Mexico Surgical Sutures Market Size, Share, Trends and Forecast by Type, Material, Application, End User, and Region, 2025-2033

Mexico Surgical Sutures Market Overview:

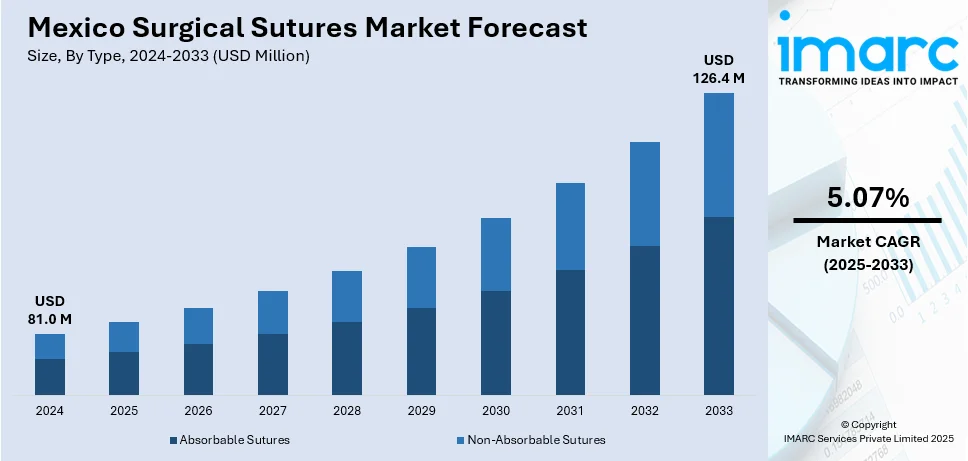

The Mexico surgical sutures market size reached USD 81.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 126.4 Million by 2033, exhibiting a growth rate (CAGR) of 5.07% during 2025-2033. The market is driven by the growing number of surgeries in both public and private healthcare facilities in Mexico, technological advancements in suture material and design, and opening of additional surgical units in rural hospitals and community health centers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 81.0 Million |

| Market Forecast in 2033 | USD 126.4 Million |

| Market Growth Rate 2025-2033 | 5.07% |

Mexico Surgical Sutures Market Trends:

Growing Demand for Surgical Procedures

The growing number of surgeries in both public and private healthcare facilities in Mexico is impelling the market growth. Increased rates of chronic diseases like cardiovascular diseases, cancer, and diabetes are causing a rise in both elective and emergency surgeries. Furthermore, Mexico's aged population also contributes towards an additional surgical burden, as there are more orthopedic, ophthalmologic, and general surgeries required among older patients. Public health programs also contribute significantly in offering access to surgical services for lower-income segments, indirectly catalyzing the demand for consumables such as sutures. In 2025, Mexico’s government plans to achieve universal health coverage with Health Sector Plan 2024-2030. The growth in private hospitals and medical tourism, particularly in border states, drives the demand further, making surgical sutures an integral part of contemporary healthcare delivery in the nation.

Advancements in Suture Technologies

Technological advancements in suture material and design are contributing to the market growth. Contemporary surgical sutures now feature products such as absorbable synthetic types, antimicrobial protective coatings, and barbed sutures that provide enhanced wound healing, reduced infection rates, and greater procedural efficiency. These features are especially relevant in minimally invasive and robotic surgical procedures, where accuracy and decreased tissue damage are paramount. Global producers are launching sophisticated product lines specific to Mexican markets, frequently accompanied by training and distribution alliances. The presence of technologically advanced products increases surgeon preference, enhances patient outcomes, and facilitates the transition towards high-quality healthcare standards. Additionally, the implementation of advanced sterilization techniques and regulatory conformity with global standards increases confidence in the use of technologically superior sutures and makes them a choice of preference in multiple specialties.

Strengthening Healthcare Infrastructure and Government Initiatives

The Mexican government is investing significant amounts in upgrading the healthcare system. Plans to increase the availability of healthcare in rural and underserved areas have resulted in the opening up of additional surgical units in rural hospitals and community health centers. Moreover, government procurement by institutions such as Mexican Institute of Social Security and Institute of Security and Services of State Workers contributes significantly to surgical supplies, providing a consistent demand. Policies to boost domestic production of medical devices also promote local manufacturing of surgical sutures, which can provide cost benefits and enhanced supply chain resilience. These state initiatives increase access, affordability, and availability of surgical materials and instruments, with a view to suture products always being part of wider national health goals like minimization of post-surgical complications and enhancement of recovery rates. The government is also promoting connected healthcare system in the country to improve patient outcomes. The IMARC Group predicts that the Mexico connected healthcare market size is expected to reach USD 10,586.4 Million by 2033.

Mexico Surgical Sutures Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, material, application, and end user.

Type Insights:

- Absorbable Sutures

- Non-Absorbable Sutures

The report has provided a detailed breakup and analysis of the market based on the type. This includes absorbable sutures and non-absorbable sutures.

Material Insights:

- Monofilament

- Multifilament

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes monofilament and multifilament.

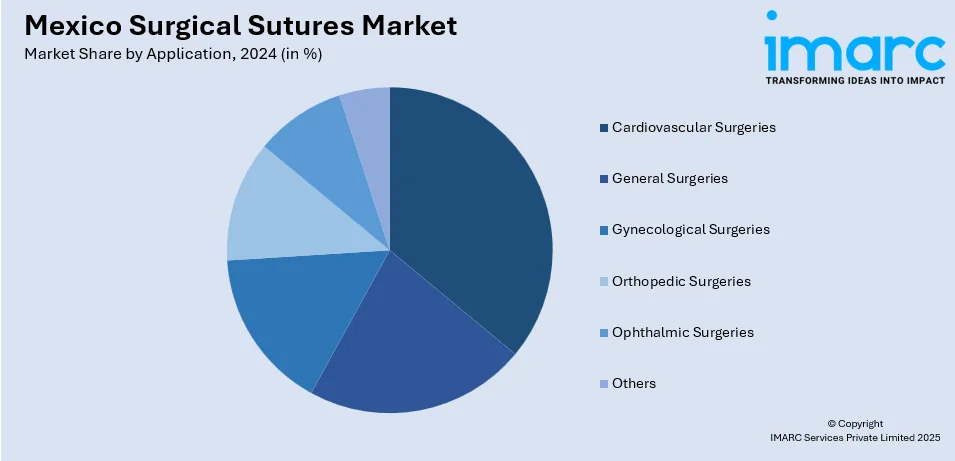

Application Insights:

- Cardiovascular Surgeries

- General Surgeries

- Gynecological Surgeries

- Orthopedic Surgeries

- Ophthalmic Surgeries

- Others

A detailed breakup and analysis of the market based on the XX have also been provided in the report. This includes cardiovascular surgeries, general surgeries, gynecological surgeries, orthopedic surgeries, ophthalmic surgeries, and others.

End User Insights:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, ambulatory surgical centers, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Surgical Sutures Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Absorbable Sutures, Non-Absorbable Sutures |

| Materials Covered | Monofilament, Multifilament |

| Applications Covered | Cardiovascular Surgeries, General Surgeries, Gynecological Surgeries, Orthopedic Surgeries, Ophthalmic Surgeries, Others |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgical Centers, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico surgical sutures market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico surgical sutures market on the basis of type?

- What is the breakup of the Mexico surgical sutures market on the basis of material?

- What is the breakup of the Mexico surgical sutures market on the basis of application?

- What is the breakup of the Mexico surgical sutures market on the basis of end user?

- What is the breakup of the Mexico surgical sutures market on the basis of region?

- What are the various stages in the value chain of the Mexico surgical sutures market?

- What are the key driving factors and challenges in the Mexico surgical sutures market?

- What is the structure of the Mexico surgical sutures market and who are the key players?

- What is the degree of competition in the Mexico surgical sutures market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico surgical sutures market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico surgical sutures market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico surgical sutures industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)