Mexico Tea Market Size, Share, Trends and Forecast by Product Type, Packaging, Distribution Channel, Application, and Region, 2025-2033

Mexico Tea Market Overview:

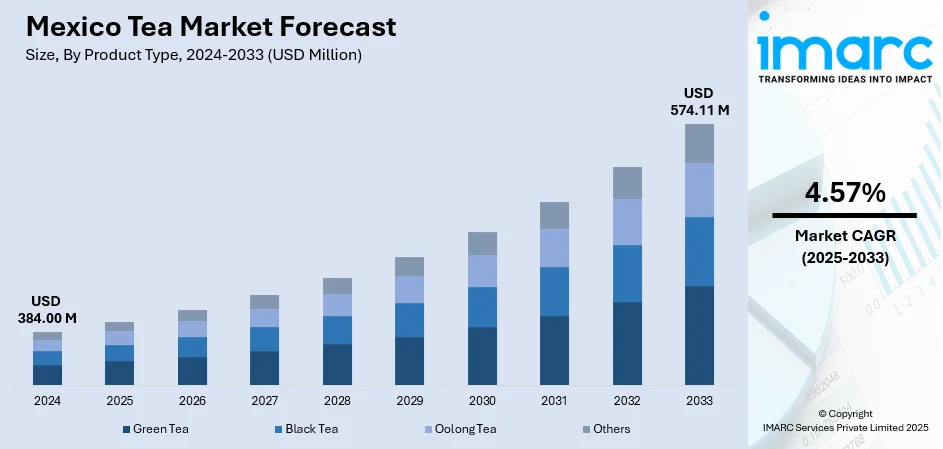

The Mexico tea market size reached USD 384.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 574.11 Million by 2033, exhibiting a growth rate (CAGR) of 4.57% during 2025-2033. The market is experiencing a steady growth due to rapid urbanization, rising awareness about health and wellness, increasing demand for herbal and green teas, and expanding ready-to-drink (RTD) beverage options across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 384.00 Million |

| Market Forecast in 2033 | USD 574.11 Million |

| Market Growth Rate 2025-2033 | 4.57% |

Mexico Tea Market Trends:

Rising Health and Wellness Awareness

Health and wellness trends are significantly influencing consumer behavior in Mexico's beverage market, with tea emerging as a preferred option among health-conscious individuals. People are increasingly turning to herbal, green, and functional teas not just for hydration, but for specific health benefits such as improved digestion, immune support, detoxification, and stress relief. This shift is particularly noticeable among urban populations and middle-income groups who are adopting healthier lifestyles and reducing their intake of sugary soft drinks and high-caffeine beverages. Chamomile, hibiscus (jamaica), green tea, and blends infused with ingredients like ginger, turmeric, and lemongrass are gaining popularity due to their natural health benefits. The rise in fitness culture and preventive health practices is further accelerating this demand. With both traditional and innovative tea products gaining visibility across retail shelves and cafes, this trend is a key contributor to Mexico tea market growth.

Expansion of Ready-to-Drink (RTD) Tea Segment

The Ready-to-Drink (RTD) tea segment is rapidly expanding in Mexico, fueled by urbanization, convenience-driven lifestyles, and growing health awareness. Consumers are increasingly opting for bottled and canned teas as refreshing, low-sugar alternatives to sodas and energy drinks. Iced green tea, black tea, and herbal infusions such as hibiscus and lemon-mint are especially popular for their functional benefits and easy portability. The younger demographic, in particular, values these beverages for their flavor, wellness positioning, and availability across vending machines, supermarkets, and convenience stores. Local and international brands are launching a range of RTD teas in innovative flavors and packaging formats, including organic and sugar-free versions, to meet rising demand. With improved cold chain infrastructure and rising disposable income, the segment is poised for further expansion. This convenience-led trend is expected to significantly shape the Mexico tea market outlook in the coming years.

Growth of Herbal and Traditional Infusions

Herbal and traditional infusions continue to dominate consumer preferences in Mexico, driven by deep-rooted cultural habits and growing health awareness. Chamomile, hibiscus (locally known as jamaica), lemongrass, and mint teas are widely consumed across households for their soothing, digestive, and immune-supporting qualities. These infusions are often associated with natural remedies passed down through generations, making them a trusted choice among all age groups. Their caffeine-free nature and therapeutic reputation make them appealing alternatives to coffee and sugary drinks. In addition to home consumption, cafés and restaurants are increasingly offering herbal blends as part of wellness-focused menus. Local producers are expanding product lines with organic and mixed-herb variants, while packaging innovations such as pyramid bags and compostable sachets enhance consumer appeal. This sustained popularity and market penetration of traditional blends significantly contribute to Mexico tea market share across both retail and foodservice channels.

Mexico Tea Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, packaging, distribution channel, and application.

Product Type Insights:

- Green Tea

- Black Tea

- Oolong Tea

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes green tea, black tea, oolong tea, and others.

Packaging Insights:

- Plastic Containers

- Loose Tea

- Paper Boards

- Aluminium Tin

- Tea Bags

- Others

A detailed breakup and analysis of the market based on the packaging have also been provided in the report. This includes plastic containers, loose tea, paper boards, aluminum tin, tea bags, and others.

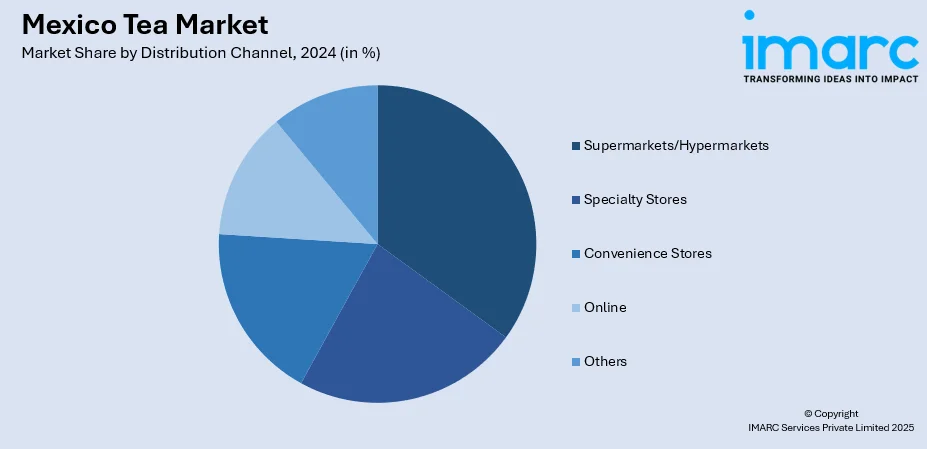

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, specialty stores, convenience stores, online, and others.

Application Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Tea Market News:

- In January 2025, Jarritos announced JARRIBOBA, a fusion of green tea and popping boba that combines Taiwanese bubble tea traditions with Mexican flavors. Available in Kiwi-Watermelon, Mango-Passion Fruit, and Strawberry-Guava, JARRIBOBA is now sold in select U.S. markets, including Atlanta and soon in Phoenix and Tucson.

- In May 2024, the Coffee Bean & Tea Leaf signed a deal with Kat Williams to open 10 locations in New Mexico. Williams, a local entrepreneur with over 25 years of business experience, aims to introduce the brand’s unique coffee and tea offerings while promoting female entrepreneurship in her community.

Mexico Tea Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Green Tea, Black Tea, Oolong Tea, Others |

| Packaging Covered | Plastic Containers, Loose Tea, Paper Boards, Aluminium Tin, Tea Bags, Others |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online, Others |

| Applications Covered | Residential, Commercial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico tea market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico tea market on the basis of product type?

- What is the breakup of the Mexico tea market on the basis of packaging?

- What is the breakup of the Mexico tea market on the basis of distribution channel?

- What is the breakup of the Mexico tea market on the basis of application?

- What is the breakup of the Mexico tea market on the basis of region?

- What are the various stages in the value chain of the Mexico tea market?

- What are the key driving factors and challenges in the Mexico tea market?

- What is the structure of the Mexico tea market and who are the key players?

- What is the degree of competition in the Mexico tea market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico tea market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico tea market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico tea industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)