Mexico Vegan Ice Cream Market Size, Share, Trends and Forecast by Source, Flavor, Sales Type, Distribution Channel, and Region, 2025-2033

Mexico Vegan Ice Cream Market Overview:

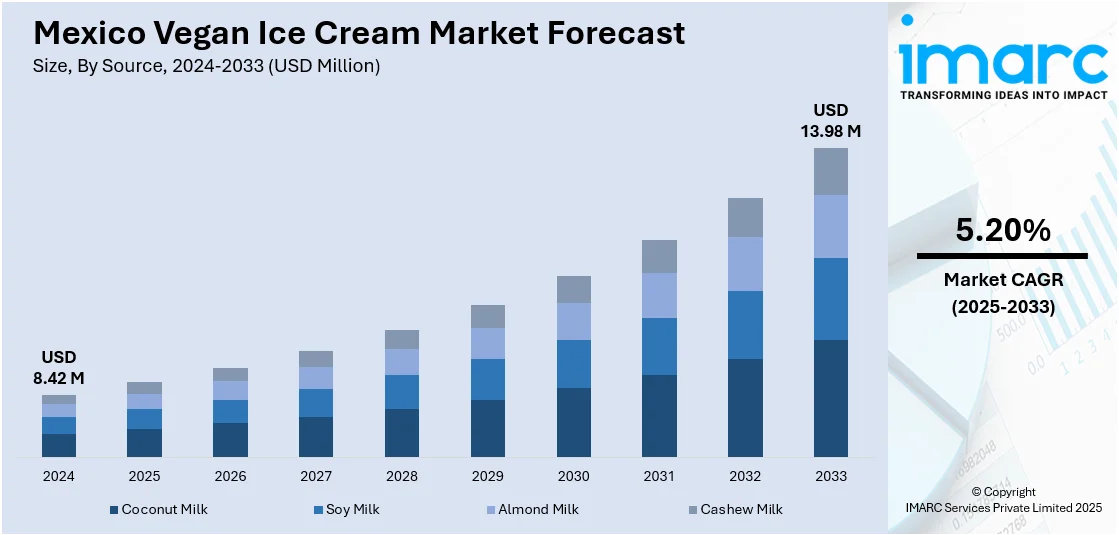

The Mexico vegan ice cream market size reached USD 8.42 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 13.98 Million by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. Rising health consciousness, increasing lactose intolerance, the surge in ethical veganism among younger consumers, expanding availability of plant-based ingredients, and innovative product launches by both local and international brands are collectively driving Mexico’s vegan ice cream market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.42 Million |

| Market Forecast in 2033 | USD 13.98 Million |

| Market Growth Rate 2025-2033 | 5.20% |

Mexico Vegan Ice Cream Market Trends:

Rising Health Consciousness and Dietary Shifts Among Mexican Consumers

Among the leading drivers of the Mexican vegan ice cream market is increased health, nutrition, and wellness awareness. Mexican consumers have become better educated about the relationship between diet and disease over the past decade, including obesity, cardiovascular conditions, lactose intolerance, and Type 2 diabetes, each of which are current issues in Mexico. This change of attitude is making individuals move towards healthier options, especially those which do not involve animal-based products, processed sugar, and chemicals. Vegan ice cream, usually produced with plant-based milk such as almond, coconut, oat, or soy, is seen as a lighter and more easily digestible option. It is particularly friendly to people suffering from lactose intolerance, a condition which besets a major part of the population. In addition, the development of functional foods and beverages in Mexican food has created a demand from consumers for products that provide indulgence as well as nutritional content. Most vegan ice creams today are enriched with superfoods, probiotics, and natural sweeteners, further enticing consumers.

Expanding Vegan and Ethical Lifestyle Movements Among Millennials and Gen Z

Another key driver is the increasing ethical and environmental consciousness particularly among Millennials and Gen Z. These generations are leading a cultural revolution based on sustainability, animal rights, and being a mindful consumer, which is helping make vegan options like plant-based ice cream popular. In contrast to previous generations who might opt for vegan products mainly due to health concerns, these young consumers are frequently motivated by moral and environmental factors. Veganism for them is a value-based lifestyle choice that reflects values of ending animal cruelty, reducing environmental destruction, and reducing their carbon footprint. Vegan ice cream is merely an extension of this lifestyle so that they can indulge in conventional treats without betraying their ethical values. Social media has further boosted this movement, with content creators and influencers promoting sustainable living, zero-waste, and plant-based diets. Moreover, vegan food festivals, environmental workshops, and local NGO campaigns further cement these values. This younger generation is also more likely to pay a premium for value-aligned brands, such as local and global vegan ice cream brands that prioritize transparency, cruelty-free sourcing, and sustainable packaging.

Mexico Vegan Ice Cream Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on source, flavor, sales type, and distribution channel.

Source Insights:

- Coconut Milk

- Soy Milk

- Almond Milk

- Cashew Milk

The report has provided a detailed breakup and analysis of the market based on the source. This includes coconut milk, soy milk, almond milk, and cashew milk.

Flavor Insights:

- Chocolate

- Caramel

- Coconut

- Vanilla

- Coffee

- Fruit

A detailed breakup and analysis of the market based on the flavor have also been provided in the report. This includes chocolate, caramel, coconut, vanilla, coffee, and fruit.

Sales Type Insights:

- Impulse

- Take Home

- Artisanal

The report has provided a detailed breakup and analysis of the market based on the sales type. This includes impulse, take home, and artisanal.

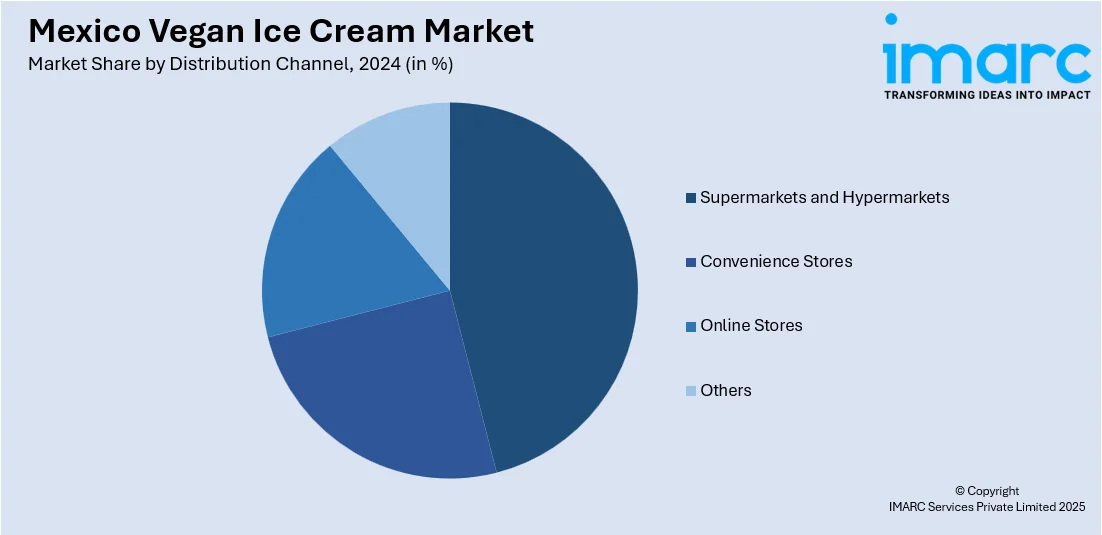

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Vegan Ice Cream Market News:

- August 2023: Mexican startup Propel Foods, known for its AI-developed plant-based proteins like Bistec, Pastor, and Chorizo, expanded into retail stores. Their growth reflects the broader surge in plant-based options, including vegan ice cream, catering to the increasing demand for sustainable and diverse vegan foods.

- March 2023: Better Balance, a Spanish plant-based meat company, partnered with Mexican restaurant chain Gorditas Doña Tota to launch Veggiebradas—vegan gorditas featuring shredded plant-based meat and salsa verde. Initially available at 38 locations in Monterrey and San Pedro, the company plans to expand nationally. This initiative complements the growing array of vegan offerings, including dairy-free desserts like vegan ice cream, catering to the increasing demand for plant-based options.

Mexico Vegan Ice Cream Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Coconut Milk, Soy Milk, Almond Milk, Cashew Milk |

| Flavors Covered | Chocolate, Caramel, Coconut, Vanilla, Coffee, Fruit |

| Sales Types Covered | Impulse, Take Home, Artisanal |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico vegan ice cream market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico vegan ice cream market on the basis of source?

- What is the breakup of the Mexico vegan ice cream market on the basis of flavor?

- What is the breakup of the Mexico vegan ice cream market on the basis of sales type?

- What is the breakup of the Mexico vegan ice cream market on the basis of distribution channel?

- What is the breakup of the Mexico vegan ice cream market on the basis of region?

- What are the various stages in the value chain of the Mexico vegan ice cream market?

- What are the key driving factors and challenges in the Mexico vegan ice cream?

- What is the structure of the Mexico vegan ice cream market and who are the key players?

- What is the degree of competition in the Mexico vegan ice cream market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico vegan ice cream market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico vegan ice cream market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico vegan ice cream industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)