Mexico Textile Chemicals Market Size, Share, Trends and Forecast by Fiber Type, Product Type, Application, and Region, 2025-2033

Mexico Textile Chemicals Market Overview:

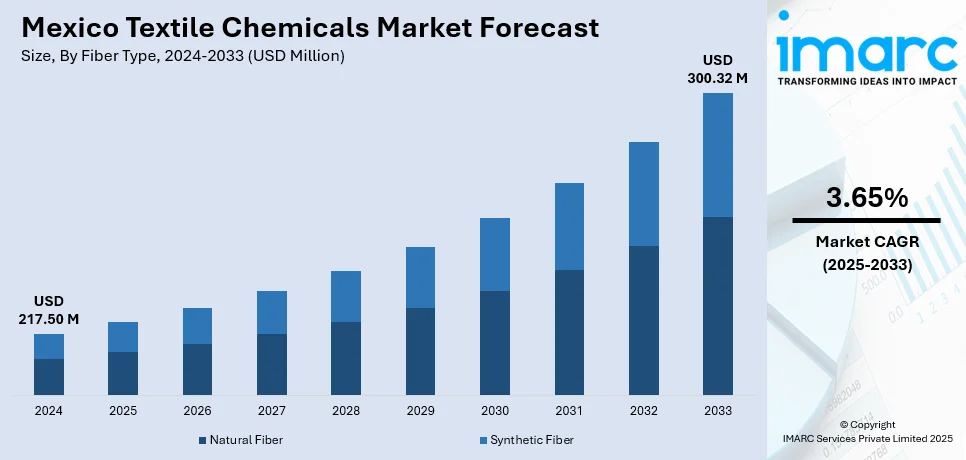

The Mexico textile chemicals market size reached USD 217.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 300.32 Million by 2033, exhibiting a growth rate (CAGR) of 3.65% during 2025-2033. The market is being shaped by growing demand for sustainable processing solutions, local production challenges due to climate issues, and rising global investment in green chemical technologies. These factors are also influencing Mexico textile chemicals market share, as producers focus on eco-friendly formulations and technological upgrades to stay competitive both locally and internationally.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 217.50 Million |

| Market Forecast in 2033 | USD 300.32 Million |

| Market Growth Rate 2025-2033 | 3.65% |

Mexico Textile Chemicals Market Trends:

Rising Emphasis on Sustainable Inputs

Mexico’s textile chemicals sector is experiencing a shift toward eco-friendly and performance-enhancing solutions as global brands demand cleaner supply chains. Sustainable dyes, low-impact processing agents, and water-efficient technologies are being adopted to meet environmental benchmarks and reduce overall resource consumption. This growing emphasis is further supported by international players bringing innovation into the country. In June 2022, Huntsman Textile Effects highlighted its commitment to green solutions by showcasing eco-friendly dyes and durable water-repellent technologies at Techtextil in Frankfurt. With operational facilities in Mexico, the company reinforced the country’s role in sustainable production by offering technologies like AVITERA SE dyes that reduce water and energy usage by up to 50%. Such advancements are positioning Mexico as a responsible supplier of value-added textile chemicals. As more brands source from Mexico, the push toward certifications like OEKO-TEX and bluesign is also gaining momentum, fostering innovation and compliance across textile production units, thereby propelling Mexico textile chemicals market growth.

Supply Chain Disruptions and Local Risks

Environmental challenges are reshaping production dynamics in Mexico’s textile chemicals market. Water scarcity and climate-related disruptions have impacted operations in key chemical hubs. In May 2024, Chemours halted titanium dioxide production in Altamira due to severe drought and government-mandated water usage restrictions. This suspension affected the availability of important inputs used in textile coatings, dyes, and printing processes. Similarly, Vestolit and Ineos Styrolution, which also serve the broader chemical and polymer supply chain, paused their operations, highlighting how vulnerable the region’s infrastructure is to environmental stress. These disruptions are driving local manufacturers to adopt more resilient and low-water technologies while prompting authorities to rethink resource allocation for industrial use. The focus is now shifting toward building robust, sustainable infrastructure that minimizes exposure to such risks. Companies are also increasing investments in closed-loop water systems and sustainable feedstocks to stabilize output and maintain their export commitments. These challenges are not just short-term supply issues they are actively influencing procurement decisions, process upgrades, and capital planning in the Mexican textile chemicals sector.

Mexico Textile Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on fiber type, product type, and application.

Fiber Type Insights:

- Natural Fiber

- Synthetic Fiber

The report has provided a detailed breakup and analysis of the market based on the fiber type. This includes natural fiber and synthetic fiber.

Product Type Insights:

- Coating and Sizing Chemicals

- Finishing Agents

- Colorants and Auxiliaries

- Surfactants

- Desizing Agents

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes coating and sizing chemicals, finishing agents, colorants and auxiliaries, surfactants, desizing agents, and others.

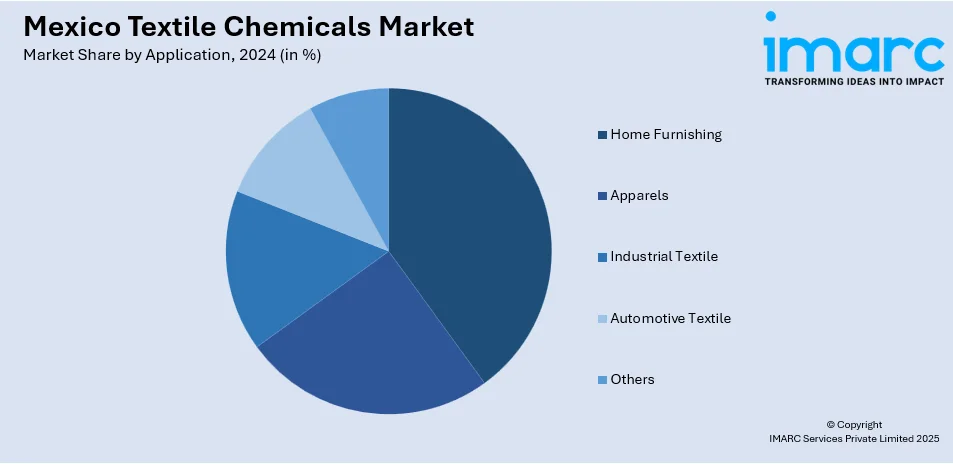

Application Insights:

- Home Furnishing

- Apparels

- Industrial Textile

- Automotive Textile

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes home furnishing, apparels, industrial textile, automotive textile, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Textile Chemicals Market News:

- March 2025: NEXTCHEM secured a licensing deal for its NX AdWinMethanol Zero technology at Pacifico Mexinol’s ultra-low carbon methanol plant in Mexico. Scheduled for 2028, the project enhanced sustainable feedstock availability for textile chemicals, supporting Mexico’s shift toward cleaner industrial chemical production.

- May 2024: Chemours halted titanium dioxide production in Altamira, Mexico, due to severe drought and government water restrictions. The suspension, affecting key inputs for textile chemicals, disrupted regional supply chains and highlighted the vulnerability of Mexico’s textile chemicals market to environmental and resource challenges.

Mexico Textile Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fiber Types Covered | Natural Fiber, Synthetic Fiber |

| Product Types Covered | Coating and Sizing Chemicals, Finishing Agents, Colorants and Auxiliaries, Surfactants, Desizing Agents, Others |

| Applications Covered | Home Furnishing, Apparels, Industrial Textile, Automotive Textile, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico textile chemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico textile chemicals market on the basis of fiber type?

- What is the breakup of the Mexico textile chemicals market on the basis of product type?

- What is the breakup of the Mexico textile chemicals market on the basis of application?

- What is the breakup of the Mexico textile chemicals market on the basis of region?

- What are the various stages in the value chain of the Mexico textile chemicals market?

- What are the key driving factors and challenges in the Mexico textile chemicals market?

- What is the structure of the Mexico textile chemicals market and who are the key players?

- What is the degree of competition in the Mexico textile chemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico textile chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico textile chemicals market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico textile chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)