Mexico Trade Finance Market Size, Share, Trends and Forecast by Finance Type, Offering, Service Provider, End User, and Region, 2025-2033

Mexico Trade Finance Market Overview:

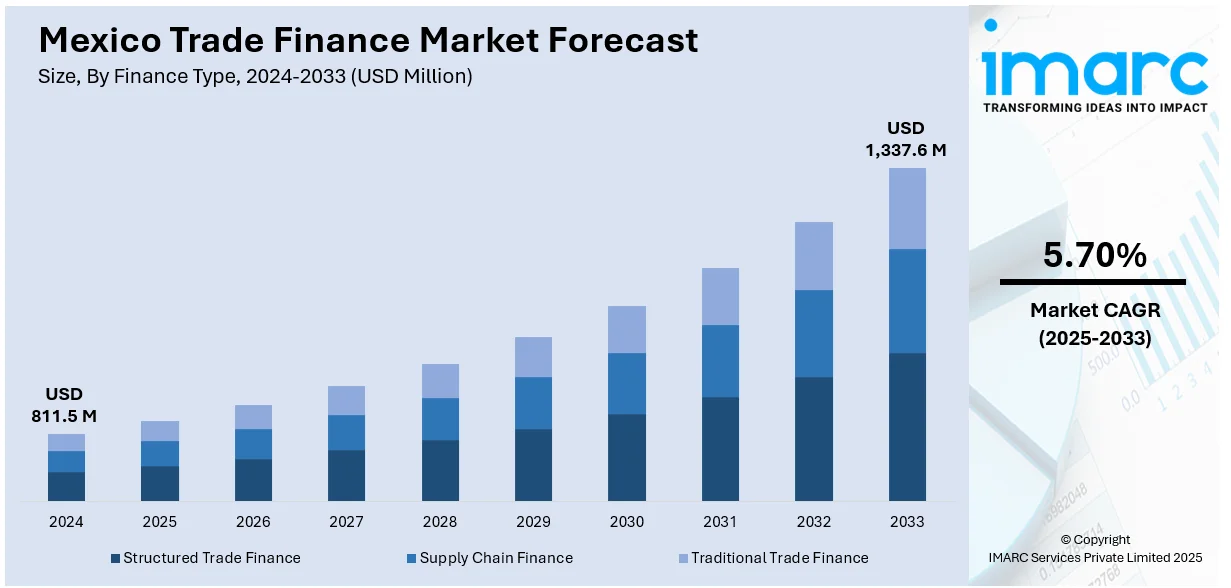

The Mexico trade finance market size reached USD 811.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,337.6 Million by 2033, exhibiting a growth rate (CAGR) of 5.70% during 2025-2033. The market is witnessing significant growth mainly driven by rising SME participation in global trade, nearshoring trends, and digital innovation in financial services. Fintech involvement and supportive policies are strengthening accessibility, boosting market growth and resilience in Mexico.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 811.5 Million |

| Market Forecast in 2033 | USD 1,337.6 Million |

| Market Growth Rate 2025-2033 | 5.70% |

Mexico Trade Finance Market Trends:

Rising Demand for Supply Chain Financing

In Mexico, supply chain finance is picking up momentum as companies look for improved cash flow management and payment protection. Exporters and importers, particularly small and medium businesses, are turning to trade finance solutions such as factoring, reverse factoring, and invoice discounting in order to free working capital tied up in receivables. This increasing dependence is being fueled by unstable global trade environments, increasing input prices, and demands to hold inventory without overstretching balance sheets. Banks, fintechs, and non-banking financial institutions are stretching their products to cater to this need, typically using digital platforms for quicker approvals and real-time monitoring. Supply chain finance also provides lower risk, better supplier relationships, and higher transactional transparency. These advantages are contributing to its rapid adoption and making it a critical component in boosting the Mexico trade finance market share.

Increased Use of Digital Trade Platforms

Digital transformation is transforming the trade finance sector in Mexico, with fintechs and banks increasingly using technologies such as blockchain, artificial intelligence, and cloud-based systems. The platforms are being utilized to automate trade documents, increase transparency, minimize errors, and limit fraud risks. Digital solutions also facilitate tracking shipment and transactions in real time, dramatically enhancing the speed and certainty of trade operations. For companies, this translates to quicker access to capital, improved compliance, and increased visibility throughout supply chains. Fintech-driven innovations are especially effective for SMEs, which tend to experience roadblocks in accessing traditional trade finance. As international trade becomes increasingly complex and digitally oriented, Mexico is positioning itself in line with these developments by adopting regulatory regimes and technological advancements that facilitate paperless trade. These developments are expected to play a central role in shaping the Mexico trade finance market outlook over the coming years.

Supportive Government and Regulatory Initiatives

The Mexican government is actively working to strengthen trade finance accessibility, especially for small and medium-sized enterprises (SMEs), which form the backbone of the country’s export sector. Initiatives include simplified export credit procedures, guarantees through development banks, and programs that reduce collateral requirements. Regulatory reforms are also being implemented to encourage digital trade documentation and cross-border financial integration. These measures are aimed at removing entry barriers for businesses seeking to participate in international trade. Public-private partnerships and collaboration with multilateral institutions are further supporting financial inclusion in trade-related activities. Additionally, regional trade agreements and nearshoring trends are prompting policymakers to create more business-friendly trade finance infrastructure. By enabling broader participation in global markets and facilitating smoother financial flows, these initiatives are helping to expand the reach of trade finance solutions and contribute to overall Mexico trade finance market growth.

Mexico Trade Finance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on finance type, offering, service provider, and end user.

Finance Type Insights:

- Structured Trade Finance

- Supply Chain Finance

- Traditional Trade Finance

The report has provided a detailed breakup and analysis of the market based on the finance type. This includes structured trade finance, supply chain finance, and traditional trade finance.

Offering Insights:

- Letters of Credit

- Bill of Lading

- Export Factoring

- Insurance

- Others

A detailed breakup and analysis of the market based on the offering have also been provided in the report. This includes letters of credit, bill of lading, export factoring, insurance, and others.

Service Provider Insights:

- Banks

- Trade Finance Houses

A detailed breakup and analysis of the market based on the service provider have also been provided in the report. This includes banks and trade finance houses.

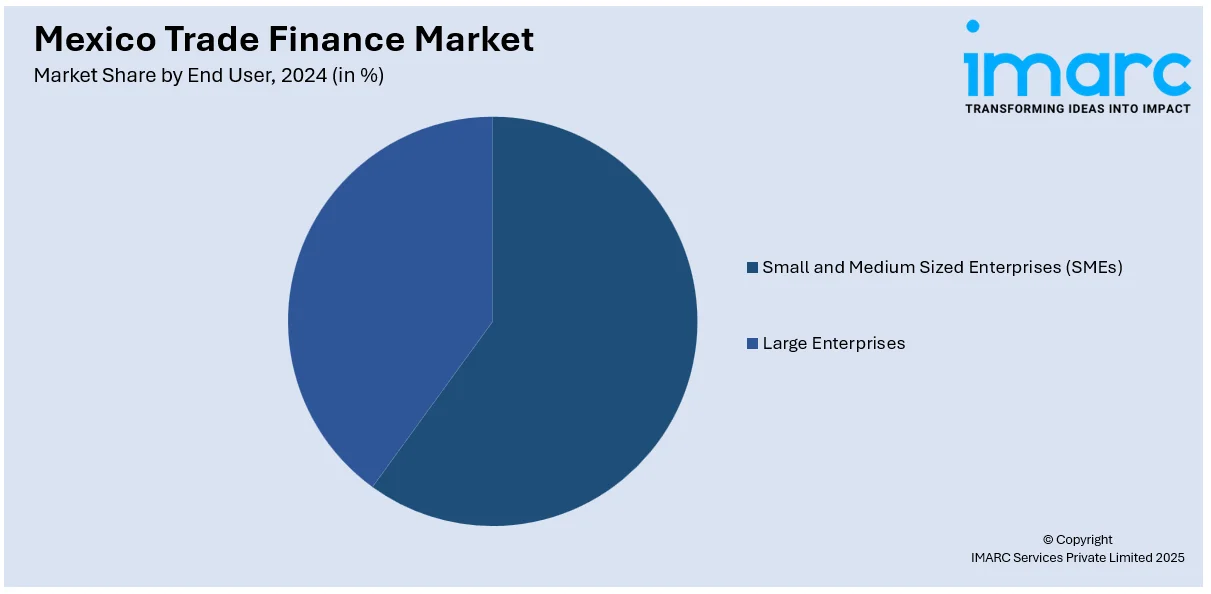

End User Insights:

- Small and Medium Sized Enterprises (SMEs)

- Large Enterprises

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes small and medium sized enterprises (SMEs) and large enterprises.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Trade Finance Market News:

- In November 2024, the International Finance Corporation (IFC) invested US$30 million in Nexxus Private Debt Fund II to enhance access to finance for small and medium enterprises (SMEs) in Mexico. This investment aims to support economic growth and job creation through nearshoring opportunities, addressing financing challenges faced by SMEs.

- In October 2024, Nowports announced the launch of a financing service for Mexican SMEs, providing up to $250,000 in capital for international product purchases. This service aims to streamline logistics and credit access, addressing the significant challenges SMEs face in securing financing. The platform features rapid quotes, shipment tracking, and a user-friendly digital interface.

Mexico Trade Finance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Finance Type Covered | Structured Trade Finance, Supply Chain Finance, Traditional Trade Finance |

| Offerings Covered | Letters of Credit, Bill of Lading, Export Factoring, Insurance, Others |

| Service Providers Covered | Banks, Trade Finance Houses |

| End Users Covered | Small and Medium Sized Enterprises (SMEs), Large Enterprises |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico trade finance market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico trade finance market on the basis of finance type?

- What is the breakup of the Mexico trade finance market on the basis of offering?

- What is the breakup of the Mexico trade finance market on the basis of service provider?

- What is the breakup of the Mexico trade finance market on the basis of end user?

- What is the breakup of the Mexico trade finance market on the basis of region?

- What are the various stages in the value chain of the Mexico trade finance market?

- What are the key driving factors and challenges in the Mexico trade finance?

- What is the structure of the Mexico trade finance market and who are the key players?

- What is the degree of competition in the Mexico trade finance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico trade finance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico trade finance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico trade finance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)