Mexico Transformer Market Size, Share, Trends and Forecast by Power Rating, Cooling Type, Transformer Type, and Region, 2026-2034

Mexico Transformer Market Overview:

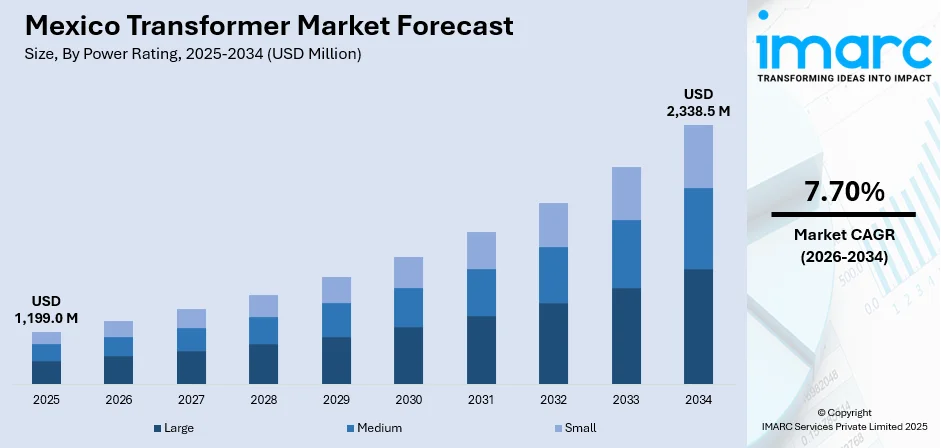

The Mexico transformer market size reached USD 1,199.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,338.5 Million by 2034, exhibiting a growth rate (CAGR) of 7.70% during 2026-2034. Expanding power generation capacity, renewable energy integration, industrialization, grid modernization, and increased infrastructure investment are some of the factors contributing to Mexico transformer market share. Government initiatives supporting rural electrification and smart grid deployment also support the rising transformer demand across transmission and distribution networks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,199.0 Million |

| Market Forecast in 2034 | USD 2,338.5 Million |

| Market Growth Rate 2026-2034 | 7.70% |

Access the full market insights report Request Sample

Mexico Transformer Market Trends:

Investment in Electrical Infrastructure Expansion

A significant development is underway in the Mexico transformer sector, marked by substantial financial commitment towards establishing new manufacturing capabilities. This move aims to bolster the production of crucial power equipment within the country. The construction of a new facility focused on distribution transformers signals an effort to meet the increasing demand in the North American market. This expansion is anticipated to generate new employment opportunities and strengthen the local manufacturing base for electrical infrastructure components. Such investments indicate a positive growth trajectory and a focus on enhancing domestic production capacity. These factors are intensifying the Mexico transformer market growth. For example, in September 2024, Hitachi Energy announced plans to invest USD 70 Million to build a new distribution transformer factory in Reynosa, Mexico, as part of a broader USD 155 Million expansion across North America. The Reynosa facility would produce single-phase padmount transformers for the North American market and is expected to create 350 jobs.

To get more information on this market Request Sample

Expanding Power Infrastructure Driving Transformer Demand

Mexico is experiencing a prominent shift in its energy landscape, characterized by extensive electrical grid modernization. This involves establishing new power plants across key states such as Guanajuato, Hidalgo, Sinaloa, Tamaulipas, and Baja California Sur. This national energy sector strategy signals a substantial increase in the need for essential electrical components. The expansion of power generation and distribution infrastructure throughout the nation points towards a robust and sustained requirement for power transformers and related equipment, vital for supporting the enhanced grid capacity and ensuring efficient power delivery across the country. This represents a strong growth area in the Mexican market. For instance, in March 2025, Mexico undertook a major electrical grid upgrade, including new power plants in five states, i.e., Salamanca (Guanajuato), Tula (Hidalgo), Mazatlán (Sinaloa), Altamira (Tamaulipas), and Los Cabos (Baja California Sur). This initiative, part of the president's National Energy Sector Strategy, suggests a growing demand for transformers to support the new infrastructure and enhanced power distribution across the country.

Mexico Transformer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on power rating, cooling type, and transformer type.

Power Rating Insights:

- Large

- Medium

- Small

The report has provided a detailed breakup and analysis of the market based on the power rating. This includes large, medium, and small.

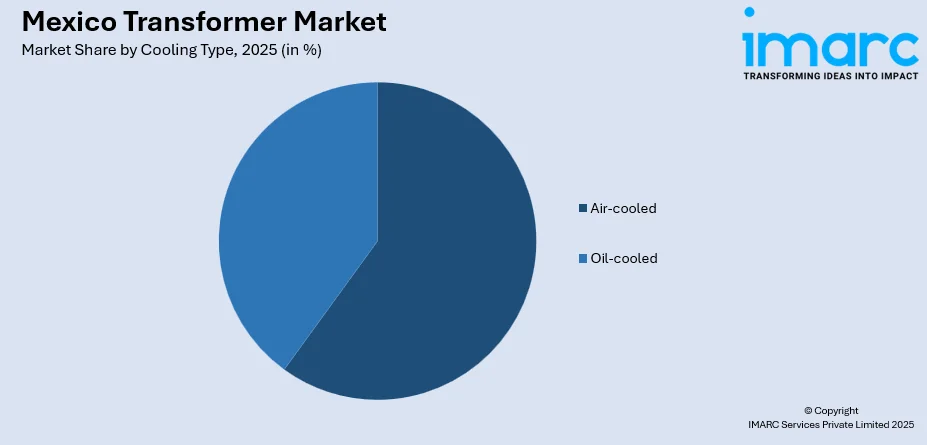

Cooling Type Insights:

To get detailed segment analysis of this market Request Sample

- Air-cooled

- Oil-cooled

A detailed breakup and analysis of the market based on the cooling type have also been provided in the report. This includes air-cooled and oil-cooled.

Transformer Type Insights:

- Power Transformer

- Distribution Transformer

A detailed breakup and analysis of the market based on the transformer type have also been provided in the report. This includes power transformer and distribution transformer.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Transformer Market News:

- In March 2025, Hitachi Energy announced plans to invest over USD 250 Million by 2027 to boost global transformer component production, addressing a growing shortage fueled by electrification and AI demands. This follows a prior USD 6 Billion investment. The expansion includes increased manufacturing in the US and strengthens supply chains worldwide. This move aims to alleviate the transformer shortage, crucial for Mexico's expanding power infrastructure and renewable energy goals.

Mexico Transformer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Power Ratings Covered | Large, Medium, Small |

| Cooling Types Covered | Air-cooled, Oil-cooled |

| Transformer Types Covered | Power Transformer, Distribution Transformer |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico transformer market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico transformer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico transformer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The transformer market in Mexico was valued at USD 1,199.0 Million in 2025.

The Mexico transformer market is projected to exhibit a CAGR of 7.70% during 2026-2034, reaching a value of USD 2,338.5 Million by 2034.

Expanding power generation capacity, renewable energy integration, extensive electrical grid modernization, increased infrastructure investment, government initiatives supporting rural electrification and smart grid deployment, establishment of new power plants across key states, and substantial investments in manufacturing capabilities are driving the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)