Mexico Television Market Size, Share, Trends and Forecast by Technology, Screen Size, Features, End User, and Region, 2025-2033

Mexico Television Market Overview:

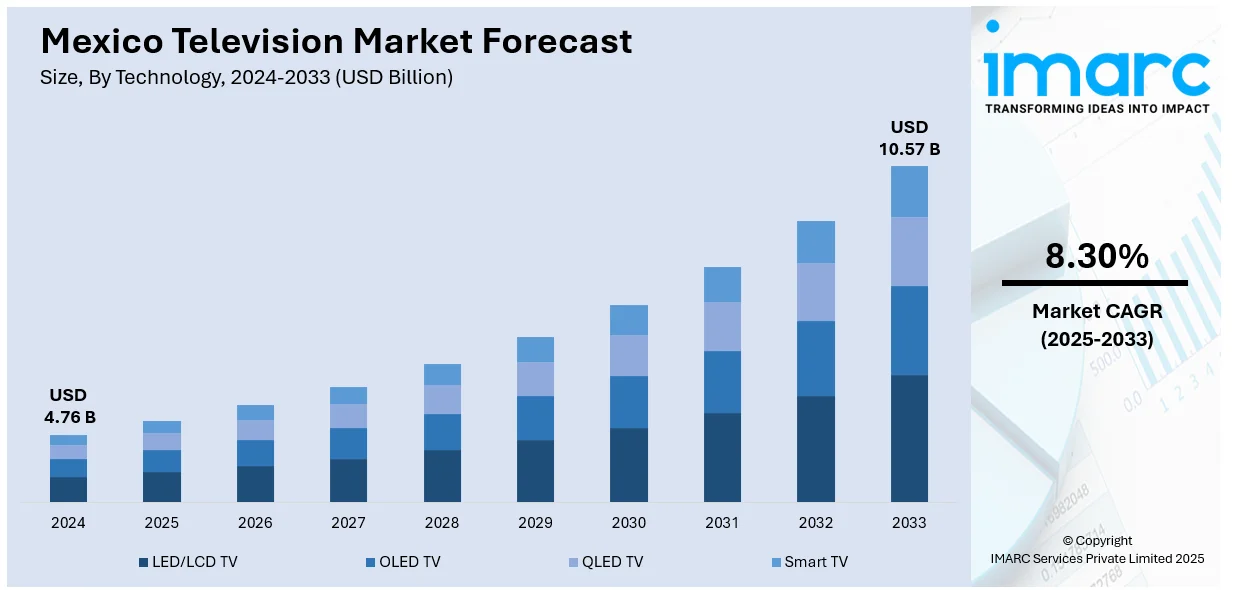

The Mexico television market size reached USD 4.76 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.57 Billion by 2033, exhibiting a growth rate (CAGR) of 8.30% during 2025-2033. The market is driven by the rapid adoption of streaming services, fueled by affordable internet and mobile device usage. Demand for localized and original content is rising, with global and domestic platforms investing in Mexican productions. Additionally, shifting advertising budgets toward digital platforms and changing viewer preferences for on-demand content are further expanding the Mexico television market share, pushing traditional broadcasters to innovate.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.76 Billion |

| Market Forecast in 2033 | USD 10.57 Billion |

| Market Growth Rate 2025-2033 | 8.30% |

Mexico Television Market Trends:

Growth of Streaming Services and Decline in Traditional TV Viewership

The market is experiencing a significant shift as streaming platforms gain popularity, leading to a decline in traditional TV viewership. Services including Netflix, Amazon Prime Video, and Disney+ are expanding rapidly due to affordable subscription plans and localized content. Younger audiences, in particular, prefer on-demand streaming over scheduled programming, driving broadcasters to adapt by launching their own digital platforms, such as Televisa’s Blim and TV Azteca’s A+. Additionally, the rise of mobile internet accessibility has fueled this trend, with more consumers watching content on smartphones and tablets. 94% of internet users in Mexico are connected to the web through smart devices at home. In 2023, 81.2% of the population used the Internet, up 9.7 percentage points since 2020, which points to progress in the digital inclusion of the population. The data highlights significant opportunities for televisions as digital engagement grows across rural and urban centers. While free-to-air TV remains relevant among older demographics, advertisers are increasingly shifting budgets toward digital platforms to reach tech-savvy viewers. This transition is reshaping Mexico’s media landscape, pushing traditional networks to innovate through hybrid models that combine linear TV with streaming options to retain audiences and remain competitive.

Escalating Demand for Localized and Original Content

The rising demand for localized and original content, driven by both streaming services and traditional broadcasters, is favoring the Mexico television market growth. International platforms such as Netflix and HBO Max are investing heavily in Mexican productions, including dramas, comedies, and documentaries, to cater to regional tastes. Shows such as La Casa de las Flores (Netflix) and Luis Miguel: La Serie (Telemundo/Netflix) have demonstrated the global appeal of Mexican storytelling. On 21st February, 2025, Netflix announced a USD 1 Billion investment to make about 20 original movies and TV shows annually in Mexico for the next four years, thus strengthening its regional content strategy. CEO Ted Sarandos has confirmed new collaborations, the development of jobs, and cooperation with Estudios Churubusco to develop talent and promote the local television sector. This major investment reflects Mexico's status as a production hub, leveraging its diverse landscapes and cultural richness for international streaming viewers. Meanwhile, domestic networks are focusing on telenovelas and reality shows with cultural relevance to maintain viewer loyalty. This trend highlights the importance of culturally resonant narratives in attracting audiences, as viewers increasingly seek relatable content. As competition intensifies, content creators are prioritizing high-quality productions with local talent, further strengthening Mexico’s position as a key region in the global entertainment industry.

Mexico Television Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, screen size, features, and end user.

Technology Insights:

- LED/LCD TV

- OLED TV

- QLED TV

- Smart TV

The report has provided a detailed breakup and analysis of the market based on the technology. This includes LED/LCD TV, OLED TV, QLED TV, and smart TV.

Screen Size Insights:

- Small Screen (Below 32 inches)

- Medium Screen (32 to 50 inches)

- Large Screen (Above 50 inches)

A detailed breakup and analysis of the market based on the screen size have also been provided in the report. This includes small screen (below 32 inches), medium screen (32 to 50 inches), and large screen (above 50 inches).

Features Insights:

- High-Resolution Displays

- 4K

- 8K

- HDR (High Dynamic Range)

- Audio Enhancement

- Dolby Atmos

- DTS X

- Connectivity Options

- Bluetooth

- Wi-Fi

- HDMI

- Voice Control and AI Integration

The report has provided a detailed breakup and analysis of the market based on the features. This includes high-resolution displays (4K and 8K), HDR (high dynamic range), audio enhancement (Dolby Atmos and DTS X), connectivity options (Bluetooth, Wi-Fi, and HDMI), and voice control and AI integration.

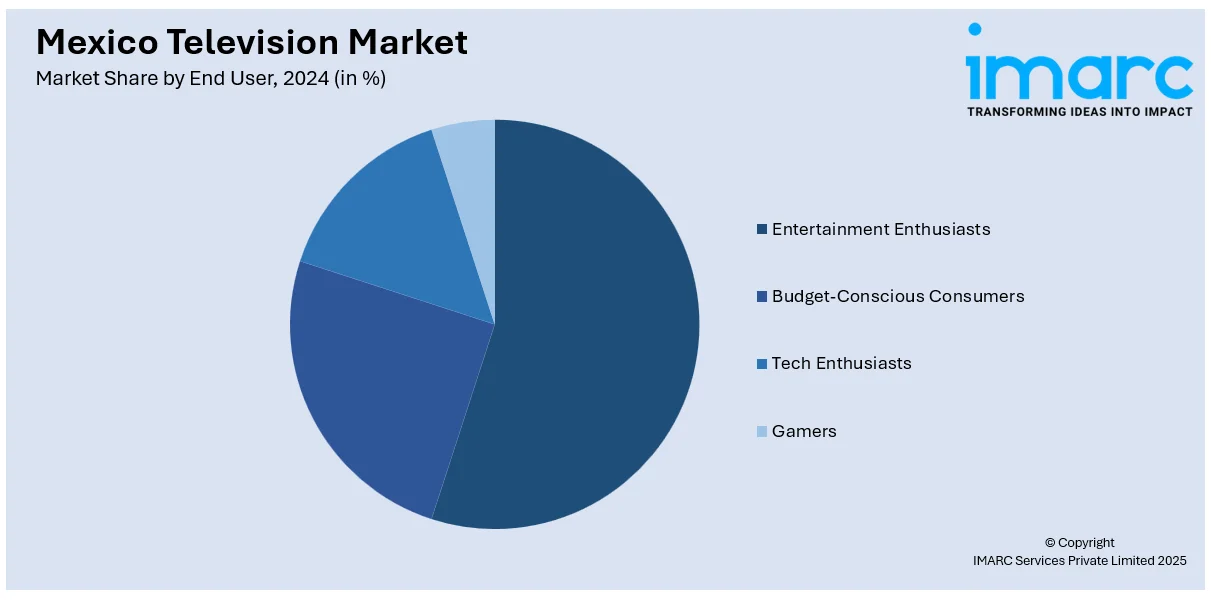

End User Insights:

- Entertainment Enthusiasts

- Budget-Conscious Consumers

- Tech Enthusiasts

- Gamers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes entertainment enthusiasts, budget-conscious consumers, tech enthusiasts, and gamers.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Television Market News:

- April 04, 2025: Hyundai launched eight new smart TVs based on Roku in Mexico, ranging from 32 inches to 60 inches and priced between MX$3,200 (approximately USD 158.64) and MX$9,500 (approximately USD 158.00). The lineup includes FHD, UHD/4K, and premium QLED models, with access to over 4,000 streaming apps and over 80 free channels on The Roku Channel. The strategic launch strengthens the footprint of Hyundai and Roku in Mexico's growing smart TV market.

Mexico Television Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | LED/LCD TV, OLED TV, QLED TV, Smart TV |

| Screen Sizes Covered | Small Screen (Below 32 inches), Medium Screen (32 to 50 inches), Large Screen (Above 50 inches) |

| Features Covered |

|

| End Users Covered | Entertainment Enthusiasts, Budget-Conscious Consumers, Tech Enthusiasts, Gamers |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico television market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico television market on the basis of technology?

- What is the breakup of the Mexico television market on the basis of screen size?

- What is the breakup of the Mexico television market on the basis of features?

- What is the breakup of the Mexico television market on the basis of end user?

- What is the breakup of the Mexico television market on the basis of region?

- What are the various stages in the value chain of the Mexico television market?

- What are the key driving factors and challenges in the Mexico television market?

- What is the structure of the Mexico television market and who are the key players?

- What is the degree of competition in the Mexico television market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico television market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico television market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico television industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)