Mexico Tissue Paper Market Size, Share, Trends and Forecast by Product Type, Raw Material, Distribution Channel, Application, and Region, 2026-2034

Mexico Tissue Paper Market Overview:

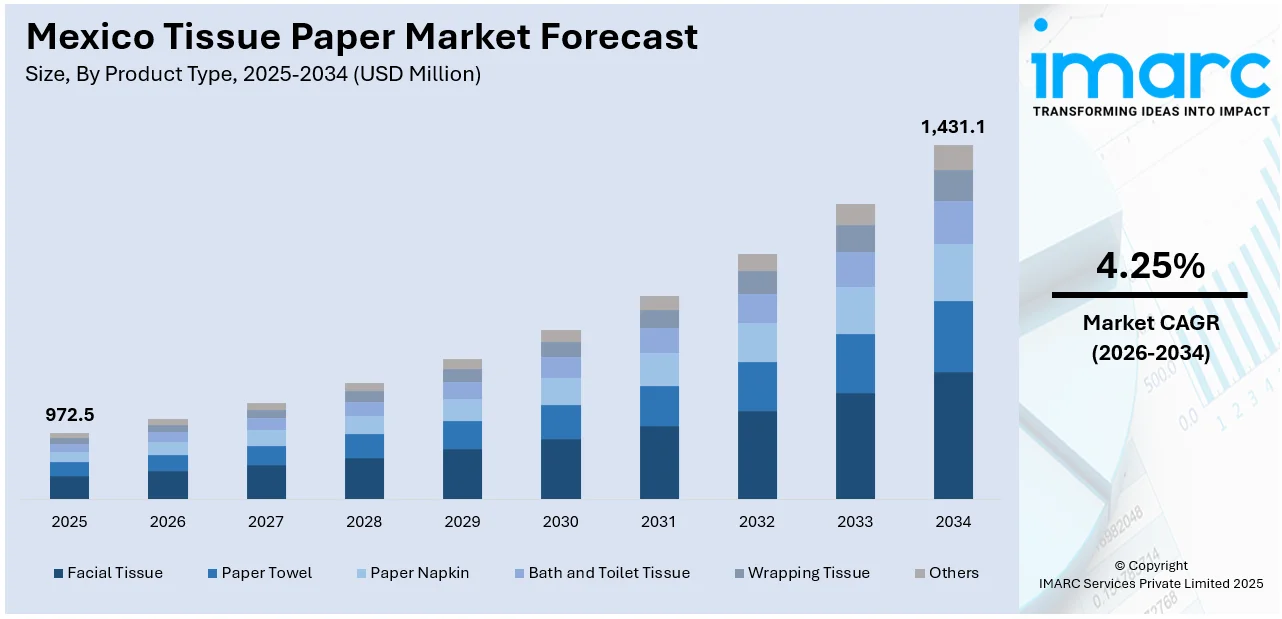

The Mexico tissue paper market size reached USD 972.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,431.1 Million by 2034, exhibiting a growth rate (CAGR) of 4.25% during 2026-2034. The market is propelled by consumer trends like heightened demand for hygiene and convenience, rising awareness about sustainability, growth in disposable income, and development of retail and e-commerce channels. Moreover, demand for high-quality and eco-friendly tissue products is driving the Mexico tissue paper market growth and innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 972.5 Million |

| Market Forecast in 2034 | USD 1,431.1 Million |

| Market Growth Rate 2026-2034 | 4.25% |

Mexico Tissue Paper Market Trends:

Increased Demand for Sustainable and Eco-friendly Products

One of the key driving trends in Mexico's tissue paper industry is demand for sustainable and green products. Consumers are becoming increasingly environmentally aware, reflecting an increasing preference for tissue paper brands that profess sustainability. Such brands include products made from recycled fibers, sustainably sourced raw materials or environment-friendly manufacturing processes. Mexican consumers have turned away from conventional tissue paper products that contributed to deforestation and pollution, and have started preferring brands that are eco-friendly. Moreover, manufacturers are now embracing eco-technologies such as energy- and water-efficient production processes, minimizing their negative impact on the environment. Demand is also surging for products that are biodegradable and chemical-free, thereby supporting innovation in the Mexico tissue paper market share. This shift is additionally supported by national policies promoting sustainable activities, which hence provides a favorable environment for green tissue paper product offerings.

To get more information on this market Request Sample

Growth in Premium and Value-added Tissue Products

Tissue products in Mexico are rapidly moving toward premiumization and value-addition. Consumers are willing to spend more on high-quality tissue papers that promise better softness, strength, and absorbency. This is attributed to the emerging middle class becoming increasingly aware of the quality and comfort of products they come into daily contact with. High-end tissue papers, often enhanced with aloe vera or essential oils, are intended for a health-conscious, luxury-experiencing audience. Apart from this, an increase in the demand for specific products such as facial tissues, wet wipes, and antibacterial tissues has also been recorded. Companies are taking advantage of these emerging trends by tapping into innovative tissue products and creating better user experiences with the paper products. With consumers in search of additional value and pleasure from their day-to-day buying, the Mexico tissue paper market outlook is experiencing a shift toward premium tissue paper offerings, which is fueling a broader diversification of products.

Rising Online Retail and E-commerce Sales

Another major trend in the tissue paper market is the rapid development of e-commerce in Mexico. The consumer shift to online shopping is leading to increased sales of tissue paper and related products through digital channels. With its home delivery, bulk buying, and greater price comparison options, e-commerce has best served individual consumers and businesses alike. The subsequent COVID-19 pandemic saw even more people going online to shop for essentials, including tissue products. Tissue paper manufacturers and retailers are thus diversifying their online presence and partnering with giants in online retail like Amazon and Mercado Libre to reach out to more people. Subscription-based delivery of tissue products is also gaining significant traction, since it ensures regular deliveries while being user-friendly for customers. The development of online shopping channels equally provides brands with fresh opportunities to reach a broad base of consumers while meeting their need for convenience and accessibility.

Mexico Tissue Paper Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type, raw material, distribution channel, and application.

Product Type Insights:

- Facial Tissue

- Paper Towel

- Paper Napkin

- Bath and Toilet Tissue

- Wrapping Tissue

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes facial tissue, paper towel, paper napkin, bath and toilet tissue, wrapping tissue, and others.

Raw Material Insights:

- Woodfree Pulp

- Wood-containing Pulp

- Recovered Paper

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes woodfree pulp, wood-containing pulp, and recovered paper.

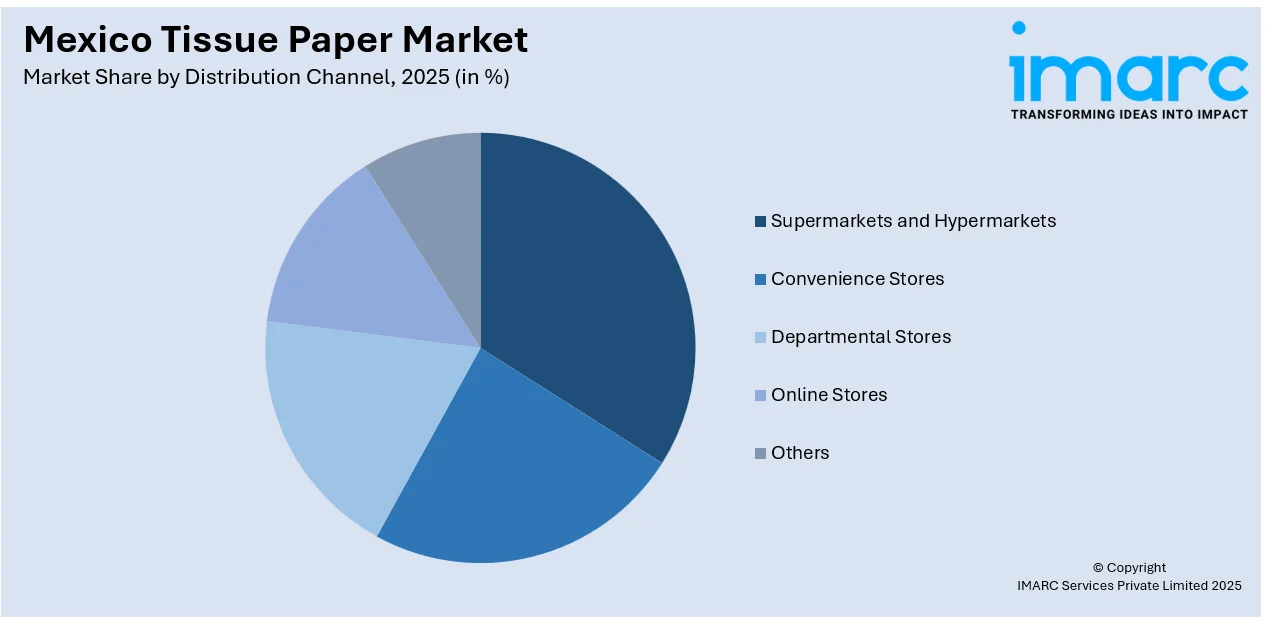

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Departmental Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, departmental stores, online stores, others.

Application Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential and commercial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Tissue Paper Market News:

- In October 2024, Mexico's Grupo Corporativo Papelera (GCP) has enhanced its standing in the U.S. market by investing in an A.Celli Paper-supplied iDEAL 2000s TM for installation at its Texas facility. GCP Paper USA, a Mexican-owned company, produces private label tissue paper items such as toilet paper, napkins, kitchen towels, facial tissues, and specialty papers. GCP runs four machines for producing paper, and the firm presently markets 85% of its goods in Mexico and 15% in the United States.

Mexico Tissue Paper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Facial Tissue, Paper Towel, Paper Napkin, Bath and Toilet Tissue, Wrapping Tissue, Others |

| Raw Materials Covered | Woodfree Pulp, Wood-containing Pulp, Recovered Paper |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Departmental Stores, Online Stores, Others |

| Applications Covered | Residential, Commercial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico tissue paper market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico tissue paper market on the basis of product type?

- What is the breakup of the Mexico tissue paper market on the basis of raw material?

- What is the breakup of the Mexico tissue paper market on the basis of distribution channel?

- What is the breakup of the Mexico tissue paper market on the basis of application?

- What is the breakup of the Mexico tissue paper market on the basis of region?

- What are the various stages in the value chain of the Mexico tissue paper market?

- What are the key driving factors and challenges in the Mexico tissue paper market?

- What is the structure of the Mexico tissue paper market and who are the key players?

- What is the degree of competition in the Mexico tissue paper market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico tissue paper market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico tissue paper market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico tissue paper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)