economic zones effectively.

Others, including specialized sectors like energy extraction and remote mining operations, is leveraging customized solutions for challenging terrains and isolated supply routes. Progressive digital adoption enables scalable visibility and vendor synchronization amid unique geographic and operational constraints.

Market Dynamics:

Growth Drivers:

Why is the Mexico Supply Chain Management Software Market Growing?

Logistics and Transportation

Logistics companies depend on supply chain management software to plan routes, coordinate fleet activities, schedule deliveries, and track shipments in real time, ensuring efficient and reliable transport operations. The industry’s growing scale is reflected in the opening of JD Logistics’ first self-operated overseas warehouse in Mexico in 2025, a 40,000 m² facility established with local partners. Such developments increase the need for centralized transport data, improved visibility, and coordinated communication among carriers, drivers, warehouses, and distribution teams. These capabilities help optimize resource allocation, maintain predictable transit times, and support uninterrupted movement of goods across domestic and cross-border networks.

Growing Employment in Retail and E-commerce

Retail and e-commerce companies rely on supply chain management software to maintain accurate inventory levels across stores, warehouses, and fulfillment centers while supporting organized order processing, replenishment planning, and vendor coordination. The scale of this requirement is evident as retail e-commerce in Mexico reached 789,700 million pesos in 2024, reflecting growth of more than 20 percent and marking six consecutive years of double-digit expansion, according to the 2025 Online Sales Study by Mexican Association of Online Sales (AMVO). Such sustained growth requires reliable systems that reduce delays, prevent overselling, and strengthen delivery accuracy across increasingly complex sales environments.

Digital Transformation Initiatives Modernizing Enterprise Operations

Digital transformation initiatives in Mexico continue to accelerate the adoption of supply chain management software as organizations seek to modernize internal processes and elevate operational efficiency. This shift is supported by significant improvements in national digital infrastructure, for instance, in 2025, Elmex announced plans for a new data center in northeast Mexico, scheduled to open in 2026 to meet rising industrial digital requirements. Such developments strengthen the technological foundation necessary for deploying advanced enterprise systems. As businesses prioritize automation, real-time data usage, and integrated digital workflows, the enhanced infrastructure supports wider software adoption across multiple economic sectors.

Market Restraints:

What Challenges the Mexico Supply Chain Management Software Market is Facing?

High Implementation Costs Constraining Adoption Among Smaller Enterprises

Smaller enterprises face challenges adopting supply chain software due to substantial upfront and recurring costs that exceed their technology budgets. Licensing fees, customization requirements, integration work, and organizational change efforts increase financial pressure during deployment. Beyond initial spending, long-term commitments like maintenance, system upgrades, training programs, and support services elevate the total cost of ownership.

Cybersecurity Concerns and Data Privacy Requirements Complicating Adoption

Enterprises evaluating cloud-based supply chain software must navigate increasing cybersecurity risks and stricter data protection requirements, leading to hesitation during decision-making. Organizations need assurance that platforms provide strong security controls, advanced encryption, and compliance features that align with industry regulations. Maintaining protection across distributed teams and remote-access environments adds further complexity. Balancing robust security with operational efficiency is difficult, especially for industries handling sensitive or regulated information.

Skilled Workforce Shortage Limiting Implementation Success

The limited availability of professionals who combine supply chain knowledge with technical implementation skills affects the ability of organizations to deploy advanced software systems effectively. Many enterprises lack internal teams capable of overseeing configuration, data migration, integration, and optimization processes required for successful adoption. External system integrators face similar capacity constraints, reducing their ability to manage multiple complex projects simultaneously.

Competitive Landscape:

The Mexico supply chain management software market exhibits moderate competitive intensity characterized by the presence of global enterprise software leaders alongside specialized supply chain technology providers and emerging local platform developers. Market dynamics reflect strategic positioning ranging from comprehensive integrated suites encompassing planning, execution, and visibility capabilities to focused best-of-breed solutions addressing specific functional requirements. Leading vendors are differentiating through AI innovation, industry-specific solution configurations, and cloud platform scalability. The competitive landscape is increasingly shaped by partnership ecosystems connecting software providers with system integrators, consulting firms, and complementary technology vendors capable of delivering complete implementation solutions.

Recent Developments:

- In July 2025, Petco Mexico selected RELEX Solutions' AI-driven platform to overhaul forecasting, replenishment, and supply chain operations across 145 stores and two distribution centers, addressing long import lead times, promotions, and e-commerce fulfillment from nearest stores. The unified system automates planning for complex SKUs, boosts inventory efficiency, reduces waste, and supports LatAm expansion, replacing legacy tools for data-driven agility and consistent product availability.

Mexico Supply Chain Management Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solution Types Covered | Transportation Management System, Warehouse Management System, Supply Chain Planning, Procurement and Sourcing, Manufacturing Execution System |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Industry Verticals Covered | Retail and Consumer Goods, Healthcare and Pharmaceuticals, Manufacturing, Food and Beverages, Transportation and Logistics, Automotive, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico and Others. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico supply chain management software market size was valued at USD 279.98 Million in 2025.

The Mexico supply chain management software market is expected to grow at a compound annual growth rate of 10.76% from 2026-2034 to reach USD 702.48 Million by 2034.

Transportation management system dominates the market with approximately 30% revenue share in 2025, driven by critical requirements for optimizing cross-border freight movements and real-time shipment visibility.

Key factors driving the Mexico supply chain management software market include the growing employment in the automotive sector, which raises demand for tools that keep production schedules, supplier coordination, and logistics flows steady as output volumes continue to rise. INEGI reported 331,517 light-vehicle exports in 2025 (+14.04%) and 361,047 units produced (+4.89%). These volumes require precise tracking, solid forecasting and synchronized workflows to maintain just-in-time operations and limit disruptions.

Major challenges include high implementation costs constraining adoption among smaller enterprises, cybersecurity concerns and data privacy requirements, skilled workforce shortage limiting implementation success, and infrastructure limitations in certain regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)