Mexico Traction Control System Market Size, Share, Trends and Forecast by Type, Component, Vehicle Type, Distribution Channel, and Region, 2025-2033

Mexico Traction Control System Market Overview:

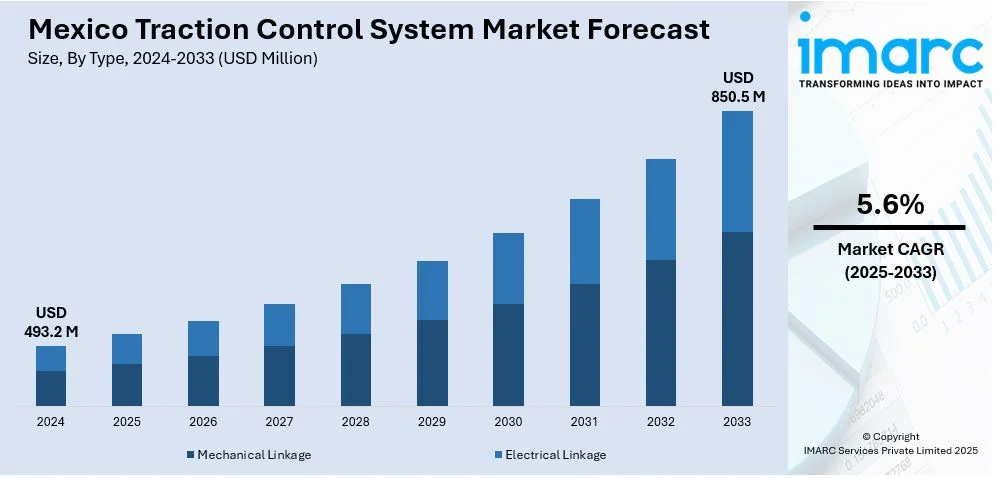

The Mexico traction control system market size reached USD 493.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 850.5 Million by 2033, exhibiting a growth rate (CAGR) of 5.6% during 2025-2033. The market share is expanding because of the growing vehicle production, rising user demand for safety, and increased investment from international original equipment manufacturers (OEMs) and suppliers that are boosting local innovation, manufacturing capacity, and the integration of advanced automotive technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 493.2 Million |

| Market Forecast in 2033 | USD 850.5 Million |

| Market Growth Rate 2025-2033 | 5.6% |

Mexico Traction Control System Market Trends:

Rising Automotive Production and Sales

Mexico has firmly established itself as a global powerhouse in automotive manufacturing, drawing sustained investment from major international automakers due to its cost-effective labor force, advantageous trade agreements, and strategic proximity to the US market. As production continues to rise, so does the integration of advanced safety technologies like traction control systems, which are increasingly being included across a broader spectrum of vehicle classes, not just in premium models. User demand for safer, more technologically sophisticated vehicles is intensifying, driven largely by a growing, younger population with rising disposable income and a strong preference for smart mobility. The Mexican Automotive Industry Association (AMIA) estimates that Mexico will become the fifth-largest global vehicle producer by the end of 2025. In 2024 alone, total automobile production reached 3,989,403 units, reflecting a 5.56% increase over 2023, with a further 2.7% growth forecasted for 2025. These figures underscore a thriving automotive ecosystem where traction control systems adoption is seen as both a functional necessity and a market differentiator. As automakers scale up output, particularly in high-demand segments like passenger cars and light trucks, the inclusion of traction control systems enhances product competitiveness, especially in export markets. Local assembly of critical components and systems also promotes faster technological adoption and adaptation within Mexico. These developments strongly support a positive Mexico traction control system market outlook, driven by robust production trends, consumer demand, and international competitiveness.

Strategic OEM and Tier-1 Supplier Investments

Leading OEMs and Tier-1 suppliers are greatly increasing their investment in Mexico’s automotive industry, promoting the use of advanced safety technologies like traction control systems. These investments typically manifest as new production plants, localized research and development efforts, and strategic alliances that bring knowledge, skills, and technology into the Mexican market. In 2024, German company Bayrak Technik and Mexican supplier IARC announced a successful partnership that developed a new center bearing for rear-wheel drive vehicles. This collaboration led to expanded production in Mexico, job creation in both countries, and improved product quality. The alliance showcased the value of intercultural cooperation and innovation in the automotive sector. Such partnerships indicate a wider movement among international companies looking to establish Mexico as a key center for vehicle production throughout North and South America. To satisfy diverse safety and performance requirements in these markets, car manufacturers are progressively incorporating traction control systems into a greater number of vehicle models. These collaborations enhance Mexico's technical framework, foster local engineering skills, and speed up the deployment of vehicle control technologies. The outcome is a more competitive, innovation-focused sector that leverages global knowledge while developing local skills. As global and local stakeholders coordinate their initiatives, these investments not only expand production but also strengthen traction control systems as a crucial component in the future of safe, dependable, and export-ready vehicles from Mexico. This surge in cross-border partnerships and technology integration is a key driver fueling Mexico traction control system market growth.

Mexico Traction Control System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and region levels for 2025-2033. Our report has categorized the market based on type, component, vehicle type, and distribution channel.

Type Insights:

- Mechanical Linkage

- Electrical Linkage

The report has provided a detailed breakup and analysis of the market based on the type. This includes mechanical linkage and electrical linkage.

Component Insights:

- Hydraulic Modulators

- ECU

- Sensors

- Others

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hydraulic modulators, ECU, sensors, and others.

Vehicle Type Insights:

- ICE Vehicles

- Electric Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes ICE vehicles and electric vehicles.

Distribution Channel Insights:

.webp)

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes OEM and aftermarket.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Traction Control System Market News:

- In May 2024, BYD launched the King plug-in hybrid sedan in Mexico, offering a 1,175 km range and priced at 499,800 pesos. It included modern features like a 12.8-inch rotating screen, OTA updates, and safety systems such as a traction control system. BYD aimed to provide an eco-friendly, high-tech driving experience at an affordable cost.

Mexico Traction Control System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mechanical Linkage, Electrical Linkage |

| Components Covered | Hydraulic Modulators, ECU, Sensors, Others |

| Vehicle Types Covered | ICE Vehicles, Electric Vehicles |

| Distribution Channels Covered | OEM, Aftermarket |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico traction control system market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico traction control system market on the basis of type?

- What is the breakup of the Mexico traction control system market on the basis of component?

- What is the breakup of the Mexico traction control system market on the basis of vehicle type?

- What is the breakup of the Mexico traction control system market on the basis of distribution channel?

- What is the breakup of the Mexico traction control system market on the basis of region?

- What are the various stages in the value chain of the Mexico traction control system market?

- What are the key driving factors and challenges in the Mexico traction control system market?

- What is the structure of the Mexico traction control system market and who are the key players?

- What is the degree of competition in the Mexico traction control system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico traction control system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico traction control system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico traction control system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)