Mexico Synthetic Rubber Market Size, Share, Trends and Forecast by Type, Form, Application, and Region, 2025-2033

Mexico Synthetic Rubber Market Overview:

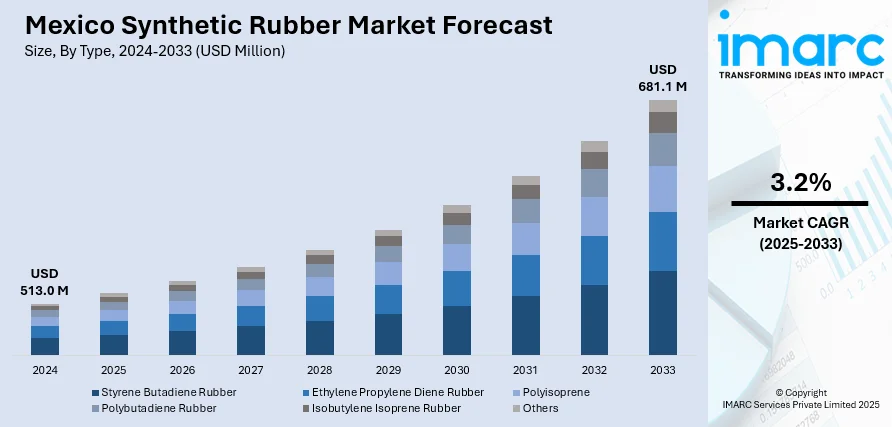

The Mexico synthetic rubber market size reached USD 513.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 681.1 Million by 2033, exhibiting a growth rate (CAGR) of 3.2% during 2025-2033. The market growth is fueled by growing demand from the automotive and manufacturing sectors, higher consumption in the tire industry, and strong industrial expansion. Moreover, favorable government policies, infrastructure advancements, and expanding automotive production capacity are further increasing Mexico synthetic rubber market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 513.0 Million |

| Market Forecast in 2033 | USD 681.1 Million |

| Market Growth Rate 2025-2033 | 3.2% |

Mexico Synthetic Rubber Market Trends:

Expanding Automotive Industry

The rapidly growing automotive industry in Mexico significantly drives the demand for synthetic rubber, particularly in the production of tires and automotive components. For instance, industry reports highlight that as of 2024, Mexico produces 3.8 million vehicles annually, ranks 7th globally, exports 3.3 million units, with the automotive sector contributing 4.7% to national GDP and 21.7% to manufacturing GDP, while 87% of Tier 1 auto parts production is exported and 13% is used domestically. Mexico has emerged as a significant center for automotive production owing to its close proximity to the American market and cost-effective production capabilities. With increased investment from global automobile firms in manufacturing plants in Mexico, demand for synthetic rubber, an essential raw material in tires, seals, and hoses, keeps growing. Moreover, the transition towards electric vehicles (EVs) adds new usage areas for synthetic rubber in EV tires, further enhancing the market size. The automotive sector’s robust expansion remains one of the primary forces propelling the Mexico synthetic rubber market growth.

To get more information of this market, Request Sample

Technological Innovations in Rubber Production

Technological innovation in synthetic rubber production is revolutionizing the Mexican market by improving product quality and reducing production costs. Developments such as the production of environmentally friendly, high-performance synthetic rubbers have gained popularity as increasingly sustainable options become the pursuit of industries. More recent, environmentally friendly technologies for the manufacture of synthetic rubber, including bio-based types, adhere to worldwide forces of sustainability and meet increasing consumer and regulatory demands for environmentally friendly products. Additionally, advances in polymer blend technologies have enhanced properties of synthetic rubbers to meet a range of specialized applications. The innovations not only render the production of rubber in Mexico more effective but also position the country among the players in the international market for synthetic rubber. For instance, in December 2024, Mesnac, a global leader in rubber processing machinery, invested USD 20 Million in a new production plant in León, Guanajuato, Mexico. This investment aims to cater to the region's growing demand from tire manufacturers. Mexico's strategic location, tax incentives, and strong automotive industry make it an ideal hub for this expansion. The project will contribute to local economic development through job creation and technology transfer, further consolidating Mesnac’s global position.

Mexico Synthetic Rubber Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on type, form, and application.

Type Insights:

- Styrene Butadiene Rubber

- Ethylene Propylene Diene Rubber

- Polyisoprene

- Polybutadiene Rubber

- Isobutylene Isoprene Rubber

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes styrene butadiene rubber, ethylene propylene diene rubber, polyisoprene, polybutadiene rubber, isobutylene isoprene rubber, and others.

Form Insights:

- Liquid Synthetic Rubber

- Solid Synthetic Rubber

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid synthetic rubber and solid synthetic rubber.

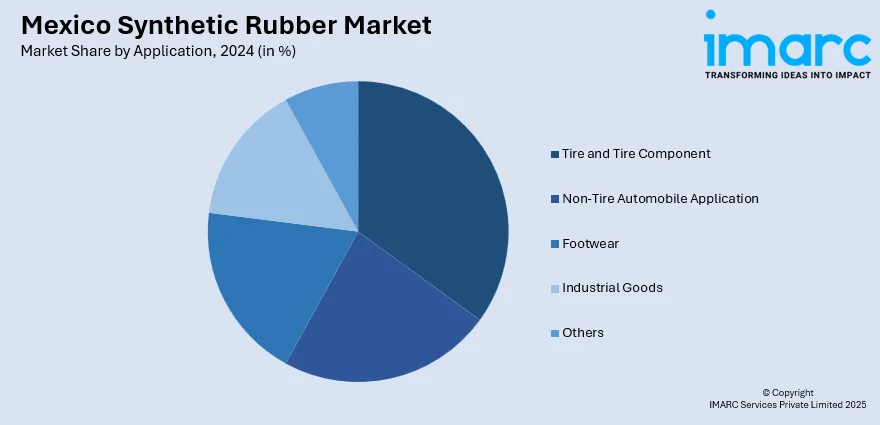

Application Insights:

- Tire and Tire Component

- Non-Tire Automobile Application

- Footwear

- Industrial Goods

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes tire and tire component, non-tire automobile application, footwear, industrial goods, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, and Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Synthetic Rubber Market News:

- In February 2025, Dynasol Elastómeros SAU secured a SODERCAN grant through the "Execution of Commercial Promotion Plans" program, aimed at enhancing R&D and innovation efforts. This grant supports Dynasol's ongoing commitment to advancing synthetic rubber solutions and expanding its global market presence. Dynasol, part of the global Dynasol Group, is recognized for its leadership in synthetic rubber production and has production centers in Spain, Mexico, and China.

Mexico Synthetic Rubber Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Styrene Butadiene Rubber, Ethylene Propylene Diene Rubber, Polyisoprene, Polybutadiene Rubber, Isobutylene Isoprene Rubber, Others |

| Forms Covered | Liquid Synthetic Rubber, Solid Synthetic Rubber |

| Applications Covered | Tire and Tire Component, Non-Tire Automobile Application, Footwear, Industrial Goods, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico synthetic rubber market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico synthetic rubber market on the basis of type?

- What is the breakup of the Mexico synthetic rubber market on the basis of form?

- What is the breakup of the Mexico synthetic rubber market on the basis of application?

- What is the breakup of the Mexico synthetic rubber market on the basis of region?

- What are the various stages in the value chain of the Mexico synthetic rubber market?

- What are the key driving factors and challenges in the Mexico synthetic rubber market?

- What is the structure of the Mexico synthetic rubber market and who are the key players?

- What is the degree of competition in the Mexico synthetic rubber market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico Synthetic rubber market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico synthetic rubber market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico synthetic rubber industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)