Mexico Vegan Chocolate Market Size, Share, Trends and Forecast by Chocolate Type, Nature, Sales Channel, and Region, 2025-2033

Mexico Vegan Chocolate Market Overview:

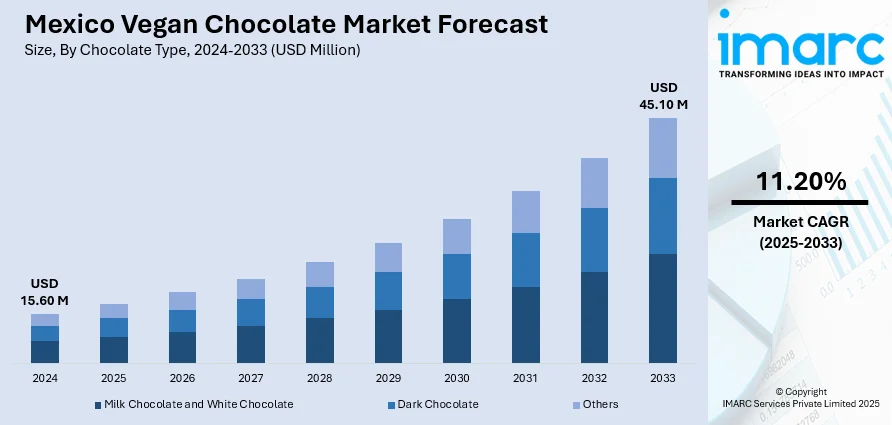

The Mexico vegan chocolate market size reached USD 15.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 45.10 Million by 2033, exhibiting a growth rate (CAGR) of 11.20% during 2025-2033. The market is driven by the growing trend towards vegetarian diets among Mexican consumers, especially in urban areas. Moreover, increasing awareness regarding lactose intolerance and concerns over animal cruelty products are further driving demand for dairy-free substitutes of chocolate. In addition to this, continual product innovations by domestic as well as foreign brands in the form of sugar-free, organic, and superfood-enriched vegan chocolates are attracting consumers, further augmenting the Mexico vegan chocolate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15.60 Million |

| Market Forecast in 2033 | USD 45.10 Million |

| Market Growth Rate 2025-2033 | 11.20% |

Mexico Vegan Chocolate Market Trends:

Rising Demand for Plant-Based and Lactose-Free Alternatives

The increasing prevalence of lactose intolerance and dairy-related sensitivities in Mexico is significantly influencing consumer preferences toward vegan chocolate. As per industry reports, the prevalence of lactose intolerance in Mexico is estimated to be over 48%, indicating that nearly half of the population struggles to digest lactose. Therefore, many individuals, especially in metropolitan regions such as Mexico City and Guadalajara, are actively seeking dairy-free confectionery options that do not compromise on taste or texture. Vegan chocolate provides an appealing alternative by using plant-based milk substitutes like almond, oat, or coconut milk. This demand is not limited to health-conscious individuals; it extends to those motivated by ethical and environmental concerns associated with dairy farming. As awareness of sustainable food choices grows, more consumers are turning to vegan chocolate as a responsible indulgence. Besides this, supermarkets, specialty organic stores, and online platforms have responded by increasing shelf space for vegan chocolate products, thereby improving accessibility. Moreover, domestic producers are beginning to experiment with local ingredients to cater to regional tastes, integrating traditional Mexican flavors, such as cinnamon, chili, or agave, with vegan formulations. These shifts reflect a broader trend of inclusivity and innovation in the country's confectionery sector.

Growth of E-Commerce and Direct-to-Consumer Channels

The rapid expansion of digital retail platforms in the country is positively impacting the Mexico vegan chocolate market growth. With growing mobile and internet usage, consumers are moving towards online buying of a broader variety of food and lifestyle items, including plant-based confectionery. As per industry reports, Gen Z will account for more than 25% of Mexico's total population of around 130 million by 2025. This generation is extremely technology-oriented and more likely to explore ethical, health-related, and niche offerings through digital means. Their demand for convenience and individualized experiences is making vegan chocolate manufacturers invest in e-commerce initiatives, such as direct-to-consumer websites, mobile apps, and social media marketing. Furthermore, subscription boxes featuring curated selections of vegan confections, including chocolates, are gaining traction, particularly among younger demographics who prioritize convenience and personalization. Moreover, e-commerce platforms offer detailed product information, including certifications like organic, non-GMO, and fair trade, which further influence purchase decisions. The digital landscape is also facilitating social media marketing and influencer collaborations, which are helping vegan chocolate brands build loyal communities around shared values such as health, sustainability, and animal welfare. Furthermore, smaller producers, who might have limited physical retail access, are leveraging these channels to compete effectively with larger brands, making e-commerce a critical driver in market expansion.

Mexico Vegan Chocolate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on chocolate type, nature, and sales channel.

Chocolate Type Insights:

- Milk Chocolate and White Chocolate

- Dark Chocolate

- Others

The report has provided a detailed breakup and analysis of the market based on the chocolate type. This includes milk chocolate and white chocolate, dark chocolate, and others.

Nature Insights:

- Organic

- Conventional

A detailed breakup and analysis of the market based on the nature have also been provided in the report. This includes organic and conventional.

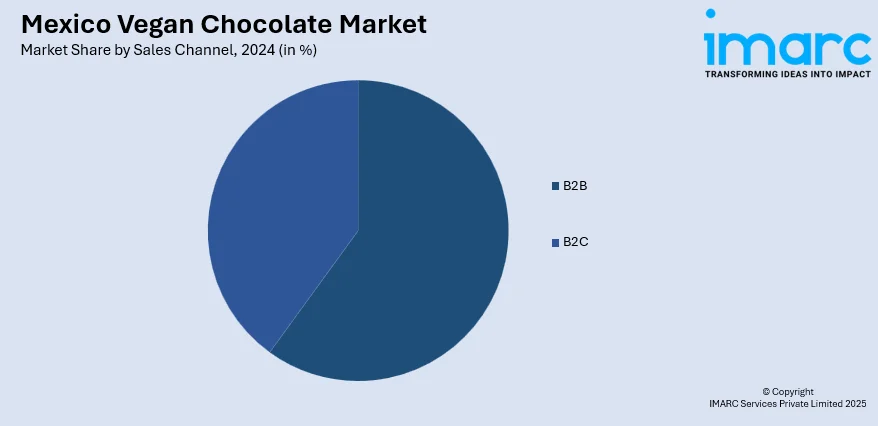

Sales Channel Insights:

- B2B

- B2C

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes B2B and B2C (supermarkets and hypermarkets, convenience stores, online stores, and others).

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Vegan Chocolate Market News:

- On May 30, 2023, Swiss chocolate manufacturer Barry Callebaut announced the expansion of its dairy-free chocolate offerings into the Mexican market with the launch of Callebaut NXT and SICAO Zero. A 100% vegan chocolate product, it is entirely plant-based, dairy-free, and free from animal-derived ingredients, making it suitable for vegan diets. It is designed to cater to health-conscious consumers, particularly Millennials and Centennials, by providing low-sugar, environmentally friendly chocolate alternatives.

Mexico Vegan Chocolate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Chocolate Types Covered | Milk Chocolate and White Chocolate, Dark Chocolate, Others |

| Natures Covered | Organic, Conventional |

| Sales Channels Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico vegan chocolate market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico vegan chocolate market on the basis of chocolate type?

- What is the breakup of the Mexico vegan chocolate market on the basis of nature?

- What is the breakup of the Mexico vegan chocolate market on the basis of sales channel?

- What is the breakup of the Mexico vegan chocolate market on the basis of region?

- What are the various stages in the value chain of the Mexico vegan chocolate market?

- What are the key driving factors and challenges in the Mexico vegan chocolate market?

- What is the structure of the Mexico vegan chocolate market and who are the key players?

- What is the degree of competition in the Mexico vegan chocolate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico vegan chocolate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico vegan chocolate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico vegan chocolate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)