Mexico Toluene Market Size, Share, Trends and Forecast by Technology, Application, and Region, 2025-2033

Mexico Toluene Market Overview:

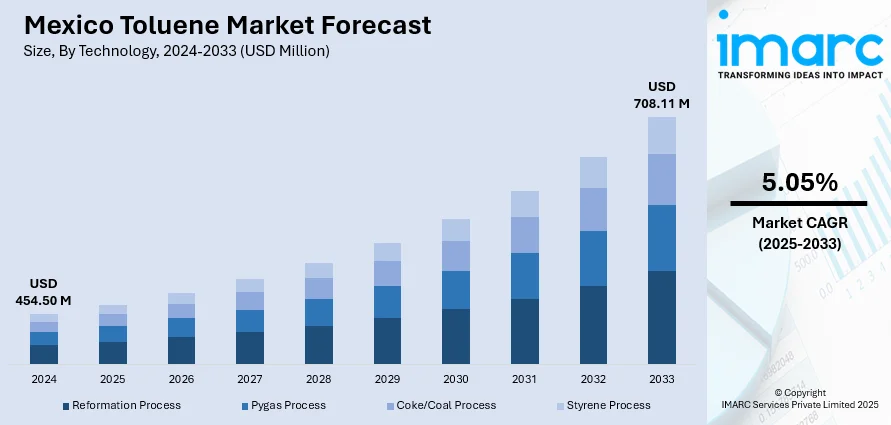

The Mexico toluene market size reached USD 454.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 708.11 Million by 2033, exhibiting a growth rate (CAGR) of 5.05% during 2025-2033. The rising demand for toluene in Mexico's chemical manufacturing, especially for benzene and xylene production, is driving market growth. In addition to this, expanding automotive and construction industries, increasing pharmaceutical applications, steady growth in consumer goods manufacturing, and the growing use of toluene as an industrial solvent in paints, coatings, adhesives, and cleaning agents are some of the major factors augmenting Mexico toluene market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 454.50 Million |

| Market Forecast in 2033 | USD 708.11 Million |

| Market Growth Rate 2025-2033 | 5.05% |

Mexico Toluene Market Trends:

Rising Demand from the Construction and Infrastructure Sector

The expansion of Mexico’s construction and infrastructure sector is increasingly driving toluene consumption. Public and private investments targeting improvements in transport networks, urban housing, and commercial facilities have strengthened the demand for toluene-based products, particularly paints, coatings, adhesives, and sealants. For instance, on March 7, 2025, the Ministry of Infrastructure, Communications, and Transport (SICT) announced the adoption of a mixed investment approach that combines public and private resources to accelerate road development initiatives. Under this model, the first five projects are set to cover more than 300 kilometers of road infrastructure, representing an investment of approximately USD 1.51 Billion. This surge in construction activities amplifies the requirement for high-performance materials, where toluene plays a critical role as a solvent, especially in the production of protective coatings essential for infrastructure exposed to demanding environmental conditions. In addition to this, government programs focused on urban regeneration projects and the growing number of industrial parks, especially in states like Nuevo León and Querétaro, are also creating new avenues for downstream industries reliant on toluene derivatives. Furthermore, architectural trends favoring modern designs with greater emphasis on aesthetic finishes are increasing the preference for high-performance paints and varnishes, indirectly supporting toluene’s consumption. This expanding use within the construction ecosystem is leading local manufacturers to secure stable toluene supply chains and invest in capacity upgrades.

Expansion of Automotive Manufacturing

The expanding automotive industry is emerging as a critical driver for the Mexico toluene market growth. As per industry reports, the country manufactured 3,989,403 light vehicles, representing a 5.6% increase compared to 2023. As a major production hub for global carmakers, there is an increasing requirement for automotive paints, synthetic rubbers, adhesives, and specialty coatings, all of which involve toluene. This, in turn, is providing an impetus to the market. In addition to this, new vehicle assembly plants in Guanajuato, San Luis Potosí, and Coahuila are attracting investments in component manufacturing, particularly in parts requiring precision coatings and bonded materials. Also, toluene’s role in producing polyurethanes and other specialty polymers used in vehicle interiors, insulation, and lightweight structures is elevating its importance. Besides this, electric vehicle (EV) investments are further contributing to this trend, as toluene-based products are utilized in battery casing adhesives and thermal insulation materials. Moreover, automakers’ increasing focus on lightweight, durable, and aesthetic components to enhance vehicle efficiency and appeal is leading to greater innovation in toluene-derived materials, intensifying domestic consumption patterns within Mexico’s manufacturing corridors.

Mexico Toluene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology and application.

Technology Insights:

- Reformation Process

- Pygas Process

- Coke/Coal Process

- Styrene Process

The report has provided a detailed breakup and analysis of the market based on the technology. This includes reformation process, pygas process, coke/coal process, and styrene process.

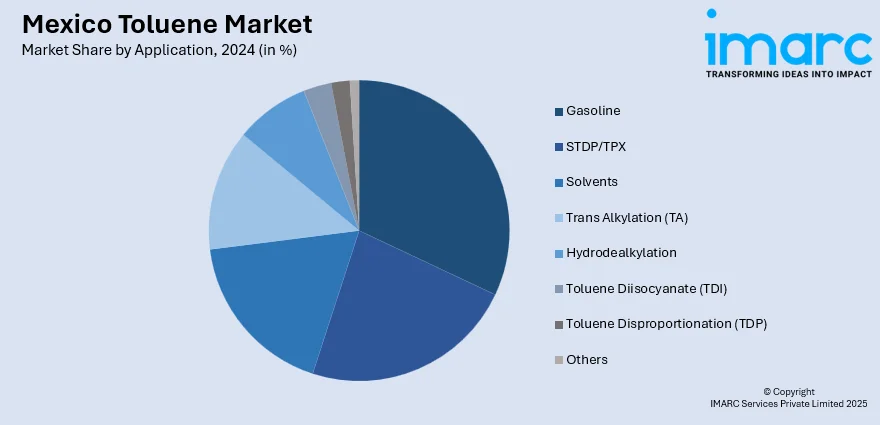

Application Insights:

- Gasoline

- STDP/TPX

- Solvents

- Trans Alkylation (TA)

- Hydrodealkylation

- Toluene Diisocyanate (TDI)

- Toluene Disproportionation (TDP)

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes gasoline, STDP/TPX, solvents, trans alkylation (TA), hydrodealkylation, toluene diisocyanate (TDI), toluene disproportionation (TDP), and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Toluene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Reformation Process, Pygas Process, Coke/Coal Process, Styrene Process |

| Applications Covered | Gasoline, STDP/TPX, Solvents, Trans Alkylation (TA), Hydrodealkylation, Toluene Diisocyanate (TDI), Toluene Disproportionation (TDP), Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico toluene market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico toluene market on the basis of technology?

- What is the breakup of the Mexico toluene market on the basis of application?

- What is the breakup of the Mexico toluene market on the basis of region?

- What are the various stages in the value chain of the Mexico toluene market?

- What are the key driving factors and challenges in the Mexico toluene market?

- What is the structure of the Mexico toluene market and who are the key players?

- What is the degree of competition in the Mexico toluene market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico toluene market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico toluene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico toluene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)