Mexico Tooling Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

Mexico Tooling Market Overview:

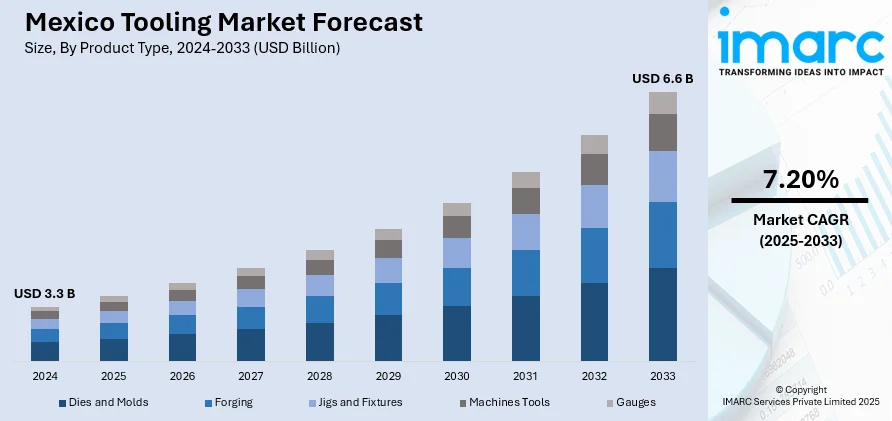

The Mexico tooling market size reached USD 3.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.6 Billion by 2033, exhibiting a growth rate (CAGR) of 7.20% during 2025-2033. The market share is expanding, driven by the increasing reliance on precision tools for mass manufacturing of vehicles, along with the rising establishment of international companies in the country, which is creating a higher need for specialized tools and machinery essential for aircraft production.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.3 Billion |

| Market Forecast in 2033 | USD 6.6 Billion |

| Market Growth Rate 2025-2033 | 7.20% |

Mexico Tooling Market Trends:

Rising vehicle production

The increasing vehicle production is fueling the Mexico tooling market growth. As reported by the National Institute of Geography and Statistics (INEGI), the Mexican automotive sector experienced a 9.8% rise in vehicle sales in 2024, totaling 1,496,806 units. As more car manufacturers set up plants and expand existing ones, the need for high-quality tools, molds, dies, and fixtures is high. Automakers rely heavily on precision tools for mass manufacturing, ranging from stamping car body parts to assembling engines and components. With Mexico becoming a key player in the worldwide automotive supply chain, especially for the US and Canada, local tooling suppliers are experiencing steady demand. Companies want equipment that are reliable, efficient, and able to keep up with large-scale operations. This is encouraging expenditure on new manufacturing technologies, such as computer numerical control (CNC) machining and automation. Local suppliers also get more opportunities to collaborate with big international players, boosting their capabilities. Moreover, vehicle models are being updated frequently, which means more tooling changes and fresh demand every few years. The rising adoption of electric vehicles (EVs) in the country is positively influencing the market, since they require effective modern tools and components. As car production continues to increase, the tooling industry is working to deliver faster, better, and more economical solutions.

Increasing foreign direct investment (FDI)

The rising FDI is offering a favorable Mexico tooling market outlook. According to the data released by the Federal Economy Ministry (SE), FDI in Mexico reached USD 36.87 Billion in 2024. FDI helps bring in capital and advanced technologies, especially in manufacturing sectors like aerospace. As international companies establish and broaden operations in Mexico, they are creating a higher need for specialized tools and machinery essential for production. This influx of FDI not only drives the demand for local tooling suppliers but also encourages the adoption of modern manufacturing techniques and quality standards. Additionally, the presence of foreign firms fosters knowledge transfer and skill development among the local workforce, enhancing the overall capabilities of the tooling industry. Government initiatives that promote FDI further stimulate infrastructure establishment, creating a more conducive environment for tooling manufacturers to thrive. Overall, the continuous flow of foreign investment strengthens Mexico's position as a competitive player in the international market.

Mexico Tooling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Dies and Molds

- Forging

- Jigs and Fixtures

- Machines Tools

- Gauges

The report has provided a detailed breakup and analysis of the market based on the product type. This includes dies and molds, forging, jigs and fixtures, machines tools, and gauges.

Material Type Insights:

- Stainless Steel

- Iron

- Aluminum

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes stainless steel, iron, aluminum, and others.

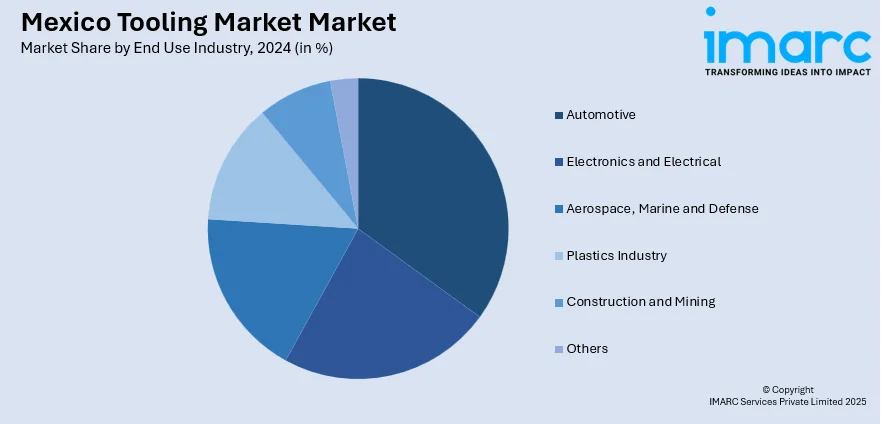

End Use Industry Insights:

- Automotive

- Electronics and Electrical

- Aerospace, Marine and Defense

- Plastics Industry

- Construction and Mining

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, electronics and electrical, aerospace, marine and defense, plastics industry, construction and mining, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Tooling Market News:

- In March 2025, Labelexpo Mexico 2025 was scheduled to occur from April 1-3 at Expo Guadalajara in the country. Nilpeter was set to present the new FB-14 flexo press, which was to be offered in a 17-inch version. The FB-Line utilized Nilpeter’s PowerLink software platform and provided enhanced automation and digitalization. A modification kit enabled the utilization of tooling from the 'classic' FB-Line presses.

- In October 2024, Nefab, a worldwide frontrunner in sustainable packaging and logistics solutions, revealed that PolyFlex, a division of Nefab Group, inaugurated its facility in León, Mexico. It aimed to enhance its manufacturing capabilities to boost in-house production of heavy gauge thermoformed packaging. Sturdy gauge-based packaging was created to safeguard intricate parts and assemblies utilized in LiB, EVs, and internal combustion engines, along with additional industrial applications, guaranteeing secure transport of valuable components, such as battery trays and stators.

Mexico Tooling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dies and Molds, Forging, Jigs and Fixtures, Machines Tools, Gauges |

| Material Types Covered | Stainless Steel, Iron, Aluminum, Others |

| End Use Industries Covered | Automotive, Electronics and Electrical, Aerospace, Marine and Defense, Plastics Industry, Construction and Mining, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico tooling market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico tooling market on the basis of product type?

- What is the breakup of the Mexico tooling market on the basis of material type?

- What is the breakup of the Mexico tooling market on the basis of end use industry?

- What is the breakup of the Mexico tooling market on the basis of region?

- What are the various stages in the value chain of the Mexico tooling market?

- What are the key driving factors and challenges in the Mexico tooling market?

- What is the structure of the Mexico tooling market and who are the key players?

- What is the degree of competition in the Mexico tooling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico tooling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico tooling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico tooling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)