Mexico Testing and Commissioning Market Size, Share, Trends and Forecast by Service Type, Commissioning Type, Sourcing Type, End Use Sector, and Region, 2025-2033

Mexico Testing and Commissioning Market Overview:

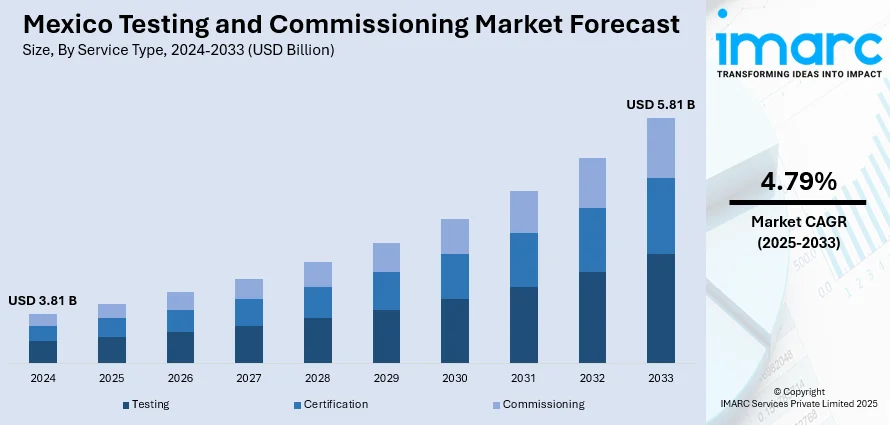

The Mexico testing and commissioning market size reached USD 3.81 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.81 Billion by 2033, exhibiting a growth rate (CAGR) of 4.79% during 2025-2033. The market is being driven by rapid infrastructure development, increasing industrial automation, stringent government regulations for safety and quality assurance, and growing demand for reliable power and energy systems, alongside the rising adoption of smart technologies and international standards across sectors, such as construction, manufacturing, transportation, and utilities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.81 Billion |

| Market Forecast in 2033 | USD 5.81 Billion |

| Market Growth Rate 2025-2033 | 4.79% |

Mexico Testing and Commissioning Market Trends:

Infrastructure Development and Smart City Initiatives

One of the key drivers of Mexico's testing and commissioning market is the fast development of infrastructure projects, including the roll-out of smart city projects throughout the nation. The government of Mexico has made significant investments in mega-scale infrastructure projects like transportation systems (e.g., railways, highways, and airports), renewable energy facilities, industrial parks, and urban residential developments. These projects demand stringent testing and commissioning to meet national and international safety standards prior to being operational. Smart city initiatives in Mexico City, Guadalajara, and Monterrey are incorporating advanced technologies like IoT sensors, smart traffic systems, and digital management of utilities. Each of these needs careful commissioning to work properly as part of a larger digital ecosystem. With the increased complexity of urban infrastructure, there is a greater need for expert testing and commissioning services. Moreover, Mexico's rising dependence on public-private partnerships (PPPs) in infrastructure construction implies that third-party testing is becoming the norm to maintain transparency, quality control, and accountability.

Growing Industrial Automation and Export-Driven Manufacturing Sector

Another key driver is the expansion of Mexico’s manufacturing and export-oriented industrial automation sectors. The country has positioned itself as a leading manufacturing hub, with a strong focus on automotive, aerospace, electronics, and medical devices. As a large percentage of GDP in the country remains export-dependent (about 33% export-to-GDP ratio), quality assurance is critical, and stringent testing and commissioning are inevitable parts of the production process. As manufacturers move to Industry 4.0 technologies — like robotics, machine learning, real-time monitoring systems, and predictive maintenance — manufacturing system complexity rises exponentially. Every combined process or system needs to be extensively tested for efficiency, safety, and consistency with international export standards like ISO, IEC, and many more. Failure here may result in expensive recalls, regulatory fines, or international business loss. In addition, multinational companies doing business in Mexico tend to introduce strict internal requirements that call for extensive commissioning procedures. This development not only increases the benchmark for local testing service companies but also fosters innovation and implementation of the latest testing technologies.

Mexico Testing and Commissioning Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on service type, commissioning type, sourcing type, and end use sector,.

Service Type Insights:

- Testing

- Certification

- Commissioning

The report has provided a detailed breakup and analysis of the market based on the service type. This includes testing, certification, and commissioning.

Commissioning Type Insights:

- Initial Commissioning

- Retro Commissioning

- Monitor-Based Commissioning

A detailed breakup and analysis of the market based on the commissioning type have also been provided in the report. This includes initial commissioning, retro commissioning, and monitor-based commissioning.

Sourcing Type Insights:

- Inhouse

- Outsourced

The report has provided a detailed breakup and analysis of the market based on the sourcing type. This includes inhouse and outsourced.

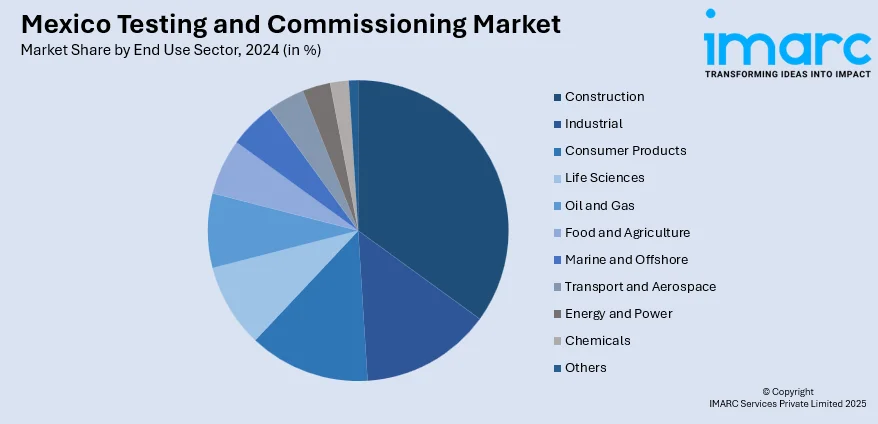

End Use Sector Insights:

- Construction

- Industrial

- Consumer Products

- Life Sciences

- Oil and Gas

- Food and Agriculture

- Marine and Offshore

- Transport and Aerospace

- Energy and Power

- Chemicals

- Others

A detailed breakup and analysis of the market based on the end use sector have also been provided in the report. This includes construction, industrial, consumer products, life sciences, oil and gas, food and agriculture, marine and offshore, transport and aerospace, energy and power, chemicals, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Testing and Commissioning Market News:

- November 2024: UL Solutions expanded its Querétaro, Mexico laboratory to meet growing demand for product testing in Latin America. The expansion included comprehensive testing and commissioning processes, ensuring the laboratory met stringent safety and performance standards. The facility also achieved certification as an external partner laboratory for Volkswagen de Mexico, enabling it to test automotive components according to the automaker's specifications.

- July 2024: SGS expanded its labs in Mexico City and Guadalajara, boosting testing capabilities for automotive components, furniture items, and toys. New services like BIFMA X5.1 and ASTM F963 certifications supported US market entry, driving demand for compliance testing.

Mexico Testing and Commissioning Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Testing, Certification, Commissioning |

| Commissioning Types Covered | Initial Commissioning, Retro Commissioning, Monitor-Based Commissioning |

| Sourcing Types Covered | Inhouse, Outsourced |

| End Use Sectors Covered | Construction, Industrial, Consumer Products, Life Sciences, Oil and Gas, Food and Agriculture, Marine and Offshore, Transport and Aerospace, Energy and Power, Chemicals, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico testing and commissioning market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico testing and commissioning market on the basis of service type?

- What is the breakup of the Mexico testing and commissioning market on the basis of commissioning type?

- What is the breakup of the Mexico testing and commissioning market on the basis of sourcing type?

- What is the breakup of the Mexico testing and commissioning market on the basis of end use sector?

- What are the various stages in the value chain of the Mexico testing and commissioning market?

- What are the key driving factors and challenges in the Mexico testing and commissioning market?

- What is the structure of the Mexico testing and commissioning market and who are the key players?

- What is the degree of competition in the Mexico testing and commissioning market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico testing and commissioning market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico testing and commissioning market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico testing and commissioning industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)